A New Jersey Simple Promissory Note for Family Loan is a legal document used to formalize a loan agreement between family members in the state of New Jersey. This note outlines the terms and conditions of the loan, including the borrowed amount, interest rate (if any), repayment schedule, and consequences for defaulting on the loan. It is crucial to have a promissory note for family loans to avoid potential misunderstandings and to protect the interests of both the lender and borrower. There are different types of New Jersey Simple Promissory Notes for Family Loans, including: 1. Interest-bearing promissory note: This type of promissory note specifies that the borrower must pay interest on the loan amount in addition to the principal. The interest rate is agreed upon by both parties and is typically based on the current market rates. 2. Non-interest-bearing promissory note: In this case, the lender agrees to lend a specific amount to the borrower without charging any interest. This type of note is commonly used when the loan amount is relatively small or when a family member is helping another in times of financial need. 3. Secured promissory note: A secured promissory note is backed by collateral. The borrower pledges an asset, such as real estate, vehicles, or valuable possessions, to secure the loan. If the borrower defaults on the loan, the lender has the legal right to seize the pledged asset to recover the outstanding amount. 4. Unsecured promissory note: Unlike a secured promissory note, an unsecured note does not require collateral. This means that the borrower does not have to pledge any assets to secure the loan. However, if the borrower fails to repay the loan, the lender's recourse is limited to legal action. When creating a New Jersey Simple Promissory Note for Family Loan, certain elements should be included for clarity and legality. These elements may vary depending on the specific requirements of the parties involved, but commonly include: 1. Names and contact information: The full names, addresses, and contact details of both the lender and borrower must be clearly stated. 2. Loan amount and interest (if applicable): The exact amount of money borrowed and any interest applicable should be clearly mentioned. 3. Repayment schedule: The promissory note should outline the agreed-upon repayment terms, such as the number of payments, frequency (monthly, quarterly, etc.), and due dates. 4. Late fees and penalties: The note may include provisions for late fees or penalties if the borrower fails to make timely payments. 5. Default and remedies: The consequences of defaulting on the loan should be clearly defined. This may include legal action, collection costs, or even acceleration of the full loan amount plus interest. 6. Governing law: Specifying that the promissory note is governed by the laws of the state of New Jersey ensures legal compliance and consistency. 7. Signatures and witness: Both the lender and borrower must sign the promissory note, ideally in the presence of a witness, to authenticate the agreement. It is important to consult with a legal professional when drafting a New Jersey Simple Promissory Note for Family Loan to ensure compliance with the state's laws and to address any specific concerns or requirements you may have.

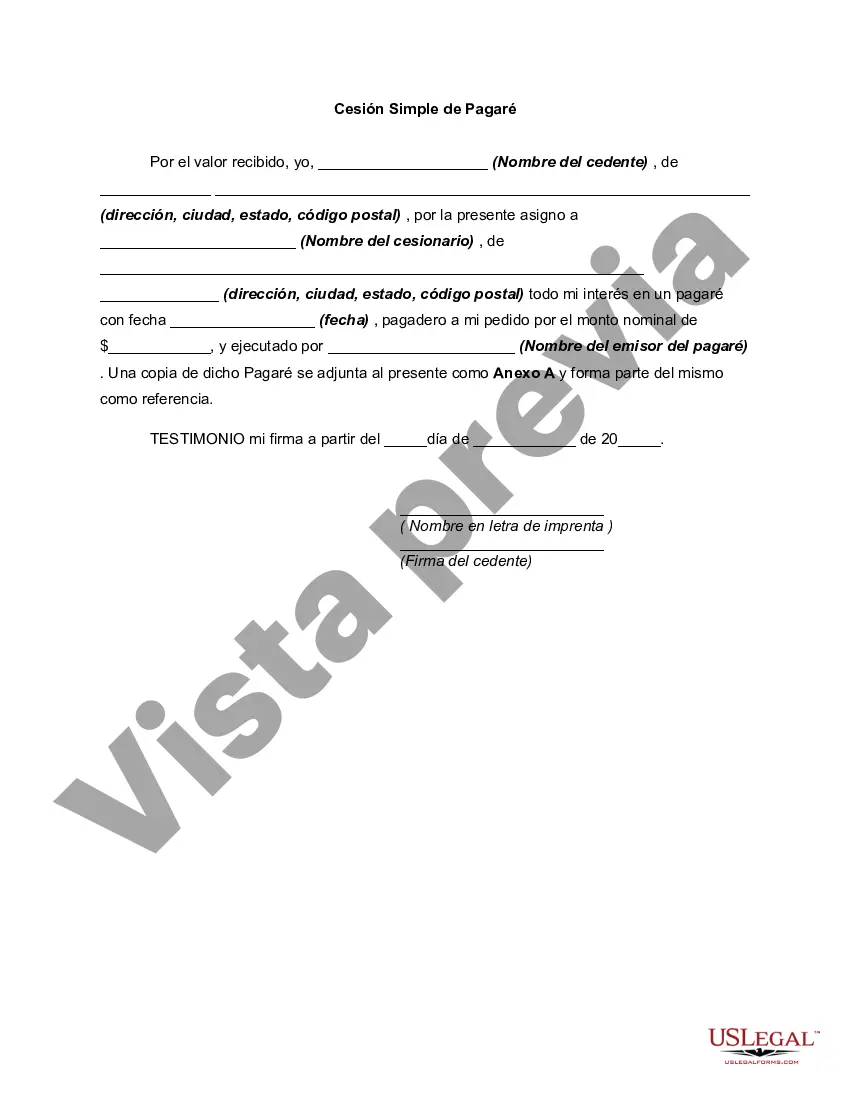

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Pagaré Simple para Préstamo Familiar - Simple Promissory Note for Family Loan

Description

How to fill out New Jersey Pagaré Simple Para Préstamo Familiar?

You can invest hrs online trying to find the lawful file format that suits the state and federal specifications you require. US Legal Forms supplies a large number of lawful varieties which are examined by pros. You can easily acquire or print the New Jersey Simple Promissory Note for Family Loan from my service.

If you already possess a US Legal Forms profile, you are able to log in and click the Download key. Next, you are able to comprehensive, revise, print, or sign the New Jersey Simple Promissory Note for Family Loan. Every single lawful file format you buy is your own permanently. To acquire an additional copy associated with a bought kind, proceed to the My Forms tab and click the related key.

If you are using the US Legal Forms web site the first time, keep to the straightforward instructions under:

- Very first, make certain you have selected the best file format for the region/area of your choosing. Look at the kind description to ensure you have picked the right kind. If accessible, make use of the Preview key to look through the file format too.

- If you wish to locate an additional edition of your kind, make use of the Lookup discipline to obtain the format that meets your needs and specifications.

- After you have discovered the format you would like, click Get now to carry on.

- Choose the rates program you would like, key in your references, and sign up for a merchant account on US Legal Forms.

- Complete the transaction. You can use your bank card or PayPal profile to fund the lawful kind.

- Choose the structure of your file and acquire it for your gadget.

- Make modifications for your file if possible. You can comprehensive, revise and sign and print New Jersey Simple Promissory Note for Family Loan.

Download and print a large number of file web templates making use of the US Legal Forms web site, that offers the greatest assortment of lawful varieties. Use professional and state-distinct web templates to handle your small business or specific requires.