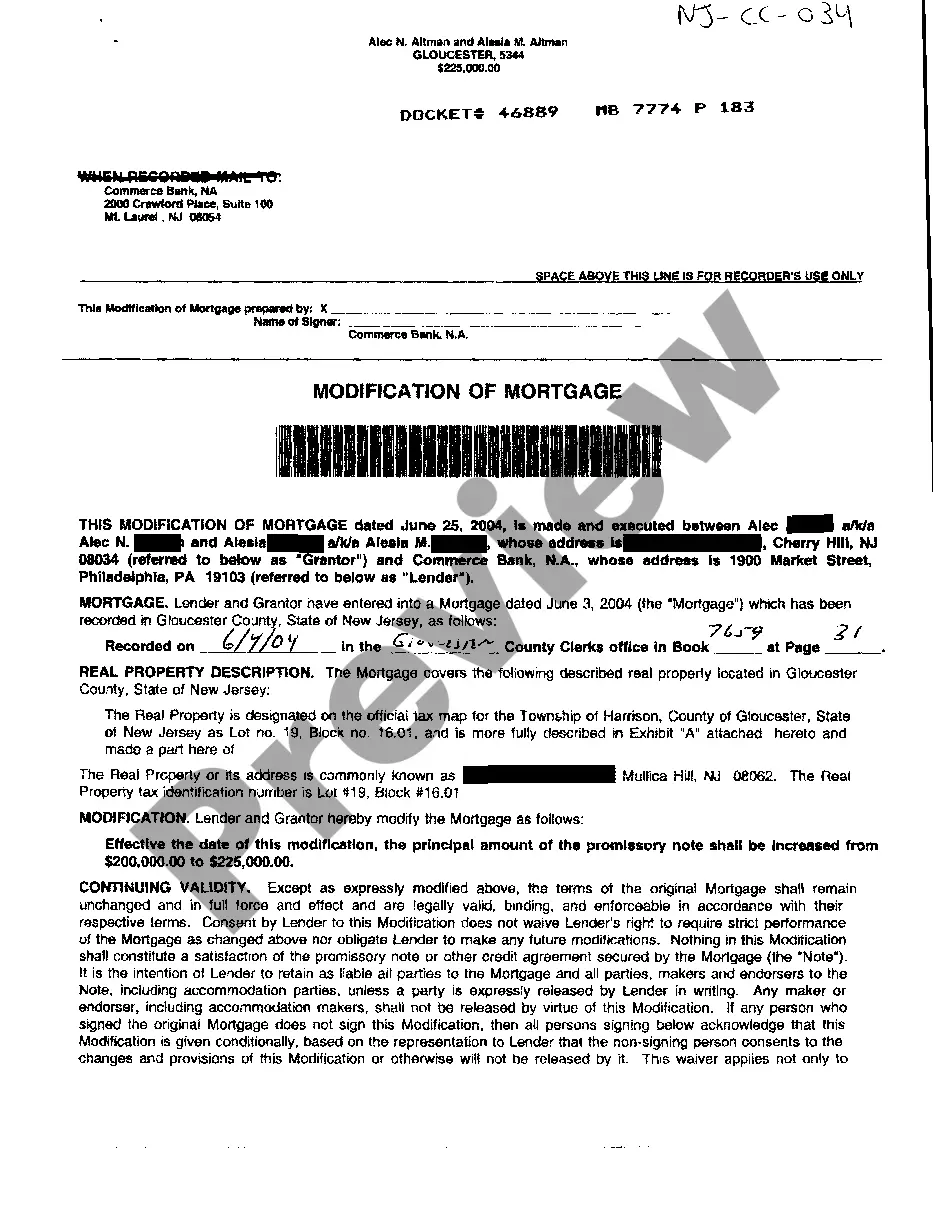

New Jersey Modification Of Mortgage

Description

How to fill out New Jersey Modification Of Mortgage?

US Legal Forms is a unique system to find any legal or tax form for filling out, including New Jersey Modification Of Mortgage. If you’re tired of wasting time looking for appropriate samples and paying money on file preparation/lawyer charges, then US Legal Forms is exactly what you’re searching for.

To reap all of the service’s benefits, you don't have to download any software but just select a subscription plan and create an account. If you have one, just log in and get the right sample, download it, and fill it out. Saved files are kept in the My Forms folder.

If you don't have a subscription but need to have New Jersey Modification Of Mortgage, check out the recommendations listed below:

- check out the form you’re considering is valid in the state you want it in.

- Preview the example and read its description.

- Click Buy Now to get to the sign up page.

- Pick a pricing plan and continue registering by providing some information.

- Pick a payment method to finish the sign up.

- Save the document by choosing the preferred file format (.docx or .pdf)

Now, complete the file online or print out it. If you are uncertain concerning your New Jersey Modification Of Mortgage sample, contact a lawyer to examine it before you send out or file it. Get started hassle-free!

Form popularity

FAQ

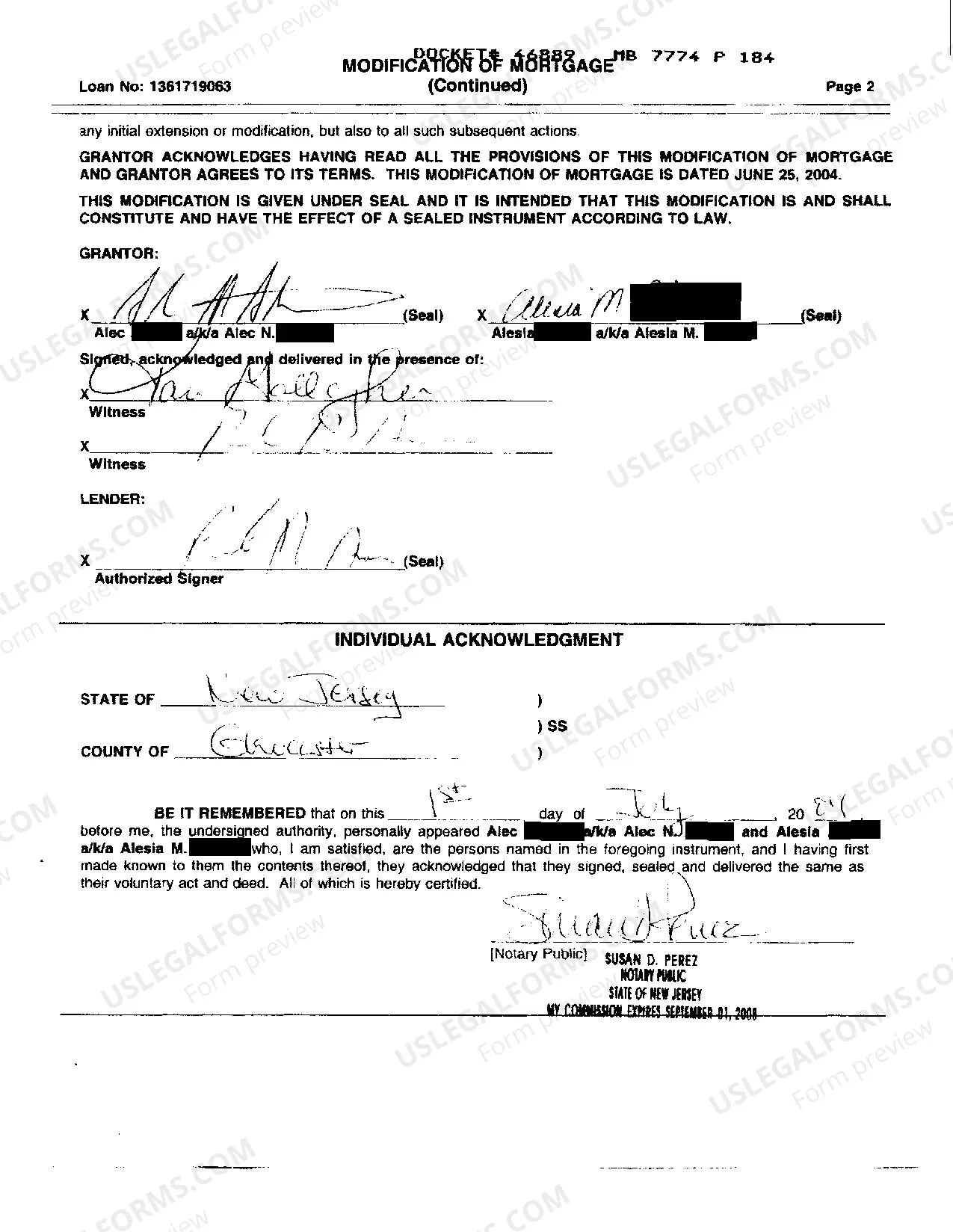

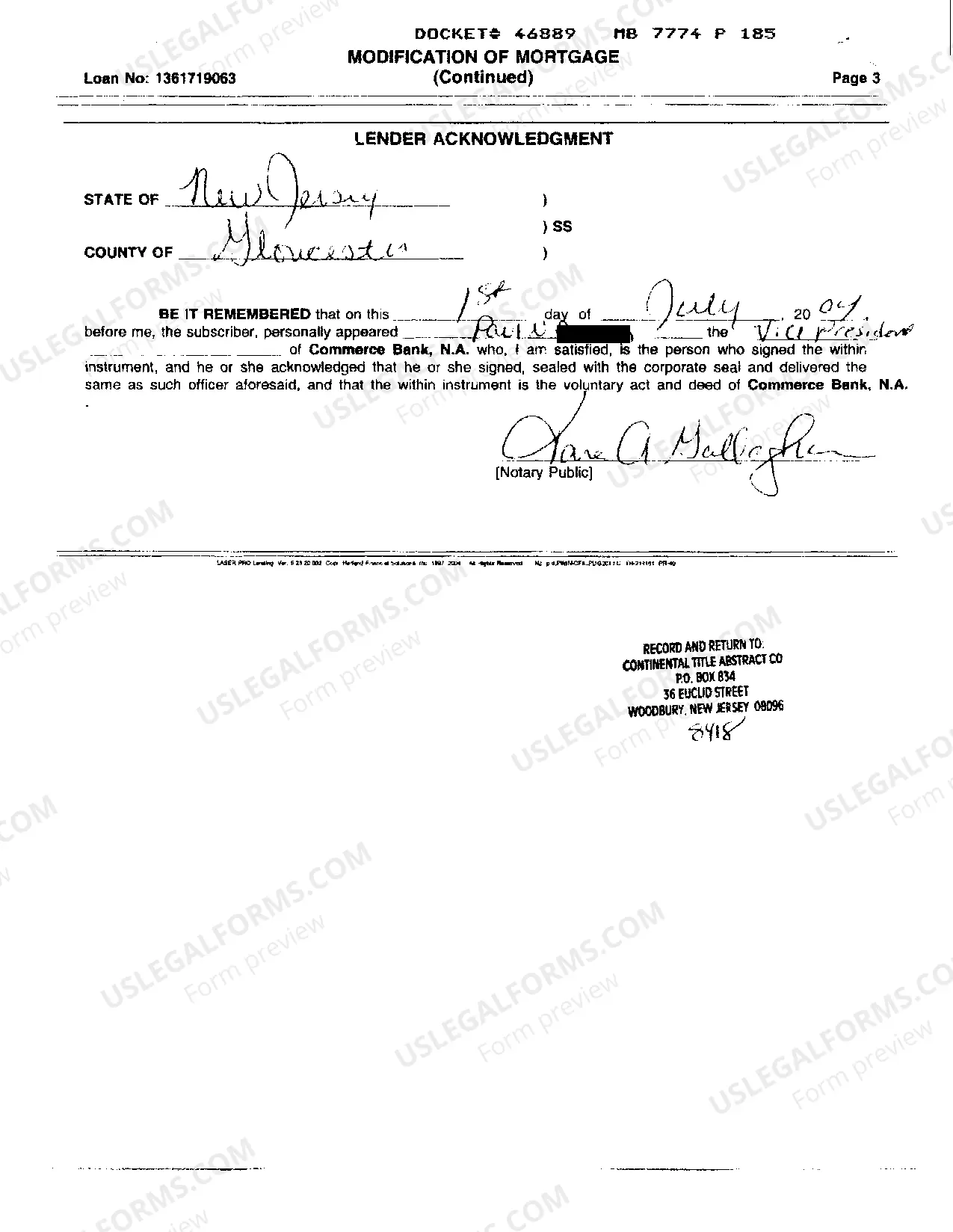

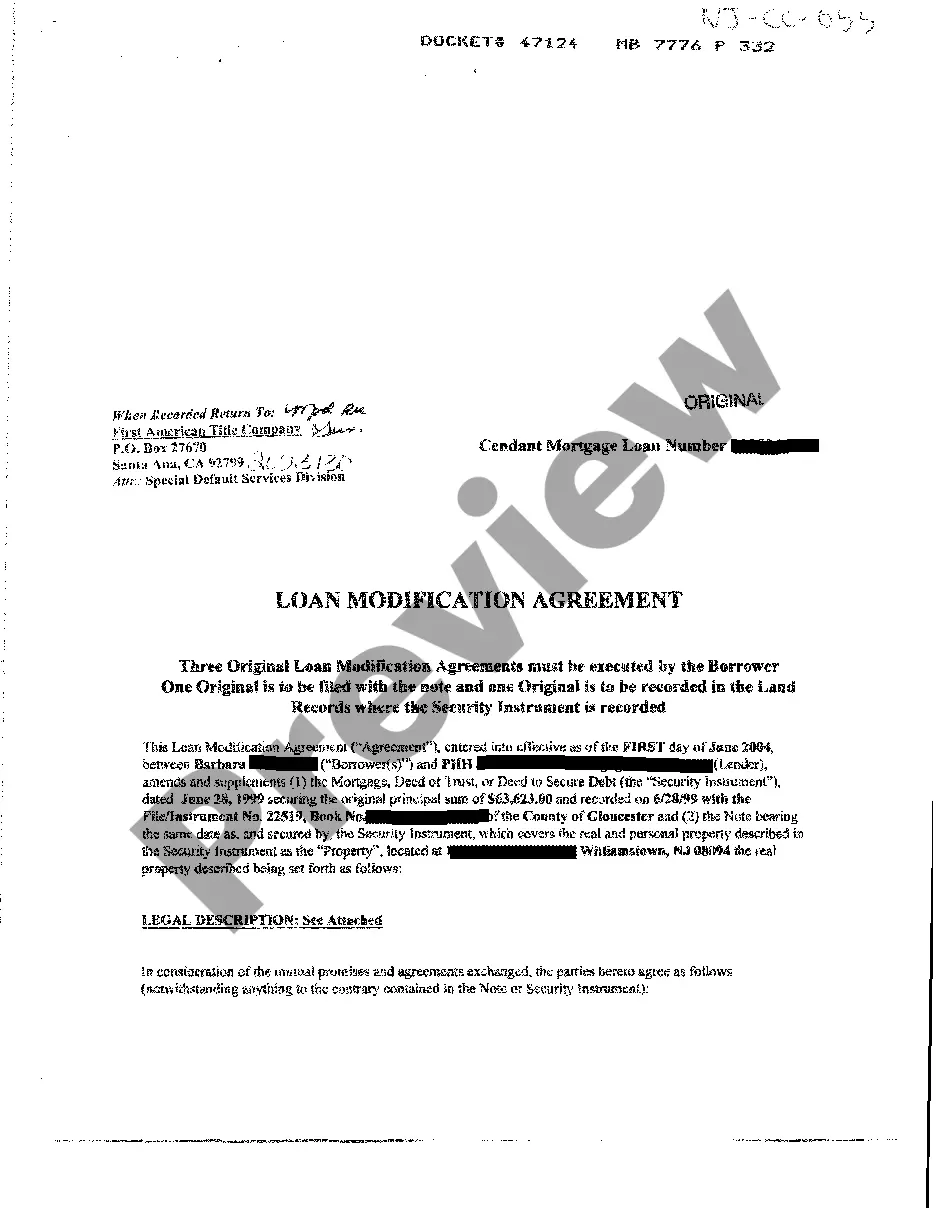

In order to properly and efficiently document loan modifications for real estate loans, it is essential that: All modifications be in writing. All parties involved sign the modification. In appropriate cases, the modification should be recorded.

Be at least one regular mortgage payment behind or show that missing a payment is imminent. Provide evidence of significant financial hardship, for reasons such as:

You have to be suffering a financial hardship. You have to show you cannot afford your current mortgage payments. You have to be able to show that you can stay current on a modified payment schedule.

Yes, probably. In California, a law called the Homeowner Bill of Rights (HBOR) generally gives borrowers the right to appeal a modification denial. Under HBOR, in most cases, if the servicer denies a borrower's application to modify a first lien loan, the borrower can appeal.

The loan modification underwriter will analyze and review the particular circumstances which justify a loan modification. The underwriter will evaluate and assess the borrower's financial status, current income and asset situation and ability to pay.

Under this option, you reach an agreement between you and your mortgage company to change the original terms of your mortgagesuch as payment amount, length of loan, interest rate, etc. In most cases, when your mortgage is modified, you can reduce your monthly payment to a more affordable amount.

Under this option, you reach an agreement between you and your mortgage company to change the original terms of your mortgagesuch as payment amount, length of loan, interest rate, etc. In most cases, when your mortgage is modified, you can reduce your monthly payment to a more affordable amount.

Best practice still is to obtain a signature from the borrower on the extension /modification of the underlying note. However, this can be obtained by electronic means and does not require notarization.

Some of the most common types of hardship are: job loss, pay reduction, underemployment, declining business revenue, death of a coborrower, illness, injury, and divorce.