Partnerships may be dissolved by acts of the partners, order of a Court, or by operation of law. From the moment of dissolution, the partners lose their authority to act for the firm except as necessary to wind up the partnership affairs or complete transactions which have begun, but not yet been finished.

A partner has the power to withdraw from the partnership at any time. However, if the withdrawal violates the partnership agreement, the withdrawing partner becomes liable to the co-partners for any damages for breach of contract. If the partnership relationship is for no definite time, a partner may withdraw without liability at any time.

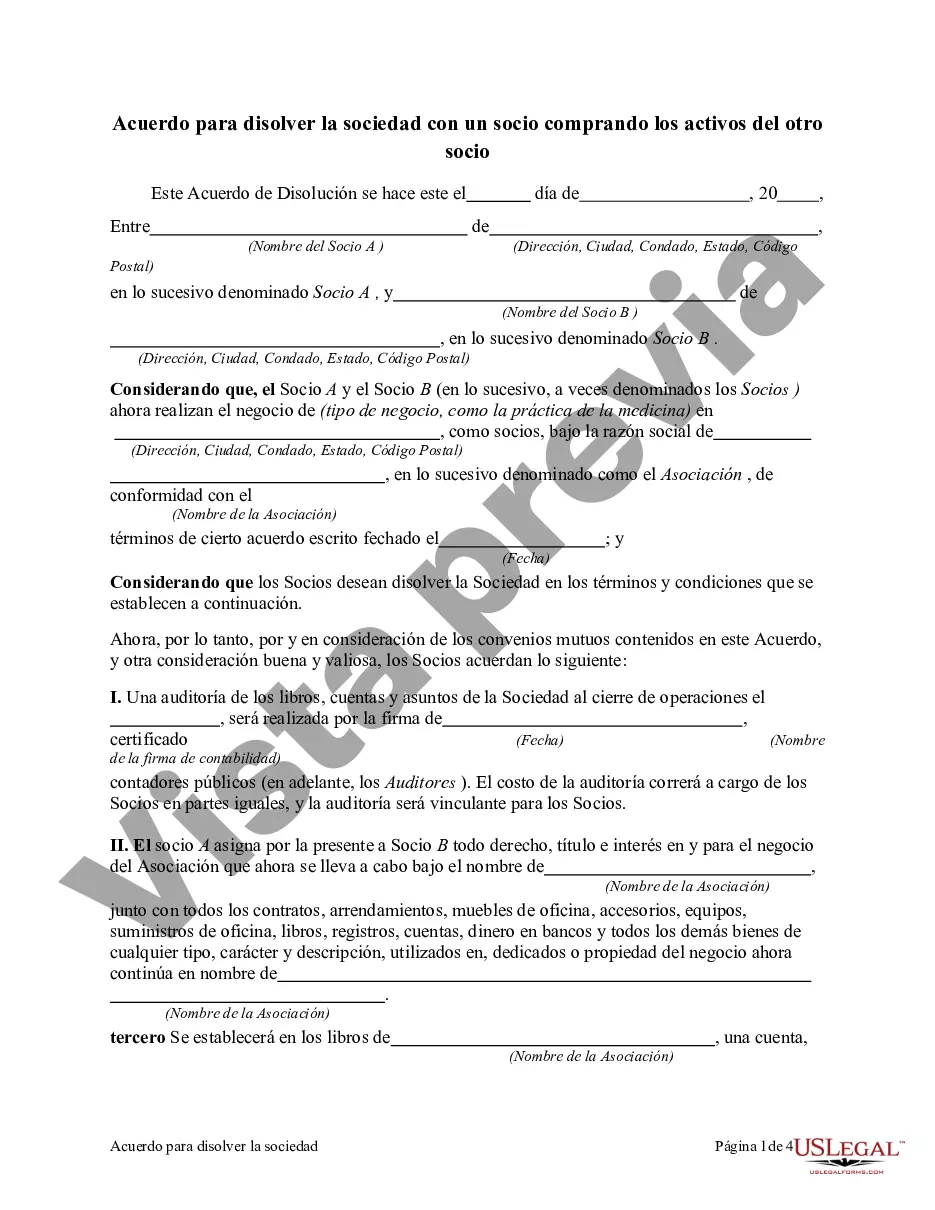

Title: New Jersey Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner — A Comprehensive Overview Keywords: New Jersey Partnership Dissolution Agreement, Asset Purchase Agreement, Partnership Break-up, Partner Purchase Agreement, Dissolution of Partnership, Partnership Termination, Asset Transfer, Partnership Asset Acquisition Introduction: The New Jersey Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a legal document that outlines the terms and conditions for dissolving a partnership where one partner (the Purchasing Partner) acquires the assets of the other partner (the Selling Partner). This agreement provides a framework for a smooth transition and equitable division of assets during the dissolution of the partnership. Types of New Jersey Agreements to Dissolve Partnership with one Partner Purchasing the Assets: 1. Comprehensive Asset Purchase Agreement: This type of agreement encompasses a complete transfer of all assets, liabilities, and obligations of the partnership to the Purchasing Partner. It includes detailed provisions addressing the purchase price, payment terms, allocation of assets, liabilities, and any ongoing obligations. 2. Limited Asset Purchase Agreement: In some cases, partners may decide to dissolve the partnership without transferring all assets. A limited asset purchase agreement specifies specific assets included in the purchase, and the remaining assets are liquidated, distributed, or retained by the Selling Partner. Key Elements of the Agreement: 1. Identification of the Parties: Clearly state the legal names of both partners, their roles within the partnership, and their addresses for effective communication. 2. Agreement Purpose: Explicitly state the intention to dissolve the partnership, highlighting the reason for dissolution, such as retirement, change in business focus, or mutual agreement. 3. Asset Transfer and Purchase Price: Define the assets being transferred to the Purchasing Partner and specify the purchase price for those assets. Include provisions for payment terms, such as installment payments or lump-sum payment. 4. Allocation of Liabilities: Address how existing partnership liabilities and debts will be allocated between the partners. Determine who assumes responsibility for outstanding debts or liabilities. 5. Partner Withdrawal and Release: Outline the withdrawal process for the Selling Partner, including the termination of their role within the partnership. Include provisions for the release of any claims, rights, or obligations held by the Selling Partner upon completion of the dissolution. 6. Confidentiality and Non-Compete: Include clauses regarding confidentiality and non-compete obligations to protect the interest of both partners and maintain goodwill after the dissolution. 7. Dispute Resolution: Specify methods for resolving any disputes that may arise during or after the dissolution process, such as mediation or arbitration, ensuring a fair and amicable resolution. Conclusion: The New Jersey Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner serves as a legally binding document that defines the terms and conditions of the dissolution process. It safeguards the interests of both partners involved, offers clarity on asset transfer, liabilities, and sets a framework for a smooth transition while concluding the partnership. It is essential to consult legal professionals proficient in New Jersey law to draft a comprehensive and customized agreement based on the specific needs of the partnership.Title: New Jersey Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner — A Comprehensive Overview Keywords: New Jersey Partnership Dissolution Agreement, Asset Purchase Agreement, Partnership Break-up, Partner Purchase Agreement, Dissolution of Partnership, Partnership Termination, Asset Transfer, Partnership Asset Acquisition Introduction: The New Jersey Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner is a legal document that outlines the terms and conditions for dissolving a partnership where one partner (the Purchasing Partner) acquires the assets of the other partner (the Selling Partner). This agreement provides a framework for a smooth transition and equitable division of assets during the dissolution of the partnership. Types of New Jersey Agreements to Dissolve Partnership with one Partner Purchasing the Assets: 1. Comprehensive Asset Purchase Agreement: This type of agreement encompasses a complete transfer of all assets, liabilities, and obligations of the partnership to the Purchasing Partner. It includes detailed provisions addressing the purchase price, payment terms, allocation of assets, liabilities, and any ongoing obligations. 2. Limited Asset Purchase Agreement: In some cases, partners may decide to dissolve the partnership without transferring all assets. A limited asset purchase agreement specifies specific assets included in the purchase, and the remaining assets are liquidated, distributed, or retained by the Selling Partner. Key Elements of the Agreement: 1. Identification of the Parties: Clearly state the legal names of both partners, their roles within the partnership, and their addresses for effective communication. 2. Agreement Purpose: Explicitly state the intention to dissolve the partnership, highlighting the reason for dissolution, such as retirement, change in business focus, or mutual agreement. 3. Asset Transfer and Purchase Price: Define the assets being transferred to the Purchasing Partner and specify the purchase price for those assets. Include provisions for payment terms, such as installment payments or lump-sum payment. 4. Allocation of Liabilities: Address how existing partnership liabilities and debts will be allocated between the partners. Determine who assumes responsibility for outstanding debts or liabilities. 5. Partner Withdrawal and Release: Outline the withdrawal process for the Selling Partner, including the termination of their role within the partnership. Include provisions for the release of any claims, rights, or obligations held by the Selling Partner upon completion of the dissolution. 6. Confidentiality and Non-Compete: Include clauses regarding confidentiality and non-compete obligations to protect the interest of both partners and maintain goodwill after the dissolution. 7. Dispute Resolution: Specify methods for resolving any disputes that may arise during or after the dissolution process, such as mediation or arbitration, ensuring a fair and amicable resolution. Conclusion: The New Jersey Agreement to Dissolve Partnership with one Partner Purchasing the Assets of the Other Partner serves as a legally binding document that defines the terms and conditions of the dissolution process. It safeguards the interests of both partners involved, offers clarity on asset transfer, liabilities, and sets a framework for a smooth transition while concluding the partnership. It is essential to consult legal professionals proficient in New Jersey law to draft a comprehensive and customized agreement based on the specific needs of the partnership.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.