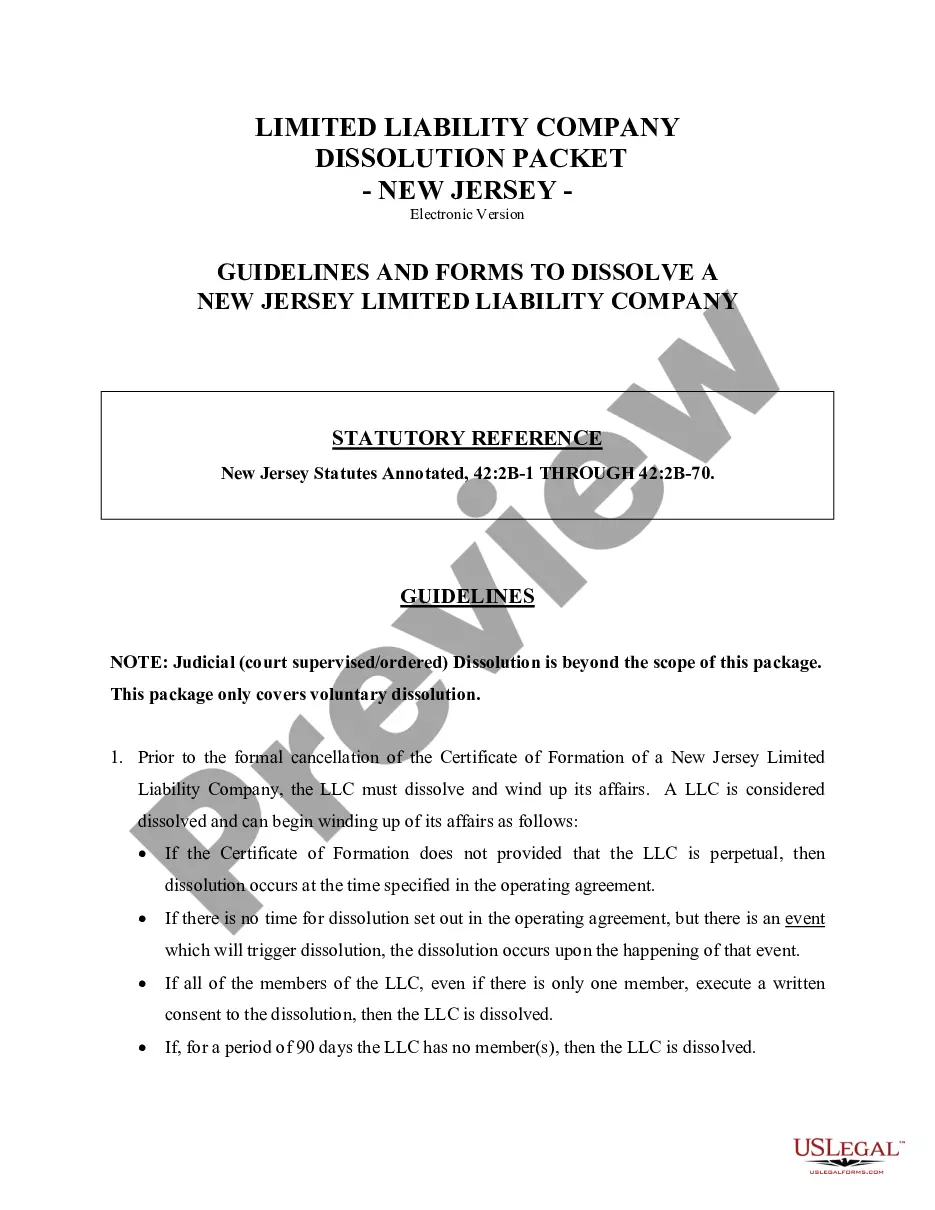

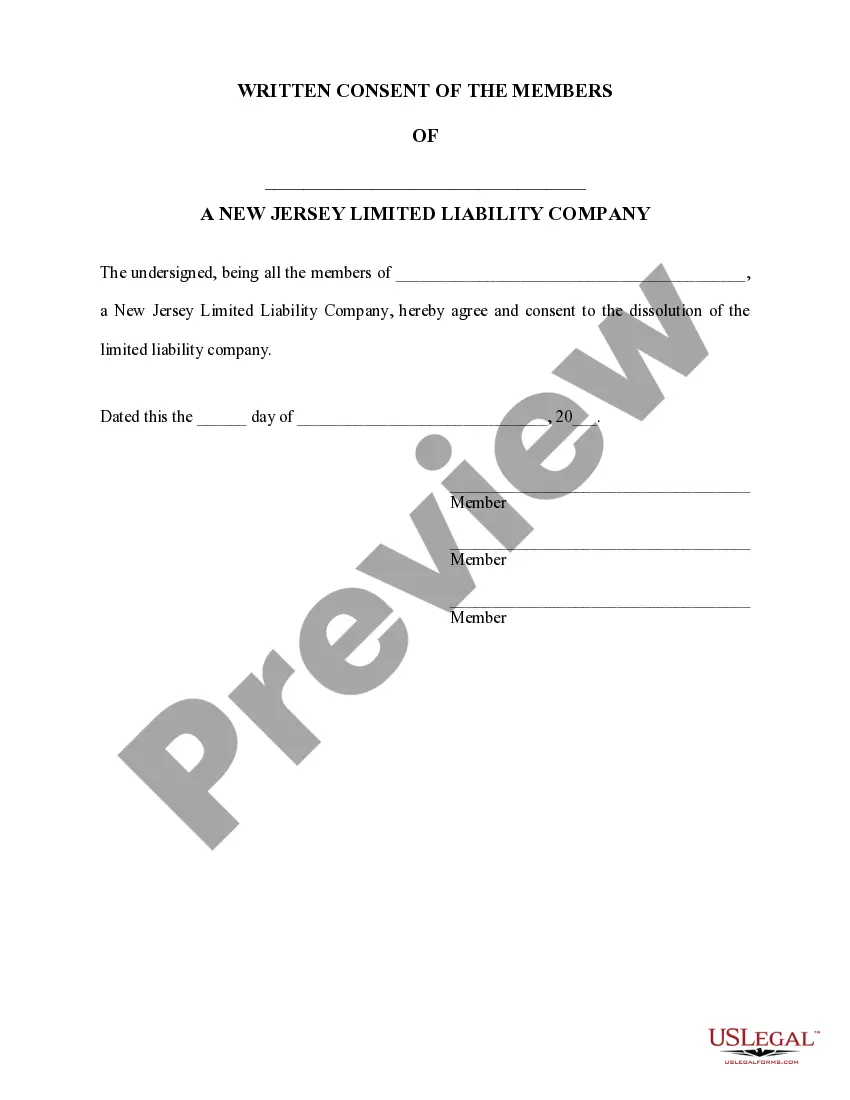

New Jersey Dissolution Package to Dissolve Limited Liability Company LLC

Description

How to fill out New Jersey Dissolution Package To Dissolve Limited Liability Company LLC?

US Legal Forms is really a unique platform where you can find any legal or tax template for submitting, such as New Jersey Dissolution Package to Dissolve Limited Liability Company LLC. If you’re sick and tired of wasting time searching for appropriate examples and paying money on record preparation/lawyer charges, then US Legal Forms is exactly what you’re seeking.

To reap all the service’s advantages, you don't need to download any application but just choose a subscription plan and register an account. If you already have one, just log in and get an appropriate template, save it, and fill it out. Saved documents are saved in the My Forms folder.

If you don't have a subscription but need to have New Jersey Dissolution Package to Dissolve Limited Liability Company LLC, check out the instructions listed below:

- make sure that the form you’re considering applies in the state you need it in.

- Preview the example its description.

- Click Buy Now to reach the sign up webpage.

- Select a pricing plan and proceed signing up by entering some information.

- Pick a payment method to complete the registration.

- Download the document by selecting the preferred format (.docx or .pdf)

Now, submit the file online or print out it. If you feel uncertain regarding your New Jersey Dissolution Package to Dissolve Limited Liability Company LLC template, contact a lawyer to check it before you send or file it. Start hassle-free!

Form popularity

FAQ

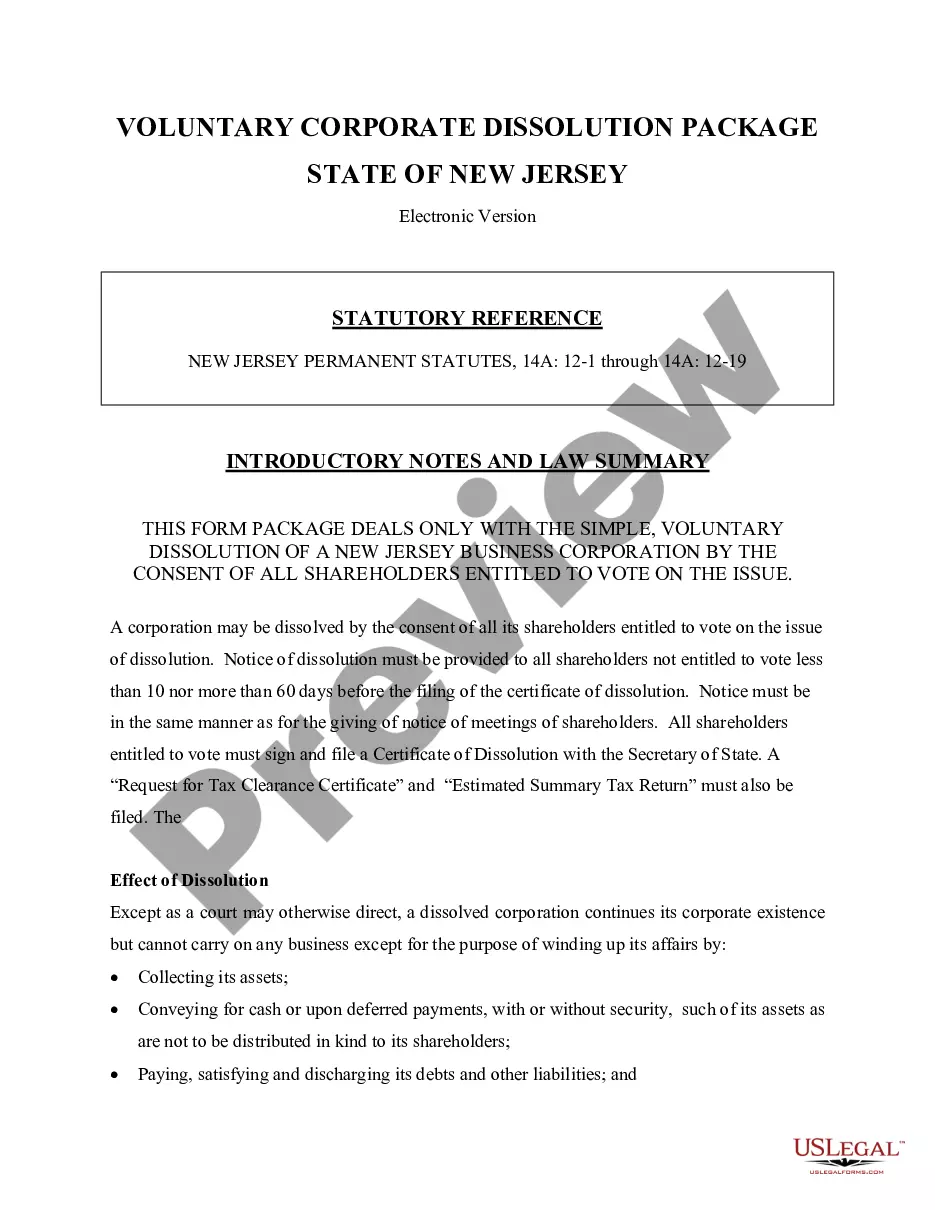

The corporation should be wound up, adopt a plan of dissolution, pay or make provision for payment of creditors, obtain a tax clearance certificate from the state, file 'final' tax returns, withdraw from other states in which it has qualified to do business, and dissolve, said Stuart Pachman, an attorney with Brach

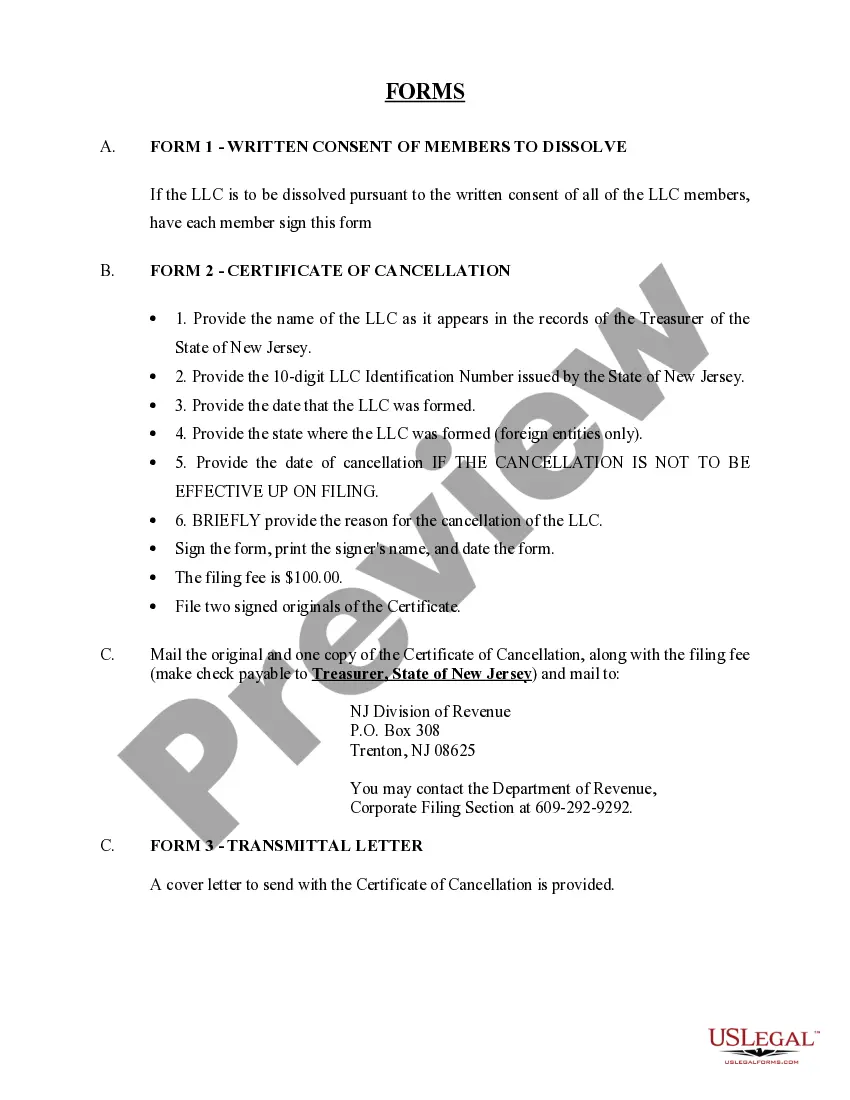

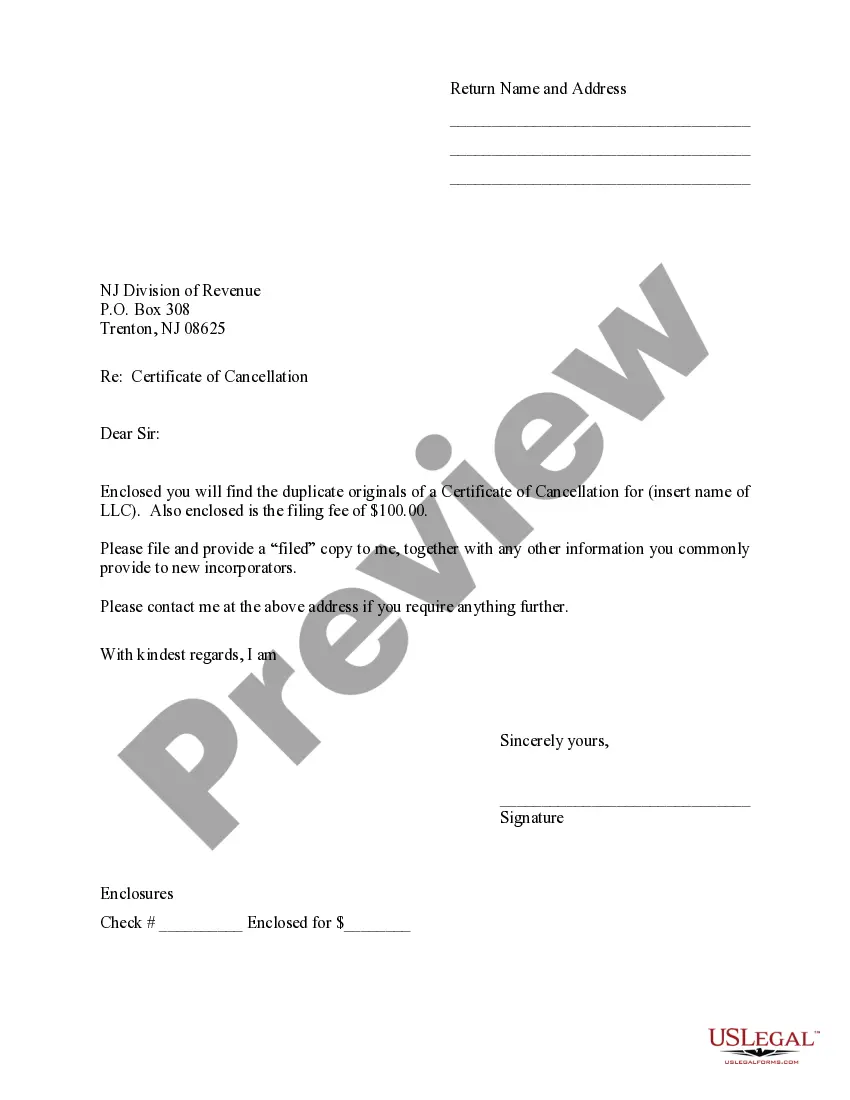

New Jersey requires business owners to submit their Certificate of Cancellation by mail or online. You can also have a professional service provider file your Articles of Dissolution for you. Incfile prepares the Articles of Dissolution for you, and files them to the state for $149 + State Fees.

To dissolve a limited liability company (LLC) in New Jersey, you must file a certificate of cancellation or dissolution with the state Division of Revenue, pay the required fees, and wind up the company's remaining business.

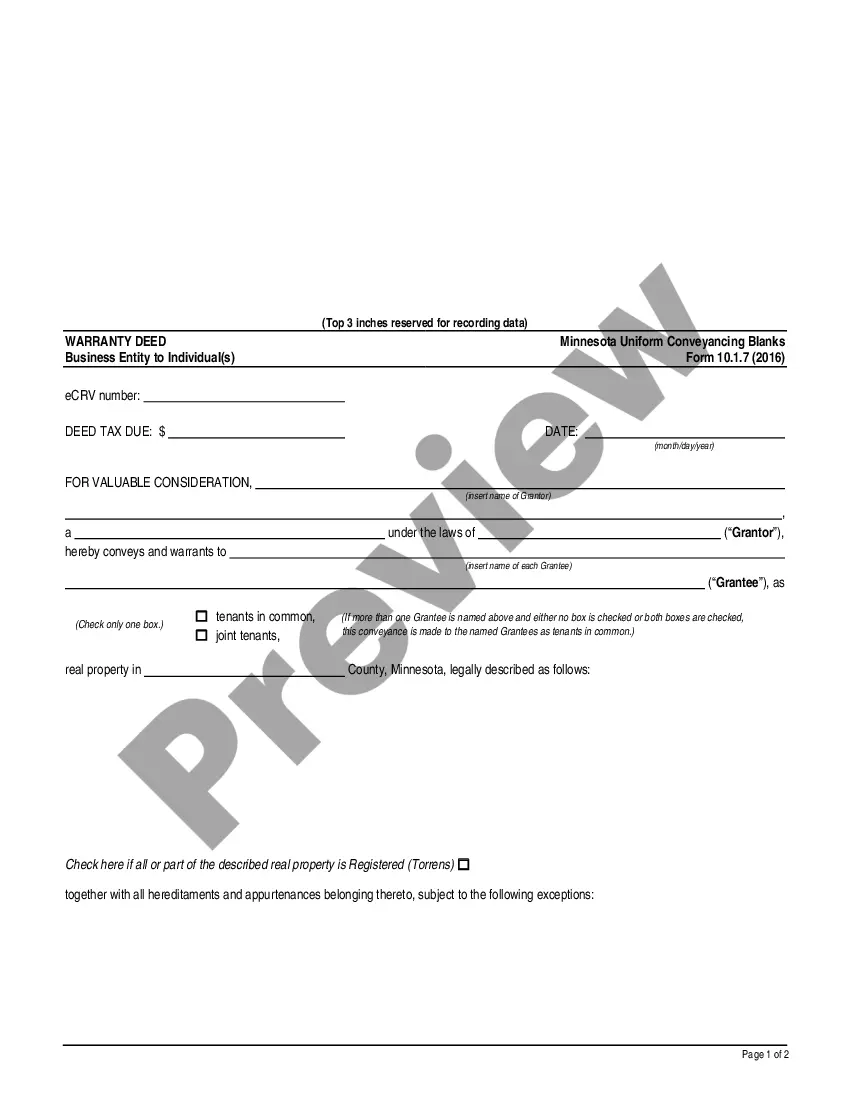

Just as you filed paperwork with the state to form your LLC, you must file articles of dissolution or a similar document to dissolve the LLC. These papers are filed with the same state agency that handed your original LLC formationusually the secretary of state.

There is no fee to file the certificate of dissolution. However, there is a non-refundable $15 special handling fee for processing documents delivered in person at the Sacramento SOS office. It can take the SOS many weeks to process a certificate. However, expedited service is available for an additional fee.