The New Jersey General Form of Inter Vivos Irrevocable Trust Agreement is a legal document that sets forth the terms and conditions of a trust created during the lifetime of an individual (inter vivos) in the state of New Jersey. This type of trust is irrevocable, meaning that once it is established, the granter (person creating the trust) cannot alter or revoke its provisions without the consent of the named beneficiaries. The New Jersey General Form of Inter Vivos Irrevocable Trust Agreement outlines the roles and responsibilities of the granter, trustee, and beneficiaries involved in the trust. It specifies the assets that will be transferred to the trust, the purposes of the trust, and how the assets will be managed and distributed. There are several types of New Jersey General Form of Inter Vivos Irrevocable Trust Agreements, each designed to serve specific purposes: 1. Revocable Living Trust: This type of trust allows the granter to maintain control over the assets during their lifetime while providing for seamless asset management and distribution after their death. 2. Testamentary Trust: Unlike a revocable living trust, a testamentary trust is created through a will and only takes effect upon the granter's death. It allows for the distribution of assets according to the granter's specific wishes. 3. Special Needs Trust: This type of trust is designed to ensure that individuals with disabilities continue to receive necessary government benefits while still benefiting from the trust's assets. It helps protect their eligibility for programs like Medicaid and Supplemental Security Income. 4. Charitable Remainder Trust: Charitable remainder trusts allow the granter to donate assets to a designated charitable organization while retaining income from the trust during their lifetime. This type of trust provides both charitable giving and potential tax benefits. 5. Family Trust: Family trusts are established to provide a mechanism for managing and distributing family assets. They can be used for estate planning, tax reduction, and asset protection for future generations. 6. Generation-Skipping Trust: This type of trust allows the granter to transfer assets directly to their grandchildren (or even more remote generations) while providing some level of control over how the assets are used. It can bypass the granter's children and avoid certain estate taxes. Creating a New Jersey General Form of Inter Vivos Irrevocable Trust Agreement requires careful consideration of personal circumstances, financial goals, and desired distribution plans. It is essential to consult with an experienced estate planning attorney to ensure that the trust meets legal requirements and addresses individual needs.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Modelo General de Contrato de Fideicomiso Irrevocable Inter Vivos - General Form of Inter Vivos Irrevocable Trust Agreement

Description

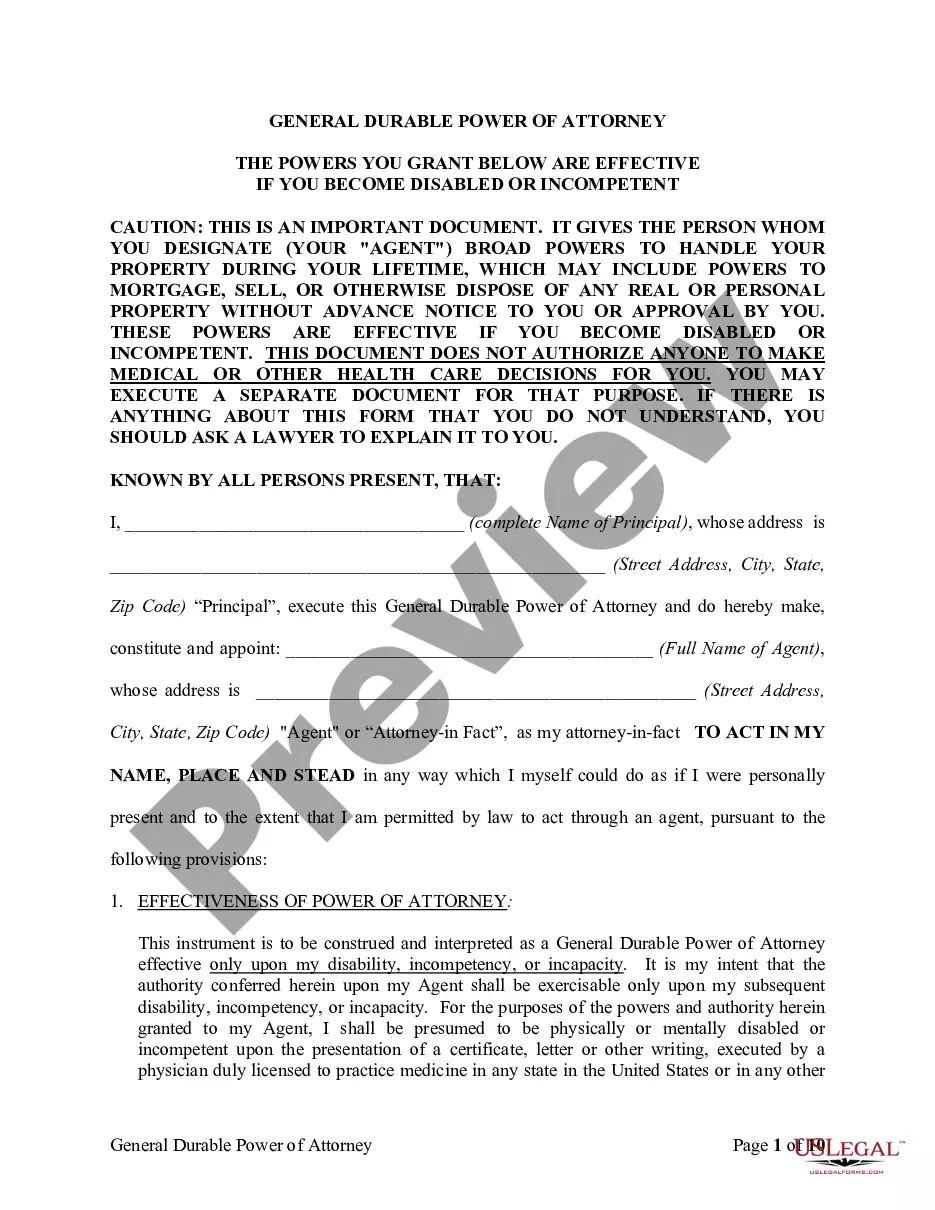

How to fill out New Jersey Modelo General De Contrato De Fideicomiso Irrevocable Inter Vivos?

It is possible to invest time on-line trying to find the legitimate document format which fits the state and federal needs you want. US Legal Forms offers 1000s of legitimate forms which are examined by experts. It is simple to down load or print the New Jersey General Form of Inter Vivos Irrevocable Trust Agreement from the service.

If you already have a US Legal Forms account, you may log in and click the Acquire switch. Following that, you may total, change, print, or indicator the New Jersey General Form of Inter Vivos Irrevocable Trust Agreement. Every legitimate document format you buy is your own forever. To obtain an additional version of any obtained kind, check out the My Forms tab and click the corresponding switch.

If you work with the US Legal Forms site the very first time, adhere to the easy instructions beneath:

- First, ensure that you have selected the proper document format to the state/area of your liking. Read the kind description to ensure you have selected the correct kind. If offered, utilize the Review switch to search throughout the document format as well.

- In order to locate an additional version from the kind, utilize the Research field to find the format that fits your needs and needs.

- Upon having discovered the format you would like, click Purchase now to continue.

- Select the rates program you would like, key in your accreditations, and sign up for a merchant account on US Legal Forms.

- Total the purchase. You may use your Visa or Mastercard or PayPal account to cover the legitimate kind.

- Select the file format from the document and down load it to the gadget.

- Make changes to the document if necessary. It is possible to total, change and indicator and print New Jersey General Form of Inter Vivos Irrevocable Trust Agreement.

Acquire and print 1000s of document themes using the US Legal Forms Internet site, that offers the most important assortment of legitimate forms. Use expert and status-distinct themes to handle your small business or individual needs.