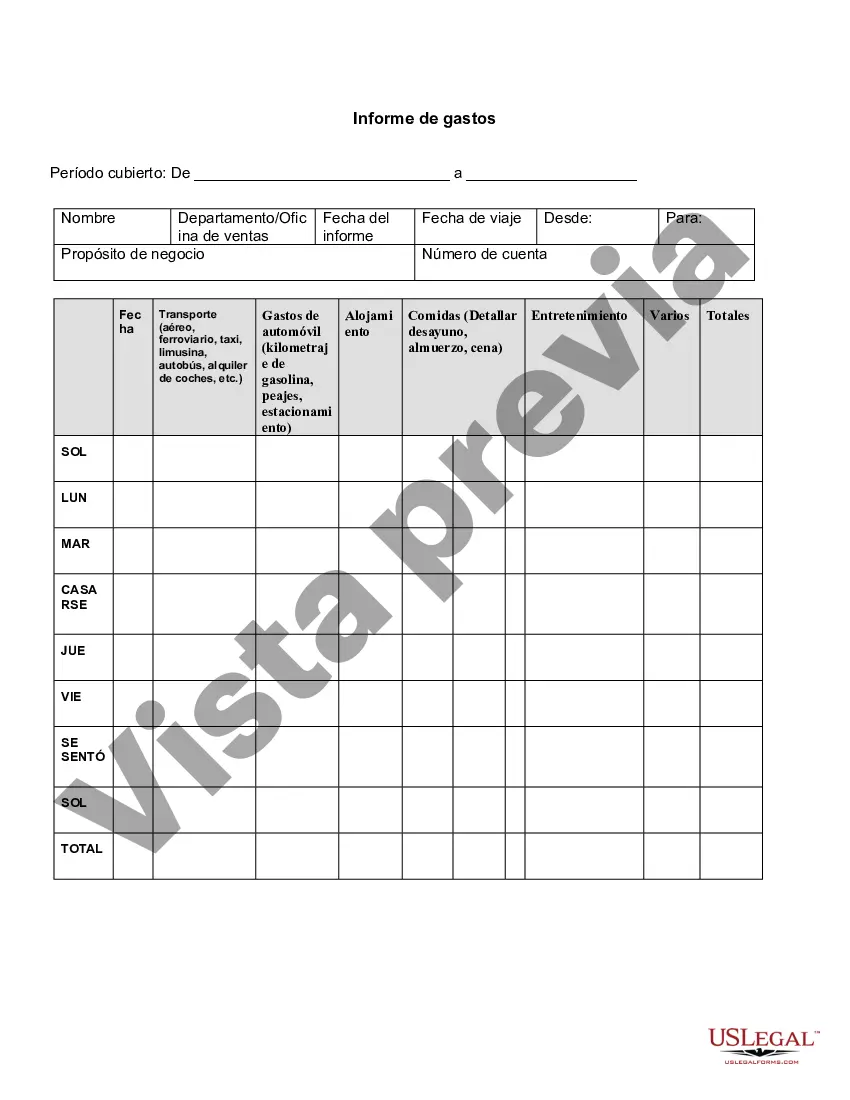

New Mexico Expense Report is a standardized form used by individuals or organizations to track and report expenses incurred during business trips, conferences, or any official travel within or outside New Mexico. This report serves as a legal document to ensure transparency and accountability in managing expenses. The New Mexico Expense Report typically includes various sections that require the detailed information related to each expense. It consists of fields such as date, purpose of travel, mode of transportation, accommodation, meals, entertainment, and miscellaneous expenses. To provide a comprehensive description, it is essential to emphasize relevant keywords related to the New Mexico Expense Report, ensuring clarity and accuracy. These keywords may include: 1. New Mexico: Relevant to the specific location and jurisdiction where the expense report is being used, distinguishing it from reports used in other regions. 2. Expense Report: The primary focus of the content, highlighting the purpose and nature of the document. 3. Business Travel: Referring to the specific context of the report, indicating it is used for tracking expenses incurred during official trips or events. 4. Conferences: Highlighting one of the specific purposes for which the expense report may be utilized, emphasizing the importance of accurate reporting for such events. 5. Accountability: Stresses the transparency and responsibility associated with the New Mexico Expense Report, underlining its significance in financial management. 6. Transparency: Emphasizes the openness and clarity necessary while reporting expenses, ensuring all details are accurately recorded. 7. Tracking: Indicates the process of recording and monitoring expenses, illustrating the purpose of the report and its practical use. 8. Legal Document: Highlights the formal and obligatory nature of the report, indicating its compliance with New Mexico regulations and its value in auditing and financial control. Different Types of New Mexico Expense Reports: 1. Individual Expense Report: Used by individuals who are responsible for managing their own expenses during official travel. 2. Group Expense Report: Applicable for teams or groups traveling together, where each member contributes their expenses to be consolidated in a single report. 3. Per Diem Expense Report: A specific type of report that focuses on fixed daily allowances provided to individuals for meals, accommodation, and incidental expenses during travel. 4. Mileage Expense Report: Pertains to the reimbursement of travel expenses based on the number of miles traveled using personal or rented vehicles. 5. Entertainment Expense Report: Specifically used to track expenses associated with business-related entertainment activities, such as client dinners, meetings, or events. By incorporating these keywords and highlighting the different types of New Mexico Expense Reports, the content becomes relevant, informative, and provides a comprehensive description of what the documents entail.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Mexico Informe de gastos - Expense Report

Description

How to fill out New Mexico Informe De Gastos?

Choosing the best legitimate file format can be a battle. Naturally, there are tons of layouts available online, but how will you obtain the legitimate kind you want? Make use of the US Legal Forms website. The service offers a huge number of layouts, such as the New Mexico Expense Report, which you can use for business and private needs. All of the types are examined by pros and satisfy federal and state specifications.

When you are currently listed, log in for your accounts and click the Down load button to get the New Mexico Expense Report. Use your accounts to search through the legitimate types you might have ordered formerly. Check out the My Forms tab of your accounts and acquire yet another version of the file you want.

When you are a fresh customer of US Legal Forms, here are basic instructions that you should stick to:

- Very first, make certain you have chosen the right kind for your town/county. It is possible to look over the shape making use of the Preview button and look at the shape explanation to guarantee this is basically the right one for you.

- If the kind does not satisfy your expectations, take advantage of the Seach area to get the appropriate kind.

- Once you are sure that the shape is acceptable, go through the Purchase now button to get the kind.

- Opt for the prices plan you want and enter the necessary information and facts. Make your accounts and buy the order utilizing your PayPal accounts or charge card.

- Pick the file format and acquire the legitimate file format for your product.

- Full, change and produce and indicator the obtained New Mexico Expense Report.

US Legal Forms is the greatest local library of legitimate types for which you will find numerous file layouts. Make use of the service to acquire expertly-made documents that stick to condition specifications.