New Jersey Checklist — Key Employee Life Insurance: Your Complete Guide Are you a business owner in New Jersey? Do you have key employees who play a crucial role in your company's success? If so, it's essential to protect your business against the unexpected by considering Key Employee Life Insurance. This checklist will provide you with a detailed description of what Key Employee Life Insurance is and why it's necessary for your business in New Jersey. Key Employee Life Insurance is a type of insurance that protects a business in the event of the death of a key employee. Key employees are individuals who contribute significantly to the company's profitability, possess critical skills, or have relationships with important clients. The loss of a key employee can result in severe financial losses, disruption of operations, and potential damage to business relationships. Key Employee Life Insurance serves as a safety net for your business, providing the necessary funds to overcome these challenges. Here's a comprehensive New Jersey Checklist for Key Employee Life Insurance: 1. Determine your key employees: Identify the individuals within your organization who are vital to its success. This could include top executives, sales professionals, or individuals with unique technical expertise. 2. Assess the financial impact: Calculate the potential financial losses your business may suffer if a key employee were to pass away unexpectedly. Consider the costs of recruiting and training a replacement, lost revenue, disrupted projects, and the impact on employee morale. 3. Select the appropriate coverage amount: Consult with an experienced insurance agent to determine the appropriate coverage amount for your business. Factors to consider include the key employee's salary, their value to the company, and the potential financial impact their loss may have. 4. Research insurance providers: Conduct thorough research to find reputable insurance providers that offer Key Employee Life Insurance in New Jersey. Look for providers with a solid track record, excellent customer service, and competitive premiums. 5. Compare policy options: Explore different types of Key Employee Life Insurance policies available. These may include term life insurance, whole life insurance, or universal life insurance. Each type offers distinct features and benefits, so choose the one that suits your business's needs. 6. Understand policy limitations: Familiarize yourself with the policy's limitations and exclusions. Ensure you comprehend the circumstances under which the insurance coverage will be effective and any waiting periods that may apply. 7. Review beneficiary designations: Carefully select the beneficiary of the Key Employee Life Insurance policy. This individual should be someone who can efficiently manage the funds and ensure they are used for the intended purposes. 8. Review and update policies regularly: Review your Key Employee Life Insurance policies periodically to ensure they align with your business's changing needs. Make any necessary adjustments as key employees come and go or as your business expands. By following this checklist, you can safeguard your business against the financial challenges that may arise due to the loss of a key employee. Key Employee Life Insurance is a strategic investment that provides peace of mind, knowing that your business will have the necessary financial resources to navigate unexpected circumstances. Different types of Key Employee Life Insurance policies available in New Jersey may include: 1. Term Life Insurance: Provides coverage for a specific term, typically 10, 20, or 30 years. Premiums may be lower compared to other policy types, making it an affordable choice for some businesses. 2. Whole Life Insurance: Provides coverage for the entire lifetime of the key employee. This policy accumulates a cash value over time, providing an additional asset for the employee or the business. 3. Universal Life Insurance: Offers flexible premiums and the potential to accumulate cash value. This policy provides coverage for the key employee's lifetime and allows for adjustments in death benefit amounts if needed. Remember, investing in Key Employee Life Insurance is a responsible business decision that helps protect your investment and secure your company's future. Consult with insurance professionals and choose the policy that best addresses your specific business needs in New Jersey.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Lista de verificación: seguro de vida para empleados clave - Checklist - Key Employee Life Insurance

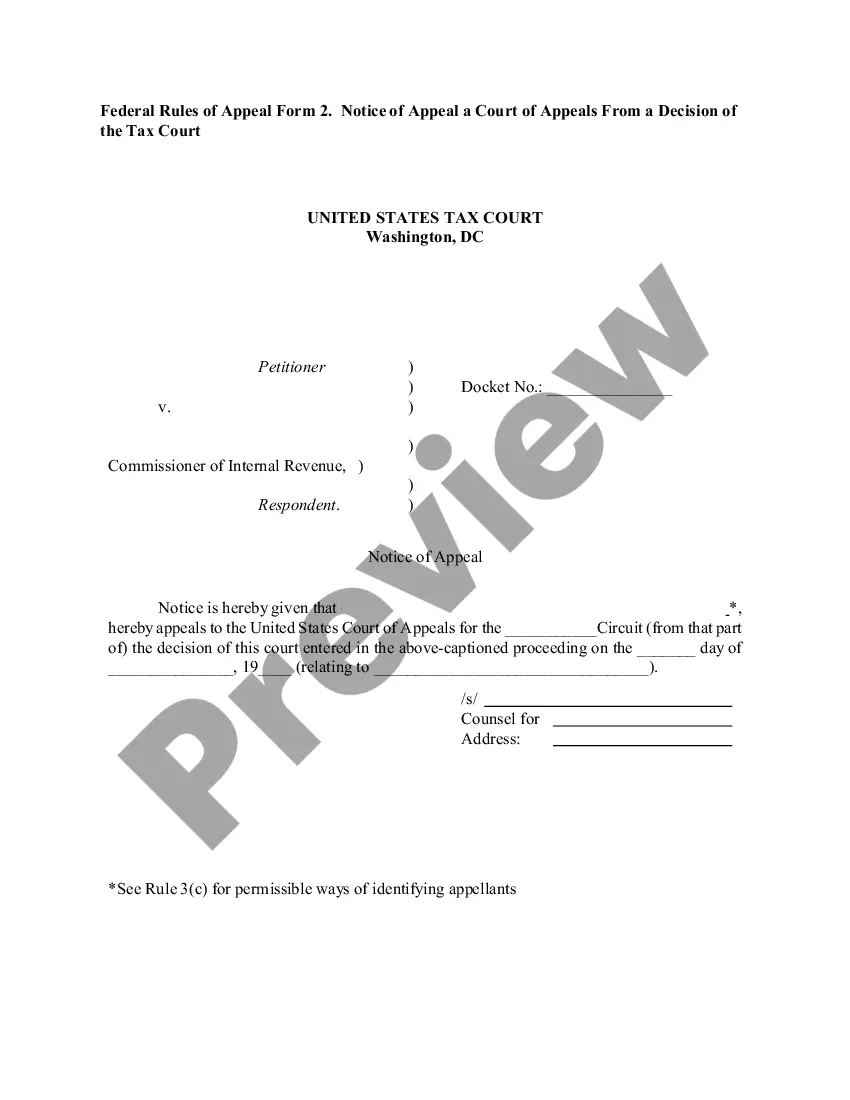

Description

How to fill out New Jersey Lista De Verificación: Seguro De Vida Para Empleados Clave?

If you have to complete, down load, or produce lawful papers themes, use US Legal Forms, the largest collection of lawful kinds, which can be found on the Internet. Make use of the site`s simple and practical lookup to obtain the paperwork you need. A variety of themes for enterprise and individual reasons are categorized by types and suggests, or keywords. Use US Legal Forms to obtain the New Jersey Checklist - Key Employee Life Insurance in a handful of click throughs.

Should you be previously a US Legal Forms buyer, log in to the accounts and then click the Download button to have the New Jersey Checklist - Key Employee Life Insurance. You may also gain access to kinds you previously downloaded within the My Forms tab of the accounts.

If you work with US Legal Forms initially, refer to the instructions under:

- Step 1. Ensure you have chosen the shape to the right metropolis/nation.

- Step 2. Utilize the Review method to look through the form`s content material. Never neglect to learn the information.

- Step 3. Should you be not satisfied using the type, take advantage of the Search industry towards the top of the display screen to get other models in the lawful type format.

- Step 4. After you have discovered the shape you need, select the Buy now button. Pick the prices program you choose and add your qualifications to sign up for the accounts.

- Step 5. Method the purchase. You may use your bank card or PayPal accounts to complete the purchase.

- Step 6. Find the structure in the lawful type and down load it on your system.

- Step 7. Full, revise and produce or sign the New Jersey Checklist - Key Employee Life Insurance.

Every lawful papers format you get is yours eternally. You may have acces to every type you downloaded inside your acccount. Go through the My Forms area and choose a type to produce or down load once again.

Compete and down load, and produce the New Jersey Checklist - Key Employee Life Insurance with US Legal Forms. There are many skilled and status-distinct kinds you may use to your enterprise or individual requirements.