This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

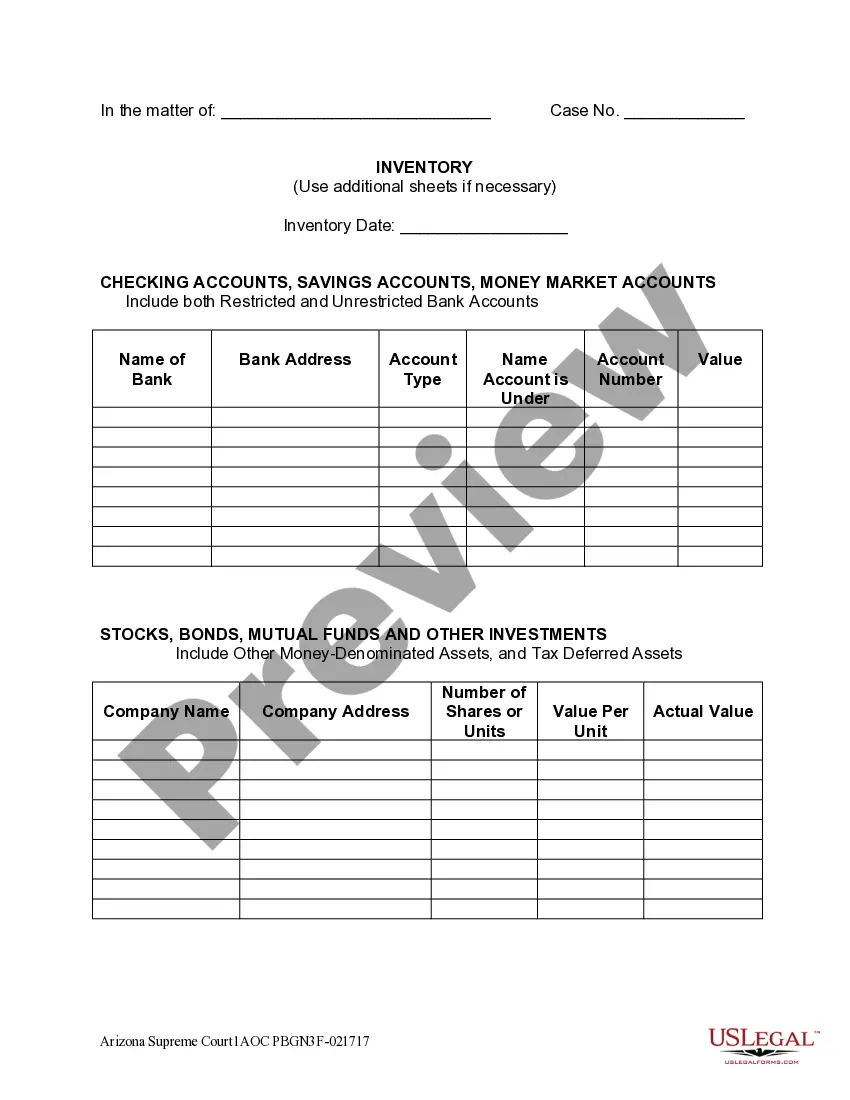

New Mexico Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent Dear [Investment Firm], I am writing to provide you with detailed instructions for the transfer of assets in the account of the decedent to the trustee of the trust established for the benefit of the decedent. As the executor/trustee, it is my responsibility to ensure a smooth transition of these assets. Please find the essential information and instructions as outlined below: Account Details: Account Holder: [Decedent's Name] Account Number: [Account Number] Account Type: [Type of Account] Date of Death: [Date of Death] Trust Details: Trust Name: [Trust Name] Trustee's Name: [Name of Trustee] Date of Trust Creation: [Date of Trust Creation] Asset Transfer Instructions: 1. Please transfer all assets held in the account of the decedent to the trust account mentioned below: — Trust Account Name: [Trust Account Name] — Trust Account Number: [Trust Account Number] — Trust Account Type: [Type of Trust Account] 2. Ensure that the assets are transferred in their entirety, including any cash balances, stocks, bonds, mutual funds, or other securities. 3. The transfer should be completed in a prompt and efficient manner to avoid any unnecessary delays. Please confirm the expected timeline for the transfer and provide me with regular updates regarding its progress. 4. In compliance with the provisions of the trust agreement, please include any necessary documentation required for the transfer, such as notarized copies of the death certificate, letters testamentary, or other legal documents. 5. If there are any specific procedures or forms that need to be followed for the asset transfer, kindly provide them to me promptly. I am also open to any additional requirements or instructions from your firm to ensure a seamless transfer process. 6. In case of any complications or questions regarding the transfer, please direct all communications to my attention at the address provided below: [Executor/Trustee's Name] [Executor/Trustee's Address] [Phone Number] [Email Address] 7. Finally, please ensure that the account is appropriately updated and reflects the transfer of ownership to the trustee of the trust for the benefit of the decedent. It is crucial to reflect the trustee's name and contact information accurately in your records. Types of New Mexico Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent: 1. Standard Letter of Instruction: This type of letter includes all the necessary details and instructions for the transfer of assets from the account of the decedent to the trust. 2. Urgent Transfer Request: If there is an impending need for the assets or financial emergency in the trust, an executor/trustee may draft an urgent transfer request, urging the investment firm to expedite the process. 3. Complex Asset Transfer Request: In cases where the decedent's account contains complex assets, such as real estate holdings or business interests, a more detailed instruction letter might be required, outlining the specific procedures for transferring such assets. 4. Multiple Account Transfer Request: When the decedent had multiple accounts with the investment firm, an executor/trustee may need to submit a separate instruction letter for each account, ensuring all assets are appropriately transferred to the designated trust. By following these instructions, we aim to facilitate a smooth and efficient transfer of assets from the account of the decedent to the trustee of the trust for the benefit of the decedent. Your cooperation and attention to these matters are greatly appreciated. Sincerely, [Executor/Trustee's Name] [Executor/Trustee's Title] [Date]