New Mexico Cash Receipts Control Log is a document that serves as a tool for tracking and managing cash transactions in various organizations and businesses across the state. This log is an essential component of financial controls and helps ensure the integrity, accuracy, and security of cash receipts. The New Mexico Cash Receipts Control Log contains detailed information relating to all cash transactions, including the date, time, amount, recipient, source, purpose, and any relevant notes or comments. It provides a comprehensive record of cash inflows and outflows, allowing for efficient monitoring and reconciliation. By maintaining a Cash Receipts Control Log, organizations can effectively monitor the processing of cash receipts, identify any discrepancies, and prevent fraud or errors. The log acts as an internal control mechanism, providing a clear audit trail and facilitating the reconciliation process between various departments, such as finance, sales, and administration. Different types of New Mexico Cash Receipts Control Logs may exist depending on the specific industry or organization. Some examples include: 1. Nonprofit Cash Receipts Control Log: This log is used by nonprofit organizations to track all cash transactions related to donations, grants, fundraising events, and other sources of revenue. It helps nonprofit organizations maintain transparency and accountability in their financial management. 2. Retail Cash Receipts Control Log: Retail businesses often use a specific log to record cash transactions from sales, returns, and exchanges. This log assists in monitoring cash collection, cash register reconciliation, and identifying any discrepancies or potential theft. 3. Government Cash Receipts Control Log: Government organizations, such as state agencies, municipalities, or educational institutions, may have their own unique log to document cash inflows from various sources, such as taxes, fines, permits, or fees. This log enables accountability and transparency in the government's financial operations. 4. Restaurant Cash Receipts Control Log: Restaurants and food establishments utilize a log to track cash transactions from food sales, tips, and credit card transactions. This log assists in ensuring accurate cash handling and detecting any cash shortages or discrepancies. In summary, the New Mexico Cash Receipts Control Log is a vital tool used in various industries and organizations across the state to track, monitor, and manage cash transactions. It helps establish financial controls, prevent fraud, and ensure the accuracy and integrity of cash receipts. Different types of logs may exist depending on the industry, such as nonprofit, retail, government, or restaurant-specific logs.

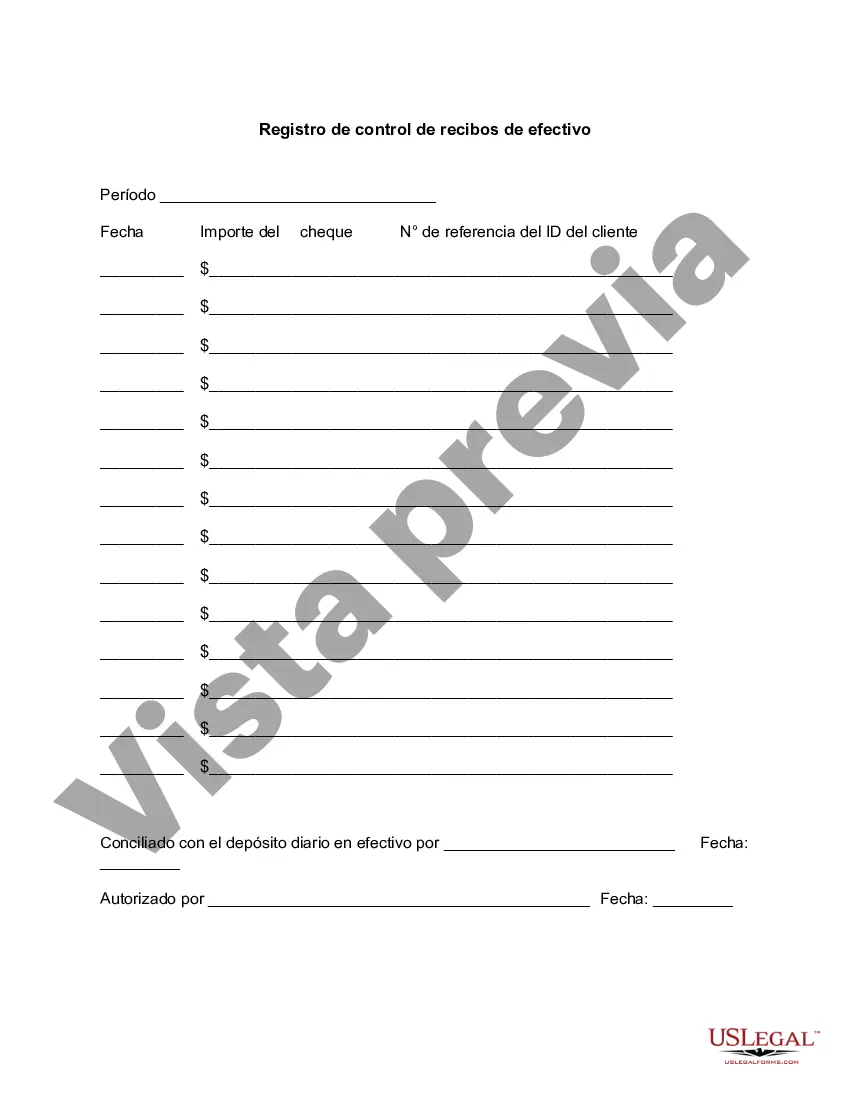

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Mexico Registro de control de recibos de efectivo - Cash Receipts Control Log

Description

How to fill out New Mexico Registro De Control De Recibos De Efectivo?

If you wish to total, download, or produce legitimate papers layouts, use US Legal Forms, the most important variety of legitimate varieties, which can be found online. Make use of the site`s easy and practical look for to get the papers you will need. A variety of layouts for company and person uses are categorized by types and claims, or keywords. Use US Legal Forms to get the New Mexico Cash Receipts Control Log within a few clicks.

When you are currently a US Legal Forms client, log in for your accounts and then click the Acquire key to obtain the New Mexico Cash Receipts Control Log. You may also accessibility varieties you earlier downloaded inside the My Forms tab of your accounts.

If you use US Legal Forms the very first time, refer to the instructions beneath:

- Step 1. Ensure you have selected the form for your proper town/country.

- Step 2. Use the Preview method to look over the form`s content material. Don`t forget about to read the information.

- Step 3. When you are not satisfied with all the develop, use the Lookup industry near the top of the screen to get other models in the legitimate develop format.

- Step 4. Once you have identified the form you will need, select the Acquire now key. Choose the rates plan you prefer and add your accreditations to register for the accounts.

- Step 5. Process the financial transaction. You can use your credit card or PayPal accounts to complete the financial transaction.

- Step 6. Choose the file format in the legitimate develop and download it on your own gadget.

- Step 7. Full, modify and produce or signal the New Mexico Cash Receipts Control Log.

Each legitimate papers format you purchase is yours eternally. You may have acces to every develop you downloaded in your acccount. Click the My Forms segment and decide on a develop to produce or download once again.

Compete and download, and produce the New Mexico Cash Receipts Control Log with US Legal Forms. There are many skilled and state-distinct varieties you can use to your company or person demands.