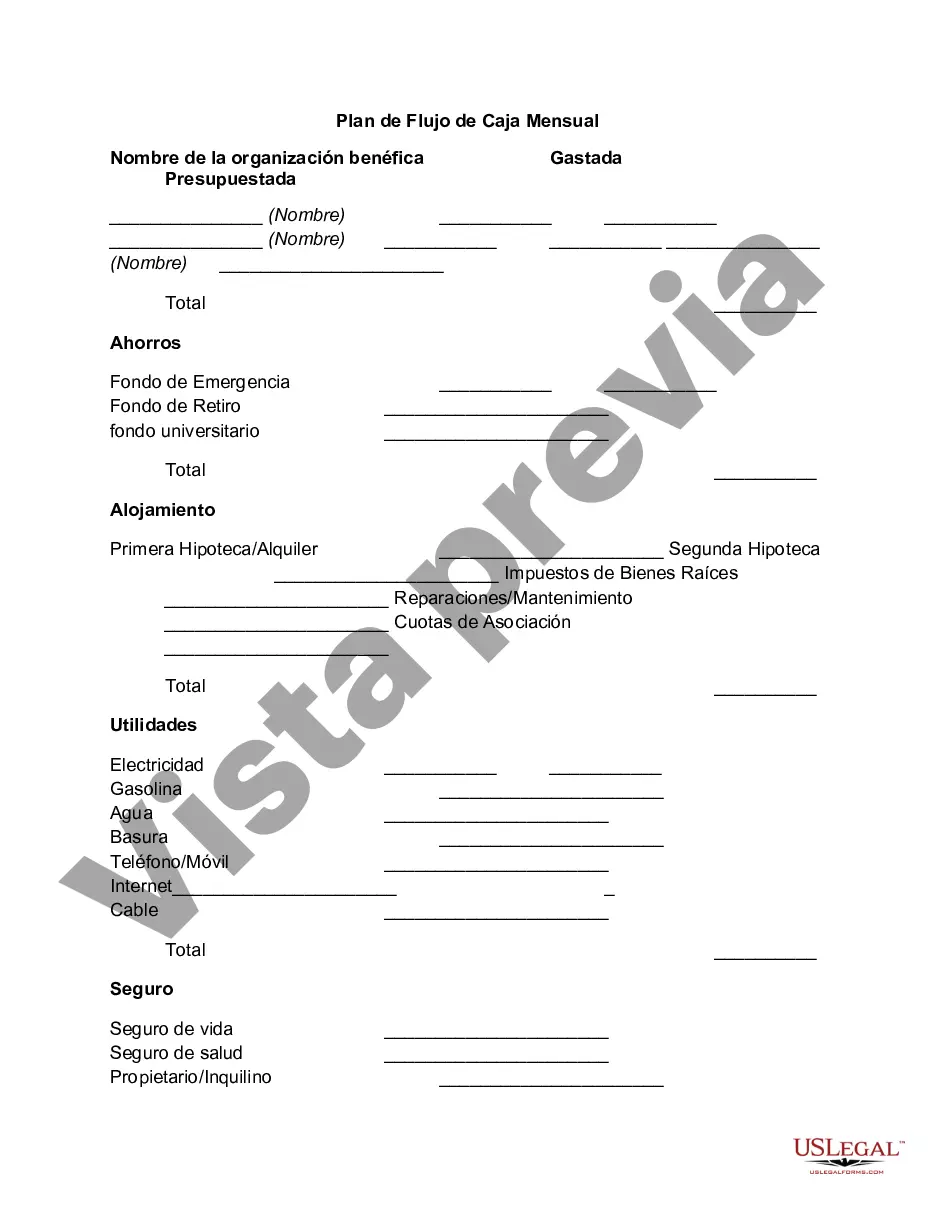

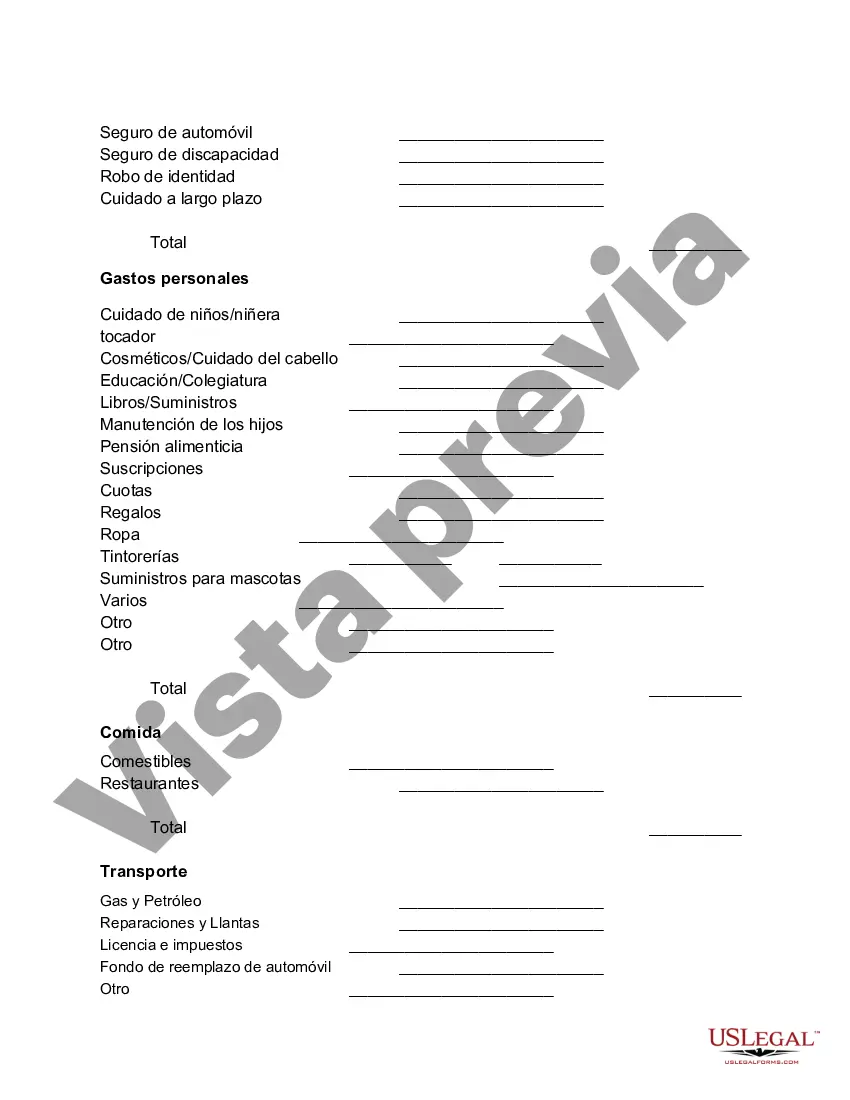

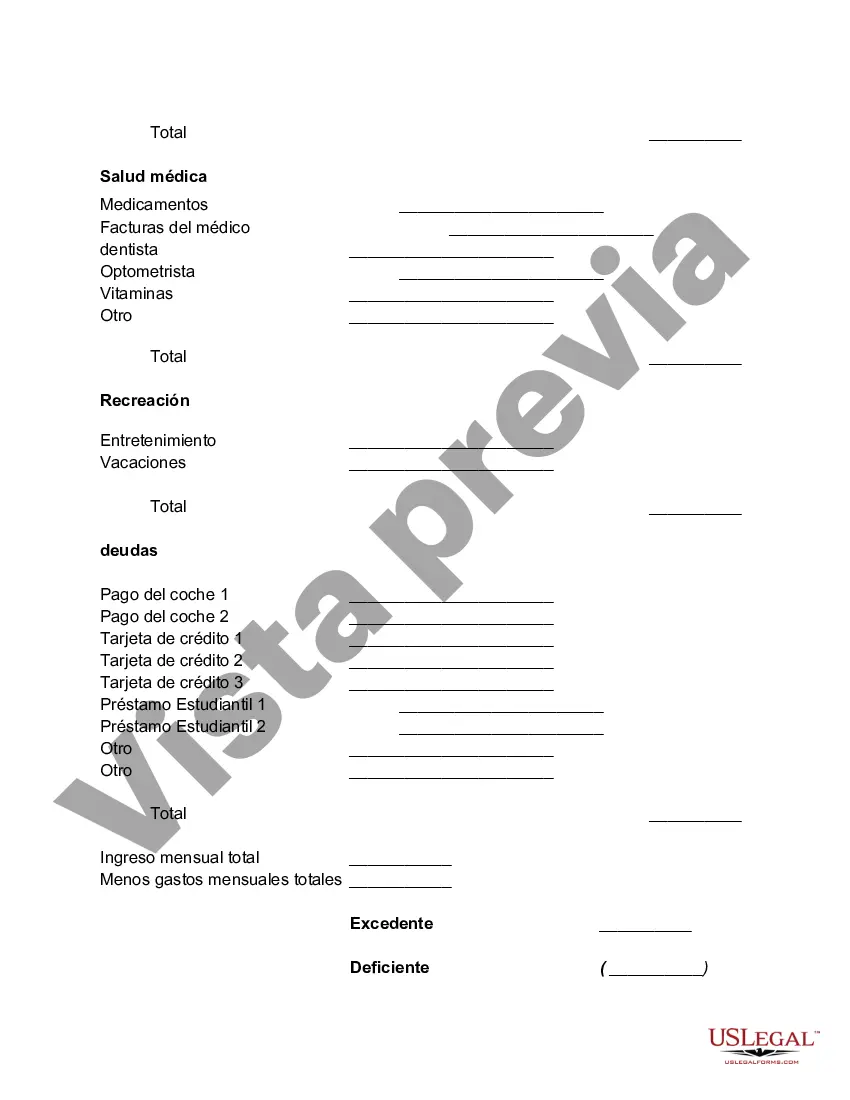

New Mexico Monthly Cash Flow Plan is a budgeting tool designed to help individuals and businesses in New Mexico track their income and expenses on a monthly basis. This comprehensive financial plan enables individuals to gain control over their finances, identify potential savings opportunities, and achieve their financial goals. The New Mexico Monthly Cash Flow Plan takes into account all sources of income, such as salary, business revenue, investments, and any other form of cash inflow. It then prompts individuals to list their monthly expenses in various categories, including rent/mortgage, utilities, transportation, groceries, entertainment, debt repayments, savings, and more. By tracking income and expenses on a monthly basis, the New Mexico Monthly Cash Flow Plan allows individuals to analyze their financial situation and make informed decisions. It helps identify areas where expenses can be reduced or eliminated, enabling individuals to save more money, pay off debt, or invest for the future. The plan also includes a feature that allows individuals to set financial goals and allocate a portion of their income towards achieving them. This may include saving for emergencies, buying a house, starting a business, or planning for retirement. The New Mexico Monthly Cash Flow Plan is a flexible tool that can be adapted to various financial situations. It can be used by individuals, families, or businesses of any size. It is designed to empower users to take control of their finances, make confident financial decisions, and ultimately achieve financial stability. In addition to the standard New Mexico Monthly Cash Flow Plan, there may be different variations tailored to specific needs or circumstances. These could include the New Mexico Monthly Cash Flow Plan for Small Businesses, the New Mexico Monthly Cash Flow Plan for Seniors, the New Mexico Monthly Cash Flow Plan for Students, or even the New Mexico Monthly Cash Flow Plan for Entrepreneurs. Each variation would offer specific guidelines and considerations that cater to the unique financial challenges faced by those specific groups. With its comprehensive approach, the New Mexico Monthly Cash Flow Plan is an invaluable tool for anyone looking to gain control over their finances, improve their financial well-being, and work towards their long-term financial goals in the state of New Mexico.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.New Mexico Plan de Flujo de Caja Mensual - Monthly Cash Flow Plan

Description

How to fill out New Mexico Plan De Flujo De Caja Mensual?

Finding the right authorized papers design could be a struggle. Naturally, there are a lot of templates accessible on the Internet, but how do you get the authorized type you require? Take advantage of the US Legal Forms internet site. The service offers 1000s of templates, including the New Mexico Monthly Cash Flow Plan, that can be used for company and private needs. Every one of the types are inspected by experts and meet up with state and federal requirements.

If you are already registered, log in for your accounts and click the Download button to find the New Mexico Monthly Cash Flow Plan. Make use of accounts to check through the authorized types you may have purchased in the past. Check out the My Forms tab of your own accounts and obtain yet another version of the papers you require.

If you are a brand new consumer of US Legal Forms, listed here are easy guidelines for you to stick to:

- First, make sure you have chosen the proper type for the area/area. You may look through the form making use of the Preview button and read the form description to ensure this is basically the best for you.

- In case the type fails to meet up with your needs, utilize the Seach discipline to get the proper type.

- Once you are positive that the form is acceptable, click the Get now button to find the type.

- Opt for the rates prepare you would like and enter in the needed information and facts. Build your accounts and purchase your order using your PayPal accounts or bank card.

- Opt for the document format and download the authorized papers design for your product.

- Complete, change and printing and sign the acquired New Mexico Monthly Cash Flow Plan.

US Legal Forms is definitely the largest catalogue of authorized types where you can discover a variety of papers templates. Take advantage of the service to download appropriately-created documents that stick to status requirements.