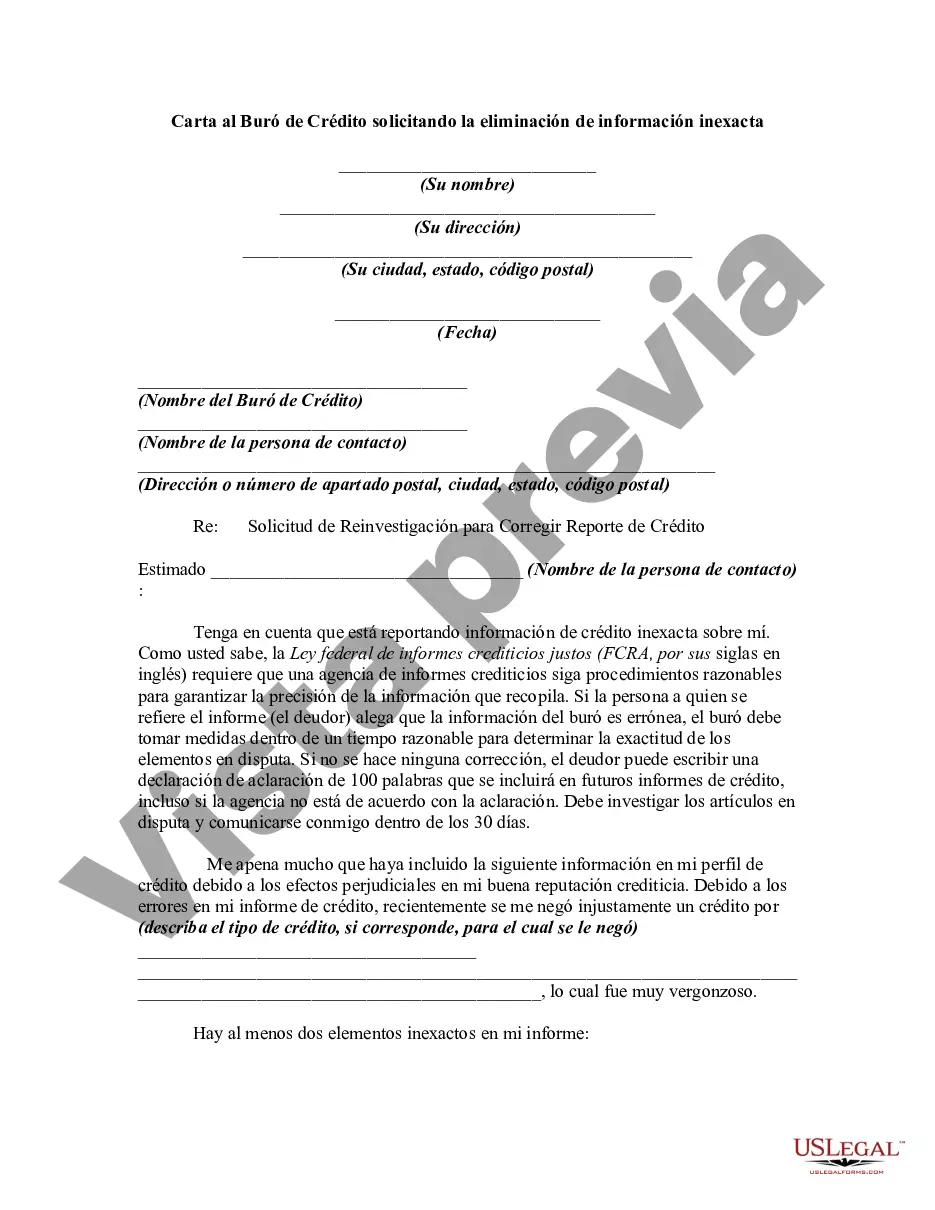

This form is a sample letter requesting the removal of inaccurate information. Always include any copies of proof you may have (e.g., copies of cancelled checks showing timely payments). If the person claims that the information of the bureau is erroneous, the bureau must take steps within a reasonable time to determine the accuracy of the disputed items. If no correction is made, the debtor can write a 100 word statement of clarification which will be included in future credit reports, even it the agency disagrees with clarification.

Subject: New Jersey Letter to Credit Bureau — Requesting Removal of Inaccurate Information Keywords: New Jersey, letter, credit bureau, removal, inaccurate information, dispute, credit report, credit score, consumer rights, identity theft Dear [Credit Bureau Name], I hope this letter finds you well. I am writing to bring to your attention certain inaccurate information being reported on my credit report, as per the provisions of the Fair Credit Reporting Act (FCRA). I am a resident of the beautiful state of New Jersey and have identified discrepancies that need to be rectified promptly. First and foremost, I am requesting the removal of the following inaccurate information from my credit report: 1. Account [Account Number]: According to my records, this account was closed on [Date]. However, it is currently being reported as open on my credit report. I kindly request you review this matter and correct the status accurately. 2. Collection [Collection Agency Name]: There is an alleged debt collection account initiated by [Collection Agency Name] for an amount of [Amount] on [Date]. I have no knowledge of any such debt and believe this to be a case of mistaken identity or potential identity theft. I request an immediate investigation and ask you to remove this erroneous collection account from my credit report. Additionally, please be advised that I have enclosed copies of supporting documents, such as account statements, payment receipts, or any other relevant evidence, to support my claim. I kindly urge you to give careful consideration to this matter and conduct a thorough investigation as soon as possible. In accordance with the FCRA, I understand that you have 30 days to investigate my dispute and respond accordingly. Therefore, I request that you provide me with a written confirmation of the initiation of the investigation within five business days of receiving this letter. Furthermore, as a New Jersey resident, I seek to exercise my rights granted under the New Jersey Fair Credit Reporting Act (N.J.S.A. 56:11-14 et seq.). I expect that my concerns and request for rectification will be handled in a proper and timely manner. I also demand that you provide me with a free copy of my credit report once the inaccuracies have been resolved in compliance with the FCRA. Please note that failure to comply with these legal obligations may result in the escalation of this matter, which could lead to legal action, including but not limited to filing a complaint with the New Jersey Department of Banking and Insurance and seeking damages through the appropriate legal means. I appreciate your cooperation in this matter and expect a prompt response. You may contact me at the address listed below or reach out to me via phone at [Your Contact Number] to discuss any further details or clarifications. Thank you for your immediate attention to this important matter. Sincerely, [Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] Types of New Jersey Letter to Credit Bureau Requesting the Removal of Inaccurate Information: 1. New Jersey Letter to Credit Bureau — Requesting Removal of Inaccurate Information due to Mistaken Identity 2. New Jersey Letter to Credit Bureau — Requesting Removal of Inaccurate Information due to Identity Theft 3. New Jersey Letter to Credit Bureau — Requesting Removal of Inaccurate Information for Incorrectly Reported Account Status Remember, it is crucial to personalize the letter according to your specific situation or inaccurate information found on your credit report.Subject: New Jersey Letter to Credit Bureau — Requesting Removal of Inaccurate Information Keywords: New Jersey, letter, credit bureau, removal, inaccurate information, dispute, credit report, credit score, consumer rights, identity theft Dear [Credit Bureau Name], I hope this letter finds you well. I am writing to bring to your attention certain inaccurate information being reported on my credit report, as per the provisions of the Fair Credit Reporting Act (FCRA). I am a resident of the beautiful state of New Jersey and have identified discrepancies that need to be rectified promptly. First and foremost, I am requesting the removal of the following inaccurate information from my credit report: 1. Account [Account Number]: According to my records, this account was closed on [Date]. However, it is currently being reported as open on my credit report. I kindly request you review this matter and correct the status accurately. 2. Collection [Collection Agency Name]: There is an alleged debt collection account initiated by [Collection Agency Name] for an amount of [Amount] on [Date]. I have no knowledge of any such debt and believe this to be a case of mistaken identity or potential identity theft. I request an immediate investigation and ask you to remove this erroneous collection account from my credit report. Additionally, please be advised that I have enclosed copies of supporting documents, such as account statements, payment receipts, or any other relevant evidence, to support my claim. I kindly urge you to give careful consideration to this matter and conduct a thorough investigation as soon as possible. In accordance with the FCRA, I understand that you have 30 days to investigate my dispute and respond accordingly. Therefore, I request that you provide me with a written confirmation of the initiation of the investigation within five business days of receiving this letter. Furthermore, as a New Jersey resident, I seek to exercise my rights granted under the New Jersey Fair Credit Reporting Act (N.J.S.A. 56:11-14 et seq.). I expect that my concerns and request for rectification will be handled in a proper and timely manner. I also demand that you provide me with a free copy of my credit report once the inaccuracies have been resolved in compliance with the FCRA. Please note that failure to comply with these legal obligations may result in the escalation of this matter, which could lead to legal action, including but not limited to filing a complaint with the New Jersey Department of Banking and Insurance and seeking damages through the appropriate legal means. I appreciate your cooperation in this matter and expect a prompt response. You may contact me at the address listed below or reach out to me via phone at [Your Contact Number] to discuss any further details or clarifications. Thank you for your immediate attention to this important matter. Sincerely, [Your Name] [Your Address] [City, State, ZIP] [Email Address] [Phone Number] Types of New Jersey Letter to Credit Bureau Requesting the Removal of Inaccurate Information: 1. New Jersey Letter to Credit Bureau — Requesting Removal of Inaccurate Information due to Mistaken Identity 2. New Jersey Letter to Credit Bureau — Requesting Removal of Inaccurate Information due to Identity Theft 3. New Jersey Letter to Credit Bureau — Requesting Removal of Inaccurate Information for Incorrectly Reported Account Status Remember, it is crucial to personalize the letter according to your specific situation or inaccurate information found on your credit report.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.