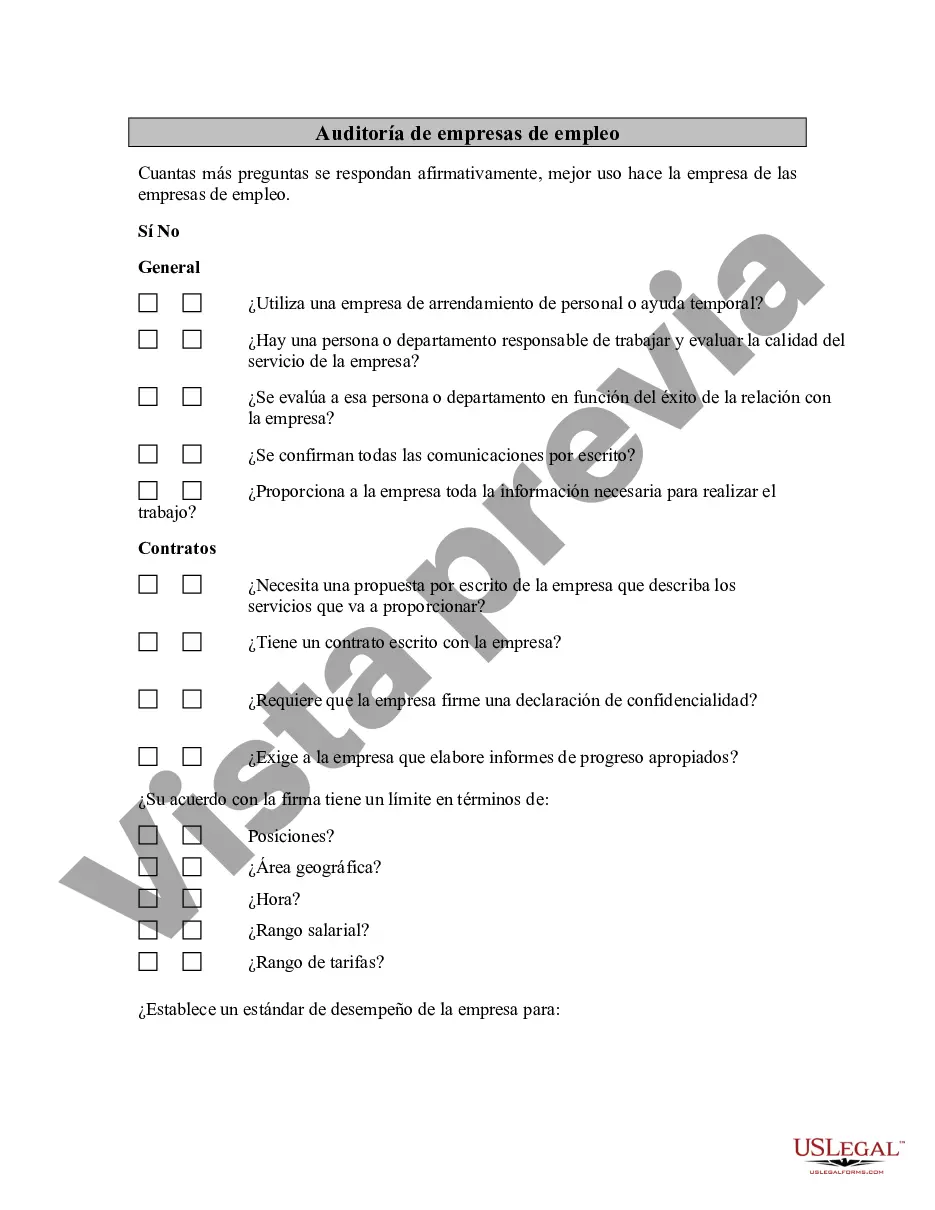

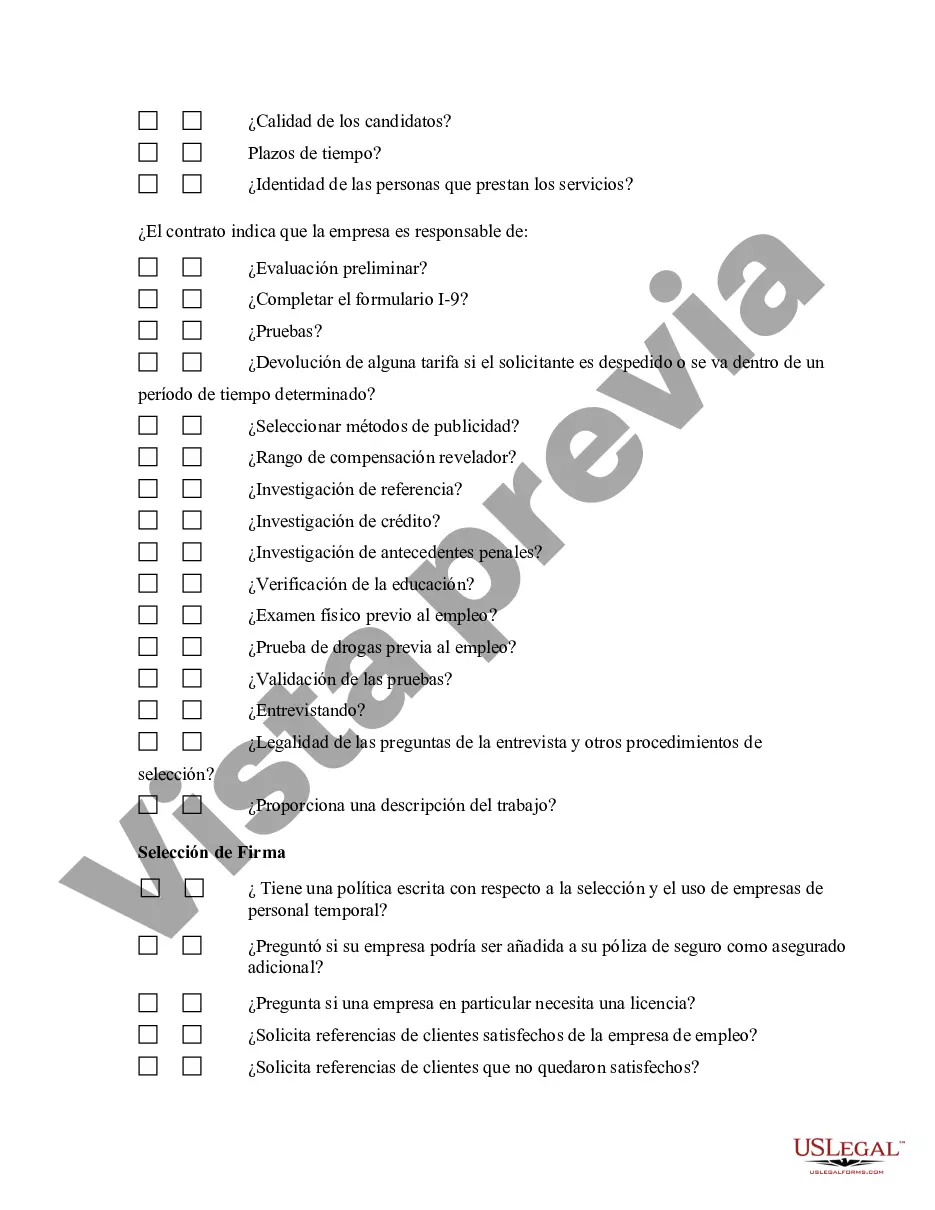

New Jersey Employment Firm Audit is a comprehensive review process conducted by professional auditors to evaluate the employment practices and financial records of firms operating in the state of New Jersey. This procedure ensures that employers comply with the applicable labor laws, regulations, and reporting standards, ultimately safeguarding the rights and benefits of employees. The main objective of a New Jersey Employment Firm Audit is to verify the accuracy of the employment-related information provided by employers, such as payroll records, employee classifications, wages, benefits, and compliance with state and federal taxation requirements. This audit aims to detect any potential violations, misclassifications, underpayments, or fraudulent activities that may negatively impact the workforce or the state's economy. There are several types of New Jersey Employment Firm Audits, each focusing on different aspects of employment practices and regulatory compliance. These include: 1. Payroll Audit: This type of audit mainly examines the accuracy of payroll processes, including payroll taxes, wage calculations, timesheets, overtime payments, and the adherence to minimum wage requirements. It ensures that employees receive their rightful compensations promptly and accurately. 2. Employee Classification Audit: This audit type evaluates whether workers are properly classified as employees or independent contractors according to the state's guidelines. It verifies that the firms are correctly distinguishing between different worker classifications, thereby adhering to the relevant labor laws and taxation regulations. 3. Benefits and Compliance Audit: This assessment concentrates on analyzing employee benefits packages, such as health insurance, retirement plans, and workers' compensation. It ensures that employers provide the legally required benefits and are compliant with state and federal regulations governing benefit programs. 4. Tax Compliance Audit: This type of audit focuses primarily on verifying that employers adequately withhold and remit federal and state taxes on behalf of their employees. It encompasses the evaluation of income tax deductions, unemployment insurance taxes, social security taxes, and any other tax liabilities associated with employment. 5. Record keeping Audit: This audit scrutinizes employers' record keeping practices ascertaining whether records are accurate, complete, and maintained in accordance with the law. It involves reviewing employee files, time cards, employment contracts, termination records, and other relevant documents. 6. Compliance with Labor Laws Audit: This audit type ensures that firms comply with various New Jersey labor laws governing areas such as minimum wage, overtime, working hours, leave policies, workplace safety, and anti-discrimination regulations. It helps protect the rights and well-being of employees and reinforces fair employment practices. By conducting New Jersey Employment Firm Audits, the state can effectively enforce compliance, deter non-compliance, and identify any necessary corrective actions. Ultimately, these audits contribute to a fair and ethical working environment, fostering economic growth and ensuring that both employees and employers benefit from a level playing field.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Auditoría de empresas de empleo - Employment Firm Audit

Description

How to fill out New Jersey Auditoría De Empresas De Empleo?

If you wish to total, acquire, or print legitimate record templates, use US Legal Forms, the largest collection of legitimate forms, which can be found on-line. Take advantage of the site`s simple and convenient research to discover the paperwork you will need. A variety of templates for business and person functions are sorted by classes and suggests, or search phrases. Use US Legal Forms to discover the New Jersey Employment Firm Audit within a couple of mouse clicks.

Should you be currently a US Legal Forms client, log in in your profile and then click the Download key to find the New Jersey Employment Firm Audit. You can even entry forms you previously delivered electronically in the My Forms tab of your own profile.

Should you use US Legal Forms the very first time, follow the instructions below:

- Step 1. Be sure you have selected the shape for your correct city/region.

- Step 2. Make use of the Review option to check out the form`s content material. Don`t forget to see the explanation.

- Step 3. Should you be unsatisfied together with the kind, utilize the Research discipline at the top of the monitor to get other models in the legitimate kind design.

- Step 4. After you have found the shape you will need, click on the Purchase now key. Select the costs strategy you choose and include your qualifications to sign up to have an profile.

- Step 5. Process the deal. You should use your charge card or PayPal profile to accomplish the deal.

- Step 6. Pick the structure in the legitimate kind and acquire it on the product.

- Step 7. Total, change and print or indicator the New Jersey Employment Firm Audit.

Each and every legitimate record design you acquire is the one you have permanently. You may have acces to every kind you delivered electronically in your acccount. Click on the My Forms segment and decide on a kind to print or acquire again.

Remain competitive and acquire, and print the New Jersey Employment Firm Audit with US Legal Forms. There are many specialist and express-particular forms you may use for your business or person requires.