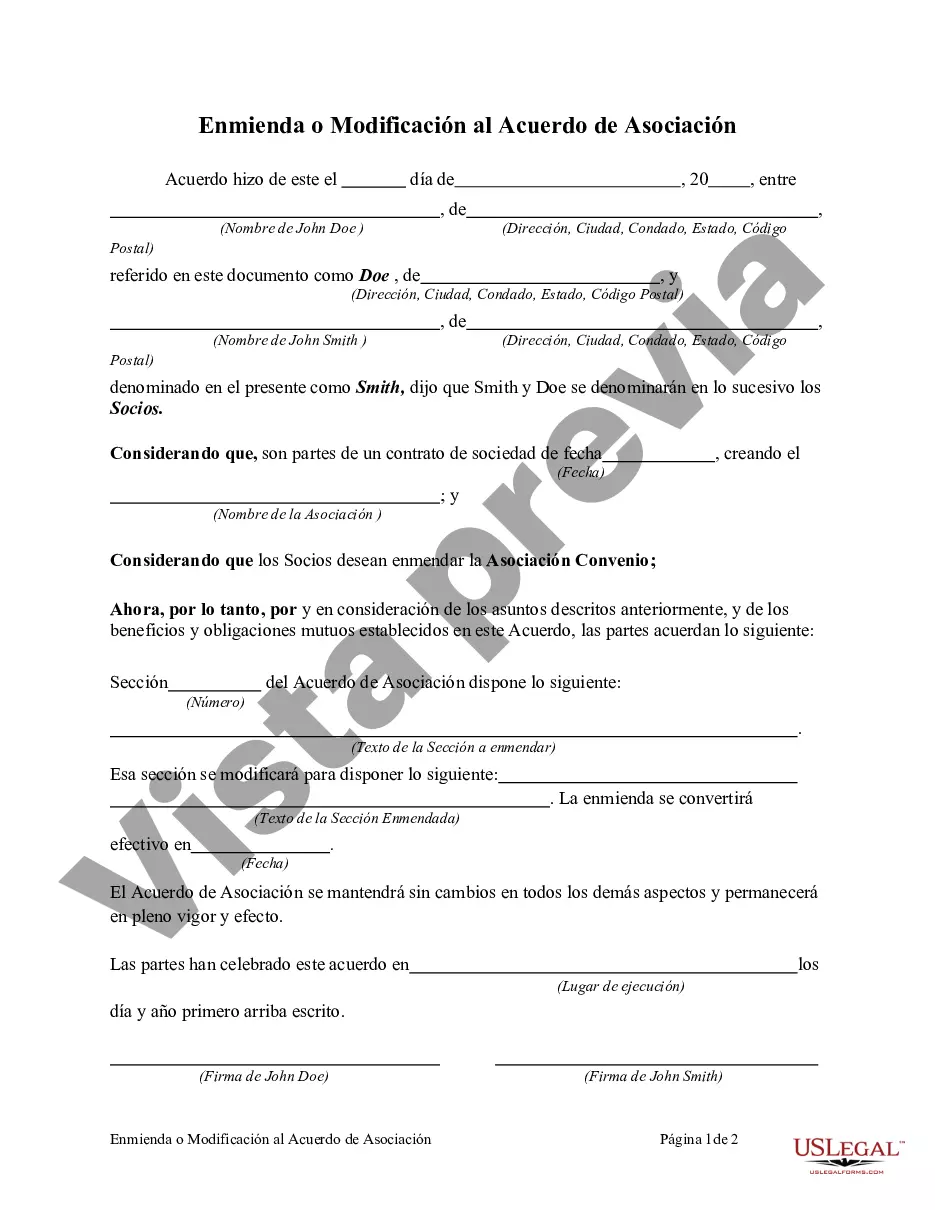

This form is an amendment or modification to a partnership agreement

Title: Understanding New Jersey Amendment or Modification to Partnership Agreement: Types and Importance Introduction: In the state of New Jersey, partnership agreements are legally binding contracts that outline the terms and conditions of a business partnership. However, circumstances may arise where amendments or modifications are necessary to reflect changes in the partnership structure, objectives, or other relevant factors. This article aims to provide a detailed description of what a New Jersey Amendment or Modification to a Partnership Agreement entails, its significance, and explore any potential types available. Key Points: 1. Definition of a New Jersey Amendment or Modification to Partnership Agreement: — A New Jersey Amendment or Modification refers to the alteration, change, or addition made to an existing partnership agreement. — It allows partners to amend or modify specific provisions based on their mutual agreement or evolving business needs. 2. Significance and Purpose: — Flexibility: Amendments or modifications enable partnerships to adjust their contractual obligations as circumstances change. — Better Partnership Management: It allows partners to clarify their roles, responsibilities, profit sharing, decision-making processes, and other terms that may need adjustments. — Legal Compliance: Amendments help partnerships to comply with changing New Jersey state laws or regulations that may impact their operations. — Dispute Resolution: Parties can use amendments to address potential conflicts, adding provisions for mediation, arbitration, or other dispute resolution mechanisms. 3. Common Types of New Jersey Amendments or Modifications to Partnership Agreement: — Adding or Removing Partners: Partnerships may need to amend the agreement when adding new partners or when existing partners leave the business. — Profit and Loss Sharing: Adjustments to profit sharing ratios or changes in the allocation of losses among partners may require an amendment. — Capital Contributions: Altered investment amounts, changes in funding sources, or modifications to existing capital contribution clauses require amendments. — Tax Structure Changes: Adjustments to partnership tax status or changes in how profits are taxed may necessitate amendments. — Dissolution Clauses: Modifications to partnership dissolution processes, timelines, or conditions can be made through amendments. 4. Procedure for Executing Amendments or Modifications: — Mutual Agreement: All partners must agree on the proposed amendment, whether by written consent or through a vote as outlined in the original partnership agreement. — Drafting a Written Amendment: Partners should consult with a legal professional and draft a detailed written amendment or modification document that clearly states the desired changes. — Signatures and Notarization: The amendment document must be signed by all partners and notarized to ensure its legality and enforceability. — Filing the Amendment: Partners should file the executed amendment with the New Jersey Division of Revenue and Enterprise Services to keep the partnership records updated. Conclusion: In conclusion, a New Jersey Amendment or Modification to a Partnership Agreement enables partners to adapt their partnership to changing circumstances such as partner additions or departures, evolving business objectives, or legal requirements. By executing the appropriate amendment or modification, partners can maintain a harmonious and legally compliant partnership while ensuring clarity, fairness, and accountability among all involved parties.Title: Understanding New Jersey Amendment or Modification to Partnership Agreement: Types and Importance Introduction: In the state of New Jersey, partnership agreements are legally binding contracts that outline the terms and conditions of a business partnership. However, circumstances may arise where amendments or modifications are necessary to reflect changes in the partnership structure, objectives, or other relevant factors. This article aims to provide a detailed description of what a New Jersey Amendment or Modification to a Partnership Agreement entails, its significance, and explore any potential types available. Key Points: 1. Definition of a New Jersey Amendment or Modification to Partnership Agreement: — A New Jersey Amendment or Modification refers to the alteration, change, or addition made to an existing partnership agreement. — It allows partners to amend or modify specific provisions based on their mutual agreement or evolving business needs. 2. Significance and Purpose: — Flexibility: Amendments or modifications enable partnerships to adjust their contractual obligations as circumstances change. — Better Partnership Management: It allows partners to clarify their roles, responsibilities, profit sharing, decision-making processes, and other terms that may need adjustments. — Legal Compliance: Amendments help partnerships to comply with changing New Jersey state laws or regulations that may impact their operations. — Dispute Resolution: Parties can use amendments to address potential conflicts, adding provisions for mediation, arbitration, or other dispute resolution mechanisms. 3. Common Types of New Jersey Amendments or Modifications to Partnership Agreement: — Adding or Removing Partners: Partnerships may need to amend the agreement when adding new partners or when existing partners leave the business. — Profit and Loss Sharing: Adjustments to profit sharing ratios or changes in the allocation of losses among partners may require an amendment. — Capital Contributions: Altered investment amounts, changes in funding sources, or modifications to existing capital contribution clauses require amendments. — Tax Structure Changes: Adjustments to partnership tax status or changes in how profits are taxed may necessitate amendments. — Dissolution Clauses: Modifications to partnership dissolution processes, timelines, or conditions can be made through amendments. 4. Procedure for Executing Amendments or Modifications: — Mutual Agreement: All partners must agree on the proposed amendment, whether by written consent or through a vote as outlined in the original partnership agreement. — Drafting a Written Amendment: Partners should consult with a legal professional and draft a detailed written amendment or modification document that clearly states the desired changes. — Signatures and Notarization: The amendment document must be signed by all partners and notarized to ensure its legality and enforceability. — Filing the Amendment: Partners should file the executed amendment with the New Jersey Division of Revenue and Enterprise Services to keep the partnership records updated. Conclusion: In conclusion, a New Jersey Amendment or Modification to a Partnership Agreement enables partners to adapt their partnership to changing circumstances such as partner additions or departures, evolving business objectives, or legal requirements. By executing the appropriate amendment or modification, partners can maintain a harmonious and legally compliant partnership while ensuring clarity, fairness, and accountability among all involved parties.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.