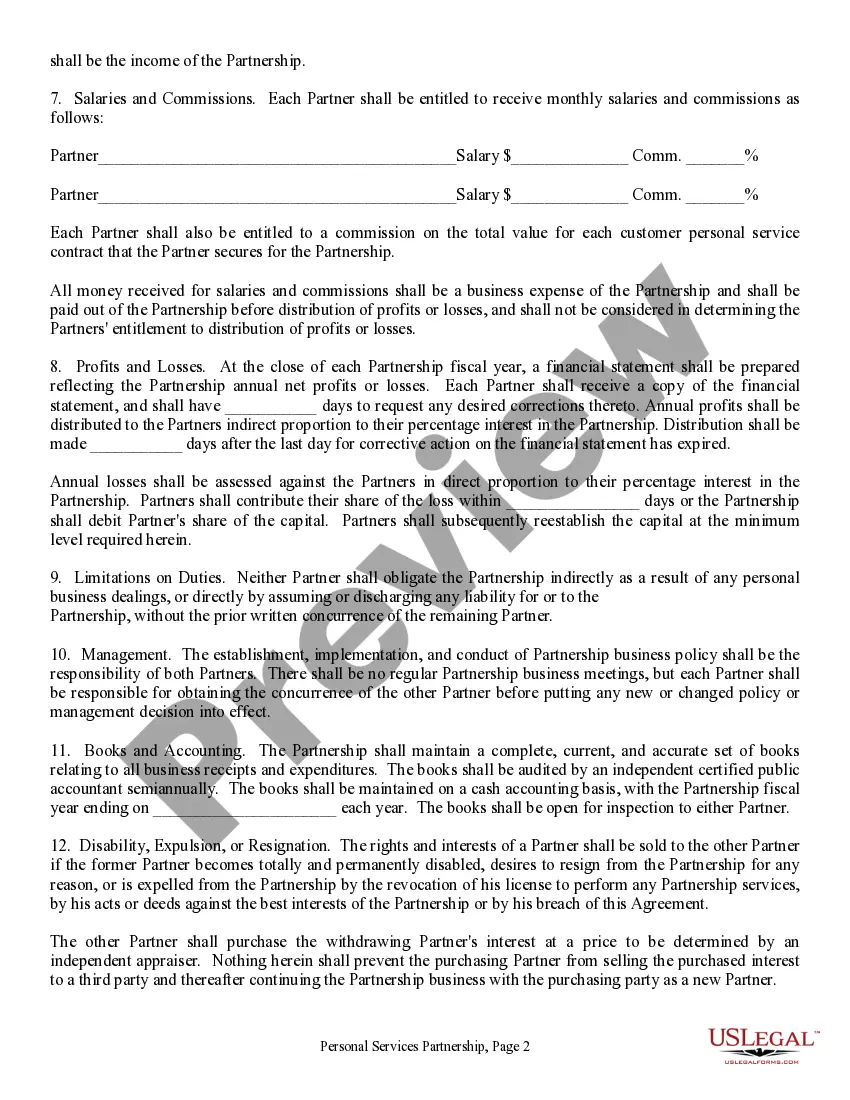

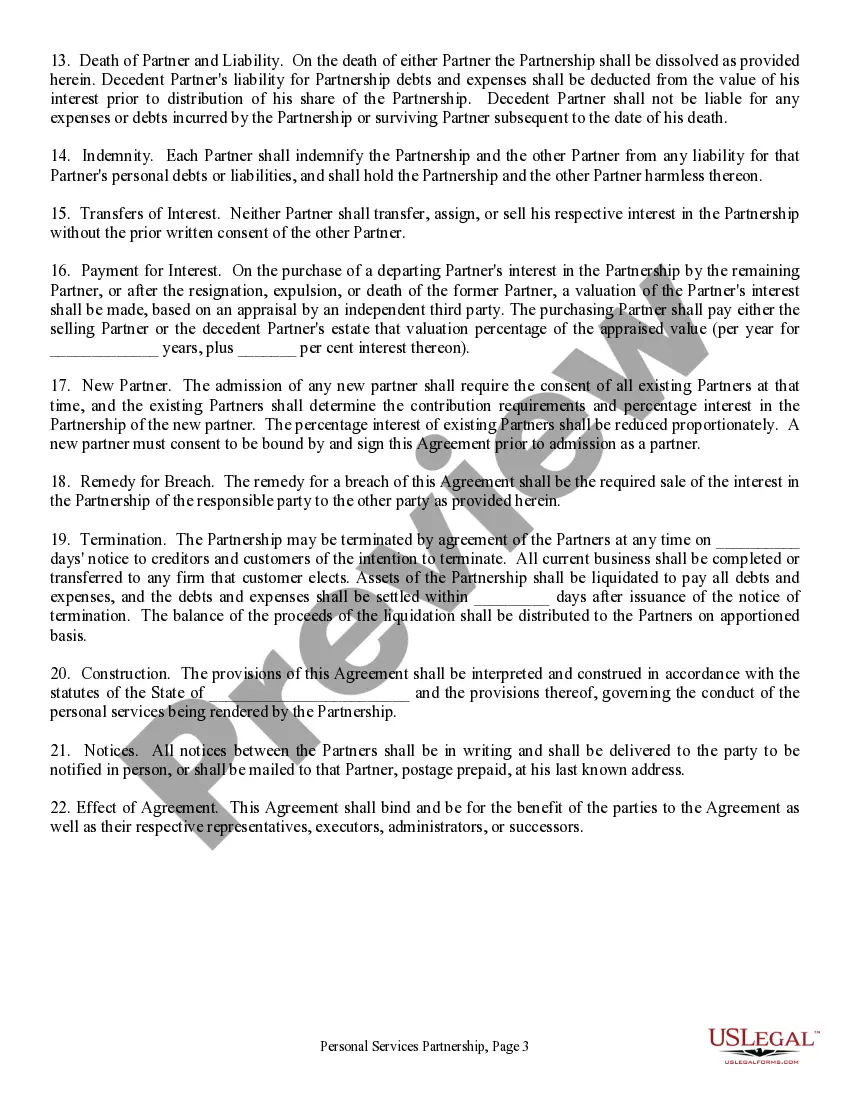

The New Jersey Personal Services Partnership Agreement is a legal contract that establishes a mutually beneficial relationship between two or more parties that wish to enter into a partnership for personal services. This agreement outlines the rights, responsibilities, and obligations of each party involved and ensures clarity and fairness in the partnership. The New Jersey Personal Services Partnership Agreement is designed to be flexible and can be customized to meet the specific needs and goals of the parties involved. It provides a framework for collaboration, promoting the successful execution of personal services projects while protecting the interests of all parties involved. There are different types of New Jersey Personal Services Partnership Agreements that can be established based on the nature of the services being provided. Some common types include: 1. Professional Services Partnership Agreement: This type of partnership agreement is suitable for professionals such as lawyers, accountants, consultants, or any other individuals offering specialized personal services. 2. Creative Services Partnership Agreement: This agreement is tailored for partnerships involving artists, designers, writers, photographers, or any individuals working in creative fields. 3. Health Services Partnership Agreement: This type of partnership agreement is specifically designed for partnerships providing healthcare services, such as doctors, psychologists, therapists, or other healthcare professionals. 4. Maintenance Services Partnership Agreement: This agreement is suitable for partnerships involved in providing home maintenance, landscaping, cleaning, or other types of maintenance services. Regardless of the type of personal services being provided, a New Jersey Personal Services Partnership Agreement typically includes key elements such as: 1. Identification of the parties involved, including their names and contact information. 2. Purpose and scope of the partnership, including a detailed description of the personal services to be provided. 3. Duration of the partnership, outlining the start and end dates or any provisions for termination or renewal. 4. Roles and responsibilities of each party involved, clearly defining the tasks and obligations of each partner. 5. Financial matters, including the division of profits, liabilities, and any provisions for reimbursement of expenses. 6. Intellectual property rights, specifying ownership and usage rights of any intellectual property created or utilized during the partnership. 7. Dispute resolution mechanisms, outlining procedures for resolving conflicts or disagreements between the parties. 8. Confidentiality and non-disclosure agreements, to safeguard sensitive information shared between the parties. In conclusion, the New Jersey Personal Services Partnership Agreement is a customizable contract that establishes a detailed framework for partnerships involving personal services. By entering into this agreement, all parties involved can ensure that their rights are protected, responsibilities are clearly defined, and their partnership is conducted in a fair and mutually beneficial manner.

New Jersey Personal Services Partnership Agreement

Description

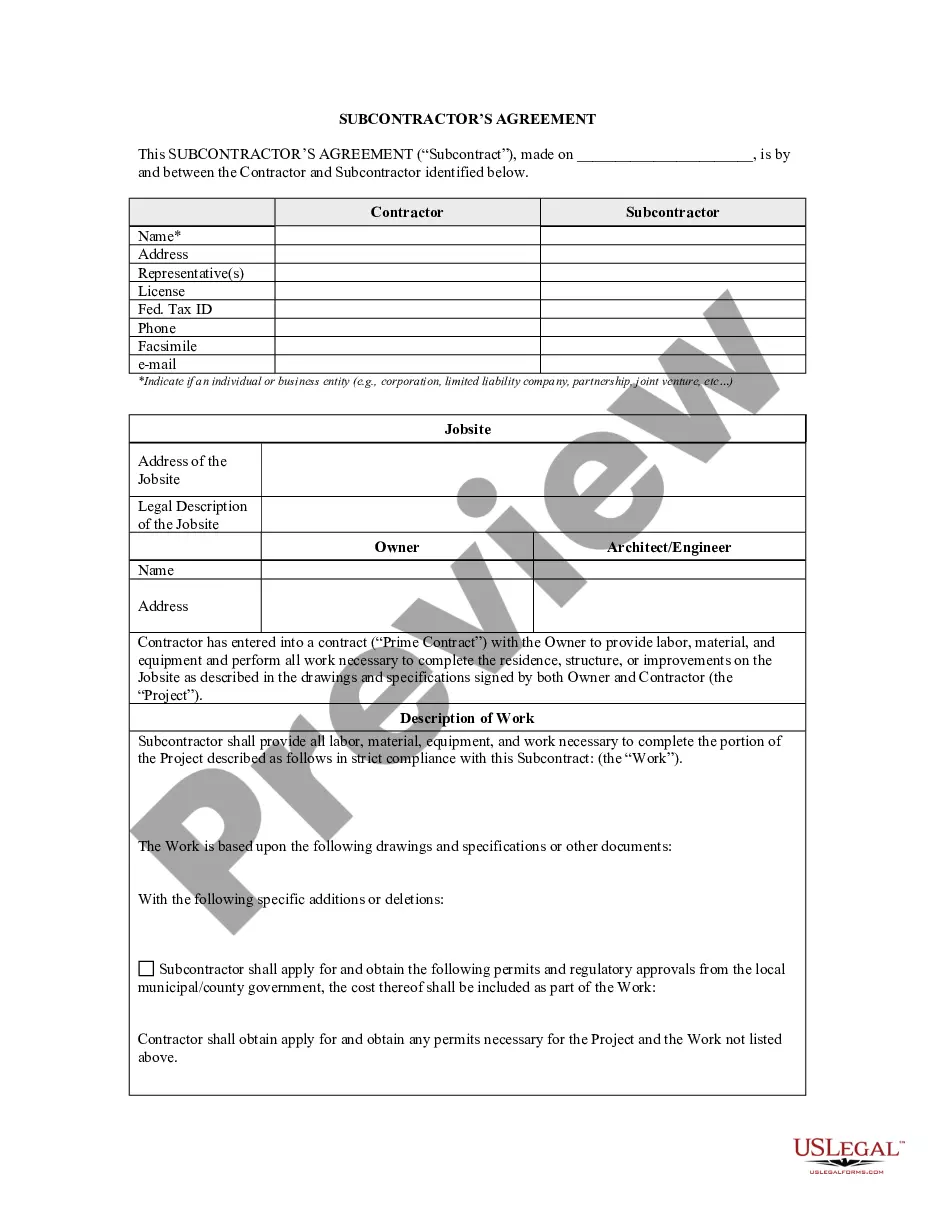

How to fill out Personal Services Partnership Agreement?

Selecting the optimal legal document template can be a challenge.

It goes without saying that there are numerous templates accessible online, but how can you locate the legal form you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the New Jersey Personal Services Partnership Agreement, which can be used for business and personal purposes.

If the form does not meet your needs, utilize the Search field to find the appropriate form.

- All templates are reviewed by experts and meet state and federal requirements.

- If you are already registered, Log In to your account and click the Download button to obtain the New Jersey Personal Services Partnership Agreement.

- Use your account to view the legal forms you have purchased previously.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps to follow.

- First, ensure you have selected the correct form for your city/county. You can review the form using the Review button and check the form details to confirm it is the right one for you.

Form popularity

FAQ

Yes, partnerships that operate in New Jersey must file the New Jersey Corporation Business Tax (NJ CBT). This requirement applies to those who create a New Jersey Personal Services Partnership Agreement. By filing the NJ CBT, partnerships can ensure compliance with state tax laws and avoid potential penalties. If you need assistance in managing this process, consider using the resources available on US Legal Forms to simplify your filing.

Not all partnerships need to file Form K-2. This form is specifically for partnerships engaged in international transactions and reporting income from foreign sources. If your partnership operates under the New Jersey Personal Services Partnership Agreement and does not have international activities, you likely will not need to file Form K-2. However, consulting with a tax professional can provide guidance based on your unique situation.

No, Form 1065 and Form 1099 serve different purposes in the tax reporting process. Form 1065 is used by partnerships to report income and losses, whereas Form 1099 is typically used to report various types of income received by individuals who are not employees. For partners in a New Jersey Personal Services Partnership Agreement, using both forms correctly is essential to meet IRS guidelines.

Schedule K-1 is not the same as Form 1065, although they are related. Schedule K-1 provides each partner with a share of the partnership's income, deductions, and credits reported on Form 1065. Thus, while Form 1065 reflects the overall financial data of the partnership, K-1 forms detail individual partners' allocations, ensuring everyone accurately reports their taxes.

Form 1065 is specifically designed for partnerships, not S Corporations or C Corporations. If you operate a partnership under the New Jersey Personal Services Partnership Agreement, this form is your go-to for reporting. S and C Corporations use Form 1120 or 1120S for their tax filings, so be sure to choose the correct form for your entity type.

Filling out a partnership form, such as the New Jersey Personal Services Partnership Agreement, requires providing essential details about the partnership's structure, partners, and financial information. You should gather all necessary documentation related to income, expenses, and partnership agreements. Additionally, using a reliable platform like US Legal Forms can simplify the process by providing templates that guide you through each section.

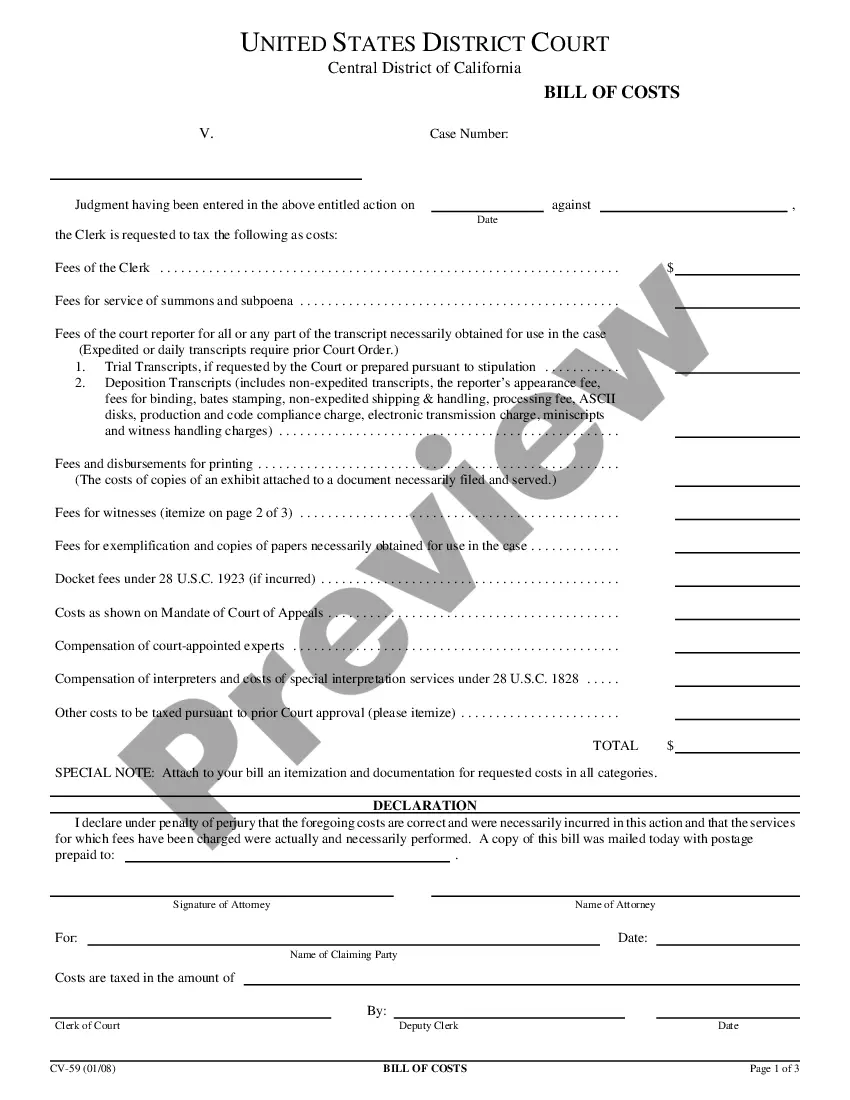

Partnerships in New Jersey typically need to fill out Form 1065 when filing their taxes. This form allows partnerships to report their income, deductions, gains, and losses. Completing this form is crucial for partnerships to properly report their financial activities to the IRS and split profits among partners.

To register a partnership business in New Jersey, you must complete the necessary steps outlined for forming a partnership under the New Jersey Personal Services Partnership Agreement. Start by choosing a name for your partnership that complies with state regulations. Next, file a Certificate of Partnership with the New Jersey Division of Revenue and Enterprise Services. Completing these steps ensures your business is properly recognized and able to operate legally in the state.

Any partnership operating in New Jersey must file Form NJ-1065, including those outlined under the New Jersey Personal Services Partnership Agreement. This filing requirement includes partnerships with two or more members conducting business for profit. It's essential for ensuring compliance with state tax obligations and reporting partnership income correctly. If your business structure fits these criteria, it's important to complete and submit this form annually.

Yes, New Jersey allows for the deduction of unreimbursed partnership expenses on individual partner tax returns. However, the specifics can vary based on the partner's role and income structure. When you create a New Jersey Personal Services Partnership Agreement, consider outlining these expenses to clarify responsibilities among partners.

Interesting Questions

More info

Share on link Share on link Share on link Share on link Share on link Share on link Share on link Personal Partner Agreements — Personal Legal Terms & Conditions.