Subject: Explore the Benefits of New Mexico's Sample Letter for Cash Advances! Greetings, Are you in need of quick funds to tackle unexpected expenses or meet urgent financial needs? Look no further than New Mexico's Sample Letter for Cash Advances! This comprehensive guide will provide you with a detailed description of what a cash advance entails, how it works, and the various types of cash advances available in the state. Read on to discover the convenience and flexibility this financial solution offers. At its core, a cash advance is a short-term loan that allows individuals to access a portion of their upcoming paycheck in advance. New Mexico has numerous reputable lenders that provide these financial products to help bridge the gap between paychecks and address financial emergencies with ease. Here are the different types of cash advances commonly available in New Mexico: 1. Payday Loans: Payday loans are the most prevalent type of cash advance. They allow borrowers to receive a small sum of money, usually ranging from $100 to $1,500. These loans are typically repaid in full on the borrower's next payday or within a short period, usually two to four weeks. 2. Installment Loans: Installment loans provide borrowers with more flexibility in repayment. These cash advances allow individuals to borrow larger amounts, often up to $5,000 or more, which can be repaid over several months in smaller, regular installments. 3. Line of Credit Loans: Line of credit loans provide borrowers with a revolving credit limit, similar to a credit card. New Mexico residents can draw funds from the credit line as needed, up to the approved limit. The outstanding balance can be repaid in flexible installments or in a lump sum at the end of the loan term. When considering a cash advance in New Mexico, it is essential to understand the key benefits of this financial solution. Some advantages include: 1. Speedy Access to Funds: Cash advances allow you to swiftly obtain the money you need, often within hours or the next business day, helping you address emergencies without unnecessary delays. 2. Minimal Eligibility Criteria: The eligibility requirements for cash advances are typically less stringent than those of traditional loans. Often, lenders only require proof of income, a valid ID, and an active bank account. 3. No Credit Check Required: Many cash advance lenders in New Mexico do not perform extensive credit checks. This means individuals with less-than-perfect credit scores can still qualify for a cash advance. 4. Convenience: With online lenders and apps, you can apply for a cash advance from the comfort of your home at any time, making the process simple and hassle-free. 5. Financial Flexibility: Unlike traditional loans, cash advances offer more flexibility in repayment. Depending on the type of advance you choose, you can repay the borrowed amount in one lump sum or in smaller, manageable installments over time. In conclusion, New Mexico's Sample Letter for Cash Advances provides a lifeline in times of financial need, offering quick and convenient access to funds. Whether you require emergency cash for medical bills, car repairs, or any unexpected expenses, cash advances can be a reliable solution. Explore the various types of cash advances available in New Mexico and make a well-informed decision based on your specific needs and financial situation. Take control of unforeseen circumstances with New Mexico's Sample Letter for Cash Advances — the financial tool designed to support you in your time of need! Best regards, [Your Name]

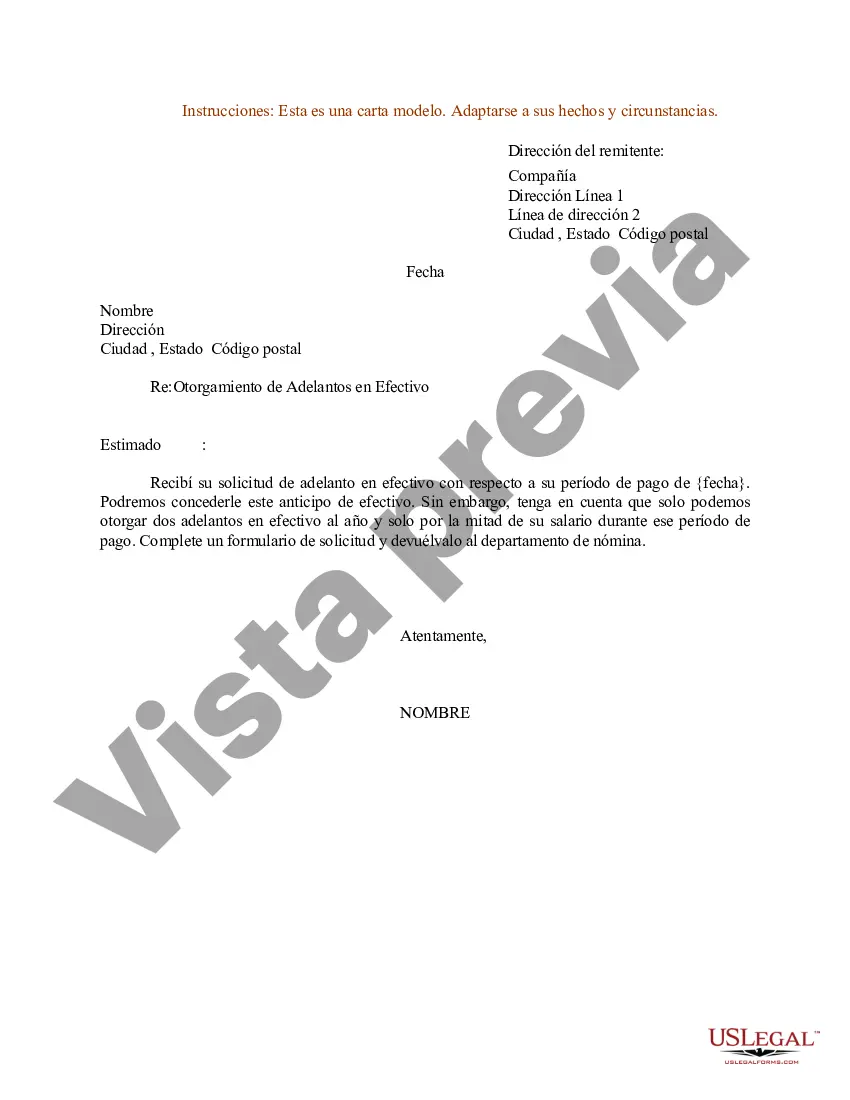

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Mexico Modelo de carta para adelantos en efectivo - Sample Letter for Cash Advances

Description

How to fill out New Mexico Modelo De Carta Para Adelantos En Efectivo?

Finding the right legitimate file format could be a struggle. Naturally, there are a lot of layouts available on the net, but how would you discover the legitimate kind you require? Take advantage of the US Legal Forms web site. The support provides 1000s of layouts, including the New Mexico Sample Letter for Cash Advances, that you can use for business and private requires. All of the forms are checked by experts and meet up with federal and state specifications.

Should you be previously listed, log in for your account and then click the Acquire button to find the New Mexico Sample Letter for Cash Advances. Use your account to appear throughout the legitimate forms you may have acquired earlier. Check out the My Forms tab of the account and have another backup of the file you require.

Should you be a whole new end user of US Legal Forms, allow me to share easy instructions that you should stick to:

- Initial, make certain you have selected the correct kind for your personal city/region. It is possible to look through the shape making use of the Preview button and read the shape explanation to guarantee it is the best for you.

- In the event the kind does not meet up with your expectations, utilize the Seach area to obtain the correct kind.

- When you are positive that the shape would work, go through the Get now button to find the kind.

- Choose the prices prepare you desire and type in the needed information and facts. Make your account and buy the transaction with your PayPal account or credit card.

- Pick the submit formatting and acquire the legitimate file format for your system.

- Comprehensive, modify and print out and indication the obtained New Mexico Sample Letter for Cash Advances.

US Legal Forms may be the largest library of legitimate forms that you can discover various file layouts. Take advantage of the service to acquire appropriately-made papers that stick to status specifications.