New Mexico Retirement Cash Flow: A Complete Guide to Financial Stability in Your Golden Years Are you considering New Mexico as your retirement destination and want to ensure a smooth and stable cash flow during your golden years? Look no further! In this comprehensive guide, we will delve into the details of New Mexico Retirement Cash Flow, providing you with all the relevant information you need to secure a financially sound future. New Mexico Retirement Cash Flow: Explained Retirement Cash Flow refers to the income streams and financial resources that retirees rely on after leaving the workforce. These resources can include pensions, Social Security benefits, investments, rental income, and any other sources of income you may have accumulated during your working years. New Mexico, with its scenic landscapes, vibrant culture, and affordable cost of living, is an attractive retirement destination for many individuals. To ensure a worry-free retirement experience, it is crucial to understand the various factors influencing your retirement cash flow in this region. Types of New Mexico Retirement Cash Flow 1. Social Security Benefits: Whether you are planning to retire in bustling Albuquerque, charming Santa Fe, or any other city in New Mexico, understanding the role of Social Security benefits is vital. Social Security provides a reliable source of income for retirees, helping cover essential expenses and ensuring a baseline cash flow. 2. Pension Plans: If you were fortunate enough to have a pension plan during your working years, it will play a significant role in your retirement cash flow. Understanding the intricacies of your pension plan, such as the payout structure, survivor benefits, and any cost-of-living adjustments, is crucial. 3. Retirement Savings and Investments: Many retirees rely on their personal savings and investments to supplement their cash flow. Whether it's 401(k) plans, IRAs, or other investment vehicles, having a well-managed retirement savings strategy is vital to ensure financial stability. Seek advice from financial planners or retirement advisors to optimize your investment portfolio. 4. Rental Income: New Mexico's real estate market offers opportunities for retirees to generate additional income through rental properties. Whether it's a second home, vacation rental, or long-term residential property, understanding the local real estate market and property management can provide an ongoing cash flow stream. 5. Part-time Employment: Some retirees choose to continue working part-time during their retirement years. This could be through freelance work, consulting, or even pursuing a passion project. Supplementing retirement cash flow through part-time employment can provide a sense of purpose and financial stability. Conclusion In conclusion, New Mexico Retirement Cash Flow involves careful planning and management of various income streams to ensure financial stability during retirement. Social Security benefits, pension plans, retirement savings, investments, rental income, and potentially part-time employment are all key components that retirees need to consider. By understanding the different types of New Mexico Retirement Cash Flow and carefully outlining a financial plan, retirees can enjoy the beautiful landscapes and vibrant communities of New Mexico while ensuring a worry-free and financially secure future. Seek professional advice, educate yourself on the relevant keywords, and plan ahead to make the most of your retirement in New Mexico.

New Mexico Retirement Cash Flow

Description

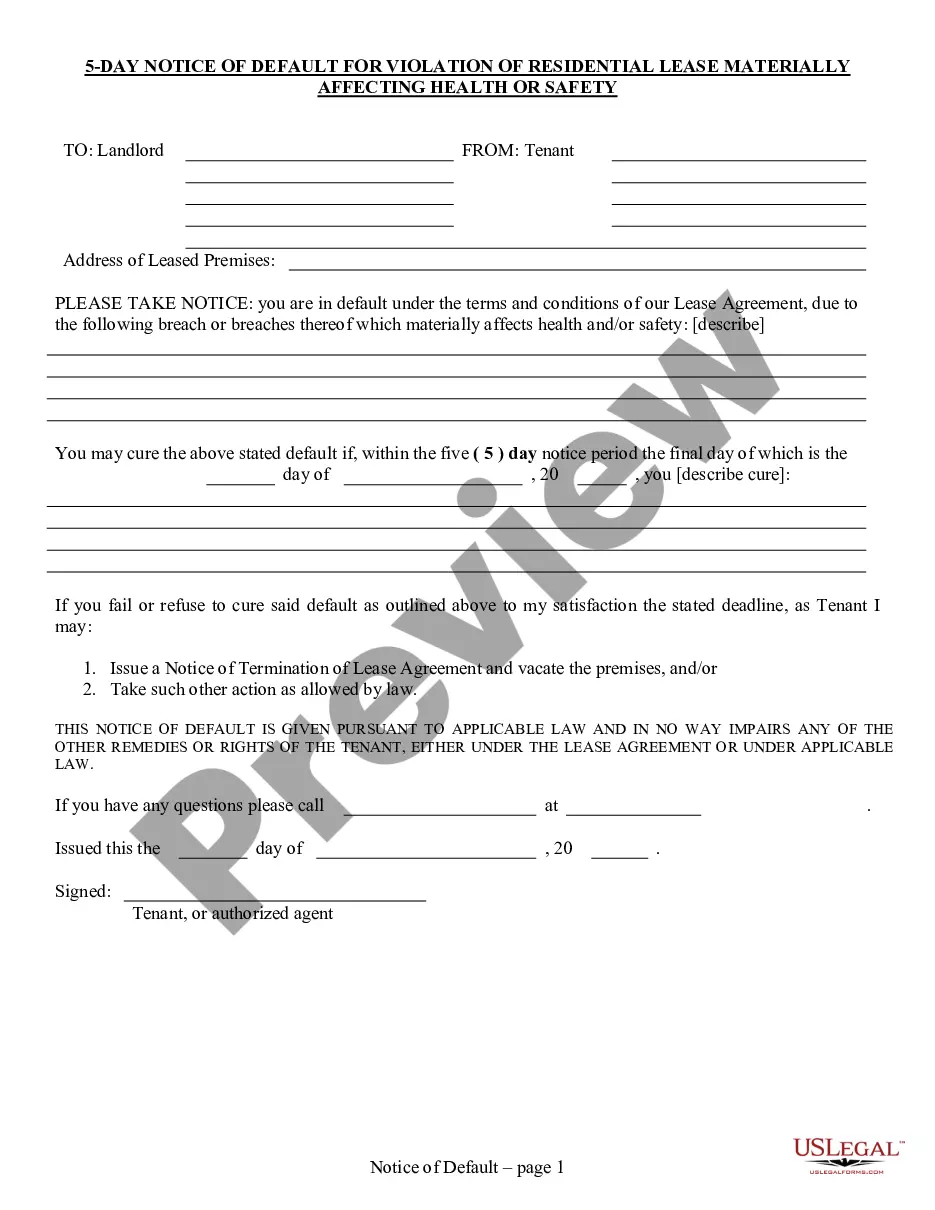

How to fill out Retirement Cash Flow?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

By using the website, you can find thousands of forms for business and personal use, organized by categories, states, or keywords. You can access the latest versions of forms like the New Mexico Retirement Cash Flow in minutes.

If you already have a monthly subscription, Log In and download the New Mexico Retirement Cash Flow from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously downloaded forms in the My documents section of your account.

Process the transaction. Utilize your credit card or PayPal account to complete the purchase.

Select the format and download the form to your device. Make adjustments. Fill out, modify, print, and sign the downloaded New Mexico Retirement Cash Flow. Every template you add to your account does not have an expiration date and belongs to you permanently. So, if you wish to download or print another copy, just go to the My documents section and click on the form you need. Access the New Mexico Retirement Cash Flow with US Legal Forms, the most extensive collection of legal form templates. Leverage thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are a first-time user of US Legal Forms, here are simple steps to help you get started.

- Ensure that you have selected the correct form for your city/state.

- Click the Preview button to examine the form's content.

- Review the form description to confirm that you have chosen the appropriate document.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Next, select the pricing plan you desire and provide your credentials to create an account.

Form popularity

FAQ

The bill eliminates taxation on social security, saving New Mexico seniors over $84 million next year. The bill includes a cap for exemption eligibility of $100,000 for single filers and $150,000 for married couples filing jointly.

Texas finished 34th overall in the WalletHub survey, while New Mexico was close behind at No. 36. WalletHub says it compared states across 47 key indicators for retirement friendliness, including things like cost of living, health care rankings, crime rates and tax levels, even museums and theaters per capita.

New Mexico seniors with a modified gross income of $22,000 or lower may qualify for the personal in- come tax low-income comprehensive tax rebate and the property tax rebate (see property tax in this pam- phlet) reserved for persons 65 or older.

Other benefits of retiring in New Mexico include a temperate and continental climate, a vibrant and diverse cultural scene, not to mention the beautiful landscape, and lots of fun activities. The main drawbacks include a high altitude, a disturbingly high crime rate, and the poor condition of the state's roads.

The bill eliminates taxation on social security, saving New Mexico seniors over $84 million next year. The bill includes a cap for exemption eligibility of $100,000 for single filers and $150,000 for married couples filing jointly.

The state is quickly becoming a popular retirement destination, attracting seniors from all over the country. New Mexico has a low cost of living and an abundance of opportunity when combined with its temperate climate and welcoming culture makes it a great place to spend retirement.

All New Mexico seniors at least 65 years old may claim a special exemption. See the instructions for PIT-ADJ.

New Mexico's vast lands are the perfect setting for a peaceful retirement. The mountains and the diverse landscapes add a beautiful view to the many things that make this state an ideal place to call home.

If you'd like to lower your New Mexico property taxes, you could try one of the following strategies:Walk with the assessor during the property appraisal.Wait until after the assessment to renovate your home.Apply for one of the New Mexico property tax exemptions if you qualify.More items...

New Mexico is moderately tax-friendly for retirees. For seniors age 65 or older, there is an $8,000 deduction on retirement income if the household adjusted gross income (AGI) is less than $28,500 for single filers, $51,000 for married people filing jointly and $25,500 for married taxpayers filing separately.

Interesting Questions

More info

INDEPENDENCE INDEPENDENCE .