The New Jersey Cash Receipts Control Log is a vital document used to track and record all cash transactions within an organization operating in the state of New Jersey. It serves as a comprehensive tool for maintaining accurate financial records and ensuring the proper handling of cash. This control log is specifically designed to meet the requirements and regulations set forth by the state of New Jersey in regard to cash management. It provides a structured system to record every cash inflow, whether from sales, services rendered, or any other source of revenue. Each log entry includes important information such as the date, the purpose of the transaction, the type of cash received, the amount received, and the name of the person responsible for handling the funds. This detailed information enables organizations to maintain transparency and accountability throughout their financial operations. The New Jersey Cash Receipts Control Log is both a legal and organizational necessity, ensuring that all cash received is properly documented and reported. In addition, this log acts as a crucial internal control measure, minimizing the risk of fraud, theft, or misappropriation of funds. There are several types of New Jersey Cash Receipts Control Logs that may exist, depending on the specific needs and requirements of an organization. These may include: 1. Sales Receipts Control Log: This type of control log focuses on tracking cash received from sales transactions. It enables organizations to monitor daily sales, reconcile with cash deposits, and identify any discrepancies that may occur. 2. Donation Receipts Control Log: Non-profit organizations often use this type of control log to accurately record cash donations received. It helps ensure that all donations are properly documented, acknowledged, and allocated for their intended purposes. 3. Service Receipts Control Log: Organizations offering services, such as consultants, contractors, or service providers, may utilize this log to record cash payments received for their services rendered. It allows for effective tracking of service-related revenues and serves as a reference for future billing or invoicing. 4. Petty Cash Receipts Control Log: In cases where a company maintains a petty cash fund, a separate control log is used to track all disbursements and replenishments within the fund. This log facilitates the monitoring of petty cash transactions and helps maintain a clear audit trail. Overall, the New Jersey Cash Receipts Control Log is an essential tool for any organization operating within the state, ensuring compliance with financial regulations and promoting sound financial management practices. It keeps all cash transactions transparent, accountable, and organized, thus enhancing the overall integrity and accuracy of financial reporting.

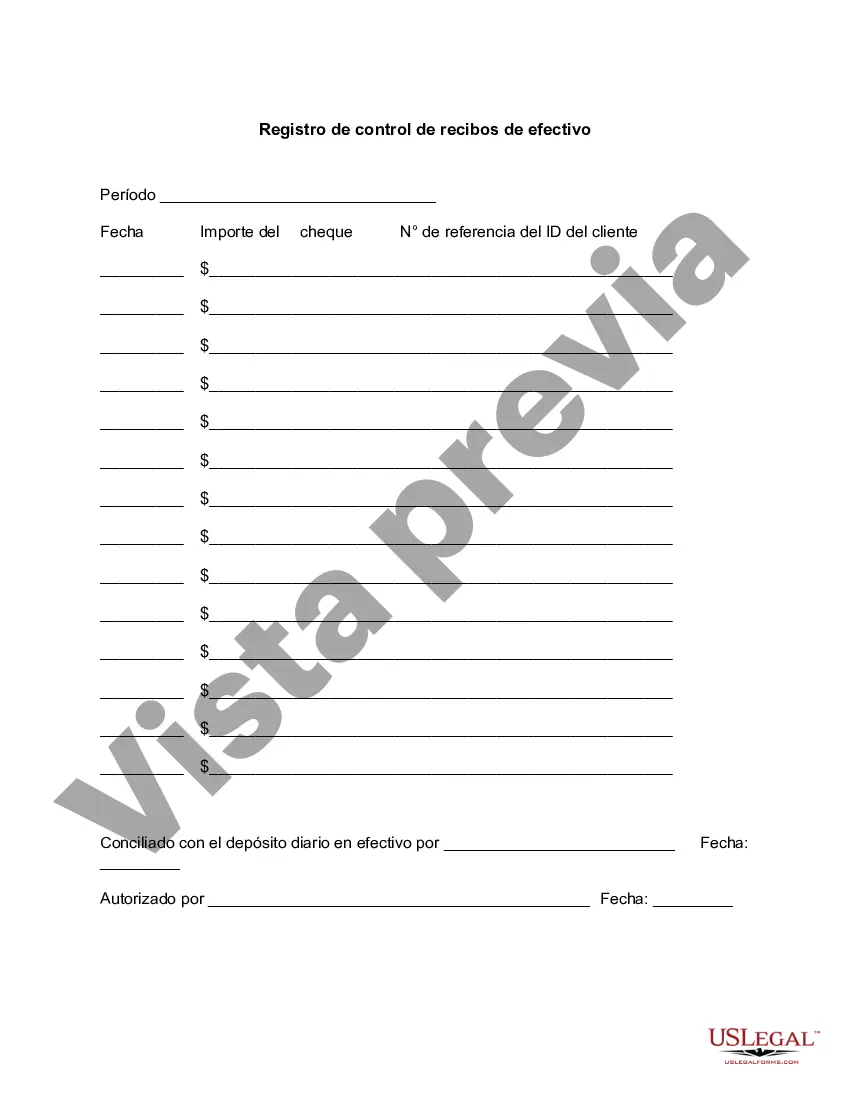

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out New Jersey Registro De Control De Recibos De Efectivo?

US Legal Forms - one of several largest libraries of authorized forms in the United States - delivers an array of authorized record layouts you are able to acquire or printing. Using the site, you can find a huge number of forms for organization and person reasons, sorted by categories, claims, or keywords.You can get the most recent versions of forms such as the New Jersey Cash Receipts Control Log within minutes.

If you have a subscription, log in and acquire New Jersey Cash Receipts Control Log from the US Legal Forms local library. The Obtain button can look on each and every type you look at. You have accessibility to all in the past delivered electronically forms in the My Forms tab of your respective bank account.

If you would like use US Legal Forms the first time, allow me to share easy directions to obtain started off:

- Be sure to have picked out the best type for your personal city/state. Select the Preview button to check the form`s articles. Look at the type outline to actually have chosen the correct type.

- If the type doesn`t satisfy your requirements, utilize the Research discipline towards the top of the screen to find the one that does.

- In case you are pleased with the form, affirm your choice by clicking on the Buy now button. Then, opt for the costs plan you want and give your accreditations to sign up for an bank account.

- Process the deal. Make use of bank card or PayPal bank account to finish the deal.

- Select the file format and acquire the form on the device.

- Make modifications. Fill up, edit and printing and signal the delivered electronically New Jersey Cash Receipts Control Log.

Each format you included in your money does not have an expiry date and it is your own property forever. So, if you would like acquire or printing one more copy, just go to the My Forms portion and click in the type you require.

Gain access to the New Jersey Cash Receipts Control Log with US Legal Forms, one of the most considerable local library of authorized record layouts. Use a huge number of specialist and express-specific layouts that fulfill your company or person demands and requirements.