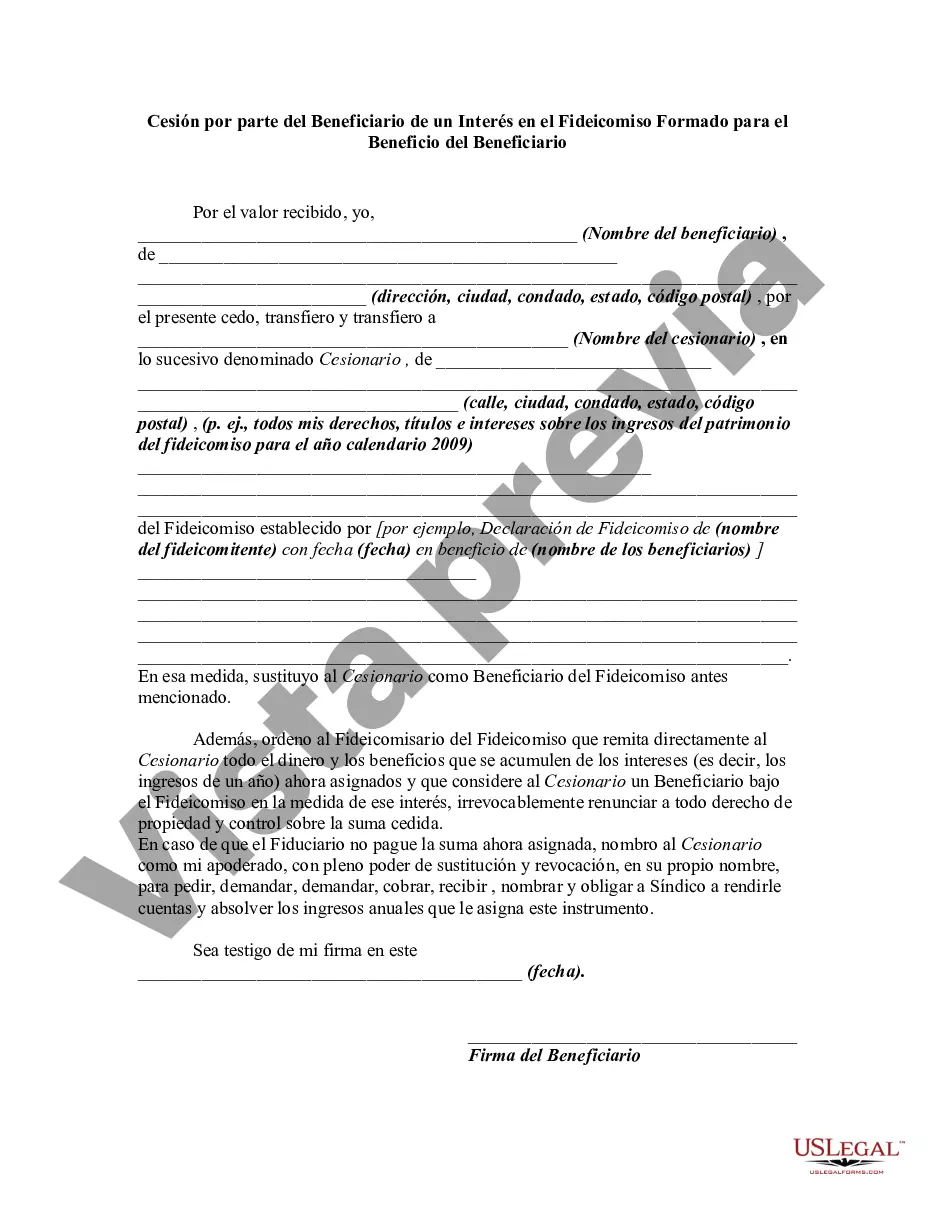

An assignment by a beneficiary of his or her interest in a trust is usually regarded as a transfer of a right, title, or estate in property rather than a chose in action (like an account receivable). As a general rule, the essentials of such an assignment or transfer are the same as those for any transfer of real or personal property. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

A New Jersey Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legal document in which a beneficiary transfers or assigns their interest or rights in a trust to another party. This assignment can either be partial or whole, depending on the beneficiary's decision. The keywords relevant to this assignment form include "New Jersey," "assignment," "beneficiary," "interest," "trust," and "formed for the benefit of beneficiary." This document is specific to New Jersey, highlighting its jurisdiction and legal requirements. There are various types of New Jersey Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, depending on the specific circumstances and intentions of the beneficiary. Some common types include: 1. Partial Assignment: In this type, the beneficiary assigns only a portion of their interest in the trust. It could be a specific percentage or defined assets within the trust. 2. Total Assignment: This assignment involves the transfer of the beneficiary's entire interest in the trust. The beneficiary relinquishes all rights, title, and claims related to the trust. 3. Revocable Assignment: This type of assignment allows the beneficiary to withdraw or alter the assignment at any given period. They can revoke or change the assignment based on their changing circumstances or preferences. 4. Irrevocable Assignment: In contrast to the revocable assignment, an irrevocable assignment cannot be withdrawn or altered once it is made. The beneficiary permanently gives up their interest in the trust. 5. Inter Vivos Assignment: This assignment takes place during the lifetime of the beneficiary. The assignment can occur for various reasons, such as financial planning, tax implications, or estate planning. 6. Testamentary Assignment: This type involves the assignment of the beneficiary's interest in the trust upon their death as stated in their will. It becomes effective only after the beneficiary's passing. 7. Absolute Assignment: In this assignment, the beneficiary transfers their interest in the trust without any conditions or restrictions. The assignee receives the full rights and benefits associated with the assigned interest. 8. Conditional Assignment: Unlike the absolute assignment, the conditional assignment is subject to certain terms or conditions. The transfer of the beneficiary's interest occurs only if the conditions, such as the occurrence of a specific event, are met. To create a comprehensive New Jersey Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, it is crucial to consider the specific type of assignment and the purpose behind the beneficiary's decision. Seeking legal advice and ensuring compliance with applicable New Jersey laws is strongly recommended during the creation and execution of such assignment forms.A New Jersey Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary is a legal document in which a beneficiary transfers or assigns their interest or rights in a trust to another party. This assignment can either be partial or whole, depending on the beneficiary's decision. The keywords relevant to this assignment form include "New Jersey," "assignment," "beneficiary," "interest," "trust," and "formed for the benefit of beneficiary." This document is specific to New Jersey, highlighting its jurisdiction and legal requirements. There are various types of New Jersey Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, depending on the specific circumstances and intentions of the beneficiary. Some common types include: 1. Partial Assignment: In this type, the beneficiary assigns only a portion of their interest in the trust. It could be a specific percentage or defined assets within the trust. 2. Total Assignment: This assignment involves the transfer of the beneficiary's entire interest in the trust. The beneficiary relinquishes all rights, title, and claims related to the trust. 3. Revocable Assignment: This type of assignment allows the beneficiary to withdraw or alter the assignment at any given period. They can revoke or change the assignment based on their changing circumstances or preferences. 4. Irrevocable Assignment: In contrast to the revocable assignment, an irrevocable assignment cannot be withdrawn or altered once it is made. The beneficiary permanently gives up their interest in the trust. 5. Inter Vivos Assignment: This assignment takes place during the lifetime of the beneficiary. The assignment can occur for various reasons, such as financial planning, tax implications, or estate planning. 6. Testamentary Assignment: This type involves the assignment of the beneficiary's interest in the trust upon their death as stated in their will. It becomes effective only after the beneficiary's passing. 7. Absolute Assignment: In this assignment, the beneficiary transfers their interest in the trust without any conditions or restrictions. The assignee receives the full rights and benefits associated with the assigned interest. 8. Conditional Assignment: Unlike the absolute assignment, the conditional assignment is subject to certain terms or conditions. The transfer of the beneficiary's interest occurs only if the conditions, such as the occurrence of a specific event, are met. To create a comprehensive New Jersey Assignment by Beneficiary of an Interest in the Trust Formed for the Benefit of Beneficiary, it is crucial to consider the specific type of assignment and the purpose behind the beneficiary's decision. Seeking legal advice and ensuring compliance with applicable New Jersey laws is strongly recommended during the creation and execution of such assignment forms.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.