Sometimes, a prior demand by a potential plaintiff for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

New Mexico Demand for Accounting from a Fiduciary: Ensuring Financial Transparency and Accountability Introduction: In New Mexico, a demand for accounting from a fiduciary serves as a powerful tool to ensure transparency and accountability in financial matters. Fiduciaries, individuals or entities entrusted with managing someone else's finances or assets, have a legal duty to act in the best interest of their beneficiaries. However, demanding an accounting is essential to verify that fiduciaries are fulfilling their obligations diligently and responsibly. This article outlines what a demand for accounting entails, its significance, and the different types of New Mexico Demand for Accounting from a Fiduciary. Keywords: — New Mexico demand foaccountingin— - Fiduciary accounting in New Mexico — Financial transparency and accountability — Fiduciardutiesie— - Beneficiary rights - Responsibilities of fiduciaries — Types of accounting demands in New Mexico — Legal remedies for fiduciarbreachhe— - New Mexico fiduciary law Understanding Demand for Accounting from a Fiduciary: Demanding an accounting from a fiduciary refers to the legal right of beneficiaries to request comprehensive financial statements and records detailing the fiduciary's actions and transactions regarding their assets. In New Mexico, this demand serves to promote transparency, uncover potential mismanagement of assets, detect fraud, and protect beneficiaries' interests. Significance of New Mexico Demand for Accounting: 1. Ensures Financial Transparency: Holding fiduciaries accountable through accounting demands can shed light on their financial actions, preventing any hidden or inappropriate activities. 2. Detects Mismanagement or Fraud: An accounting demand enables beneficiaries to identify any potential mismanagement or fraud, protecting their assets from harm or loss. 3. Validates Fiduciary's Compliance: By examining the financial records, beneficiaries can verify if the fiduciary is complying with their duties and acting in their best interests. 4. Protects Beneficiary Rights: Demand for accounting empowers beneficiaries to exercise their rights and access key financial information related to their assets. Types of New Mexico Demand for Accounting from a Fiduciary: 1. Informal Accounting Demand: This is the most common type of accounting demand and usually involves a direct request from the beneficiary for financial records and statements. It is a simple, informal process where beneficiaries can ask the fiduciary to provide the necessary information voluntarily. 2. Formal Accounting Demand: If an informal request is unsuccessful, beneficiaries can file a formal accounting demand with the New Mexico court. This demand triggers a legal process that compels the fiduciary to provide a detailed account of all financial activities and transactions. 3. Accounting in Probate: In cases involving estates, beneficiaries have a right to demand accounting from the fiduciary responsible for the administration and distribution of the deceased person's assets. This ensures transparency and protects the interests of heirs and creditors. Legal Remedies for Fiduciary Breaches: If a fiduciary refuses to comply with a legitimate accounting demand or there are suspicions of financial mismanagement, beneficiaries have legal recourse. They can seek various remedies, such as filing a lawsuit against the fiduciary, requesting a removal or replacement of the fiduciary, or pursuing criminal charges if fraud or embezzlement is suspected. Conclusion: Demanding accounting from a fiduciary is crucial for maintaining financial transparency and ensuring the fiduciary is fulfilling their legal duties responsibly. In New Mexico, beneficiaries have the right to request comprehensive financial records, which can be done informally or formally through the court system. These demands serve to protect the interests of beneficiaries, detect fraud, and hold fiduciaries accountable for their actions. By demanding accounting, New Mexicans can safeguard their financial well-being and maintain trust in fiduciary relationships.New Mexico Demand for Accounting from a Fiduciary: Ensuring Financial Transparency and Accountability Introduction: In New Mexico, a demand for accounting from a fiduciary serves as a powerful tool to ensure transparency and accountability in financial matters. Fiduciaries, individuals or entities entrusted with managing someone else's finances or assets, have a legal duty to act in the best interest of their beneficiaries. However, demanding an accounting is essential to verify that fiduciaries are fulfilling their obligations diligently and responsibly. This article outlines what a demand for accounting entails, its significance, and the different types of New Mexico Demand for Accounting from a Fiduciary. Keywords: — New Mexico demand foaccountingin— - Fiduciary accounting in New Mexico — Financial transparency and accountability — Fiduciardutiesie— - Beneficiary rights - Responsibilities of fiduciaries — Types of accounting demands in New Mexico — Legal remedies for fiduciarbreachhe— - New Mexico fiduciary law Understanding Demand for Accounting from a Fiduciary: Demanding an accounting from a fiduciary refers to the legal right of beneficiaries to request comprehensive financial statements and records detailing the fiduciary's actions and transactions regarding their assets. In New Mexico, this demand serves to promote transparency, uncover potential mismanagement of assets, detect fraud, and protect beneficiaries' interests. Significance of New Mexico Demand for Accounting: 1. Ensures Financial Transparency: Holding fiduciaries accountable through accounting demands can shed light on their financial actions, preventing any hidden or inappropriate activities. 2. Detects Mismanagement or Fraud: An accounting demand enables beneficiaries to identify any potential mismanagement or fraud, protecting their assets from harm or loss. 3. Validates Fiduciary's Compliance: By examining the financial records, beneficiaries can verify if the fiduciary is complying with their duties and acting in their best interests. 4. Protects Beneficiary Rights: Demand for accounting empowers beneficiaries to exercise their rights and access key financial information related to their assets. Types of New Mexico Demand for Accounting from a Fiduciary: 1. Informal Accounting Demand: This is the most common type of accounting demand and usually involves a direct request from the beneficiary for financial records and statements. It is a simple, informal process where beneficiaries can ask the fiduciary to provide the necessary information voluntarily. 2. Formal Accounting Demand: If an informal request is unsuccessful, beneficiaries can file a formal accounting demand with the New Mexico court. This demand triggers a legal process that compels the fiduciary to provide a detailed account of all financial activities and transactions. 3. Accounting in Probate: In cases involving estates, beneficiaries have a right to demand accounting from the fiduciary responsible for the administration and distribution of the deceased person's assets. This ensures transparency and protects the interests of heirs and creditors. Legal Remedies for Fiduciary Breaches: If a fiduciary refuses to comply with a legitimate accounting demand or there are suspicions of financial mismanagement, beneficiaries have legal recourse. They can seek various remedies, such as filing a lawsuit against the fiduciary, requesting a removal or replacement of the fiduciary, or pursuing criminal charges if fraud or embezzlement is suspected. Conclusion: Demanding accounting from a fiduciary is crucial for maintaining financial transparency and ensuring the fiduciary is fulfilling their legal duties responsibly. In New Mexico, beneficiaries have the right to request comprehensive financial records, which can be done informally or formally through the court system. These demands serve to protect the interests of beneficiaries, detect fraud, and hold fiduciaries accountable for their actions. By demanding accounting, New Mexicans can safeguard their financial well-being and maintain trust in fiduciary relationships.

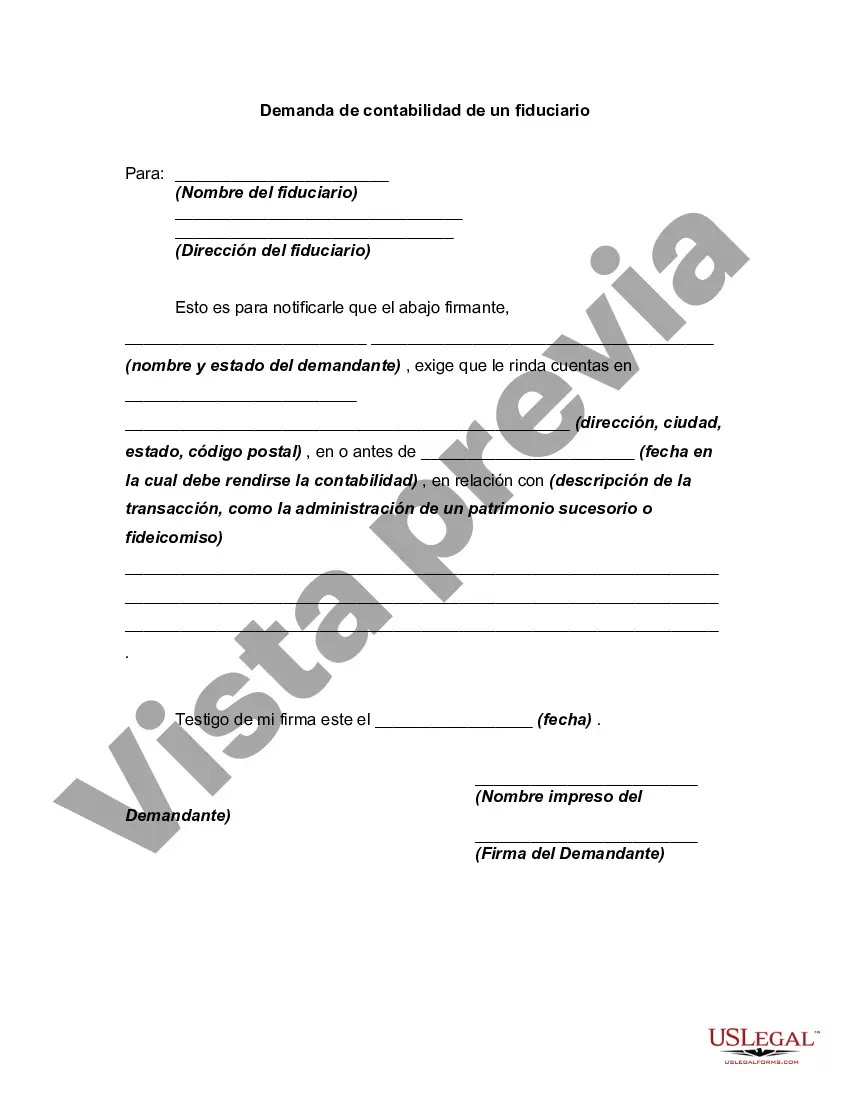

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.