Once a debt collector receives written notice from a consumer that the consumer refuses to pay the debt or wants the collector to stop further collection efforts, the debt collector must cease communications with the consumer except:

To advise the consumer that they are terminating their debt collecting efforts;

To notify the consumer that the debt collector or creditor may invoke specified remedies which they ordinarily invoke; and

To notify the consumer that the debt collector or creditor intends to invoke a specified remedy.

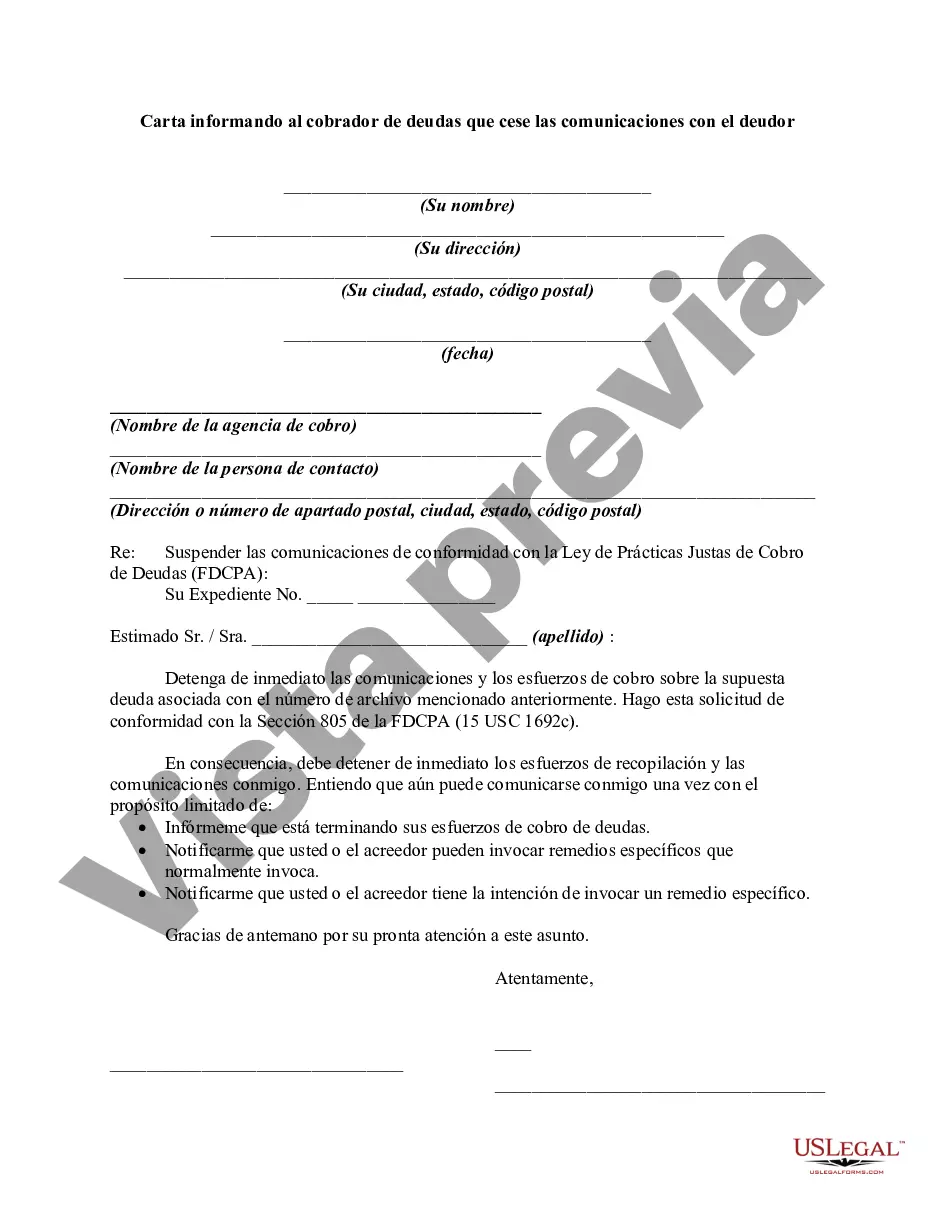

A New Jersey Letter Informing to Debt Collector to Cease Communications with Debtor is a written communication sent by a debtor to a debt collector, specifically in the state of New Jersey. This letter requests the debt collector to stop communicating with the debtor regarding a certain debt. It is crucial to use specific keywords and include essential information to make the letter effective and legally enforceable in New Jersey. The letter should start with the debtor's full name, address, and contact information. It is important to include the date to document when the letter was sent. The subject line of the letter should clearly state its purpose, such as "Cease Communications Request: [Debtor's Name] — [Account Number/Reference Number]." Next, clearly address the debt collector or collection agency by their full name, address, and contact information. Use specific language to identify the agency and any other relevant details, such as reference numbers, to ensure the letter is directed accurately. In the body of the letter, state the purpose and intent clearly. For example: "This letter is to inform you that I am hereby exercising my rights under the Fair Debt Collection Practices Act (FD CPA) and the New Jersey Consumer Fraud Act to request that you cease all communications, both written and verbal, regarding the alleged debt referenced above." It is crucial to articulate the specific debt being addressed, including the amount owed and any other relevant information to avoid any misunderstandings. Additionally, the letter should emphasize that the debtor prefers all communication to be conducted in writing. This is important to establish a record of all future communications, if necessary. The letter should specify that the debtor will respond only to written correspondence, and any further attempts to communicate through other means will be considered a violation of the FD CPA and may result in legal action. Furthermore, it is essential to mention that the debtor's request does not imply an acknowledgment or acceptance of the debt's validity or any obligation to pay. The purpose of this letter is solely to exercise the debtor's rights to cease communications. Different types of New Jersey Letters Informing Debt Collectors to Cease Communications with Debtors may vary in language and specifics based on the debtor's unique circumstances. Some may involves multiple debts or even involve multiple debt collectors. However, the overall structure and intent of the letters remain consistent. Lastly, the letter should conclude with the debtor's full name, a request for a written confirmation of receipt of the letter, and a stern warning against any violation of the debtor's rights. It is recommended to send the letter via certified mail with a return receipt requested to have documented proof of delivery. Overall, a New Jersey Letter Informing to Debt Collector to Cease Communications with Debtor provides debtors a legal means to request that debt collectors cease communication while protecting their rights under the FD CPA and state consumer protection laws.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.