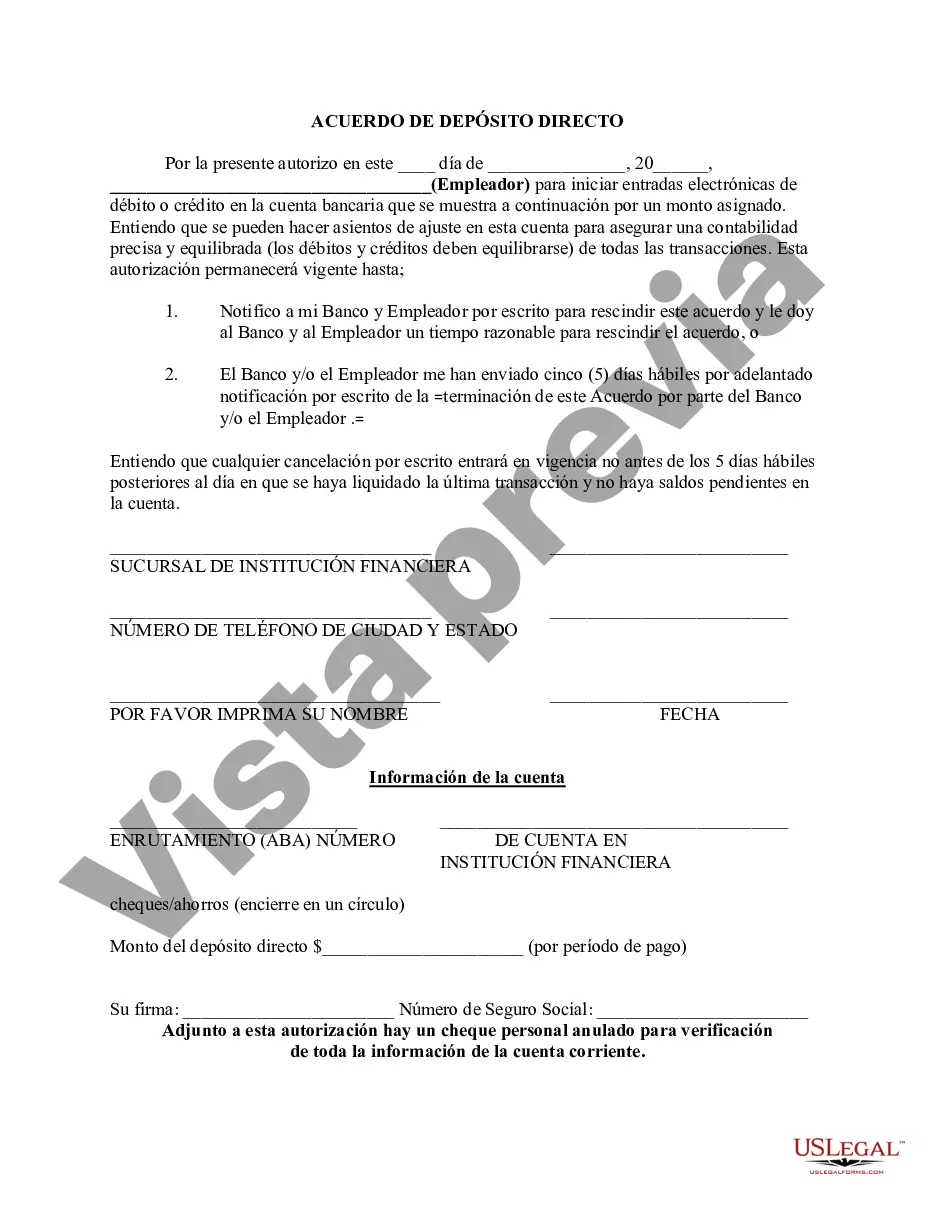

The New Jersey Direct Deposit Form for Chase is a document that allows Chase Bank customers residing in New Jersey to authorize the direct deposit of funds into their Chase checking or savings account. This form is used to set up a direct deposit service for various purposes, such as receiving regular income payments from employers, government agencies, or other organizations. The New Jersey Direct Deposit Form for Chase requires the account holder to provide crucial information, including their full name, address, social security number, and Chase account number. Additionally, the form may require the account holder to fill in their employer's details, such as the company name, address, and the employer identification number (EIN). This information is necessary to ensure the accurate transfer of funds into the designated Chase account. Different types of New Jersey Direct Deposit Forms for Chase may exist depending on the specific purpose of the direct deposit. For example, there could be separate forms for employer paychecks, government benefit payments (e.g., Social Security, unemployment benefits), or pension payments. These different forms may have slight variations in the required information, but they all serve the primary purpose of enabling the direct deposit service. It is important to ensure the accurate completion of the New Jersey Direct Deposit Form for Chase to avoid any delays or discrepancies in the direct deposit process. Following the completion of the form, it is typically submitted to the respective employer, government agency, or organization responsible for initiating the direct deposit. Overall, the New Jersey Direct Deposit Form for Chase is a crucial document that simplifies the process of receiving regular income payments into a Chase checking or savings account. By providing the necessary information, customers can enjoy the convenience and reliability of having their funds directly deposited into their account without the need for manual cash or check handling.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Formulario de depósito directo para Chase - Direct Deposit Form for Chase

Description

How to fill out New Jersey Formulario De Depósito Directo Para Chase?

US Legal Forms - one of several biggest libraries of authorized types in the United States - delivers an array of authorized document layouts you are able to down load or printing. While using web site, you can get 1000s of types for organization and individual functions, sorted by types, states, or keywords and phrases.You can find the most recent types of types just like the New Jersey Direct Deposit Form for Chase in seconds.

If you have a monthly subscription, log in and down load New Jersey Direct Deposit Form for Chase through the US Legal Forms library. The Acquire switch can look on each form you see. You have access to all previously delivered electronically types in the My Forms tab of your profile.

If you would like use US Legal Forms initially, here are basic directions to get you started off:

- Be sure you have selected the proper form for your metropolis/region. Go through the Preview switch to review the form`s content material. Read the form information to actually have selected the correct form.

- If the form does not suit your requirements, take advantage of the Search industry near the top of the display screen to obtain the the one that does.

- When you are pleased with the form, verify your selection by clicking on the Acquire now switch. Then, pick the pricing prepare you want and provide your qualifications to register for the profile.

- Approach the transaction. Make use of your bank card or PayPal profile to perform the transaction.

- Select the structure and down load the form on your own device.

- Make changes. Fill out, change and printing and indicator the delivered electronically New Jersey Direct Deposit Form for Chase.

Each template you put into your money does not have an expiration particular date which is your own property permanently. So, in order to down load or printing another backup, just check out the My Forms portion and then click in the form you will need.

Gain access to the New Jersey Direct Deposit Form for Chase with US Legal Forms, one of the most substantial library of authorized document layouts. Use 1000s of specialist and condition-distinct layouts that satisfy your organization or individual demands and requirements.