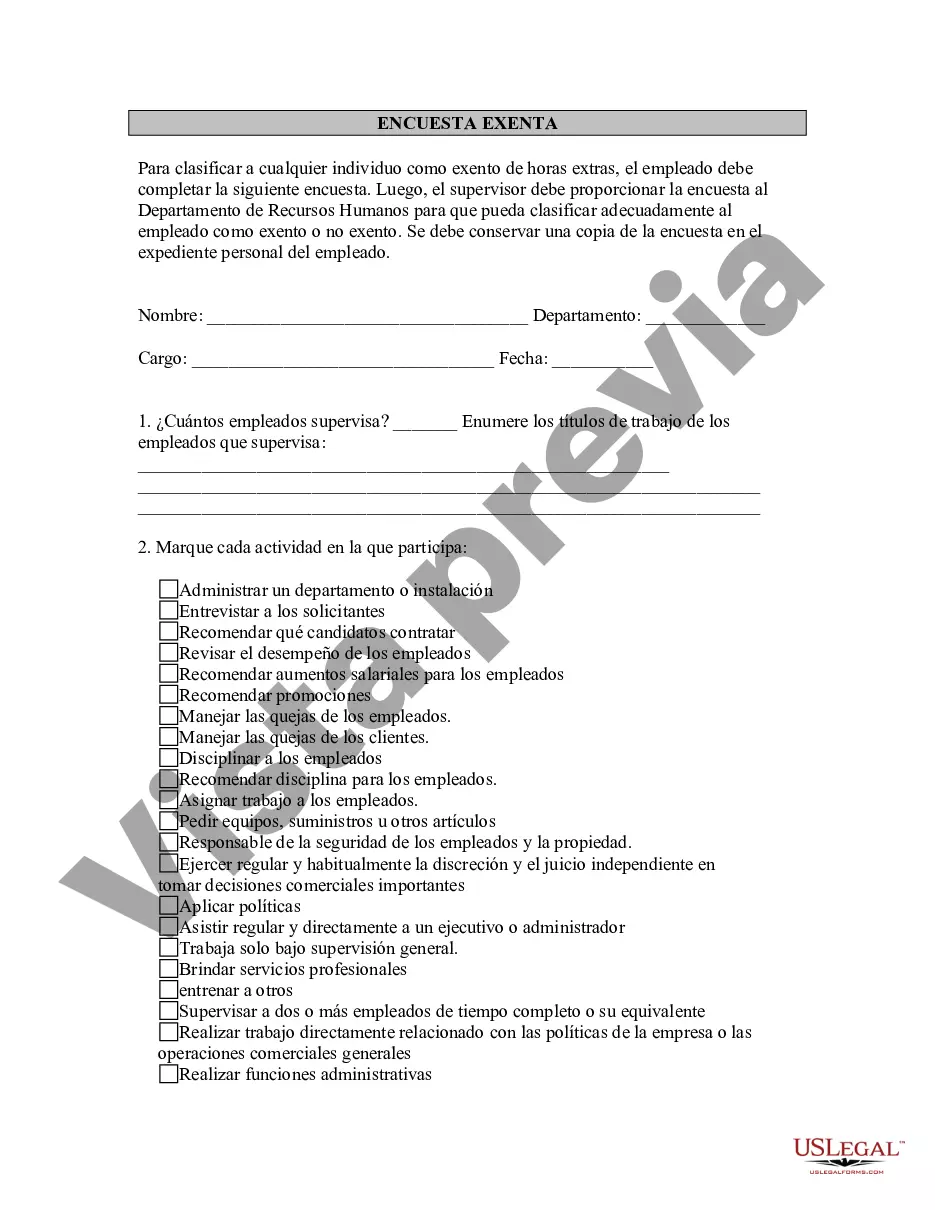

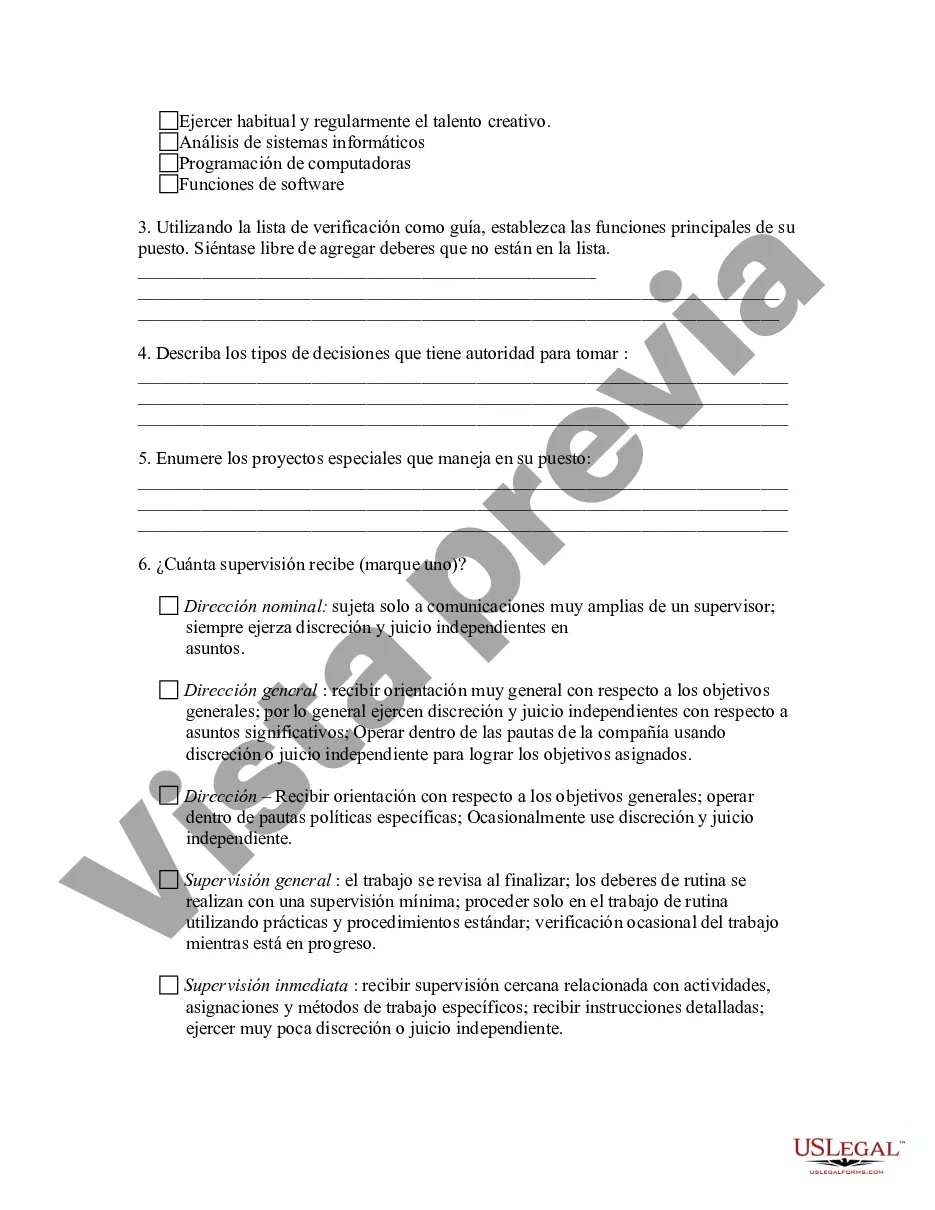

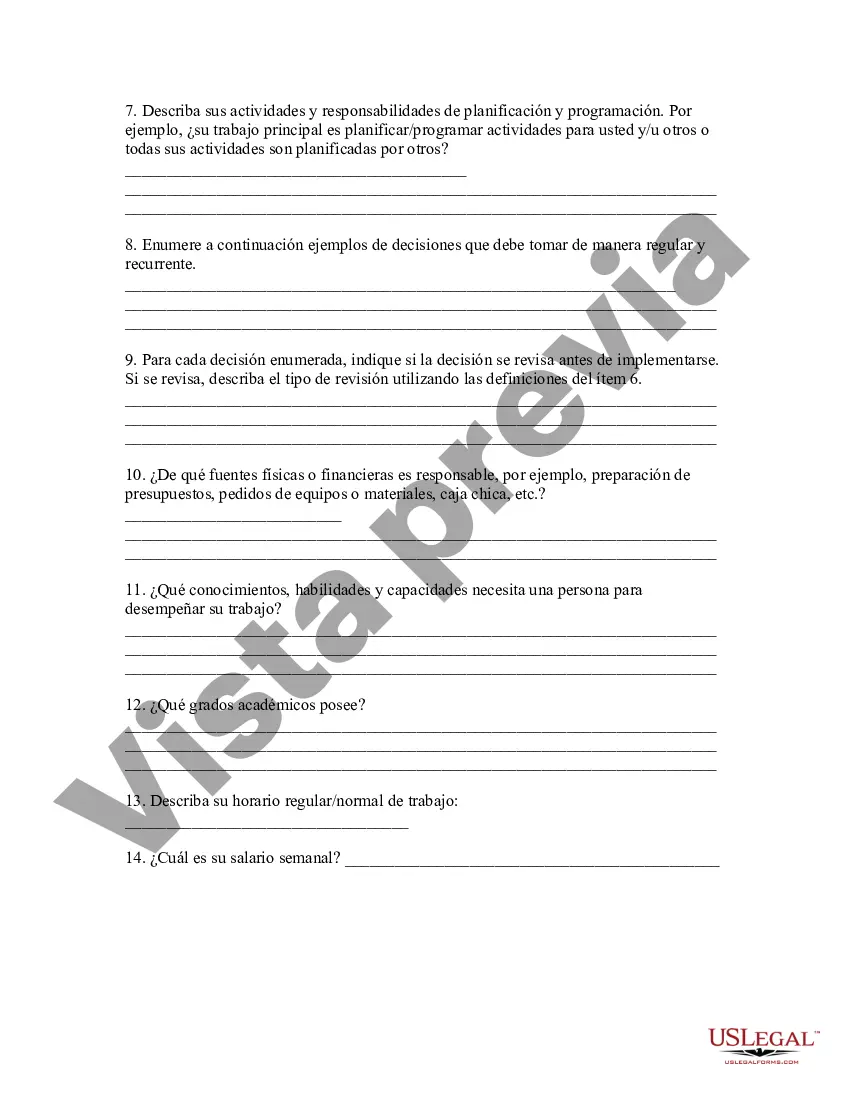

The New Jersey Exempt Survey is a vital tool used by government agencies and organizations to identify properties that are exempt from property taxes in the state of New Jersey. This comprehensive survey is conducted to determine whether certain properties meet specific criteria that render them exempt from paying property taxes. One type of New Jersey Exempt Survey is the Nonprofit Exempt Survey. This survey focuses on nonprofit organizations such as charities, religious institutions, and educational establishments. It aims to confirm if these organizations are eligible for property tax exemptions based on their mission, activities, and compliance with legal requirements. Another type of New Jersey Exempt Survey is the Government Exempt Survey. This survey concentrates on government-owned properties, including municipal buildings, public schools, administrative offices, and public parks. Its purpose is to ensure that these properties are entitled to tax exemptions, as they serve the public interest or provide essential governmental services. Additionally, the Agricultural Exempt Survey is conducted to address properties used for agricultural purposes, such as farms, nurseries, and vineyards. This survey assesses whether these properties meet the necessary qualifications, such as acreage requirements and income thresholds, to be eligible for property tax exemption. It is worth noting that the New Jersey Exempt Survey involves in-depth analysis and verification of each property's eligibility for tax exemption. Trained professionals carefully examine the documentation, review property usage, and interview property owners or representatives to gather relevant information. This process helps to ensure fairness and accuracy in determining which properties should be exempt from property taxes. Overall, the New Jersey Exempt Survey aims to maintain a fair and equitable tax system by identifying properties that meet the specific criteria for tax exemption. It is a crucial process for both property owners seeking exemption and the government agencies responsible for enforcing property tax regulations.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Encuesta exenta - Exempt Survey

Description

How to fill out New Jersey Encuesta Exenta?

It is possible to commit hrs on-line attempting to find the legitimate document web template which fits the federal and state demands you will need. US Legal Forms gives a huge number of legitimate forms which can be reviewed by specialists. You can easily acquire or printing the New Jersey Exempt Survey from our services.

If you currently have a US Legal Forms bank account, you may log in and then click the Obtain option. Next, you may full, revise, printing, or indicator the New Jersey Exempt Survey. Each legitimate document web template you get is your own permanently. To acquire one more duplicate for any purchased form, check out the My Forms tab and then click the related option.

If you are using the US Legal Forms site the first time, keep to the simple guidelines listed below:

- Very first, make sure that you have chosen the best document web template for the state/city that you pick. See the form outline to ensure you have chosen the right form. If available, utilize the Review option to look through the document web template as well.

- If you would like discover one more version of your form, utilize the Lookup field to find the web template that meets your needs and demands.

- When you have located the web template you need, just click Get now to move forward.

- Find the prices strategy you need, type your references, and register for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You should use your bank card or PayPal bank account to pay for the legitimate form.

- Find the file format of your document and acquire it for your device.

- Make adjustments for your document if needed. It is possible to full, revise and indicator and printing New Jersey Exempt Survey.

Obtain and printing a huge number of document layouts utilizing the US Legal Forms website, that provides the most important variety of legitimate forms. Use professional and express-certain layouts to handle your business or personal needs.

Form popularity

FAQ

The ST-5 exemption certificate grants your organization exemption from New Jersey sales and use tax on the organization's purchases of goods, meals, services, room occupancies and admissions that are directly related to the purposes of the organization, except purchases of energy and utility services.

If you Wish to Use a New Jersey Resale CertificateNew Jersey has two separate resale certificates, here are the links to both: Form ST-3 Resale Certificate for in-state sellers. Form ST-3NR Resale Certificate for Non-New Jersey sellers.

Sellers are not required to accept resale certificates, however, most do. If the vendor doesn't accept the certificate, the buyer will have to pay sales tax on the merchandise being purchased. In most cases, a credit is available when filing the New Jersey sales tax return.

ST-3 (3-17) The seller must collect the tax on a sale of taxable property or services unless the purchaser gives them a fully completed New Jersey exemption certificate. State of New Jersey. Division of Taxation. SALES TAX.

A seller must be registered with New Jersey to accept exemption certificates. A Public Records Filing may also be required depending upon the type of business ownership.

Form ST-4 makes it possible for businesses to purchase production machinery, packaging supplies, and other goods or services without paying Sales Tax if the way they intend to use these items is specifically exempt under New Jersey law.

Exempt items include most food sold as grocery items, most clothing and footwear, disposable paper products for household use, prescription drugs, and over-the-counter drugs.

Agencies of the federal government and the United Nations as well as the State of New Jersey and its political subdivisions are exempt from paying Sales Tax provided the agency making the purchase supplies the seller with a copy of a valid purchase order or contract signed by an authorized official.