Title: New Mexico Receipt and Withdrawal from Partnership: Explained with Types and Key Considerations Introduction: In the state of New Mexico, the receipt and withdrawal from a partnership are essential aspects that individuals and businesses must understand when entering or leaving a partnership agreement. This article aims to provide a comprehensive overview of the New Mexico Receipt and Withdrawal from Partnership, its significance, and various types associated with it. Overview of Receipt and Withdrawal: 1. Receipt from Partnership: — In New Mexico, a receipt from a partnership refers to the process of admitting a new partner into an existing partnership. — This occurs when an individual or business joins an ongoing partnership with the consent of existing partners. — The receipt process involves legal documentation, signing a partnership agreement, and an agreement on the financial terms, rights, and responsibilities of the incoming partner. 2. Withdrawal from Partnership: — Withdrawal from a partnership in New Mexico refers to the voluntary decision of an existing partner to leave the partnership. — The withdrawal must follow the provisions set forth in the partnership agreement or the New Mexico Partnership Act. — Generally, a partner intending to withdraw must provide written notice to other partners, indicating their intention to leave and the effective date of withdrawal. — Withdrawal can affect the partnership's structure, financial obligations, contributions, decision-making, and overall operations. Types of New Mexico Receipt and Withdrawal from Partnership: 1. Admission of a General Partner: — When a new partner is added to a general partnership, their admission includes sharing profits, losses, management responsibilities, decision-making power, and liabilities as per the partnership agreement. — The new partner's admission impacts the existing partnership's dynamics, such as profit-sharing ratios and governance structure. 2. Admission of a Limited Partner: — A partnership may choose to admit a new partner as a limited partner. — Limited partners generally have limited liability and limited involvement in partnership operations. — Their admission enables the partners to bring in additional capital or expertise while maintaining control over decision-making within the general partner(s). Key Considerations for New Mexico Receipt and Withdrawal: 1. Partnership Agreement: — Having a well-drafted partnership agreement is crucial for the receipt and withdrawal processes. — The agreement should outline the procedures, terms, and conditions both for admitting new partners and facilitating partner withdrawals. 2. Capital Contributions and Profit Sharing: — The admission of new partners may necessitate readjusting capital contributions and profit-sharing ratios. — A clear understanding of how the addition or withdrawal of partners affects financial aspects can prevent misunderstandings and disputes. 3. Legal Compliance: — All receipt and withdrawal processes must adhere to the New Mexico Revised Uniform Partnership Act (RPA) and other relevant legal obligations. — Parties must ensure that proper legal documentation, obligations, taxation, and regulatory requirements are fulfilled. Conclusion: Understanding the New Mexico Receipt and Withdrawal from Partnership is essential for individuals and businesses aiming to either join or leave a partnership. Admitting new partners or withdrawing from a partnership requires a thorough understanding of the legal framework, partnership agreement, and financial implications. By considering the types, key considerations, and adhering to legal compliance, the receipt and withdrawal process can be navigated effectively.

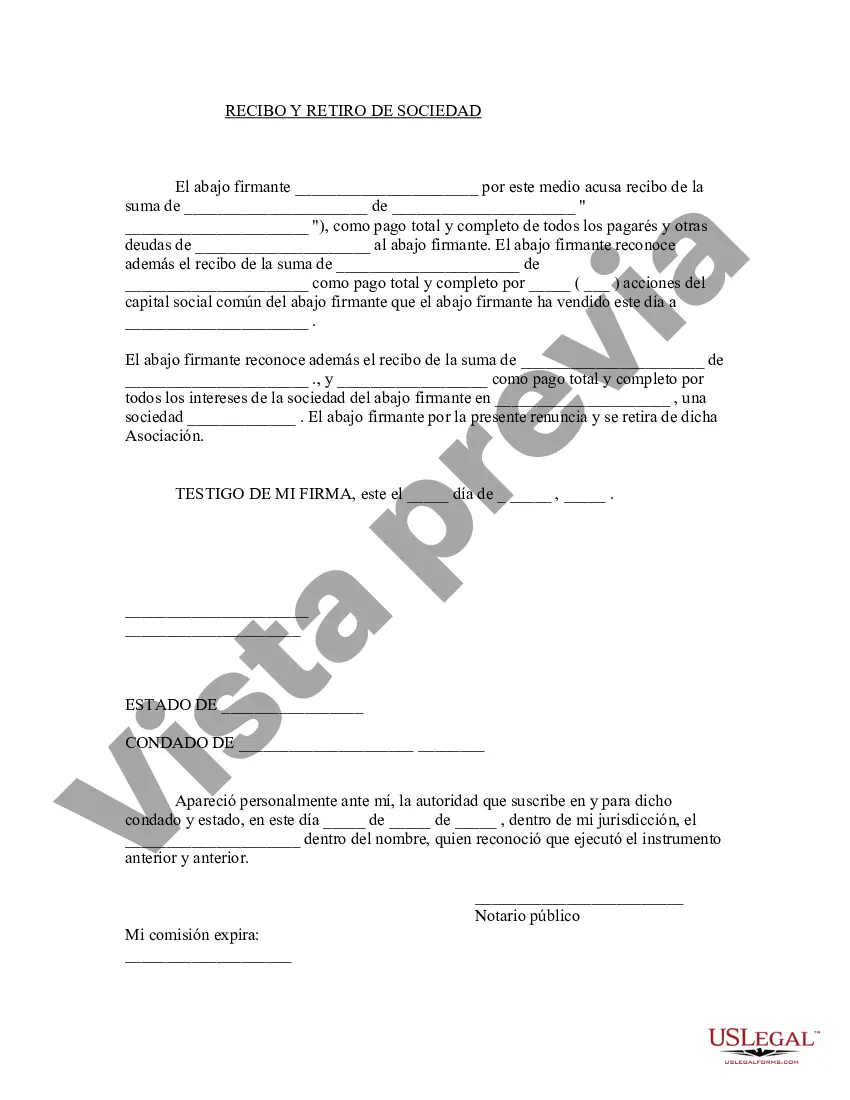

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Mexico Recepción y retiro de la sociedad - Receipt and Withdrawal from Partnership

Description

How to fill out New Mexico Recepción Y Retiro De La Sociedad?

Choosing the best legal file design can be a have difficulties. Of course, there are tons of themes available on the net, but how will you get the legal develop you want? Make use of the US Legal Forms internet site. The support gives a large number of themes, like the New Mexico Receipt and Withdrawal from Partnership, which you can use for company and private requires. All of the kinds are checked by professionals and meet up with federal and state specifications.

In case you are currently signed up, log in in your profile and then click the Download switch to find the New Mexico Receipt and Withdrawal from Partnership. Make use of profile to search through the legal kinds you have purchased earlier. Proceed to the My Forms tab of your own profile and get yet another backup of the file you want.

In case you are a fresh consumer of US Legal Forms, here are easy instructions that you should comply with:

- First, make sure you have chosen the right develop for your personal town/area. It is possible to check out the shape utilizing the Review switch and look at the shape information to make certain it will be the best for you.

- In the event the develop will not meet up with your requirements, use the Seach industry to discover the proper develop.

- Once you are sure that the shape is acceptable, select the Buy now switch to find the develop.

- Select the pricing plan you desire and enter the needed info. Create your profile and buy an order with your PayPal profile or Visa or Mastercard.

- Pick the submit file format and obtain the legal file design in your product.

- Comprehensive, change and produce and indicator the received New Mexico Receipt and Withdrawal from Partnership.

US Legal Forms will be the largest catalogue of legal kinds that you can discover various file themes. Make use of the service to obtain professionally-created paperwork that comply with condition specifications.