New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement

Description

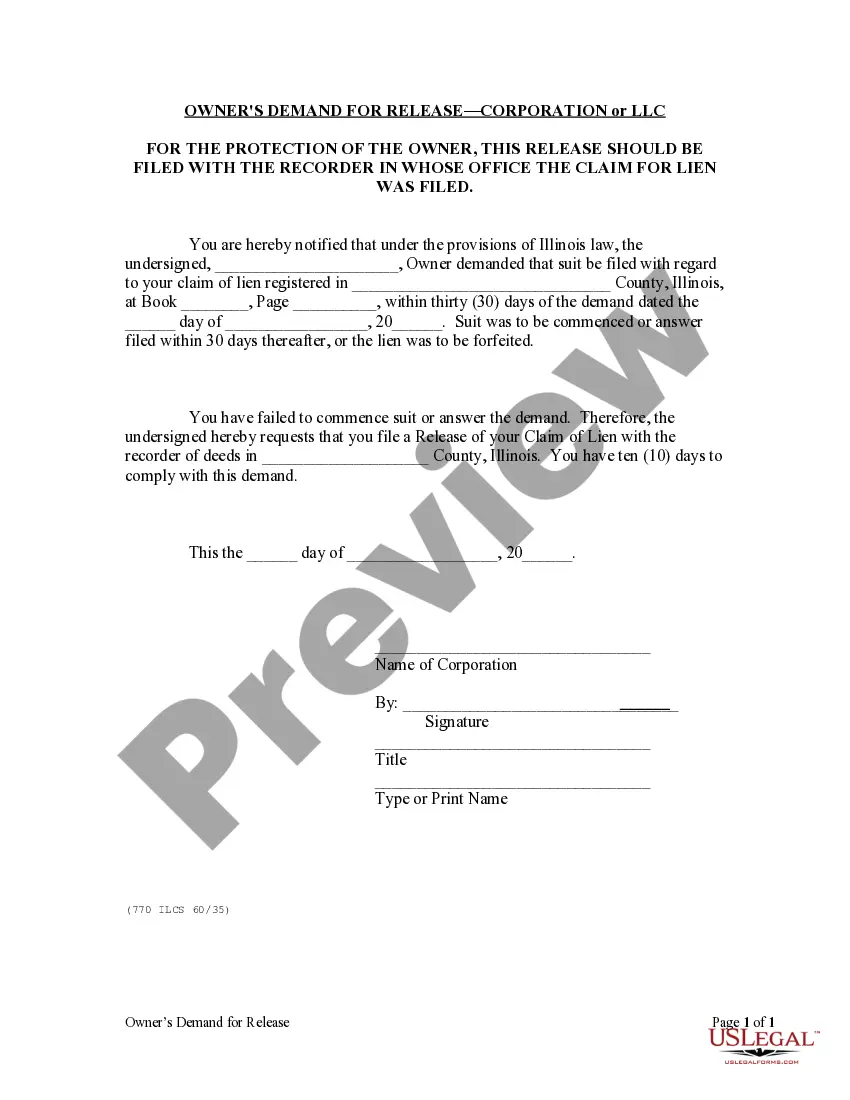

How to fill out Sample Letter For Policy On Vehicle Expense Reimbursement?

Are you presently in a position where you require documents for either business or personal motives almost every day.

There are numerous legal document templates available online, but finding reliable ones isn’t straightforward.

US Legal Forms offers thousands of form templates, such as the New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement, designed to comply with state and federal regulations.

When you find the correct form, click on Buy now.

Choose the pricing plan you want, enter the required information to create your account, and process your order using PayPal or a credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you will be able to download the New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it corresponds to the correct city/state.

- Utilize the Preview option to review the form.

- Check the description to confirm you've selected the correct form.

- If the form isn’t what you’re looking for, use the Search field to locate the one that meets your needs and requirements.

Form popularity

FAQ

To report reimbursed expenses, begin by collecting all relevant receipts and documentation that detail the expenditures. Next, complete any necessary forms required by your company’s accounting department. Incorporating a standardized submission process, such as the New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement, ensures your report is organized and complete.

Writing reimbursement usually involves creating a clear and formal request that outlines the expenses you are claiming. Be specific about the costs incurred and include relevant documentation that supports your request. A structured approach, like utilizing the New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement, can make this process smoother and more efficient.

To write a letter to claim expenses, start by addressing it to your employer or the relevant department. Clearly state your request and provide details about the expenses, including dates, amounts, and any supporting documents. Using a format like the New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement can enhance clarity and professionalism.

In New Jersey, employers are not required by law to reimburse employees for mileage. However, many companies choose to provide mileage reimbursement as part of their policies. It’s important to refer to your organization's guidelines and a well-structured document, such as the New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement, when discussing reimbursement.

To record reimbursement, begin by documenting the expenses you incurred. It’s beneficial to keep all receipts and invoices related to the vehicle expenses. Using a structured format, such as a New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement, can help you organize your claims effectively.

When writing a letter requesting reimbursement, start with a clear subject line and address it to the appropriate person. Outline the details of the expenses, including dates and amounts, while also attaching receipts if necessary. You may find the New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement helpful; it provides a structured format to ensure all important information is included. Ending the letter with a polite thank you can create a positive impression.

To politely ask for reimbursement, clearly state your request in a respectful tone. Begin by expressing appreciation for your employer or the party responsible for the reimbursement. You can mention the specific expenses you incurred related to vehicle use and reference the New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement as a guide. This approach shows professionalism and gratitude.

Filling out a reimbursement claim form requires you to provide your personal details and list all relevant expenses. Make sure to include proper documentation, such as receipts, and explain the context of each expense. Review your claim form to ensure all information is correct before submitting it for processing. A New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement can serve as a useful tool to streamline your claim.

To fill in an expense form, start by carefully reading any instructions provided. Record the date, amount, type of expense, and reason for each entry in the appropriate fields. Double-check that all entries are legible and accurate to avoid processing delays. Many find value in using a New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement as a reference during this process.

When writing a reimbursement form, begin by entering your personal information and the details related to the expenses you wish to claim. List each expense separately, including dates, amounts, and descriptions. Ensure that you review the form for completeness and accuracy before submission. Utilizing a New Jersey Sample Letter for Policy on Vehicle Expense Reimbursement can help ensure you cover all necessary components.