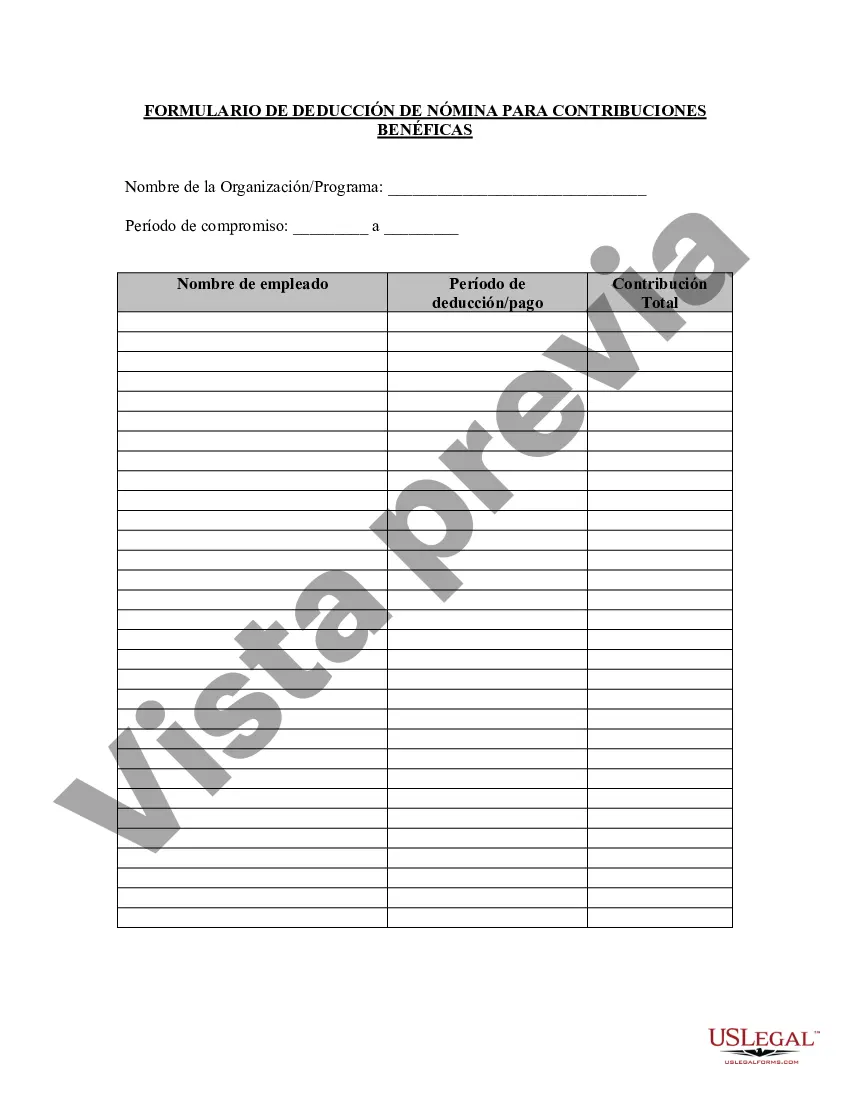

The New Jersey Charitable Contribution Payroll Deduction Form is a vital document that allows residents of New Jersey to contribute to charitable organizations through payroll deductions. This form enables employees to conveniently donate a portion of their wages directly to eligible charitable organizations on a regular basis, offering a simple and tax-efficient method to support causes in need. By utilizing the New Jersey Charitable Contribution Payroll Deduction Form, individuals can effortlessly make a positive impact on their communities and support various charitable initiatives. This form assists in promoting a culture of giving within the state, fostering a sense of philanthropy among employees who wish to contribute to charitable causes regularly. This particular form may be available in different variations depending on the employer, as companies may customize the form to fit their specific procedures and guidelines. However, the primary purpose of all New Jersey Charitable Contribution Payroll Deduction Forms remains consistent — to facilitate state residents' charitable contributions directly from their paychecks. Individuals interested in utilizing this form must ensure that the chosen charitable organization aligns with the eligibility criteria set by the state of New Jersey. Some common categories of eligible charitable organizations include but are not limited to non-profit organizations, religious institutions, educational institutions, and government agencies dedicated to social welfare. To complete the form, individuals typically need to provide pertinent information such as their name, address, social security number, employer details, and the chosen charitable organization(s) they wish to support. Additionally, employees may have the option to specify the donation amount or percentage to contribute from each paycheck. Once the completed form is submitted to the employer's payroll department, the specified amount will be deducted from the employee's salary regularly and donated to the designated charitable organization(s). It's important to note that this deduction is made before tax, thus offering potential tax benefits to the employee as allowed by state regulations. In summary, the New Jersey Charitable Contribution Payroll Deduction Form serves as a powerful tool that empowers individuals to make a positive difference in their community. By offering a streamlined process for regular charitable donations, this form encourages ongoing support to a wide range of causes. Whether it be aiding local non-profits, education programs, or religious institutions, this form enables New Jersey residents to contribute effortlessly through their payroll deductions.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Formulario de deducción de nómina de contribución benéfica - Charitable Contribution Payroll Deduction Form

Description

How to fill out New Jersey Formulario De Deducción De Nómina De Contribución Benéfica?

US Legal Forms - among the biggest libraries of legitimate varieties in the United States - delivers an array of legitimate document templates you are able to download or printing. Making use of the web site, you may get a large number of varieties for organization and individual uses, categorized by types, says, or key phrases.You will find the most recent models of varieties just like the New Jersey Charitable Contribution Payroll Deduction Form in seconds.

If you already have a subscription, log in and download New Jersey Charitable Contribution Payroll Deduction Form from the US Legal Forms local library. The Download key will show up on every develop you view. You have access to all earlier delivered electronically varieties in the My Forms tab of your respective bank account.

If you would like use US Legal Forms the first time, here are straightforward recommendations to help you started off:

- Be sure to have chosen the right develop to your town/region. Go through the Preview key to examine the form`s content material. See the develop outline to ensure that you have selected the appropriate develop.

- If the develop does not match your needs, make use of the Lookup discipline near the top of the screen to get the one that does.

- In case you are happy with the form, verify your choice by clicking on the Acquire now key. Then, pick the costs program you prefer and give your references to register for an bank account.

- Approach the transaction. Make use of your charge card or PayPal bank account to perform the transaction.

- Choose the formatting and download the form in your product.

- Make modifications. Complete, modify and printing and signal the delivered electronically New Jersey Charitable Contribution Payroll Deduction Form.

Every web template you included with your bank account does not have an expiry date and is the one you have eternally. So, if you want to download or printing an additional backup, just go to the My Forms segment and then click around the develop you will need.

Gain access to the New Jersey Charitable Contribution Payroll Deduction Form with US Legal Forms, the most comprehensive local library of legitimate document templates. Use a large number of expert and express-specific templates that meet your small business or individual requirements and needs.