An angel investor or angel (also known as a business angel or informal investor) is an affluent individual who provides capital for a business start-up, usually in exchange for convertible debt or ownership equity. New start-up companies often turn to the private equity market for seed money because the formal equity market is reluctant to fund risky undertakings. In addition to their willingness to invest in a start-up, angel investors may bring other assets to the partnership. They are often a source of encouragement; they may be mentors in how best to guide a new business through the start-up phase and they are often willing to do this while staying out of the day-to-day management of the business.

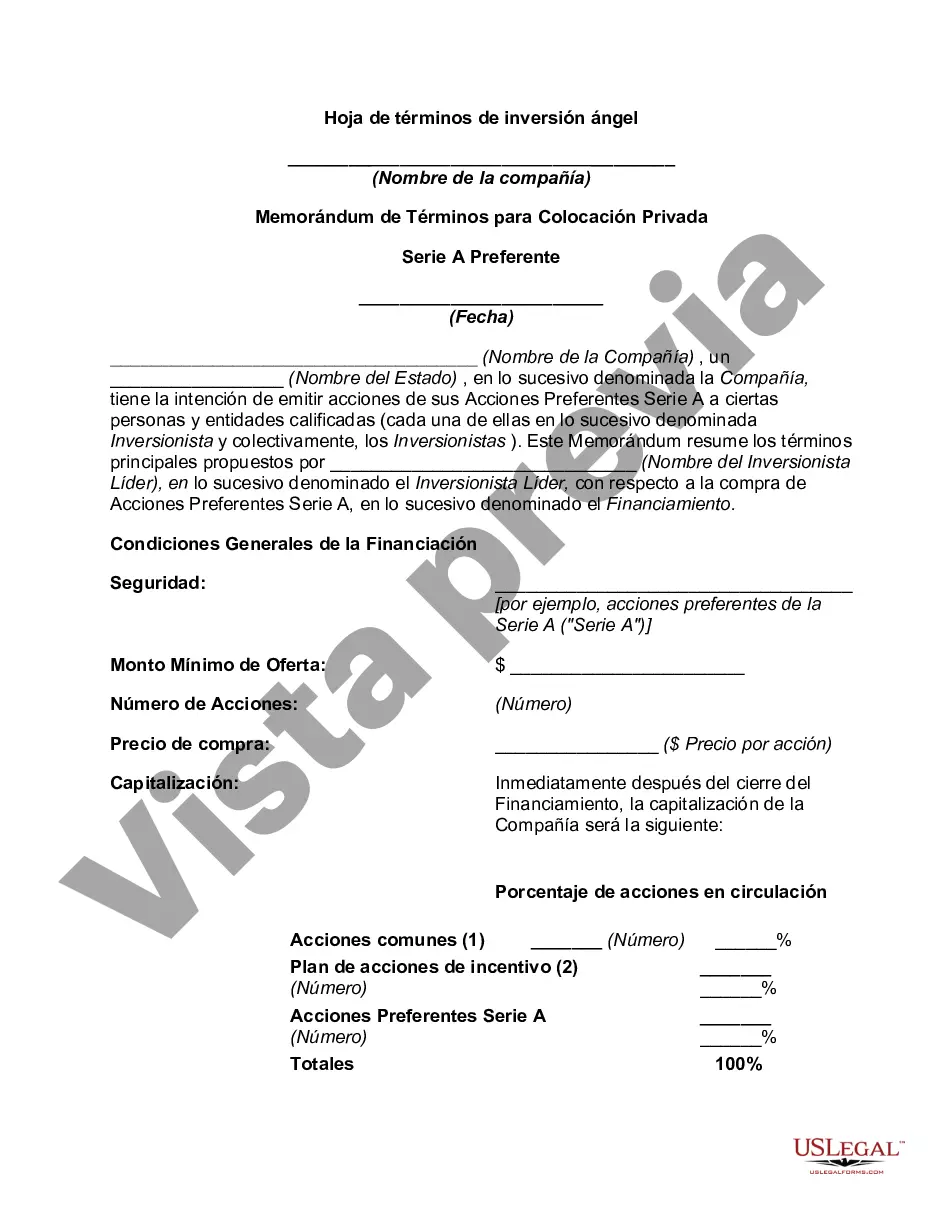

Term sheet is a non-binding agreement setting forth the basic terms and conditions under which an investment will be made.

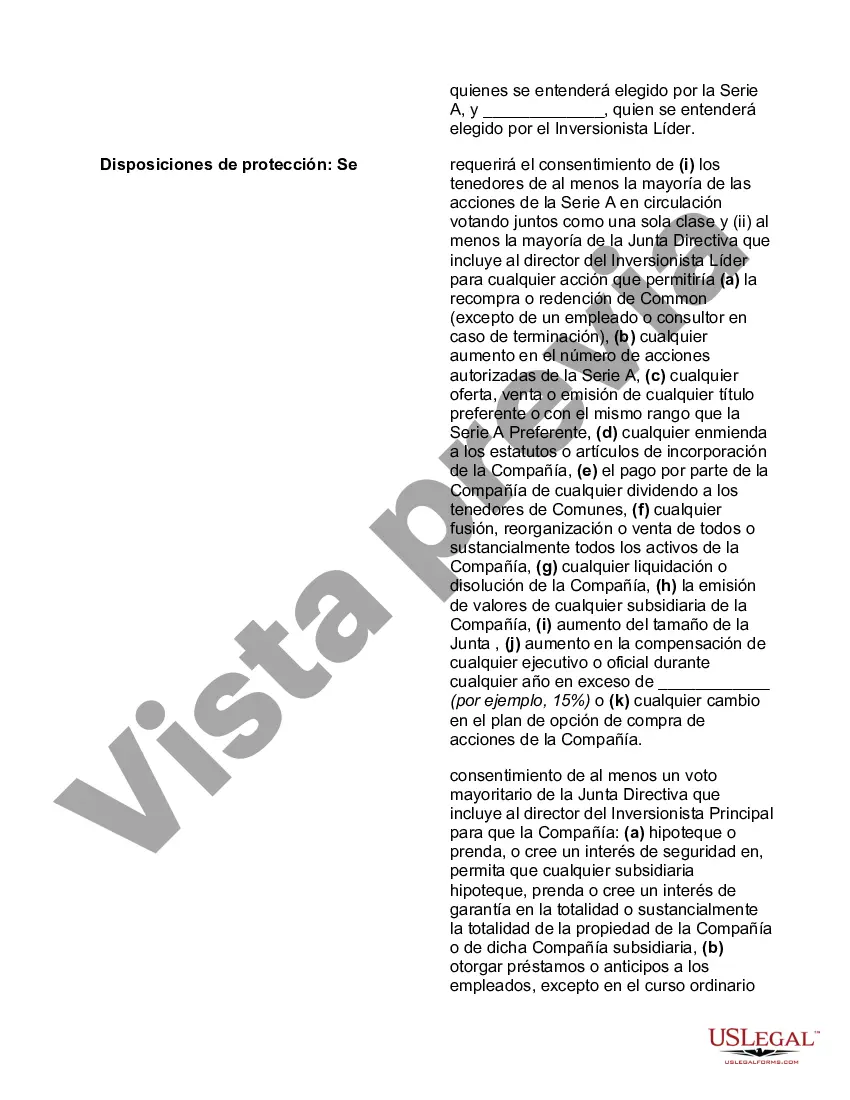

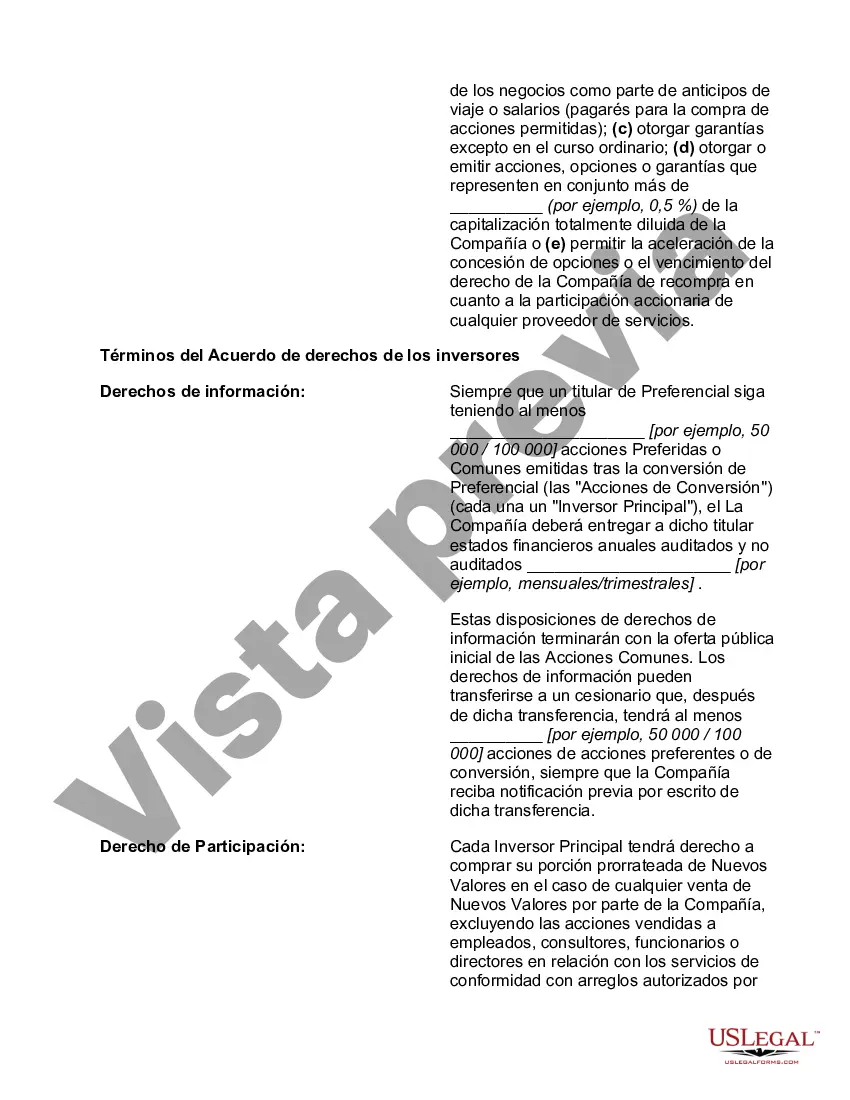

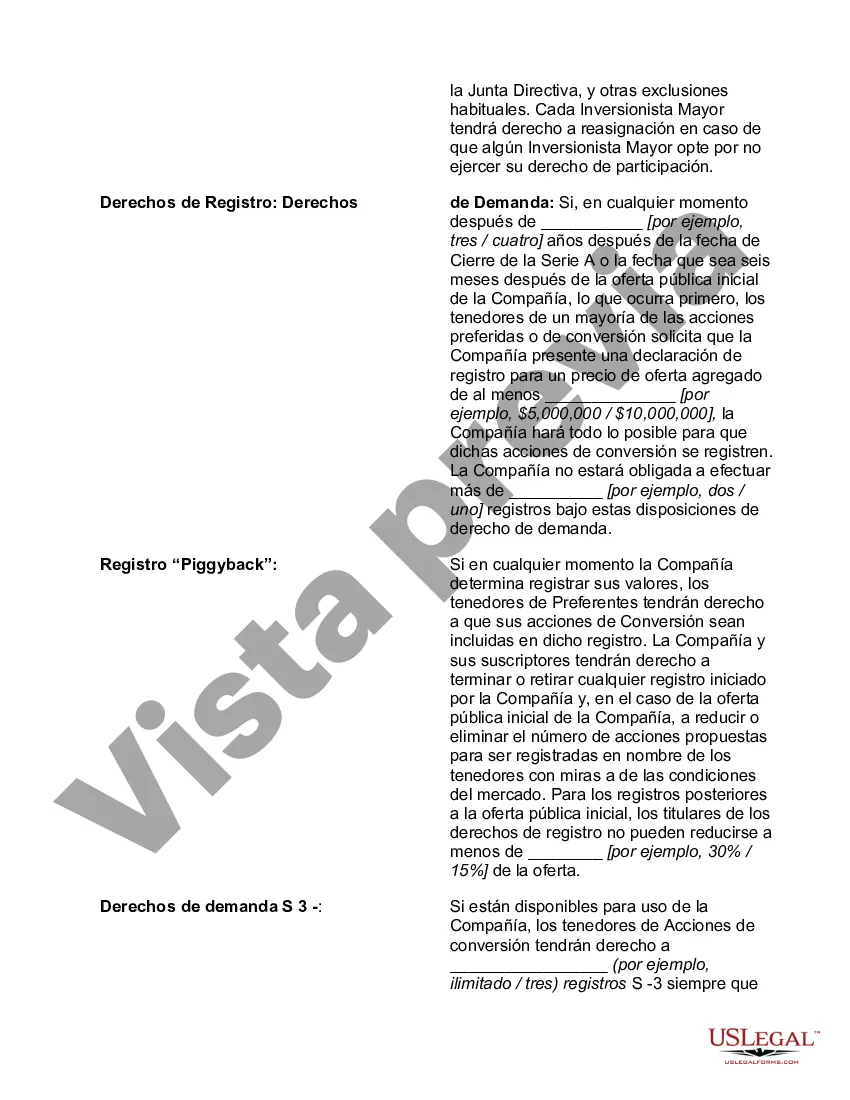

A New Mexico Angel Investment Term Sheet refers to a legal document that outlines the key terms and conditions of an investment agreement between angel investors and a startup company based in New Mexico. The term sheet serves as the foundation for the formal investment agreement and provides a detailed framework that defines the rights, obligations, and expectations of both parties involved in the investment. Typically, a New Mexico Angel Investment Term Sheet includes several important sections. These sections may cover aspects such as investment amount, valuation, ownership percentage, and the type of securities being issued by the startup. In addition, the term sheet may specify the vesting period and any conditions or restrictions on the shares being issued. Furthermore, a New Mexico Angel Investment Term Sheet may address the governance structure and control provisions. This can include appointing angel investors as board members, outlining the decision-making process, and highlighting any protective provisions that the investors may have, such as anti-dilution rights or veto power on certain matters. Different types of New Mexico Angel Investment Term Sheets may exist based on the specific nature of the investment and the preferences of the investors. For instance, there can be convertible debt term sheets, which outline the terms for a debt instrument that can convert into equity at a later stage. Alternatively, equity investment term sheets focus on the purchase of shares in exchange for capital. The specific terms and clauses within these term sheets may differ depending on the investment structure and the negotiation between the startup and the angel investors. New Mexico Angel Investment Term Sheets play a crucial role in providing clarity and transparency to both parties involved in the investment process. They serve as a guidepost for subsequent legal agreements and protect the interests of all stakeholders. By outlining the key terms, provisions, and conditions of an investment, these term sheets facilitate efficient and effective negotiations, minimizing the potential for misunderstandings or conflicts.A New Mexico Angel Investment Term Sheet refers to a legal document that outlines the key terms and conditions of an investment agreement between angel investors and a startup company based in New Mexico. The term sheet serves as the foundation for the formal investment agreement and provides a detailed framework that defines the rights, obligations, and expectations of both parties involved in the investment. Typically, a New Mexico Angel Investment Term Sheet includes several important sections. These sections may cover aspects such as investment amount, valuation, ownership percentage, and the type of securities being issued by the startup. In addition, the term sheet may specify the vesting period and any conditions or restrictions on the shares being issued. Furthermore, a New Mexico Angel Investment Term Sheet may address the governance structure and control provisions. This can include appointing angel investors as board members, outlining the decision-making process, and highlighting any protective provisions that the investors may have, such as anti-dilution rights or veto power on certain matters. Different types of New Mexico Angel Investment Term Sheets may exist based on the specific nature of the investment and the preferences of the investors. For instance, there can be convertible debt term sheets, which outline the terms for a debt instrument that can convert into equity at a later stage. Alternatively, equity investment term sheets focus on the purchase of shares in exchange for capital. The specific terms and clauses within these term sheets may differ depending on the investment structure and the negotiation between the startup and the angel investors. New Mexico Angel Investment Term Sheets play a crucial role in providing clarity and transparency to both parties involved in the investment process. They serve as a guidepost for subsequent legal agreements and protect the interests of all stakeholders. By outlining the key terms, provisions, and conditions of an investment, these term sheets facilitate efficient and effective negotiations, minimizing the potential for misunderstandings or conflicts.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.