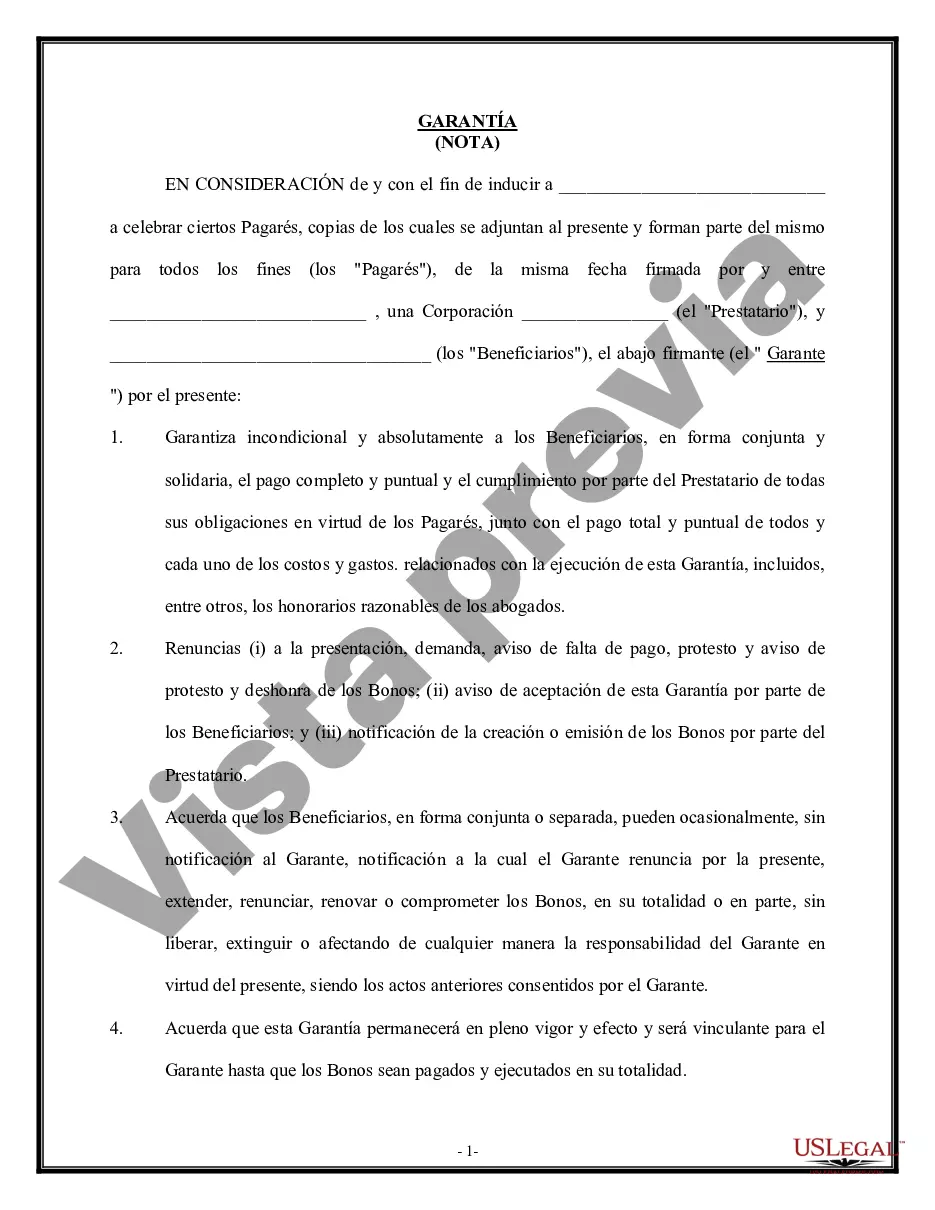

The New Mexico Guaranty of Promissory Note by Individual — Corporate Borrower is a legally binding document that outlines the agreement between an individual and a corporation regarding the guarantee of a promissory note. This document is commonly used in financial transactions where a corporation borrows money from a lender, and an individual agrees to act as a guarantor for the repayment of the loan. The New Mexico Guaranty of Promissory Note serves as a form of security for the lender, as it provides an additional party who can be held responsible for the repayment of the loan in case the corporation defaults on its obligations. The individual guarantor essentially agrees to be held personally liable for the outstanding debt if the corporation is unable to repay the loan. The document typically includes essential information such as the names and addresses of the individual guarantor and the corporate borrower, the date of the agreement, an explicit acknowledgment of the existence and terms of the promissory note being guaranteed, and the specific obligations and responsibilities of the guarantor. Additionally, the New Mexico Guaranty of Promissory Note may include provisions such as the duration of the guarantor's liability, any limitations on the guarantor's liability, and any requirements for notices or consent related to the promissory note. Different types of New Mexico Guaranty of Promissory Note by Individual — Corporate Borrower may include variations in wording or additional provisions based on the specific requirements of the lender or borrower. The primary purpose of these variations is to ensure that all parties involved are protected and that the terms of the guarantee suit their needs. In summary, the New Mexico Guaranty of Promissory Note by Individual — Corporate Borrower is a crucial legal document that outlines the mutual agreement between an individual guarantor and a corporate borrower to guarantee the repayment of a promissory note. It serves as security for the lender, and its specific terms may vary depending on the requirements of all parties involved.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Mexico Garantía de Pagaré por Individuo - Prestatario Corporativo - Guaranty of Promissory Note by Individual - Corporate Borrower

Description

How to fill out New Mexico Garantía De Pagaré Por Individuo - Prestatario Corporativo?

If you have to full, acquire, or printing legitimate record web templates, use US Legal Forms, the largest selection of legitimate varieties, that can be found online. Use the site`s basic and practical lookup to discover the documents you require. A variety of web templates for organization and specific reasons are categorized by types and says, or search phrases. Use US Legal Forms to discover the New Mexico Guaranty of Promissory Note by Individual - Corporate Borrower with a number of clicks.

Should you be previously a US Legal Forms consumer, log in to the accounts and click on the Download key to have the New Mexico Guaranty of Promissory Note by Individual - Corporate Borrower. You can also entry varieties you formerly downloaded within the My Forms tab of the accounts.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Be sure you have chosen the form for that right city/nation.

- Step 2. Utilize the Review choice to look through the form`s information. Never neglect to learn the explanation.

- Step 3. Should you be unsatisfied together with the type, use the Research discipline at the top of the display screen to find other versions of your legitimate type template.

- Step 4. When you have discovered the form you require, go through the Buy now key. Choose the prices plan you favor and add your qualifications to sign up for an accounts.

- Step 5. Process the financial transaction. You should use your charge card or PayPal accounts to perform the financial transaction.

- Step 6. Choose the structure of your legitimate type and acquire it on the gadget.

- Step 7. Full, change and printing or sign the New Mexico Guaranty of Promissory Note by Individual - Corporate Borrower.

Every single legitimate record template you get is yours for a long time. You may have acces to each and every type you downloaded within your acccount. Click on the My Forms segment and decide on a type to printing or acquire once again.

Remain competitive and acquire, and printing the New Mexico Guaranty of Promissory Note by Individual - Corporate Borrower with US Legal Forms. There are thousands of specialist and express-distinct varieties you can utilize for your organization or specific demands.