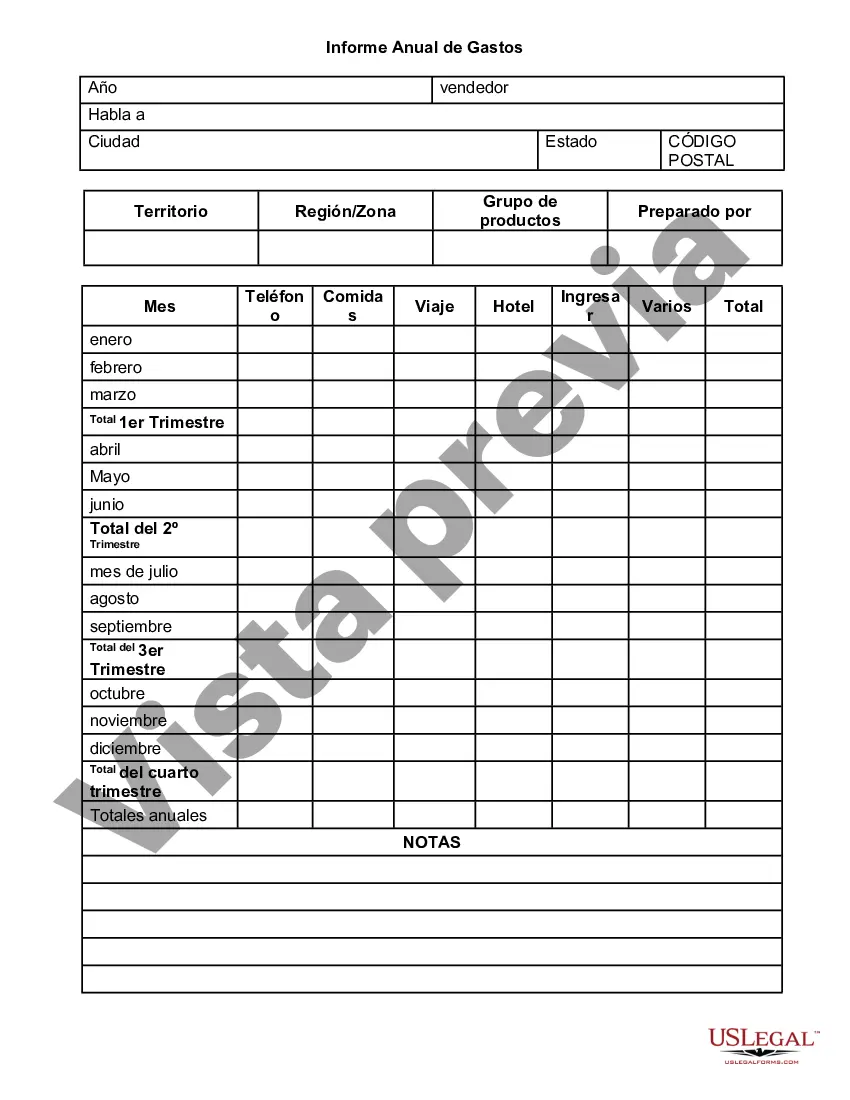

New Jersey Annual Expense Report is a comprehensive document that presents an itemized breakdown of the expenses incurred over a specific period within the state of New Jersey. This report is crucial for tracking and analyzing the financial aspects of different organizations, including government agencies, businesses, non-profit organizations, and educational institutions operating in New Jersey. The primary purpose of the New Jersey Annual Expense Report is to provide a transparent overview of the financial expenditures undertaken by these entities, ensuring accountability and facilitating informed decision-making. It allows stakeholders, such as taxpayers, investors, and regulators, to gain insights into how funds allocated to various entities are utilized and managed. The New Jersey Annual Expense Report encompasses various expense categories, including but not limited to personnel costs, operational expenses, professional services, supplies and materials, maintenance and repairs, utilities, leases, travel and entertainment, capital investments, debt service, grants and subsidies, and miscellaneous expenses. Each expenditure category is meticulously detailed with specific descriptions and amounts spent during the reporting period. Different types of New Jersey Annual Expense Reports may exist based on the nature of the entity providing the report. For instance, government agencies might have separate reports for different departments or divisions within their organizations, highlighting department-specific expenses. Similarly, businesses may have diverse expense categories based on the industry in which they operate, such as manufacturing, retail, services, or technology. Furthermore, non-profit organizations may have specific expense categories related to their charitable activities, fundraising, program management, or administrative costs. Educational institutions, on the other hand, may focus on expenses related to teaching materials, research, student services, facilities, and faculty compensation. It is worth mentioning that New Jersey Annual Expense Reports comply with relevant laws, regulations, and accounting standards, ensuring accuracy, consistency, and comparability of financial information. These reports are typically audited by external auditors to enhance their credibility and identify any discrepancies or irregularities. In summary, the New Jersey Annual Expense Report plays a critical role in providing a clear, comprehensive, and detailed overview of financial expenditures incurred by various entities in the state. By offering transparency and accountability, it enables stakeholders to assess the financial health and performance of these entities while ensuring proper utilization of funds allocated for the betterment of New Jersey's economy and society.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Informe Anual de Gastos - Annual Expense Report

Description

How to fill out New Jersey Informe Anual De Gastos?

Are you inside a place in which you require papers for sometimes enterprise or specific purposes nearly every day? There are a variety of legitimate papers web templates available online, but discovering types you can trust is not straightforward. US Legal Forms delivers thousands of type web templates, much like the New Jersey Annual Expense Report, which are created in order to meet state and federal demands.

In case you are previously familiar with US Legal Forms web site and get a merchant account, basically log in. After that, you may obtain the New Jersey Annual Expense Report web template.

Unless you offer an account and wish to begin using US Legal Forms, abide by these steps:

- Find the type you need and make sure it is to the proper metropolis/state.

- Make use of the Preview key to review the shape.

- Look at the explanation to ensure that you have selected the proper type.

- If the type is not what you`re seeking, make use of the Search industry to obtain the type that suits you and demands.

- If you obtain the proper type, simply click Buy now.

- Opt for the pricing program you need, complete the necessary info to create your account, and buy an order making use of your PayPal or Visa or Mastercard.

- Pick a practical data file structure and obtain your version.

Discover all the papers web templates you have bought in the My Forms menus. You can obtain a more version of New Jersey Annual Expense Report anytime, if necessary. Just click on the required type to obtain or printing the papers web template.

Use US Legal Forms, the most substantial assortment of legitimate kinds, in order to save time as well as prevent mistakes. The support delivers appropriately produced legitimate papers web templates which can be used for an array of purposes. Create a merchant account on US Legal Forms and commence generating your life easier.