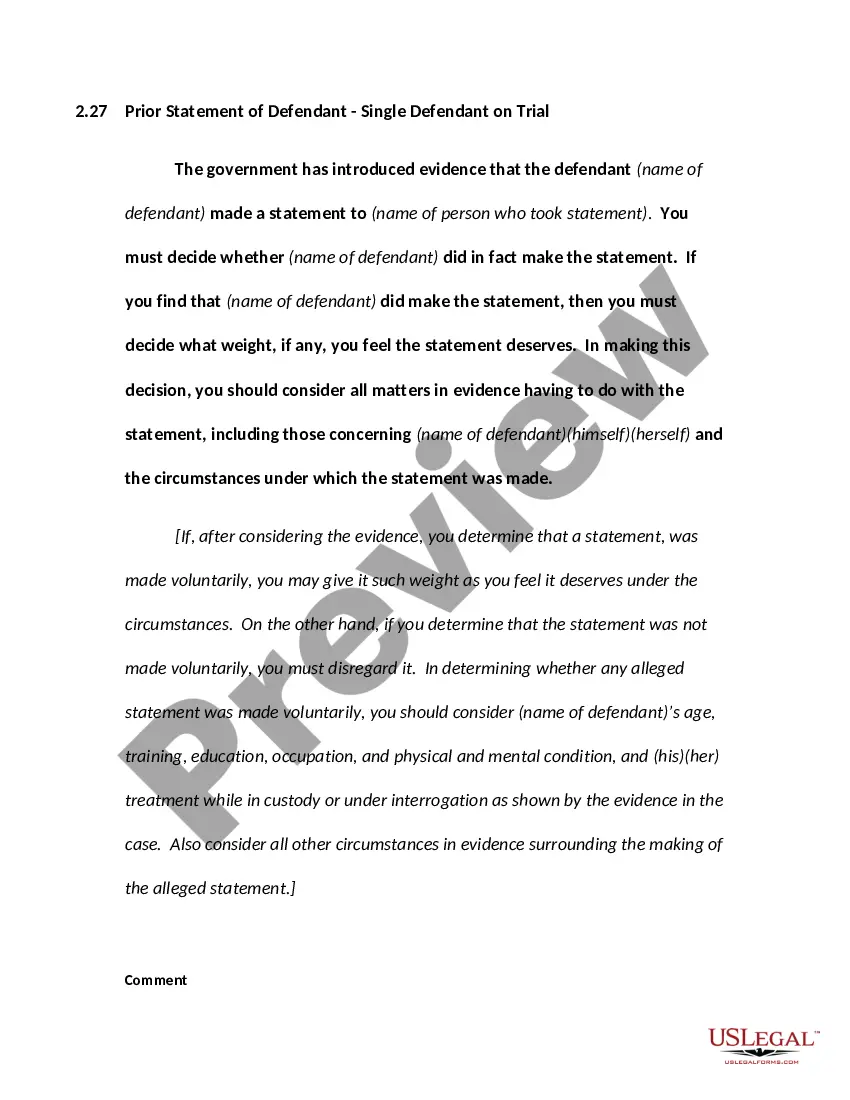

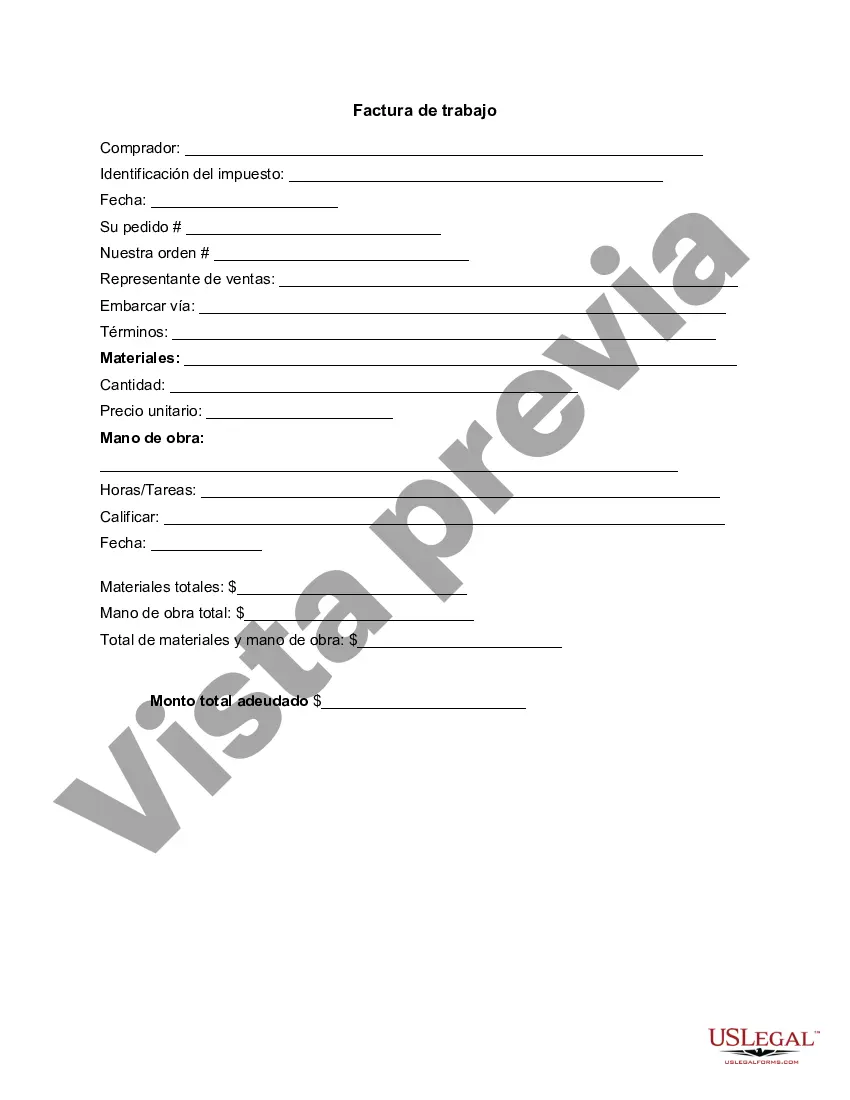

New Mexico Invoice Template for Software Developer: A Comprehensive Guide Keywords: New Mexico, invoice template, software developer, customizable, type 1, type 2, type 3, invoice format, professional, efficient, organized, billing, payment, legal, taxation, compliance. Introduction: Invoices play a pivotal role in the billing and payment process of software developers in New Mexico. An invoice serves as a legally binding document that outlines the services provided by the developer, the corresponding charges, and the timeframe for payment. New Mexico Invoice Templates for Software Developers provide a structured and efficient framework for creating professional invoices that comply with local regulations and taxation requirements. Features of New Mexico Invoice Templates for Software Developer: 1. Customizable Format: These templates offer a customizable format that allows software developers to insert their company's logo, contact information, and branding to create a personalized and professional invoice. 2. Different Types: Depending on their specific needs, software developers in New Mexico can choose from multiple types of invoice templates. Let's explore three common types: a. Type 1: Standard Invoice Template — This template is the most commonly used and offers a clear layout for including necessary details such as client information, project description, hourly rates, and total amount due. b. Type 2: Milestone-Based Invoice Template — Useful for software projects where billing milestones are established, this template allows developers to track progress and invoice clients accordingly. It includes sections for milestone descriptions, associated costs, and payment terms. c. Type 3: Recurring Invoice Template — Designed for recurring services or monthly subscriptions, this template automates the billing process by generating invoices on a predetermined schedule. It streamlines payments for subscription-based software development services. 3. Organized Layout: The templates ensure that all essential information is included in a clear and organized manner. Fields for client details, project descriptions, hours worked, rates, and subtotal, along with tax and total amount, are readily available. 4. Compliance with Legal and Taxation Requirements: New Mexico Invoice Templates for Software Developers are designed to adhere to the legal and taxation regulations specific to the state. They account for necessary details like New Mexico's sales tax rate, ensuring accurate calculation of taxes. 5. Efficient Payment Process: The templates facilitate an efficient payment process by including a section for payment terms, including due dates and acceptable payment methods. This helps software developers receive payments promptly and maintain a healthy cash flow. Conclusion: New Mexico Invoice Templates for Software Developers offer a professional and organized approach to billing and payment management. By providing customizable formats and different types to suit various billing requirements, these templates streamline the invoicing process. Software developers can ensure compliance with legal and taxation obligations, ultimately improving efficiency, accuracy, and financial control. Utilizing these templates can contribute to a successful software development business in New Mexico.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Mexico Plantilla de factura para desarrollador de software - Invoice Template for Software Developer

Description

How to fill out New Mexico Plantilla De Factura Para Desarrollador De Software?

You can commit hours online attempting to find the legitimate file template that suits the federal and state needs you require. US Legal Forms provides a large number of legitimate types which are analyzed by pros. You can actually acquire or printing the New Mexico Invoice Template for Software Developer from our support.

If you already have a US Legal Forms profile, you may log in and then click the Acquire option. Next, you may complete, change, printing, or indication the New Mexico Invoice Template for Software Developer. Each and every legitimate file template you purchase is your own permanently. To acquire yet another backup associated with a bought develop, visit the My Forms tab and then click the related option.

If you use the US Legal Forms site the first time, follow the easy guidelines under:

- First, make sure that you have chosen the proper file template to the county/area of your choice. Look at the develop description to ensure you have picked out the right develop. If accessible, use the Review option to search throughout the file template also.

- In order to get yet another version of the develop, use the Look for area to discover the template that meets your needs and needs.

- When you have located the template you desire, just click Acquire now to continue.

- Select the rates program you desire, key in your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can use your charge card or PayPal profile to purchase the legitimate develop.

- Select the file format of the file and acquire it to the gadget.

- Make modifications to the file if required. You can complete, change and indication and printing New Mexico Invoice Template for Software Developer.

Acquire and printing a large number of file themes utilizing the US Legal Forms website, that provides the most important selection of legitimate types. Use skilled and state-certain themes to take on your company or personal demands.