- Instant access to the funds via an ATM or check card; - A check can be lost or stolen anywhere between the sender and the intended payee; - Payments made electronically can be less expensive to the payor.

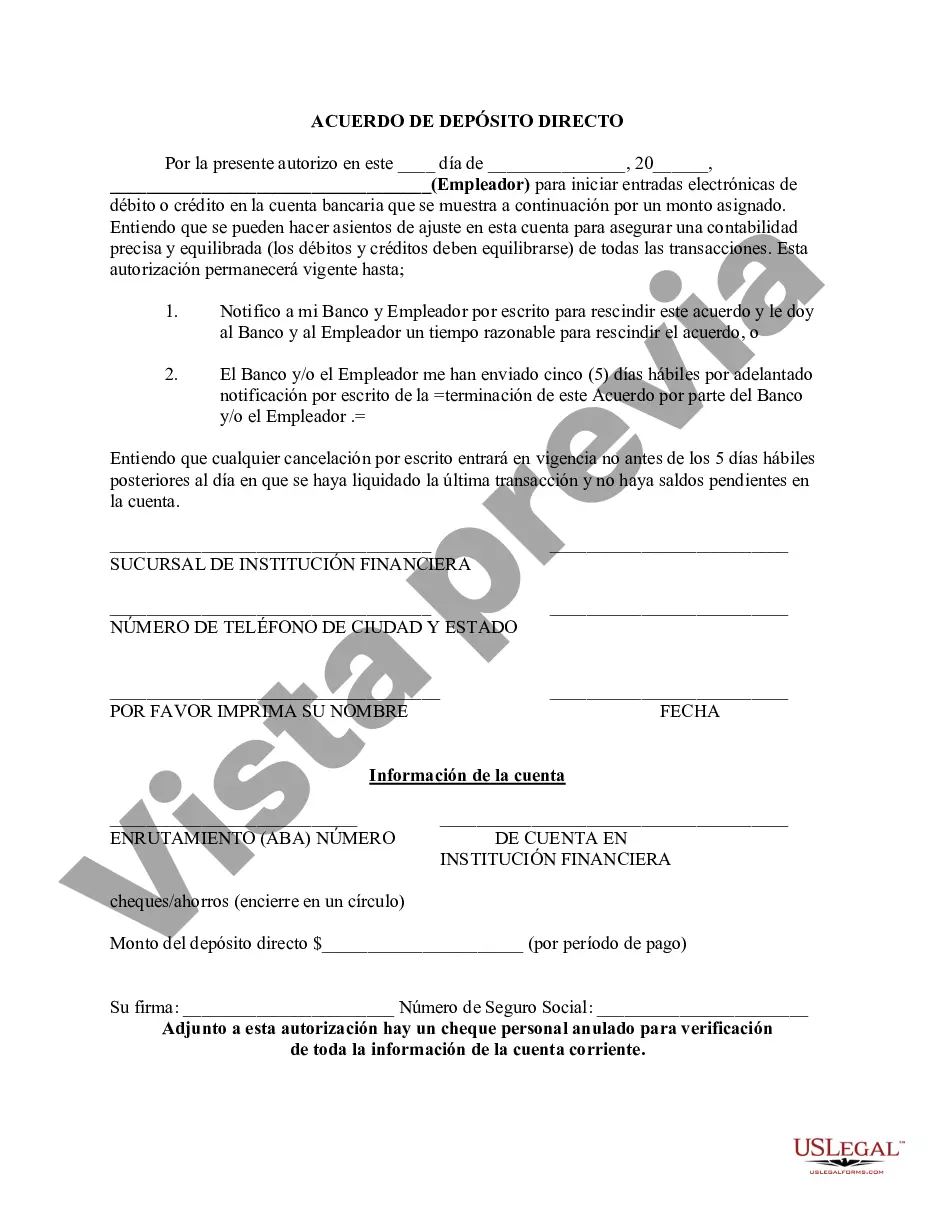

Direct deposit eliminates mailing delays and alleviates the need to go somewhere to cash or deposit your check. The New Jersey Direct Deposit Agreement is a legal document that outlines the terms and conditions for employees in the state of New Jersey to receive their wages through direct deposit. Direct deposit is a convenient and secure method of payment where employers electronically deposit employees' wages directly into their designated bank accounts. The agreement typically includes important information such as the employee's bank details, the employer's responsibilities, and the employee's rights regarding direct deposit. It specifies the type of accounts that are eligible for direct deposit, which are usually checking or savings accounts held at a financial institution that is a member of the Automated Clearing House (ACH) network. The agreement highlights the employee's consent to receiving their wages via direct deposit and acknowledges their understanding of the agreement's terms. It may also specify the timeframe for the first direct deposit to take place after the agreement is signed, as well as any subsequent deposits. It is important to note that there may be different types of New Jersey Direct Deposit Agreements, depending on the employer or industry. For example, there could be specific agreements for government employees, private sector employees, or employees represented by labor unions. The content and terms of these agreements may differ slightly, as they are tailored to meet the specific needs and regulations of the respective employment sectors. Overall, the New Jersey Direct Deposit Agreement is a crucial document that ensures a seamless and efficient method of wage payment for employees in the state. It provides legal protection for both employers and employees and promotes financial security through the safe and timely transfer of funds.

The New Jersey Direct Deposit Agreement is a legal document that outlines the terms and conditions for employees in the state of New Jersey to receive their wages through direct deposit. Direct deposit is a convenient and secure method of payment where employers electronically deposit employees' wages directly into their designated bank accounts. The agreement typically includes important information such as the employee's bank details, the employer's responsibilities, and the employee's rights regarding direct deposit. It specifies the type of accounts that are eligible for direct deposit, which are usually checking or savings accounts held at a financial institution that is a member of the Automated Clearing House (ACH) network. The agreement highlights the employee's consent to receiving their wages via direct deposit and acknowledges their understanding of the agreement's terms. It may also specify the timeframe for the first direct deposit to take place after the agreement is signed, as well as any subsequent deposits. It is important to note that there may be different types of New Jersey Direct Deposit Agreements, depending on the employer or industry. For example, there could be specific agreements for government employees, private sector employees, or employees represented by labor unions. The content and terms of these agreements may differ slightly, as they are tailored to meet the specific needs and regulations of the respective employment sectors. Overall, the New Jersey Direct Deposit Agreement is a crucial document that ensures a seamless and efficient method of wage payment for employees in the state. It provides legal protection for both employers and employees and promotes financial security through the safe and timely transfer of funds.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.