The New Jersey Credit Approval Form is an essential document used by financial institutions, lenders, and credit agencies to assess the creditworthiness of individuals or businesses in New Jersey. This detailed form helps evaluate an applicant's financial standing and credit history, enabling the lender to make informed decisions regarding granting credit or loans. The New Jersey Credit Approval Form gathers comprehensive information about the applicant, including personal details, employment history, income sources, monthly expenses, previous credit lines, loan history, and outstanding debts. These details are crucial in determining the applicant's ability to repay any credit extended to them. The form also requires the applicant to provide consent for the lender to check their credit score and history through credit reporting agencies like Equifax, Experian, or TransUnion. This allows lenders to gain access to the applicant's credit report, which shows their credit score, payment patterns, and any previous defaults or bankruptcies. Different types of New Jersey Credit Approval Forms may exist based on specific credit needs or purposes. Some common variations could include: 1. Personal Credit Approval Form: This form is used by individuals seeking personal credit, such as personal loans, credit cards, or mortgages. 2. Business Credit Approval Form: Designed for businesses or companies, this form assesses the creditworthiness of a business entity for loans, trade credit, or business lines of credit. 3. Auto Loan Credit Approval Form: This specific form targets individuals seeking credit for purchasing an automobile. The lender evaluates factors like the applicant's income, employment stability, and credit history to determine the loan amount and interest rate applicable. 4. Student Loan Credit Approval Form: This form is utilized by students or their guardians to apply for educational loans and determine their eligibility based on factors like income, past financial obligations, and credit history. 5. Credit Card Approval Form: This form focuses on evaluating an individual's creditworthiness to qualify for a credit card. It involves scrutinizing factors such as income, credit score, and history to determine the credit limit and interest rates associated. By utilizing the New Jersey Credit Approval Form, lenders are able to make informed decisions while assessing credit risks and determining the terms and conditions for extending credit or loans across various financial needs. It enables both lenders and borrowers to establish a secure and reliable financial relationship based on accurate and transparent credit evaluations.

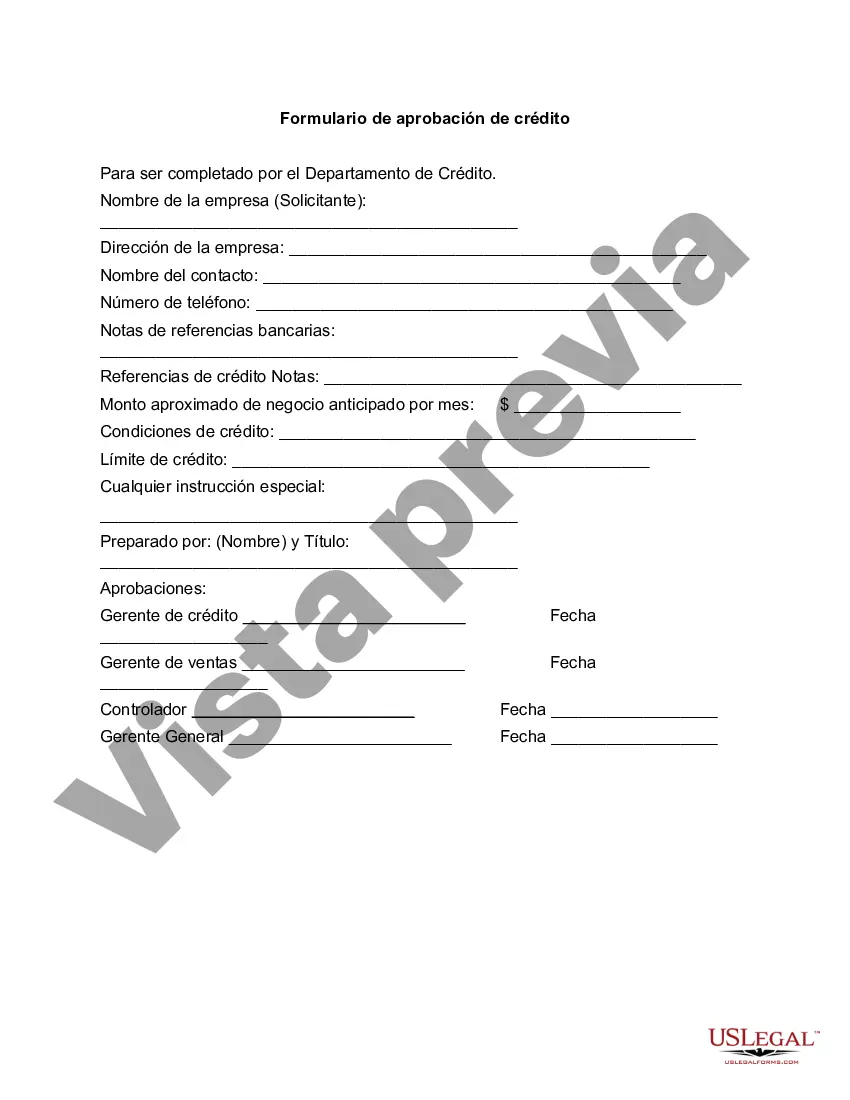

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Formulario de aprobación de crédito - Credit Approval Form

Description

How to fill out New Jersey Formulario De Aprobación De Crédito?

US Legal Forms - one of many largest libraries of authorized forms in America - delivers a wide range of authorized record layouts you can down load or print. While using web site, you can find 1000s of forms for business and individual purposes, sorted by groups, suggests, or search phrases.You can find the most recent models of forms much like the New Jersey Credit Approval Form within minutes.

If you already possess a registration, log in and down load New Jersey Credit Approval Form through the US Legal Forms library. The Acquire key will appear on each type you see. You get access to all in the past delivered electronically forms from the My Forms tab of your accounts.

If you would like use US Legal Forms initially, here are simple directions to help you get began:

- Be sure you have chosen the correct type for your town/state. Click the Review key to check the form`s content material. Look at the type information to ensure that you have chosen the proper type.

- In the event the type does not satisfy your demands, use the Research industry on top of the display screen to find the one which does.

- Should you be pleased with the shape, validate your option by simply clicking the Get now key. Then, opt for the rates program you like and offer your accreditations to sign up to have an accounts.

- Process the purchase. Use your credit card or PayPal accounts to accomplish the purchase.

- Pick the formatting and down load the shape in your device.

- Make alterations. Fill out, edit and print and signal the delivered electronically New Jersey Credit Approval Form.

Every web template you put into your money does not have an expiration time and is your own property forever. So, in order to down load or print another backup, just visit the My Forms portion and then click in the type you want.

Gain access to the New Jersey Credit Approval Form with US Legal Forms, the most comprehensive library of authorized record layouts. Use 1000s of professional and state-specific layouts that satisfy your company or individual needs and demands.