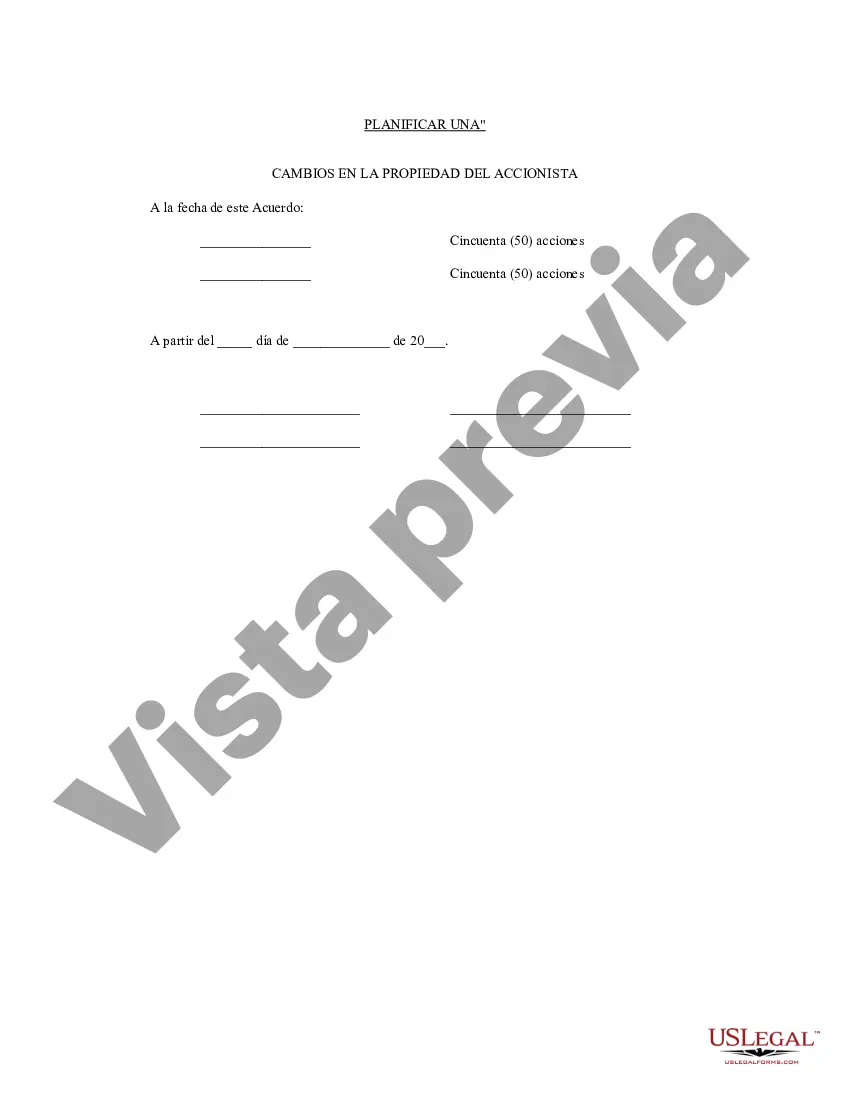

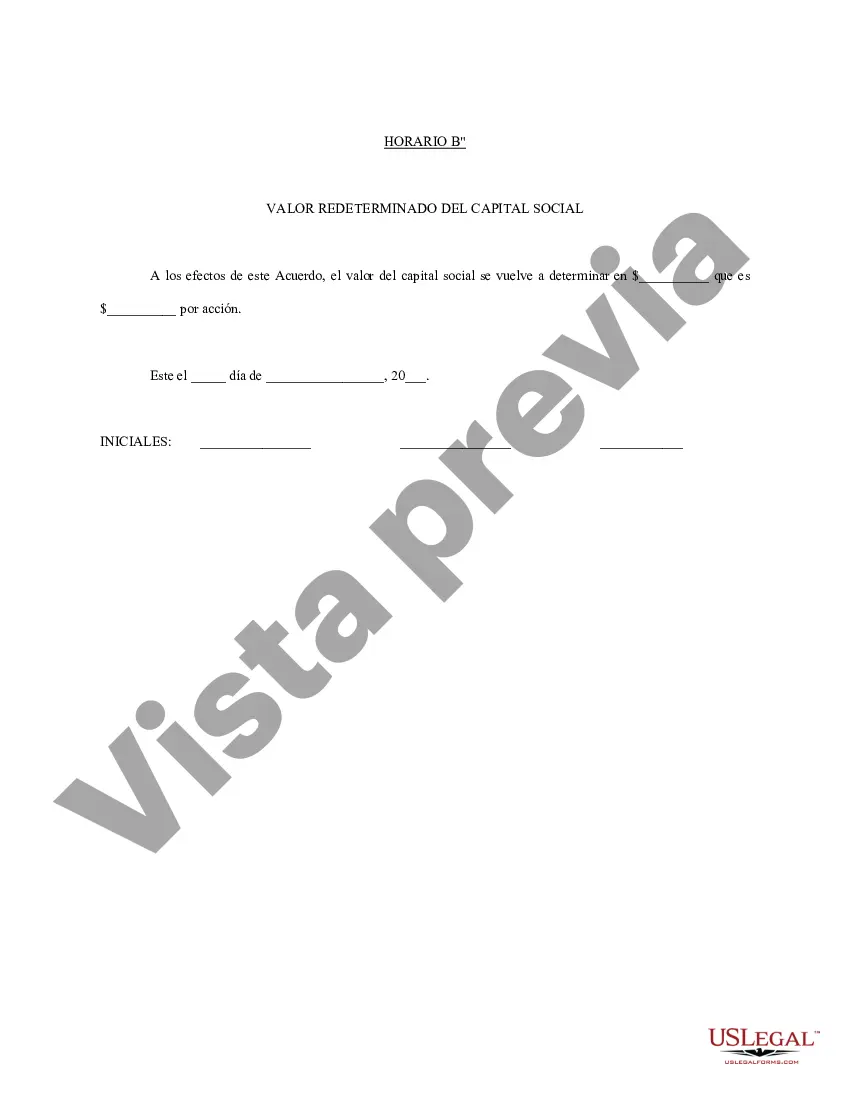

A New Mexico Buy Sell Agreement Between Shareholders and a Corporation is a legally binding contract that outlines the terms and conditions surrounding the sale or transfer of shares within a corporation. This agreement is crucial for protecting the interests of shareholders and ensuring a smooth transition of ownership in the event of certain triggering events. The primary purpose of a Buy Sell Agreement is to establish a framework for a shareholder to sell or transfer their shares in a corporation. This agreement can be triggered by various events, such as the death, disability, retirement, or voluntary sale of shares by a shareholder. By providing predetermined rules and procedures, the agreement helps prevent disputes and ensures a fair market value for the shares. There are different types of Buy Sell Agreements in New Mexico that shareholders and corporations can consider depending on their specific needs and circumstances. Some common types include: 1. Cross-Purchase Agreement: This type of agreement involves the remaining shareholders purchasing the shares of a departing or deceased shareholder. The remaining shareholders agree to buy the shares in proportion to their ownership in the corporation. 2. Stock Redemption Agreement: In this agreement, the corporation itself agrees to repurchase the shares of a departing or deceased shareholder. The corporation uses its own funds or borrows money to finance the purchase. 3. Hybrid Agreement: A combination of both the cross-purchase and stock redemption agreements, this type allows both the shareholders and the corporation to purchase shares. Key provisions found in a New Mexico Buy Sell Agreement include: 1. Purchase Price: The agreement should outline the method of determining the purchase price, which could be based on fair market value, book value, or a predetermined formula. 2. Triggering Events: The agreement must identify the specific events that will trigger the buyout, such as death, disability, retirement, voluntary sale, or bankruptcy. 3. Right of First Refusal: This provision grants the corporation or other shareholders the first opportunity to purchase the shares before they can be sold to an outside party. 4. Terms of Payment: The agreement needs to specify how the purchase price will be paid, whether in a lump sum, installments, or through financing arrangements. 5. Non-Compete and Confidentiality Clauses: These clauses may be included to prevent departing shareholders from competing with the corporation or disclosing sensitive information. 6. Dispute Resolution: The agreement should outline the process for resolving disputes, such as through mediation or arbitration. It is essential to consult with legal professionals specializing in corporate law when drafting or entering into a Buy Sell Agreement in New Mexico. They will ensure that the agreement is in accordance with state laws and tailored to the specific needs of the shareholders and the corporation.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Mexico Acuerdo de compra venta entre accionistas y una corporación - Buy Sell Agreement Between Shareholders and a Corporation

Description

How to fill out New Mexico Acuerdo De Compra Venta Entre Accionistas Y Una Corporación?

US Legal Forms - one of the greatest libraries of legal varieties in the United States - gives a wide range of legal papers themes you may down load or printing. While using web site, you can find a huge number of varieties for organization and individual functions, sorted by groups, claims, or keywords and phrases.You can find the most up-to-date variations of varieties much like the New Mexico Buy Sell Agreement Between Shareholders and a Corporation within minutes.

If you already have a membership, log in and down load New Mexico Buy Sell Agreement Between Shareholders and a Corporation in the US Legal Forms catalogue. The Obtain option can look on each and every type you view. You have accessibility to all previously downloaded varieties within the My Forms tab of the accounts.

If you would like use US Legal Forms for the first time, listed here are simple directions to obtain started off:

- Be sure to have picked the best type to your area/state. Select the Review option to review the form`s content material. See the type information to actually have chosen the correct type.

- If the type doesn`t match your demands, utilize the Research field on top of the monitor to obtain the one who does.

- In case you are satisfied with the form, verify your selection by clicking on the Get now option. Then, opt for the costs program you favor and provide your qualifications to sign up for an accounts.

- Approach the transaction. Make use of charge card or PayPal accounts to perform the transaction.

- Select the file format and down load the form on the system.

- Make changes. Complete, revise and printing and indication the downloaded New Mexico Buy Sell Agreement Between Shareholders and a Corporation.

Every web template you included in your account lacks an expiry day and is also your own property eternally. So, if you wish to down load or printing another duplicate, just go to the My Forms portion and then click in the type you need.

Gain access to the New Mexico Buy Sell Agreement Between Shareholders and a Corporation with US Legal Forms, one of the most extensive catalogue of legal papers themes. Use a huge number of specialist and status-distinct themes that meet up with your organization or individual requirements and demands.