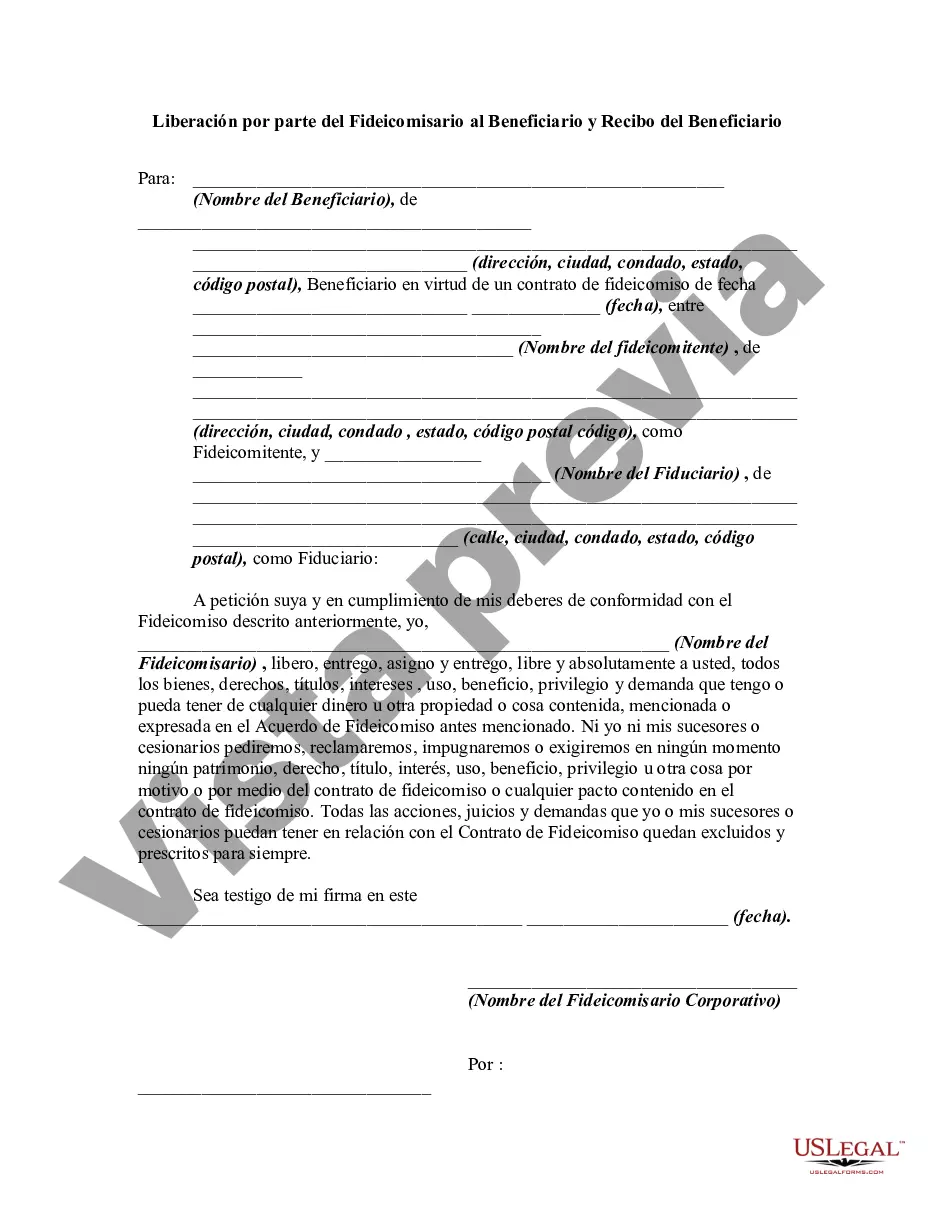

This form is a sample of a release given by the trustee of a trust agreement transferring all property held by the trustee pursuant to the trust agreement to the beneficiary and releasing all claims to the said property. This form assumes that the trust has ended and that the beneficiary has requested release of the property to him/her. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Jersey Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that signifies the completion of a trust or the transfer of assets from a trustee to a beneficiary. This document serves as evidence that the trustee has fulfilled their responsibilities and is releasing their obligations towards the beneficiary. It is an essential step in the trust administration process that ensures a smooth transition of assets. In the state of New Jersey, there are different types of Release by Trustee to Beneficiary and Receipt from Beneficiary, based on the various types of trusts established. Some of these types include: 1. Revocable Living Trust Release: This type of release occurs when a revocable living trust is terminated, usually due to the death or incapacitation of the trust's creator (granter). The trustee, who was appointed by the granter, will distribute the trust assets as specified in the trust agreement to the named beneficiaries or their representatives. The Release by Trustee to Beneficiary and Receipt from Beneficiary will document the transfer of assets to the beneficiaries and will release the trustee from any further obligations. 2. Testamentary Trust Release: A testamentary trust is established through a person's will and becomes effective upon their death. The trustee, usually named in the will, manages the trust assets and distributes them according to the will's instructions. Once the distributions are complete, the trustee will prepare the Release by Trustee to Beneficiary and Receipt from Beneficiary to formally transfer the assets to the beneficiaries and confirm their receipt. 3. Special Needs Trust Release: A special needs trust is created to provide for the ongoing care and support of a person with disabilities or special needs. The trustee is responsible for managing the trust assets in a way that does not jeopardize the beneficiary's eligibility for government benefits. When the trustee determines that it is appropriate to release funds for the beneficiary's benefit or expenses, they will execute a Release by Trustee to Beneficiary and Receipt from Beneficiary, documenting the transaction and ensuring compliance with the trust agreement. 4. Charitable Trust Release: Charitable trusts are established to support charitable causes or organizations. The trustee manages the trust assets and distributes funds or properties to the designated charitable beneficiaries. The Release by Trustee to Beneficiary and Receipt from Beneficiary will record the transfer of funds or assets from the trust to the charitable organization, acknowledging the trust's fulfillment and releasing the trustee from further obligations. In all variations of the New Jersey Release by Trustee to Beneficiary and Receipt from Beneficiary, it is crucial to accurately document the transfer of assets, including their nature and value, to maintain transparency and ensure the trust administration process complies with applicable laws and regulations.New Jersey Release by Trustee to Beneficiary and Receipt from Beneficiary is a legal document that signifies the completion of a trust or the transfer of assets from a trustee to a beneficiary. This document serves as evidence that the trustee has fulfilled their responsibilities and is releasing their obligations towards the beneficiary. It is an essential step in the trust administration process that ensures a smooth transition of assets. In the state of New Jersey, there are different types of Release by Trustee to Beneficiary and Receipt from Beneficiary, based on the various types of trusts established. Some of these types include: 1. Revocable Living Trust Release: This type of release occurs when a revocable living trust is terminated, usually due to the death or incapacitation of the trust's creator (granter). The trustee, who was appointed by the granter, will distribute the trust assets as specified in the trust agreement to the named beneficiaries or their representatives. The Release by Trustee to Beneficiary and Receipt from Beneficiary will document the transfer of assets to the beneficiaries and will release the trustee from any further obligations. 2. Testamentary Trust Release: A testamentary trust is established through a person's will and becomes effective upon their death. The trustee, usually named in the will, manages the trust assets and distributes them according to the will's instructions. Once the distributions are complete, the trustee will prepare the Release by Trustee to Beneficiary and Receipt from Beneficiary to formally transfer the assets to the beneficiaries and confirm their receipt. 3. Special Needs Trust Release: A special needs trust is created to provide for the ongoing care and support of a person with disabilities or special needs. The trustee is responsible for managing the trust assets in a way that does not jeopardize the beneficiary's eligibility for government benefits. When the trustee determines that it is appropriate to release funds for the beneficiary's benefit or expenses, they will execute a Release by Trustee to Beneficiary and Receipt from Beneficiary, documenting the transaction and ensuring compliance with the trust agreement. 4. Charitable Trust Release: Charitable trusts are established to support charitable causes or organizations. The trustee manages the trust assets and distributes funds or properties to the designated charitable beneficiaries. The Release by Trustee to Beneficiary and Receipt from Beneficiary will record the transfer of funds or assets from the trust to the charitable organization, acknowledging the trust's fulfillment and releasing the trustee from further obligations. In all variations of the New Jersey Release by Trustee to Beneficiary and Receipt from Beneficiary, it is crucial to accurately document the transfer of assets, including their nature and value, to maintain transparency and ensure the trust administration process complies with applicable laws and regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.