The following language is often referred to as the Fair Debt Collection Practices Act Validation Notice.

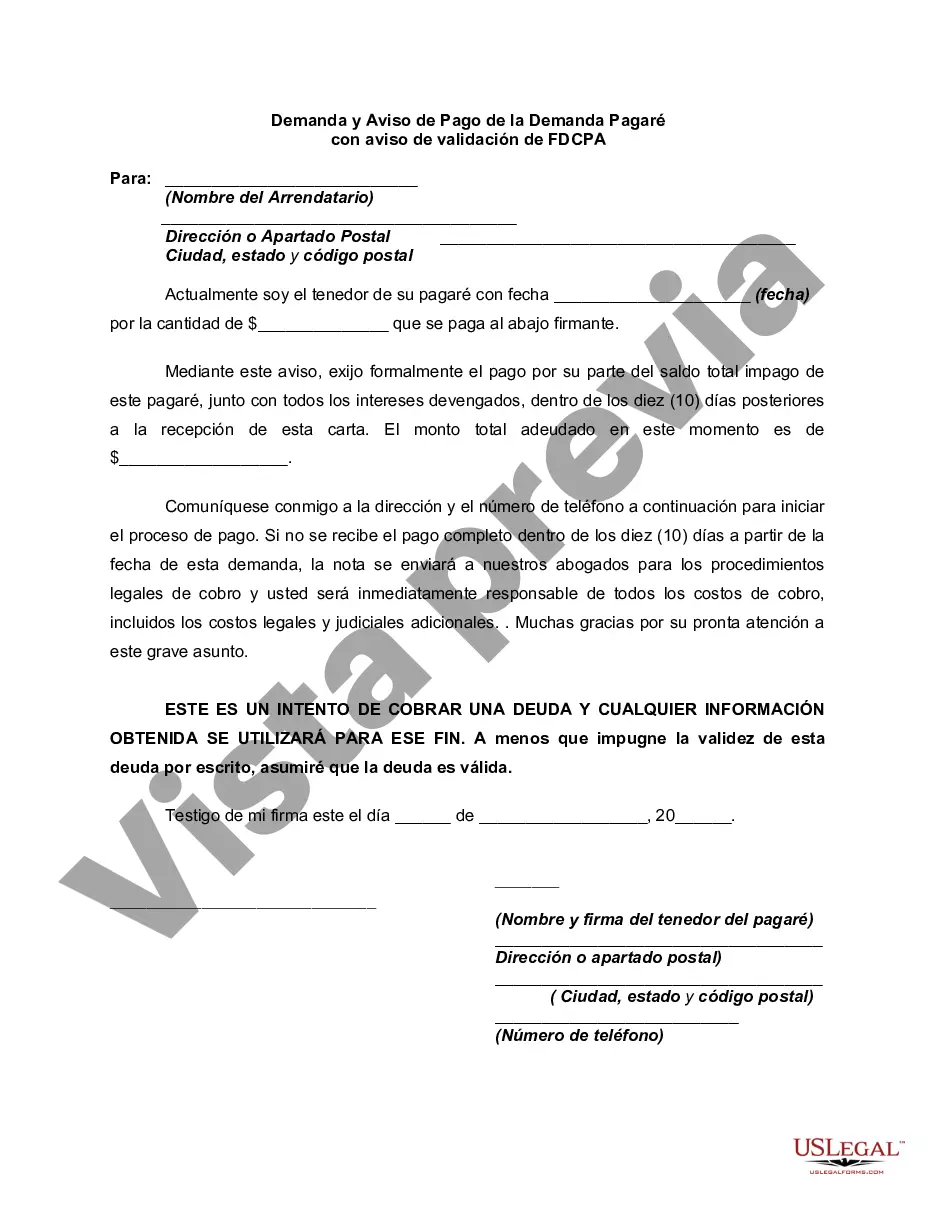

THIS IS AN ATTEMPT TO COLLECT A DEBT AND ANY INFORMATION OBTAINED WILL BE USED FOR THAT PURPOSE. Unless you contest the validity of this indebtedness in writing, I will assume that the debt is valid.

The FDCPA applies only to those who regularly engage in the business of collecting debts for others -- primarily to collection agencies. The Act does not apply when a creditor attempts to collect debts owed to it by directly contacting the debtors.

Title: New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice Keywords: New Mexico, demand, notice, payment, demand promissory note, FD CPA validation notice Introduction: The New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document designed to formally request payment on a demand promissory note within the state of New Mexico. This document ensures that proper notice is given to the debtor and adheres to the guidelines set forth by the Fair Debt Collection Practices Act (FD CPA). There may be different types of New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice based on specific circumstances. Let's explore these variations below. 1. Standard New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: This type of demand and notice is the most commonly used form when requesting payment for a demand promissory note in New Mexico. It includes all necessary information required by the FD CPA and ensures that the debtor is provided with proper notice to settle the debt promptly. 2. New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice — Delinquent Account: This specific type of demand and notice is used when the debtor has fallen significantly behind on their payment obligations. It emphasizes the overdue status of the account and urges the debtor to take immediate action to resolve the outstanding balance. 3. New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice — Final Notice: As a last resort before pursuing legal action, this form is issued when previous attempts to collect payment through notices and communications have been unsuccessful. It serves as a final warning to the debtor, emphasizing the urgency to settle the debt or face potential legal consequences. 4. New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice — Modified Payment Plan: When both parties agree to modify the repayment terms of a demand promissory note, this type of demand and notice is utilized. It outlines the revised payment plan with specific instructions for the debtor to adhere to, ensuring transparency and formalizing the new agreement. Conclusion: Regardless of the specific type used, the New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a vital legal document in prompting the debtor to fulfill their payment obligations. Each variation serves a unique purpose in addressing different circumstances and ensuring compliance with the FD CPA regulations. It is important to consult legal professionals or use authorized templates when drafting these documents to ensure accuracy and effectiveness in debt collection processes.Title: New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice Keywords: New Mexico, demand, notice, payment, demand promissory note, FD CPA validation notice Introduction: The New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a legal document designed to formally request payment on a demand promissory note within the state of New Mexico. This document ensures that proper notice is given to the debtor and adheres to the guidelines set forth by the Fair Debt Collection Practices Act (FD CPA). There may be different types of New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice based on specific circumstances. Let's explore these variations below. 1. Standard New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice: This type of demand and notice is the most commonly used form when requesting payment for a demand promissory note in New Mexico. It includes all necessary information required by the FD CPA and ensures that the debtor is provided with proper notice to settle the debt promptly. 2. New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice — Delinquent Account: This specific type of demand and notice is used when the debtor has fallen significantly behind on their payment obligations. It emphasizes the overdue status of the account and urges the debtor to take immediate action to resolve the outstanding balance. 3. New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice — Final Notice: As a last resort before pursuing legal action, this form is issued when previous attempts to collect payment through notices and communications have been unsuccessful. It serves as a final warning to the debtor, emphasizing the urgency to settle the debt or face potential legal consequences. 4. New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice — Modified Payment Plan: When both parties agree to modify the repayment terms of a demand promissory note, this type of demand and notice is utilized. It outlines the revised payment plan with specific instructions for the debtor to adhere to, ensuring transparency and formalizing the new agreement. Conclusion: Regardless of the specific type used, the New Mexico Demand and Notice for Payment of Demand Promissory Note with FD CPA Validation Notice is a vital legal document in prompting the debtor to fulfill their payment obligations. Each variation serves a unique purpose in addressing different circumstances and ensuring compliance with the FD CPA regulations. It is important to consult legal professionals or use authorized templates when drafting these documents to ensure accuracy and effectiveness in debt collection processes.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.