Title: Understanding the New Jersey Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction Introduction: A Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction in New Jersey is a legally binding contract entered between parties involved in the sale and purchase of a business. This agreement outlines the transfer of assets and provides provisions for retaining employees of the acquired company. It plays a crucial role in ensuring a smooth transition of ownership and maintaining a talented workforce. This article will discuss the various types of Sale of Business — Retained Employees Agreement — Asset Purchase Transaction in New Jersey and their key elements. 1. Types of Sale of Business — Retained Employees Agreement — Asset Purchase Transaction in New Jersey: — Partial Asset Purchase: This type of agreement involves the acquisition of only certain assets of the selling business, along with the retention of select employees. — Full Asset Purchase: In a full asset purchase transaction, the buyer acquires all the assets of the selling business, while retaining employees in key positions within the organizational structure. Key Elements of the Agreement: a) Asset Transfer: The agreement should clearly identify the assets being transferred, including tangible assets like equipment, inventory, property, as well as intangible assets such as trademarks, licenses, contracts, and goodwill. b) Employee Retention: The agreement must outline which employees will be retained by the buyer, thereby safeguarding their legal rights, job security, and employment benefits. Details regarding their roles, responsibilities, seniority, work contracts, compensation, and benefits should be specified. c) Consideration: The consideration or purchase price for the acquired assets should be clearly stated, along with the payment terms and any contingencies. d) Due Diligence: Both parties should conduct a thorough due diligence process to investigate and validate the financial, legal, operational, and tax aspects of the business. This ensures transparency and minimizes potential risks. e) Non-Compete Clauses: The agreement may include non-compete clauses that restrict sellers from competing in a similar line of business within a specified time frame or geographic location. This provision protects the buyer's interests and prevents unfair competition. f) Governing Law and Dispute Resolution: The agreement should specify that it is governed by the laws of New Jersey, and any disputes arising from the transaction shall be resolved through arbitration or litigation. Conclusion: A New Jersey Sale of Business — Retained EmployeeAgreementen— - Asset Purchase Transaction is a complex legal document that defines the terms and conditions of transferring assets from a selling business to a buyer, while ensuring the retention of crucial employees. It is vital to seek legal counsel to draft a comprehensive agreement that protects the interests of all parties involved and ensures a successful transition of ownership.

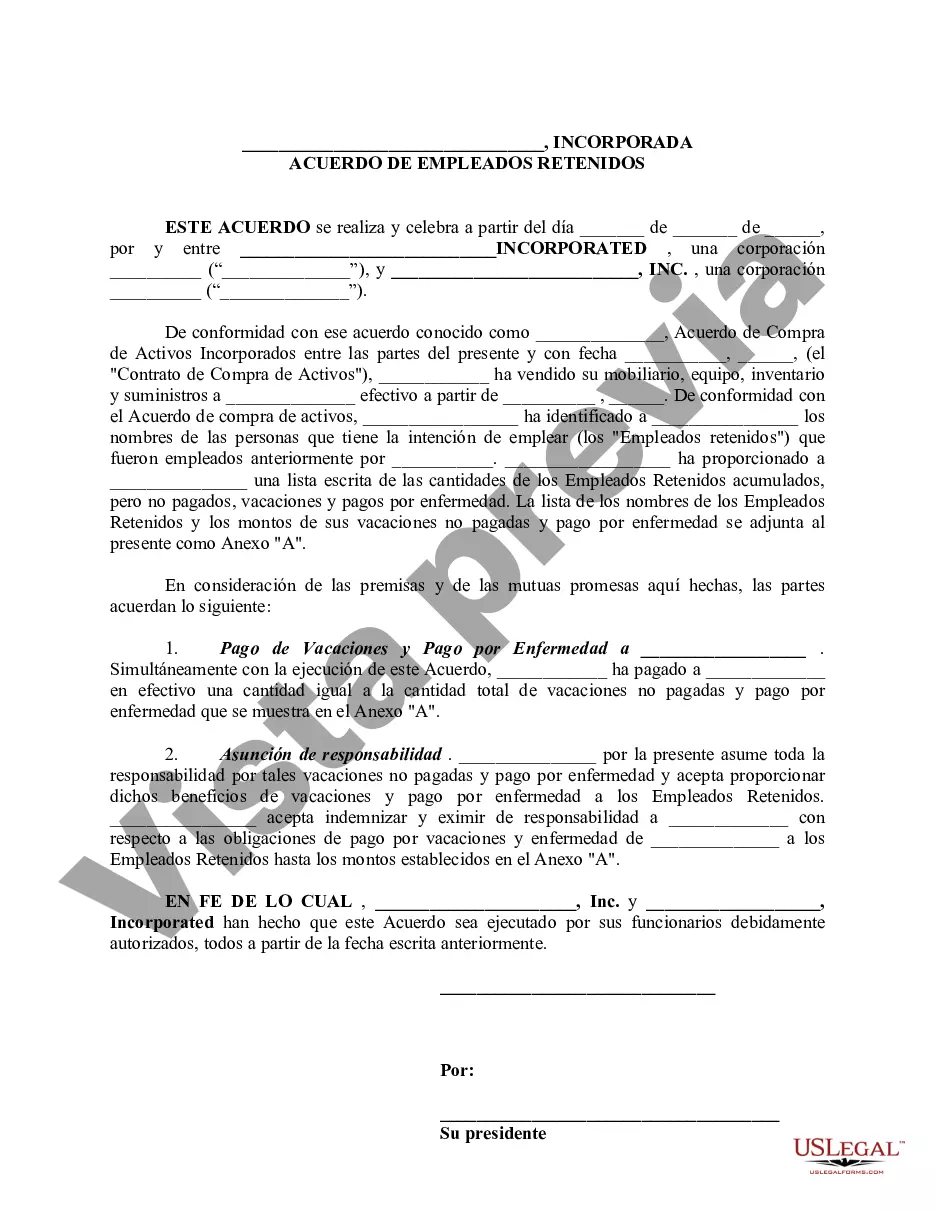

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Venta de negocio - Acuerdo de empleados retenidos - Transacción de compra de activos - Sale of Business - Retained Employees Agreement - Asset Purchase Transaction

Description

How to fill out New Jersey Venta De Negocio - Acuerdo De Empleados Retenidos - Transacción De Compra De Activos?

Discovering the right legitimate record template might be a have a problem. Naturally, there are a variety of themes available online, but how can you discover the legitimate form you need? Utilize the US Legal Forms site. The services offers 1000s of themes, for example the New Jersey Sale of Business - Retained Employees Agreement - Asset Purchase Transaction, which you can use for company and personal needs. All of the varieties are examined by pros and fulfill state and federal demands.

In case you are currently listed, log in in your profile and then click the Download key to have the New Jersey Sale of Business - Retained Employees Agreement - Asset Purchase Transaction. Utilize your profile to look throughout the legitimate varieties you might have purchased formerly. Go to the My Forms tab of your profile and acquire another copy in the record you need.

In case you are a new customer of US Legal Forms, here are easy guidelines so that you can stick to:

- First, ensure you have selected the right form to your area/state. You are able to check out the shape while using Preview key and look at the shape information to make certain this is basically the right one for you.

- If the form fails to fulfill your expectations, take advantage of the Seach area to find the correct form.

- Once you are sure that the shape is proper, go through the Get now key to have the form.

- Opt for the pricing program you want and type in the required details. Build your profile and pay money for your order making use of your PayPal profile or Visa or Mastercard.

- Opt for the data file file format and obtain the legitimate record template in your system.

- Total, revise and print and indicator the obtained New Jersey Sale of Business - Retained Employees Agreement - Asset Purchase Transaction.

US Legal Forms is the largest collection of legitimate varieties where you can find different record themes. Utilize the company to obtain professionally-made papers that stick to condition demands.