New Jersey Assignment of Overriding Royalty Interest with Proportionate Reduction

Description

How to fill out Assignment Of Overriding Royalty Interest With Proportionate Reduction?

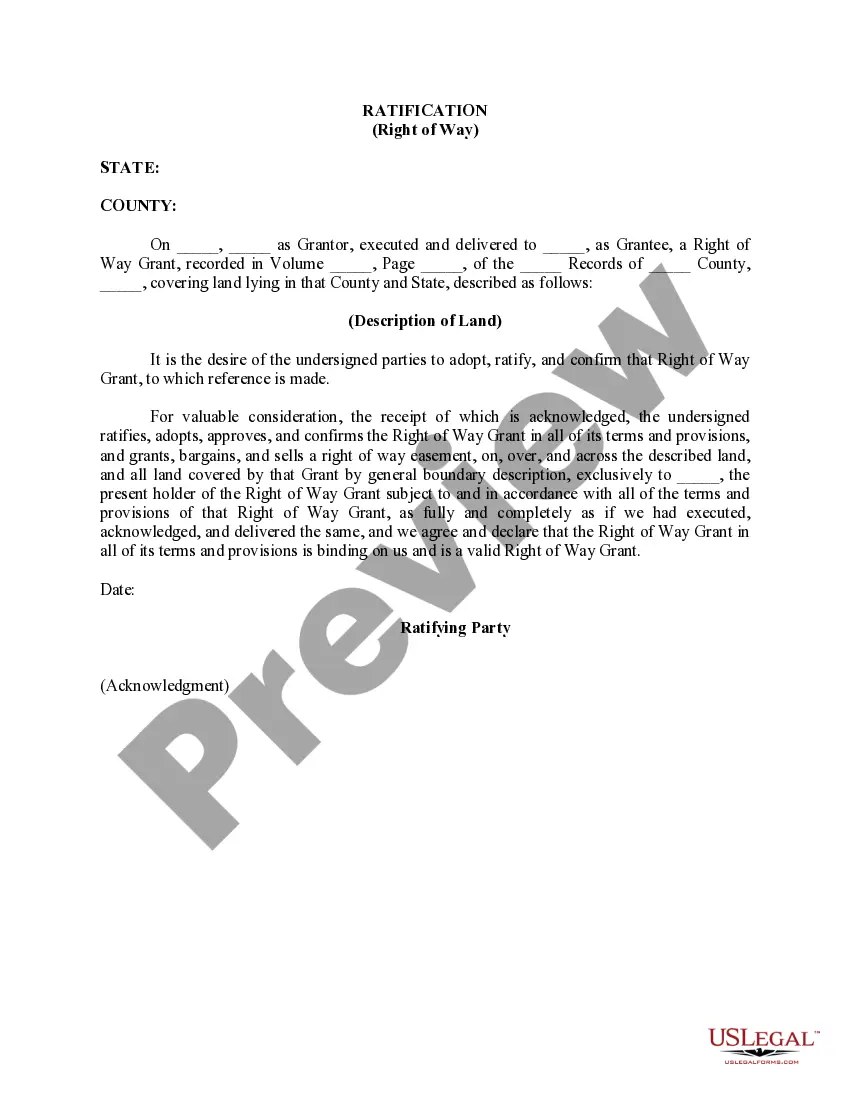

You may devote hrs on the web trying to find the authorized papers web template which fits the state and federal demands you need. US Legal Forms offers 1000s of authorized forms that happen to be reviewed by pros. It is possible to acquire or printing the New Jersey Assignment of Overriding Royalty Interest with Proportionate Reduction from our services.

If you currently have a US Legal Forms profile, you are able to log in and click the Acquire button. Following that, you are able to total, change, printing, or indication the New Jersey Assignment of Overriding Royalty Interest with Proportionate Reduction. Every authorized papers web template you acquire is your own forever. To obtain yet another backup of any bought form, check out the My Forms tab and click the related button.

If you use the US Legal Forms site initially, stick to the straightforward recommendations beneath:

- Initially, ensure that you have selected the right papers web template to the region/area of your choosing. Browse the form information to ensure you have picked the right form. If accessible, utilize the Preview button to check throughout the papers web template also.

- In order to locate yet another model from the form, utilize the Look for field to discover the web template that meets your requirements and demands.

- Once you have identified the web template you would like, simply click Purchase now to carry on.

- Find the rates plan you would like, type your accreditations, and sign up for your account on US Legal Forms.

- Full the financial transaction. You can use your charge card or PayPal profile to cover the authorized form.

- Find the file format from the papers and acquire it to your product.

- Make changes to your papers if required. You may total, change and indication and printing New Jersey Assignment of Overriding Royalty Interest with Proportionate Reduction.

Acquire and printing 1000s of papers web templates utilizing the US Legal Forms web site, which provides the most important selection of authorized forms. Use expert and express-particular web templates to tackle your small business or specific needs.

Form popularity

FAQ

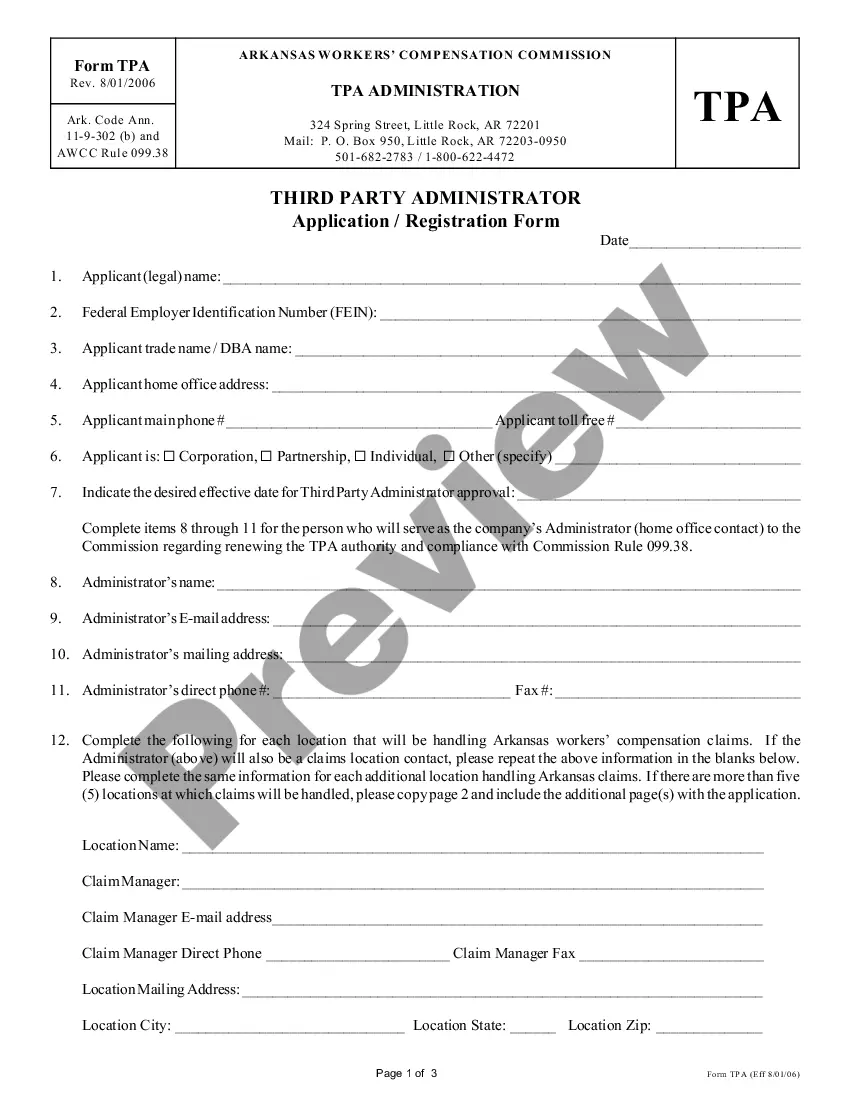

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

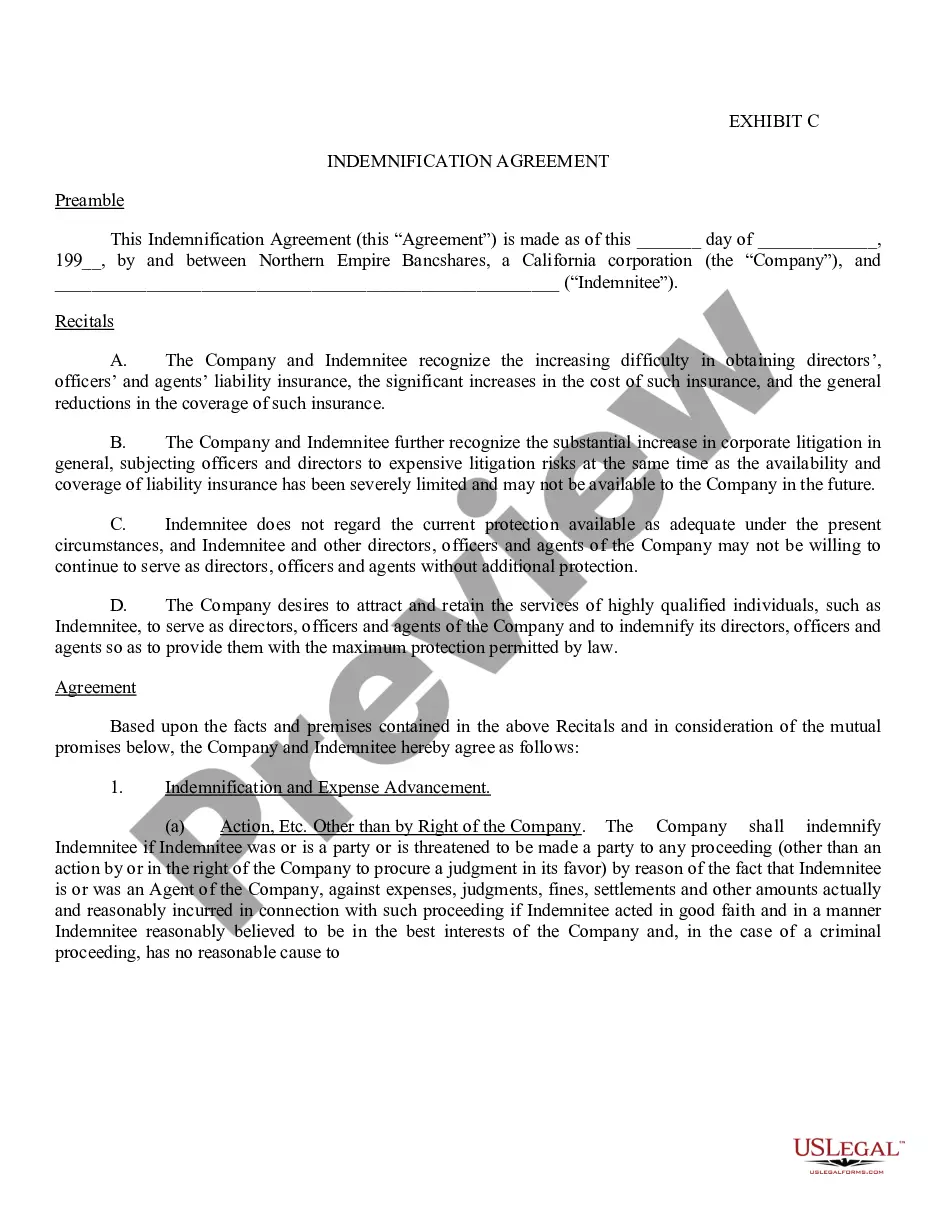

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.