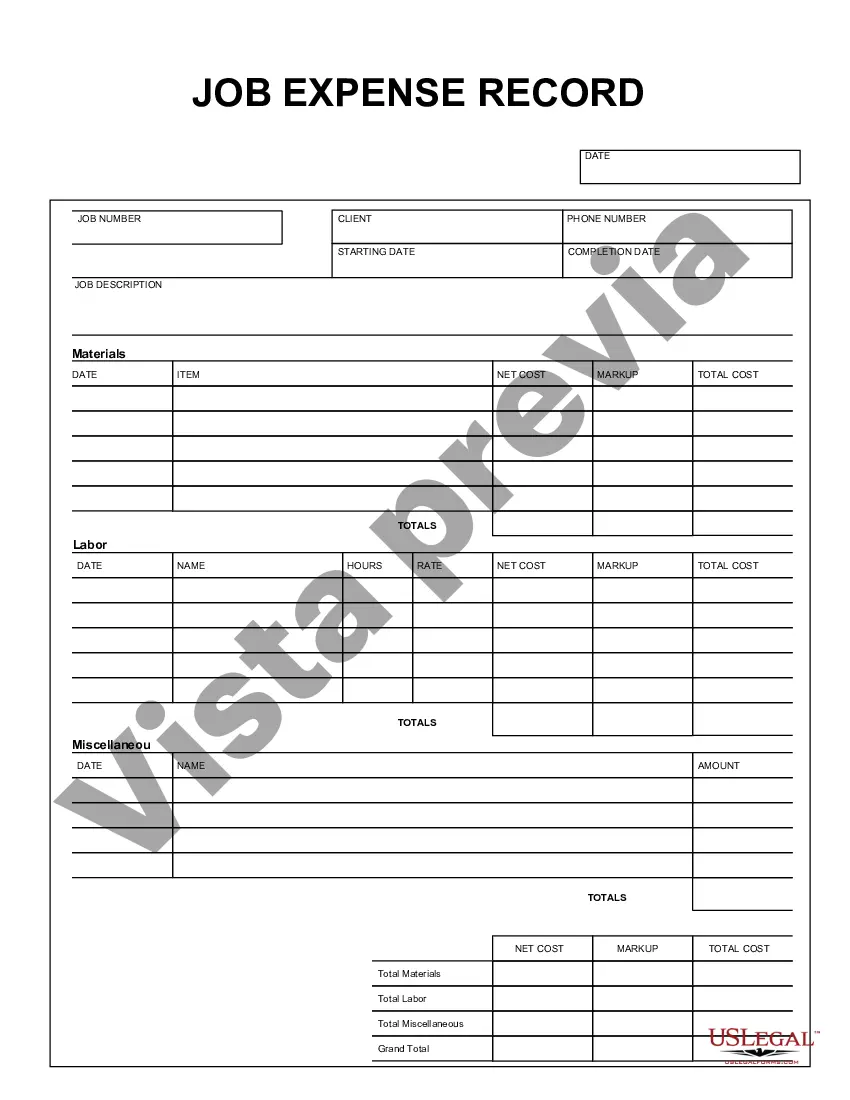

The New Jersey Job Expense Record is an essential document that helps individuals maintain accurate records of their job-related expenses in the state of New Jersey. It serves as a valuable resource for individuals who want to claim deductions on their taxes or seek reimbursement from their employers. The New Jersey Job Expense Record contains comprehensive sections to record various types of expenses incurred during employment. These expenses may include but are not limited to travel expenses, accommodation costs, meals, entertainment expenses, vehicle expenses, and supplies necessary for the job. For the sake of categorization and easier record-keeping, there are different types of New Jersey Job Expense Records available. These variations cater to different occupation types, ensuring that individuals from various industries can accurately document their job-related expenses. The specific types of expense records depend on the occupation, thus making them more tailored and relevant to certain professions. Some examples include: 1. New Jersey Job Expense Record for Sales Professionals: This variation is specifically designed for sales representatives or sales executives who frequently incur expenses related to client visits, travel, meals, and entertainment. 2. New Jersey Job Expense Record for Healthcare Professionals: Tailored to doctors, nurses, or other healthcare practitioners, this type of expense record allows for tracking expenses such as medical supplies, equipment, continuing education, licenses, and certifications. 3. New Jersey Job Expense Record for Construction Workers: Construction workers often have unique expenses associated with their trade. This variation includes categories for tools, equipment rentals, safety gear, and other construction-related purchases. 4. New Jersey Job Expense Record for Freelancers: Freelancers in various fields (writers, designers, photographers, etc.) can utilize this type of expense record to track expenses related to their self-employment, such as home office costs, software or equipment purchases, advertising, and client-related expenses. Regardless of the specific type, a New Jersey Job Expense Record requires individuals to meticulously record each expense, providing details like the date, description, amount, and purpose of the expense. This level of detail is crucial to ensure accuracy and eligibility for deductions or reimbursement. In conclusion, the New Jersey Job Expense Record is a vital tool for tracking and organizing job-related expenses. Its various types catering to specific occupations allow individuals to maintain detailed records relevant to their profession, making tax deductions and employer reimbursements more accessible.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Registro de gastos de trabajo - Job Expense Record

Description

How to fill out New Jersey Registro De Gastos De Trabajo?

Discovering the right lawful papers design could be a have difficulties. Naturally, there are a variety of layouts available on the net, but how can you find the lawful type you need? Take advantage of the US Legal Forms web site. The support delivers a large number of layouts, including the New Jersey Job Expense Record, that can be used for organization and private needs. Every one of the types are checked by specialists and fulfill state and federal needs.

In case you are presently listed, log in to your accounts and click on the Down load switch to get the New Jersey Job Expense Record. Make use of accounts to check with the lawful types you have acquired earlier. Visit the My Forms tab of your own accounts and have one more copy of your papers you need.

In case you are a brand new end user of US Legal Forms, listed below are straightforward guidelines that you can follow:

- First, be sure you have chosen the proper type for the town/county. You may check out the shape making use of the Review switch and study the shape outline to ensure it will be the best for you.

- In case the type does not fulfill your preferences, make use of the Seach industry to discover the appropriate type.

- When you are certain the shape is suitable, select the Get now switch to get the type.

- Choose the rates program you desire and enter in the needed info. Build your accounts and purchase the order utilizing your PayPal accounts or Visa or Mastercard.

- Opt for the data file structure and acquire the lawful papers design to your device.

- Comprehensive, change and print out and signal the acquired New Jersey Job Expense Record.

US Legal Forms will be the largest collection of lawful types that you can see numerous papers layouts. Take advantage of the company to acquire skillfully-manufactured files that follow condition needs.