It is essential to a contract that there be an offer and, while the offer is still in existence, it must be accepted without qualification. An offer expresses the willingness of the offeror to enter into a contract agreement regarding a particular subject. An invitation to negotiate is not an offer. An invitation to negotiate is merely a preliminary discussion or an invitation by one party to the other to negotiate or make an offer. This form is an invitation to negotiate.

Title: Exploring the New Mexico Business Purchase Proposal: Types and Key Aspects Introduction: In the vibrant business landscape of New Mexico, entrepreneurs and investors often seek lucrative opportunities to expand their ventures within the state. One crucial avenue pursued is acquiring existing businesses through well-crafted purchase proposals. This article delves into the New Mexico Business Purchase Proposal, highlighting its significance and key components. Additionally, we explore different types of purchase proposals that can be tailored to suit various business acquisition scenarios. 1. Understanding the New Mexico Business Purchase Proposal: A New Mexico Business Purchase Proposal is a comprehensive document outlining the terms and conditions for acquiring an existing business within the state. It serves as a formal offer, presenting important information to the current owners or representatives, including the purchase price, terms of payment, proposed timeline, and intended transition strategy. 2. Key Components of a New Mexico Business Purchase Proposal: — Executive Summary: Summarizes the essence of the proposal, providing a quick overview of the business's current status, the prospective buyer's qualifications, and the proposed deal structure. — Business Overview: Offers a detailed understanding of the target business, including its history, industry analysis, market position, financial information, and growth potential. — Purchase Terms: Specifies the proposed deal structure, purchase price, payment terms, and any contingencies or conditions associated with the acquisition. — Transition Plan: Outlines the strategy for transitioning ownership, including the integration of key personnel, operational processes, customer relationships, and any support required from the current owners. — Due Diligence: Includes a provision for conducting a thorough examination of the target business's financial records, legal obligations, contracts, and any potential risks or liabilities. — Closing and Post-Closing Activities: Details the steps necessary to finalize the acquisition, such as transferring assets, settling liabilities, assigning contracts, and ensuring regulatory compliance. 3. Types of New Mexico Business Purchase Proposals: a. Asset Purchase Proposal: This type of proposal focuses on acquiring specific assets of the target business, such as inventory, equipment, intellectual property, or customer contracts. It allows the buyer to cherry-pick valuable assets while limiting potential liabilities. b. Stock Purchase Proposal: In a stock purchase proposal, the buyer seeks to acquire all outstanding shares of the target business. This approach provides comprehensive ownership, including assets, liabilities, contracts, and existing relationships. However, it requires careful due diligence to identify any hidden risks. c. Merger Proposal: A merger proposal involves combining two existing businesses into a single entity. It requires detailed negotiations, including defining the new organization's structure, operations, management, and ownership. Conclusion: The New Mexico Business Purchase Proposal plays a pivotal role in the acquisition process, outlining the terms and conditions for acquiring existing businesses within the state. It is vital to have a well-structured and comprehensive proposal to increase the chances of successfully acquiring the desired business. By understanding the various types of purchase proposals available, potential buyers can tailor their approach to suit specific goals and acquisition scenarios.Title: Exploring the New Mexico Business Purchase Proposal: Types and Key Aspects Introduction: In the vibrant business landscape of New Mexico, entrepreneurs and investors often seek lucrative opportunities to expand their ventures within the state. One crucial avenue pursued is acquiring existing businesses through well-crafted purchase proposals. This article delves into the New Mexico Business Purchase Proposal, highlighting its significance and key components. Additionally, we explore different types of purchase proposals that can be tailored to suit various business acquisition scenarios. 1. Understanding the New Mexico Business Purchase Proposal: A New Mexico Business Purchase Proposal is a comprehensive document outlining the terms and conditions for acquiring an existing business within the state. It serves as a formal offer, presenting important information to the current owners or representatives, including the purchase price, terms of payment, proposed timeline, and intended transition strategy. 2. Key Components of a New Mexico Business Purchase Proposal: — Executive Summary: Summarizes the essence of the proposal, providing a quick overview of the business's current status, the prospective buyer's qualifications, and the proposed deal structure. — Business Overview: Offers a detailed understanding of the target business, including its history, industry analysis, market position, financial information, and growth potential. — Purchase Terms: Specifies the proposed deal structure, purchase price, payment terms, and any contingencies or conditions associated with the acquisition. — Transition Plan: Outlines the strategy for transitioning ownership, including the integration of key personnel, operational processes, customer relationships, and any support required from the current owners. — Due Diligence: Includes a provision for conducting a thorough examination of the target business's financial records, legal obligations, contracts, and any potential risks or liabilities. — Closing and Post-Closing Activities: Details the steps necessary to finalize the acquisition, such as transferring assets, settling liabilities, assigning contracts, and ensuring regulatory compliance. 3. Types of New Mexico Business Purchase Proposals: a. Asset Purchase Proposal: This type of proposal focuses on acquiring specific assets of the target business, such as inventory, equipment, intellectual property, or customer contracts. It allows the buyer to cherry-pick valuable assets while limiting potential liabilities. b. Stock Purchase Proposal: In a stock purchase proposal, the buyer seeks to acquire all outstanding shares of the target business. This approach provides comprehensive ownership, including assets, liabilities, contracts, and existing relationships. However, it requires careful due diligence to identify any hidden risks. c. Merger Proposal: A merger proposal involves combining two existing businesses into a single entity. It requires detailed negotiations, including defining the new organization's structure, operations, management, and ownership. Conclusion: The New Mexico Business Purchase Proposal plays a pivotal role in the acquisition process, outlining the terms and conditions for acquiring existing businesses within the state. It is vital to have a well-structured and comprehensive proposal to increase the chances of successfully acquiring the desired business. By understanding the various types of purchase proposals available, potential buyers can tailor their approach to suit specific goals and acquisition scenarios.

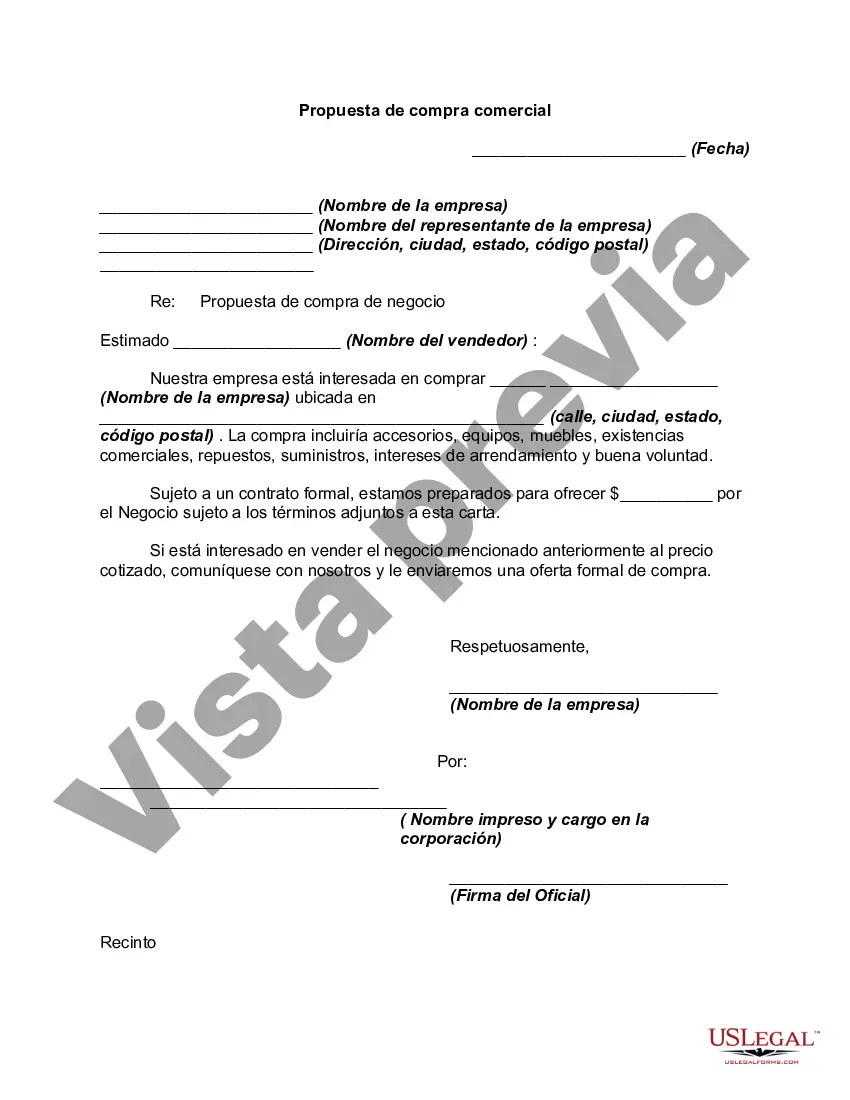

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.