A New Jersey Partnership Agreement involving a silent partner is a legally binding document that outlines the rights, responsibilities, and obligations of the partners involved in a partnership venture where one partner remains silent or inactive in the daily operations of the business. This agreement is crucial for ensuring a smooth partnership and avoiding any potential conflicts or misunderstandings. The partnership agreement typically includes key details such as the partners' personal information, the name and purpose of the partnership, the capital contributions made by each partner, and the distribution of profits and losses. It also specifies the roles and responsibilities of each partner, outlining the active partner's authority to make decisions concerning the business operations and the silent partner's limited involvement and decision-making powers. One type of New Jersey Partnership Agreement involving a silent partner is a General Partnership involving a Silent Partner. In this arrangement, the silent partner invests capital or assets in the business but does not actively participate in its day-to-day operations. The silent partner still shares in the profits or losses as per the agreed-upon terms. Another type is a Limited Partnership involving a Silent Partner. In this scenario, there are at least two types of partners: general partners and limited partners. The general partner takes on the active role, managing the operations and assuming personal liability for the partnership's obligations. The silent partner, referred to as a limited partner, provides capital and shares in profits or losses but has limited liability and involvement in the business's management. It is essential to include protective clauses in the New Jersey Partnership Agreement involving a silent partner as they typically assume more risk compared to active partners. These protective clauses may define certain circumstances where the silent partner's liability is limited or specify that they cannot be held personally liable for the partnership's debts and obligations. Additionally, the agreement may outline a dispute resolution process, including arbitration or mediation, to address any conflicts that may arise between the partners. It could also include provisions such as a buyout clause, which allows the silent partner to exit the partnership under specific conditions, safeguarding their investment. Overall, a New Jersey Partnership Agreement involving a silent partner is a vital legal document that sets clear guidelines for the partnership, ensuring that both active and silent partners have a thorough understanding of their roles, responsibilities, and rights.

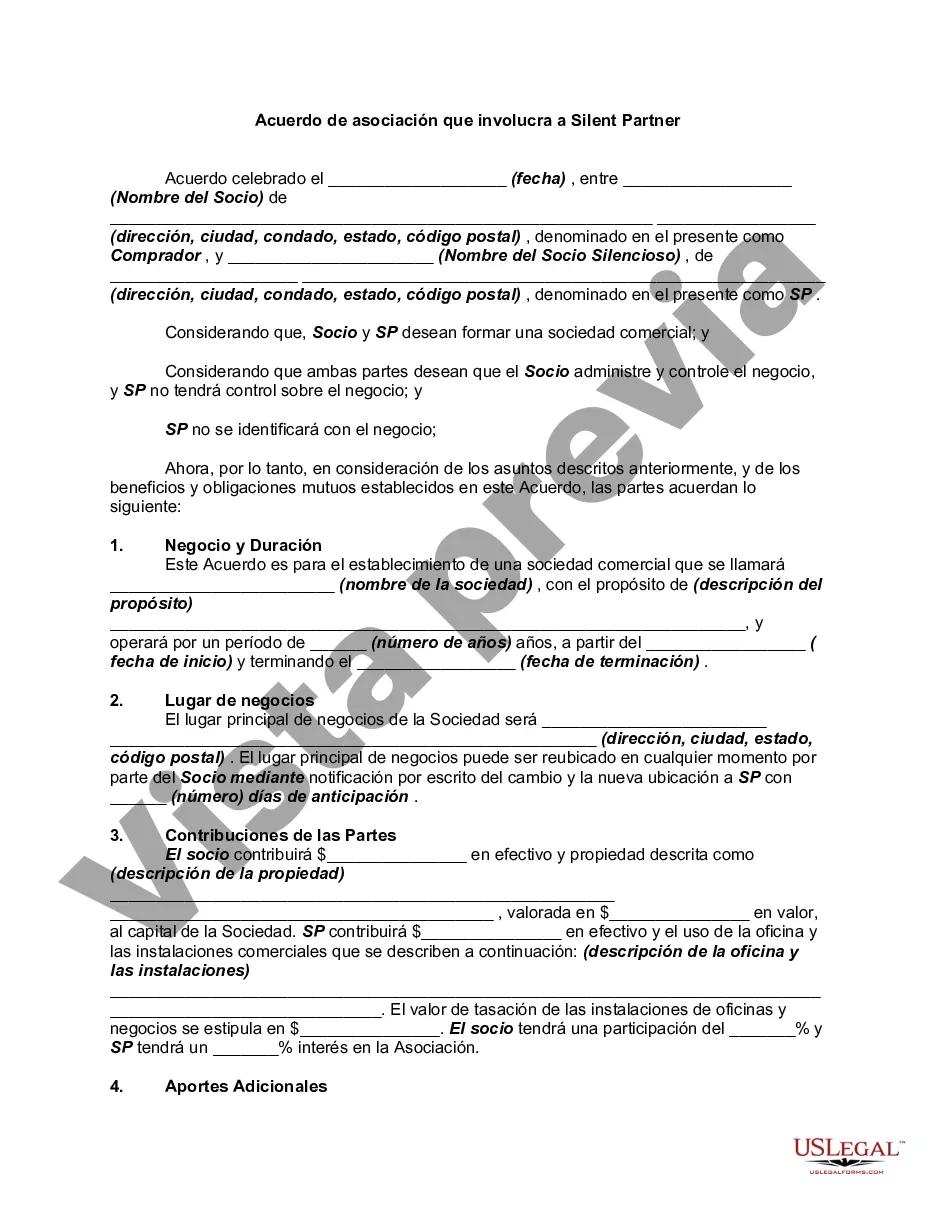

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Acuerdo de asociación que involucra a Silent Partner - Partnership Agreement Involving Silent Partner

Description

How to fill out New Jersey Acuerdo De Asociación Que Involucra A Silent Partner?

You can spend hours on the web trying to locate the legal documents template that satisfies the federal and state requirements you will need.

US Legal Forms offers a vast array of legal forms which can be reviewed by professionals.

You can effortlessly download or create the New Jersey Partnership Agreement Involving Silent Partner from our platform.

First, ensure that you have chosen the correct document template for the region/city of your preference. Review the form details to confirm you have selected the right document. If available, utilize the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click on the Download button.

- Afterward, you can complete, modify, print, or sign the New Jersey Partnership Agreement Involving Silent Partner.

- Every legal document template you acquire is yours indefinitely.

- To obtain an extra copy of the bought form, navigate to the My documents section and click the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

Form popularity

FAQ

Yes, you can become a silent partner in a business, provided you have a mutual agreement with the other partners. This relationship allows you to invest in the business without being involved in daily operations. To ensure clarity in roles and expectations, consider establishing a New Jersey Partnership Agreement Involving Silent Partner.

Being a silent partner carries several risks, including limited control over business decisions and potential loss of investment. Additionally, if the business incurs debts, you may be liable under certain conditions. It is vital to draft a comprehensive New Jersey Partnership Agreement Involving Silent Partner that outlines all partners’ rights and liabilities to mitigate these risks.

When there is no partnership agreement, conflicts can arise over responsibilities and profits. It is advisable to create a New Jersey Partnership Agreement Involving Silent Partner as soon as possible. This agreement serves as a legal framework that reflects the intentions of all partners and helps avoid costly disputes.

Generally, silent partners cannot bind a partnership unless specified in the partnership agreement. Their lack of involvement in management limits their authority in decision-making. Thus, establishing a clear New Jersey Partnership Agreement Involving Silent Partner helps define boundaries and protect your interests.

Certainly, you can refer to yourself as a partner in an LLC. However, the nature of your involvement—active or silent—will determine your rights and responsibilities. A thorough New Jersey Partnership Agreement Involving Silent Partner is essential to clarify these distinctions and ensure everyone’s expectations align.

Yes, you can be a silent partner in an LLC. In this structure, a silent partner contributes capital but does not actively manage the business. It is crucial to have a New Jersey Partnership Agreement Involving Silent Partner that outlines the role and responsibilities of each member to prevent misunderstandings.

To set up a silent partnership, you need to draft a comprehensive New Jersey Partnership Agreement Involving Silent Partner that clearly outlines the roles and responsibilities of all partners. Identify the silent partner's investment, and discuss their rights regarding decision-making and profit-sharing. It's essential to have open discussions about expectations and legal obligations to avoid misunderstandings later. Utilizing platforms like USLegalForms can simplify the drafting process and provide a reliable framework for your agreement.

Sell Agreement is essential in a New Jersey Partnership Agreement Involving Silent Partner because it restricts a partner from selling their interest without the consent of the other partners. This type of agreement helps maintain stability and trust among partners by ensuring everyone agrees to changes in ownership. It protects the existing partners and keeps the partnership aligned with its goals. Consider drafting this agreement with legal guidance to ensure all aspects are covered.

If you are involved in a New Jersey Partnership Agreement Involving Silent Partner, you must file the NJ CBT-1065 if your partnership conducts business in New Jersey and has more than one member. This includes partnerships and limited partnerships where income is earned. All partnership entities are required to report their income, deductions, and credits. By filing the NJ CBT-1065, you ensure compliance with state regulations, protecting your partnership from penalties.

Yes, you can be a silent partner in an LLC, enjoying the benefits of profit sharing while remaining uninvolved in daily operations, as stipulated in the New Jersey Partnership Agreement Involving Silent Partner. This allows you to invest in a business without the responsibilities of management. It's important to have a clear agreement that specifies your rights and obligations. Using platforms like uslegalforms can help you draft the necessary documents.

More info

As a part of the fiscal year the federal government is funded for a set time period. In other words, the government has to make its budget each fiscal year, usually the first of the calendar year. The spending and revenues are done as follows: Federal tax system is a type of taxation in which each individual pays tax into a special revenue pool. When the budget is set to run out, the government needs to allocate this budget to specific purposes of government. For example, in the U.S. government, it is possible to pay for social security system, education, infrastructure maintenance, national defense, and many other essential functions. All the government revenue is then shared to specific state or federal areas. The government allocates the national defense budget for the cost of defense and the spending for the infrastructure maintenance budget. The table below looks at the budget for the last 11 fiscal years. FY 2014 Government Spending U.S.