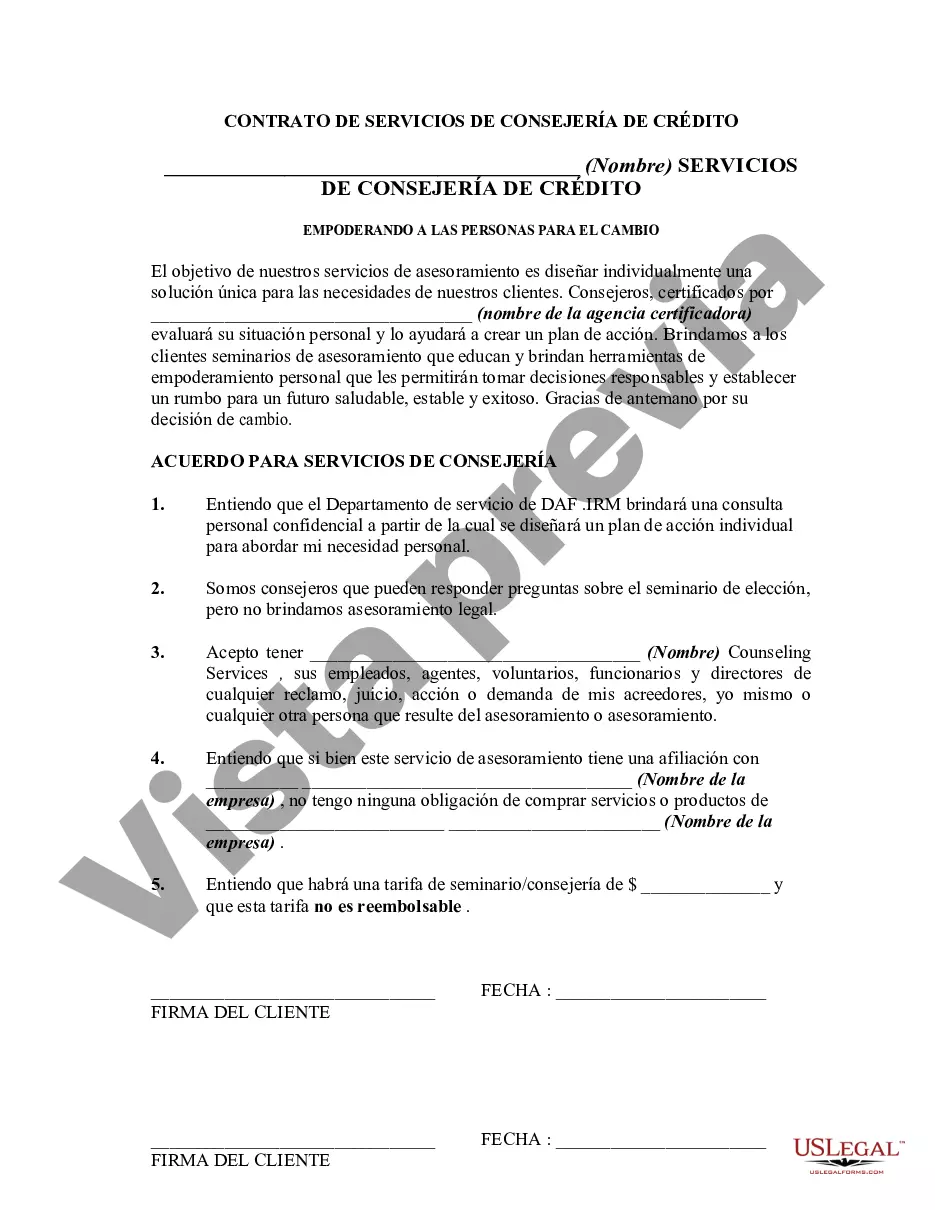

This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

The New Mexico Agreement for Credit Counseling Services is a legal document that establishes a formal relationship between a credit counseling agency and an individual seeking financial guidance and debt management assistance. This agreement outlines the terms and conditions under which the services will be provided, ensuring clarity and transparency for both parties involved. Credit counseling services aim to help individuals regain control of their finances by offering guidance on budgeting, debt management, and financial planning. By entering into the New Mexico Agreement for Credit Counseling Services, individuals can access the expertise and support of credit counseling professionals to address their specific financial needs. Keywords: New Mexico, agreement, credit counseling services, financial guidance, debt management, assistance, terms and conditions, clarity, transparency, control, finances, budgeting, financial planning, expertise, support. While there may not be different types of New Mexico Agreement for Credit Counseling Services, it's worth noting that the services provided under this agreement can vary depending on the specific credit counseling agency. However, some common variations of credit counseling services in New Mexico include: 1. Personalized Budget Counseling: This type of credit counseling service involves a thorough analysis of the individual's current financial situation, income, and expenses. The counselor then assists the individual in creating a personalized budget plan to effectively manage their finances and achieve their financial goals. 2. Debt Management Program: In cases where individuals have accumulated significant amounts of debt, a debt management program may be offered. Under this type of credit counseling service, the credit counseling agency negotiates with creditors to potentially lower interest rates, waive fees, and establish a structured repayment plan that fits within the individual's budget. 3. Financial Education Workshops: Some credit counseling agencies organize educational workshops or seminars to enhance individuals' financial literacy and money management skills. These sessions cover topics such as budgeting, credit management, debt reduction strategies, and long-term financial planning. 4. Housing Counseling: As homeownership is a significant aspect of many individuals' financial well-being, some credit counseling agencies offer specialized housing counseling services. This can include guidance on mortgage options, foreclosure prevention, rental assistance programs, and homebuyer education. 5. Student Loan Counseling: With the increasing burden of student loan debt, credit counseling agencies in New Mexico also provide counseling specific to student loans. These services can help individuals navigate loan repayment options, explore loan forgiveness programs, and develop strategies to manage student loan debt effectively. In conclusion, the New Mexico Agreement for Credit Counseling Services creates a legally binding agreement between individuals seeking financial assistance and credit counseling agencies. Through this agreement, individuals can receive personalized counseling and support related to budgeting, debt management, and other relevant financial matters. The specific types of credit counseling services provided may vary by agency but generally encompass budget counseling, debt management programs, financial education workshops, housing counseling, and student loan counseling.The New Mexico Agreement for Credit Counseling Services is a legal document that establishes a formal relationship between a credit counseling agency and an individual seeking financial guidance and debt management assistance. This agreement outlines the terms and conditions under which the services will be provided, ensuring clarity and transparency for both parties involved. Credit counseling services aim to help individuals regain control of their finances by offering guidance on budgeting, debt management, and financial planning. By entering into the New Mexico Agreement for Credit Counseling Services, individuals can access the expertise and support of credit counseling professionals to address their specific financial needs. Keywords: New Mexico, agreement, credit counseling services, financial guidance, debt management, assistance, terms and conditions, clarity, transparency, control, finances, budgeting, financial planning, expertise, support. While there may not be different types of New Mexico Agreement for Credit Counseling Services, it's worth noting that the services provided under this agreement can vary depending on the specific credit counseling agency. However, some common variations of credit counseling services in New Mexico include: 1. Personalized Budget Counseling: This type of credit counseling service involves a thorough analysis of the individual's current financial situation, income, and expenses. The counselor then assists the individual in creating a personalized budget plan to effectively manage their finances and achieve their financial goals. 2. Debt Management Program: In cases where individuals have accumulated significant amounts of debt, a debt management program may be offered. Under this type of credit counseling service, the credit counseling agency negotiates with creditors to potentially lower interest rates, waive fees, and establish a structured repayment plan that fits within the individual's budget. 3. Financial Education Workshops: Some credit counseling agencies organize educational workshops or seminars to enhance individuals' financial literacy and money management skills. These sessions cover topics such as budgeting, credit management, debt reduction strategies, and long-term financial planning. 4. Housing Counseling: As homeownership is a significant aspect of many individuals' financial well-being, some credit counseling agencies offer specialized housing counseling services. This can include guidance on mortgage options, foreclosure prevention, rental assistance programs, and homebuyer education. 5. Student Loan Counseling: With the increasing burden of student loan debt, credit counseling agencies in New Mexico also provide counseling specific to student loans. These services can help individuals navigate loan repayment options, explore loan forgiveness programs, and develop strategies to manage student loan debt effectively. In conclusion, the New Mexico Agreement for Credit Counseling Services creates a legally binding agreement between individuals seeking financial assistance and credit counseling agencies. Through this agreement, individuals can receive personalized counseling and support related to budgeting, debt management, and other relevant financial matters. The specific types of credit counseling services provided may vary by agency but generally encompass budget counseling, debt management programs, financial education workshops, housing counseling, and student loan counseling.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.