A New Mexico Simple Promissory Note for Tuition Fee is a legal document that outlines the terms and conditions for the repayment of a loan taken for educational expenses in the state of New Mexico. It serves as a binding agreement between the borrower (the student or their guardian) and the lender (usually a financial institution or individual). Keywords: New Mexico, Simple Promissory Note, Tuition Fee, legal document, repayment, loan, educational expenses, borrower, lender. Different types of New Mexico Simple Promissory Note for Tuition Fee include: 1. Fixed-Term Promissory Note: This type of promissory note specifies a fixed repayment period, and the borrower agrees to make regular payments over that period until the loan is fully repaid. The interest rate, payment schedule, and any penalties for late payments are also outlined in the note. 2. Variable-Rate Promissory Note: In this type of promissory note, the interest rate fluctuates based on a benchmark such as the prime rate or the LIBOR index. The note specifies how the interest rate is determined and how it will be adjusted over time. The repayment terms and schedule remain the same. 3. Graduated Repayment Promissory Note: This note allows the borrower to start with lower monthly payments that gradually increase over time. It is beneficial for students who expect their income to increase in the future. The note specifies the repayment schedule and the percentage by which the payments will increase. 4. Consolidation Promissory Note: If the borrower has multiple outstanding loans, they may choose to consolidate them into a single promissory note. This simplifies the repayment process, as there is only one monthly payment to be made. The note outlines the terms for consolidating the loans and the new repayment schedule. 5. Parent PLUS Promissory Note: This type of promissory note is specifically for parents who have borrowed a loan on behalf of their dependent child's educational expenses. It specifies the repayment terms and schedule, and the parent assumes responsibility for repaying the loan. It is important to carefully review and understand the terms of any promissory note before signing it. Seeking legal advice or consulting with a financial advisor can provide additional guidance to ensure compliance with applicable laws and protect the interests of both parties involved.

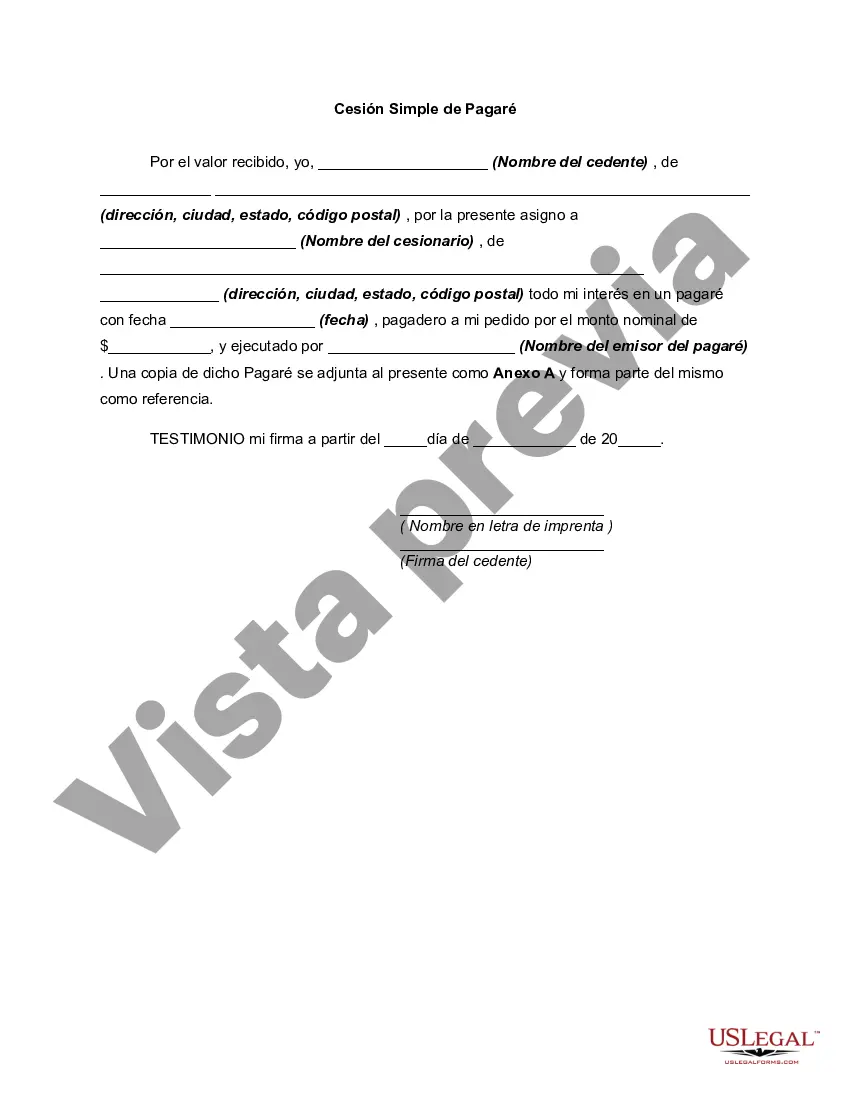

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Mexico Pagaré simple de matrícula - Simple Promissory Note for Tutition Fee

Description

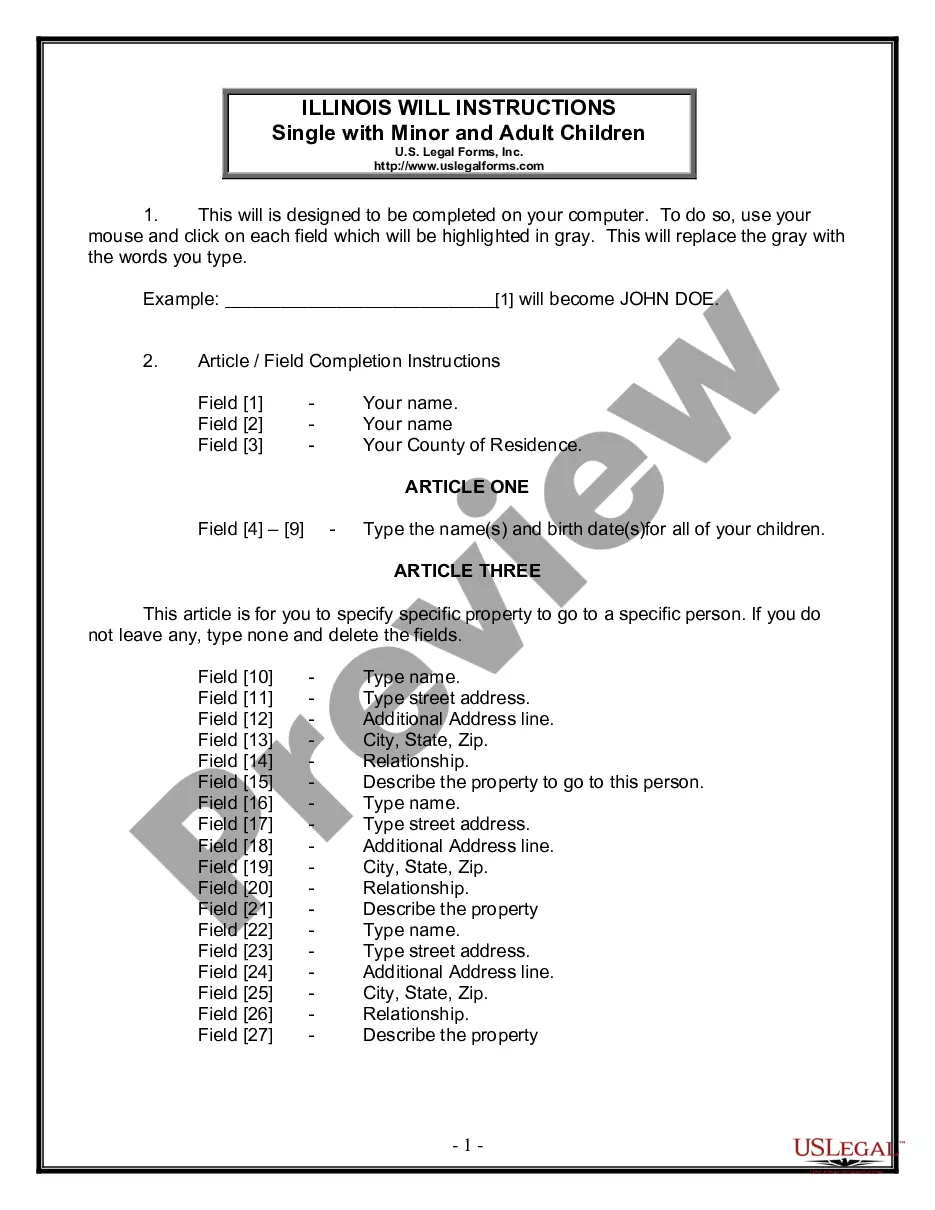

How to fill out New Mexico Pagaré Simple De Matrícula?

US Legal Forms - among the greatest libraries of legal kinds in the United States - provides an array of legal papers templates it is possible to obtain or printing. While using website, you can get a large number of kinds for business and person reasons, categorized by groups, states, or keywords and phrases.You can get the newest variations of kinds such as the New Mexico Simple Promissory Note for Tutition Fee in seconds.

If you already have a monthly subscription, log in and obtain New Mexico Simple Promissory Note for Tutition Fee in the US Legal Forms library. The Acquire option will appear on every single type you look at. You gain access to all previously delivered electronically kinds from the My Forms tab of your respective profile.

If you would like use US Legal Forms the very first time, here are straightforward recommendations to get you began:

- Be sure you have chosen the right type to your metropolis/county. Click the Preview option to review the form`s content material. Look at the type outline to actually have chosen the proper type.

- In the event the type doesn`t satisfy your specifications, utilize the Research area at the top of the display screen to get the one that does.

- Should you be satisfied with the shape, validate your selection by visiting the Acquire now option. Then, opt for the pricing prepare you prefer and offer your qualifications to sign up for the profile.

- Procedure the purchase. Use your credit card or PayPal profile to complete the purchase.

- Find the formatting and obtain the shape in your device.

- Make changes. Load, edit and printing and sign the delivered electronically New Mexico Simple Promissory Note for Tutition Fee.

Every design you added to your account does not have an expiration time and is the one you have eternally. So, if you would like obtain or printing an additional copy, just go to the My Forms portion and then click around the type you require.

Gain access to the New Mexico Simple Promissory Note for Tutition Fee with US Legal Forms, one of the most extensive library of legal papers templates. Use a large number of expert and status-distinct templates that fulfill your company or person requirements and specifications.