Title: New Jersey Demand for Payment of Account by Business to Debtor: A Comprehensive Guide Introduction: In the business world, late payments can create significant challenges for companies operating in New Jersey. To tackle this issue, businesses in the state may utilize a legally enforceable document known as a New Jersey Demand for Payment of Account by Business to Debtor. This comprehensive guide provides a detailed description of what this demand entails, its significance, and outlines different types of demands that can be employed. Keywords: New Jersey, demand for payment, account, business to debtor 1. What is a New Jersey Demand for Payment of Account? A New Jersey Demand for Payment of Account by Business to Debtor is a formal letter or document sent by a business to a debtor who has failed to make timely payments for goods or services rendered. It serves as a reminder and request for the debtor to fulfill their financial obligations. 2. Significance of New Jersey Demand for Payment of Account: Effectiveness: This demand carries enforceable legal weight, enabling businesses to seek resolution through legal means if necessary. Communication: It establishes clear communication between the business and debtor, outlining the outstanding amount, due date, and consequences of non-payment. Documentation: The demand provides a written record of the attempt to collect the debt, which can be used as evidence in legal proceedings, if required. Preservation of Business Relationships: While assertive, a demand for payment allows businesses to assert their rights and expectations, potentially resolving the issue without further escalation. Types of New Jersey Demand for Payment of Account by Business to Debtor: 1. Initial Demand for Payment: The initial demand is the first notice sent by the business to the debtor, conveying that payment is overdue and requesting immediate settlement. It typically includes details such as the amount owed, due date, and instructions for settling the debt. 2. Follow-up Demand for Payment: A follow-up demand is sent if the initial demand is ignored or if the debtor fails to respond within a specified period. It emphasizes the seriousness of the situation and highlights potential consequences if payment is not made promptly. 3. Final Demand for Payment: A final demand is issued as a last resort, signaling the business's intent to pursue legal action if the debt remains unsettled. It usually includes a deadline for payment, accompanied by a warning that failure to comply may result in litigation. Conclusion: A New Jersey Demand for Payment of Account by Business to Debtor plays a crucial role in addressing late payments and encouraging debtors to fulfill their financial obligations in a timely manner. By understanding the different types of demands available, businesses can navigate challenging situations more effectively, consequently protecting their interests and encouraging successful resolution. Keywords: New Jersey, demand for payment, account, business to debtor, initial demand, follow-up demand, final demand, settle, overdue, escalation.

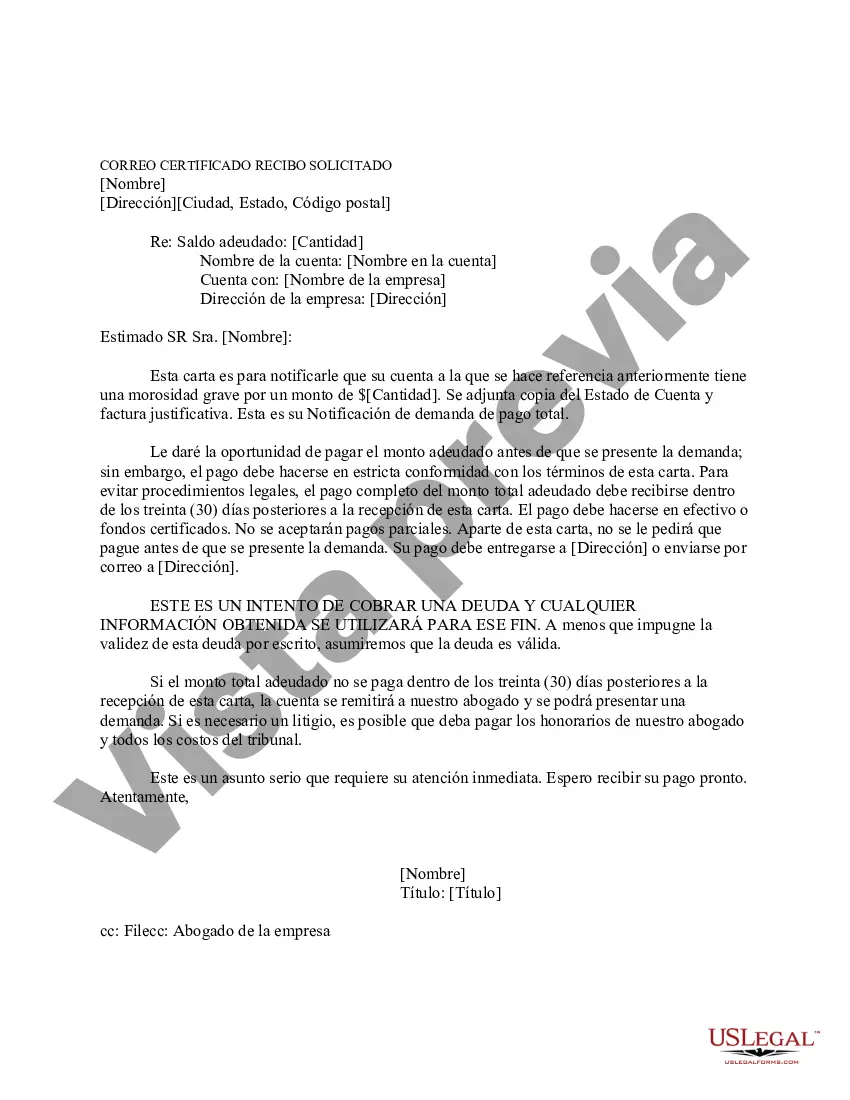

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Jersey Demanda de Pago de Cuenta por Empresa a Deudor - Demand for Payment of Account by Business to Debtor

Description

How to fill out New Jersey Demanda De Pago De Cuenta Por Empresa A Deudor?

US Legal Forms - one of the greatest libraries of authorized kinds in the USA - gives a wide array of authorized document templates it is possible to acquire or print. Using the website, you can get thousands of kinds for business and personal reasons, categorized by groups, says, or search phrases.You can find the most recent versions of kinds much like the New Jersey Demand for Payment of Account by Business to Debtor within minutes.

If you already have a monthly subscription, log in and acquire New Jersey Demand for Payment of Account by Business to Debtor from your US Legal Forms catalogue. The Obtain key will appear on every develop you view. You have access to all in the past downloaded kinds inside the My Forms tab of the profile.

If you wish to use US Legal Forms initially, here are straightforward recommendations to obtain started:

- Be sure you have chosen the best develop for the town/state. Click on the Review key to analyze the form`s content. Browse the develop explanation to ensure that you have selected the proper develop.

- In the event the develop doesn`t fit your specifications, take advantage of the Lookup area at the top of the display screen to get the one which does.

- In case you are content with the form, validate your selection by clicking the Acquire now key. Then, choose the prices prepare you want and offer your qualifications to sign up to have an profile.

- Approach the financial transaction. Use your charge card or PayPal profile to finish the financial transaction.

- Select the file format and acquire the form on your own product.

- Make alterations. Complete, revise and print and indication the downloaded New Jersey Demand for Payment of Account by Business to Debtor.

Every single format you put into your money lacks an expiration day and is yours for a long time. So, in order to acquire or print another version, just check out the My Forms portion and click on on the develop you will need.

Get access to the New Jersey Demand for Payment of Account by Business to Debtor with US Legal Forms, the most comprehensive catalogue of authorized document templates. Use thousands of expert and express-certain templates that meet up with your small business or personal needs and specifications.