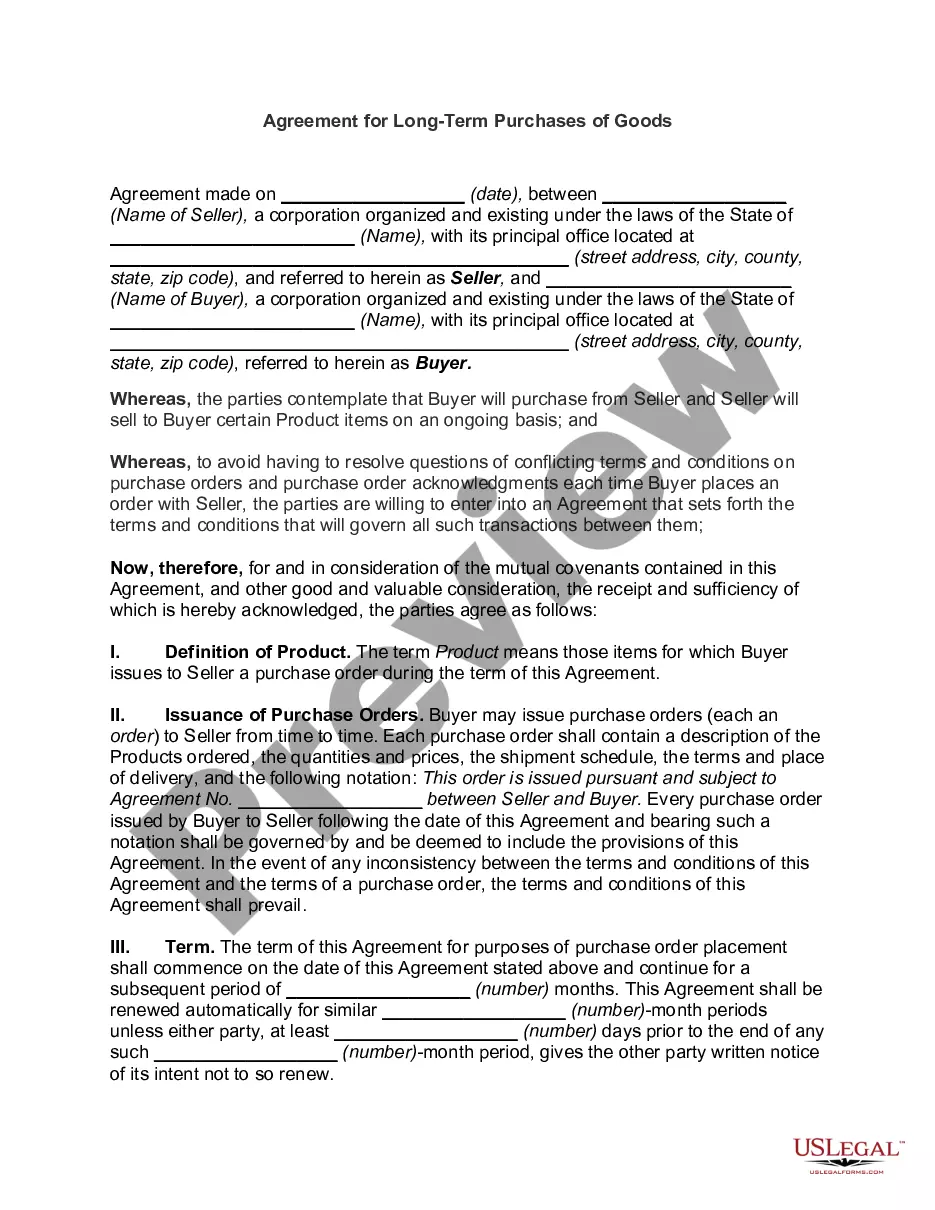

The New Mexico Agreement for Sale of Assets of Corporation is a legal document used in the state of New Mexico to facilitate the sale of assets between corporations. It outlines the terms and conditions of the transaction, providing a framework for both parties to ensure a smooth transfer of assets. This agreement is vital in situations where a corporation intends to sell its assets, whether in part or as a whole. By using this document, both the selling corporation and the acquiring party ensure that all aspects of the transaction are clearly defined and agreed upon. The agreement protects the interests and rights of both parties involved. The New Mexico Agreement for Sale of Assets of Corporation typically includes various key elements such as the identification of the assets being sold, the purchase price, payment terms, and conditions for the transfer of ownership. It may also include provisions for any liabilities assumed by the acquiring party, warranties and representations made by the selling corporation, and any necessary approvals or consents required for the transaction. There might be different types of the New Mexico Agreement for Sale of Assets of Corporation, such as: 1. General Sale of Assets Agreement: This type of agreement is used when a corporation intends to sell all or substantially all of its assets to another party. It covers a broad range of assets, including tangible and intangible assets like real estate, inventory, intellectual property, contracts, and goodwill. 2. Partial Sale of Assets Agreement: In situations where a corporation intends to sell only a specific portion of its assets, a partial sale of assets agreement is utilized. This document identifies the specific assets being sold and the terms of the transaction, while also safeguarding the rights and interests of both parties involved. In summary, the New Mexico Agreement for Sale of Assets of Corporation serves as a crucial legal tool in facilitating the sale of assets between corporations in New Mexico. It provides a comprehensive framework for the transaction, ensuring that both parties' rights, responsibilities, and expectations are clearly defined and protected.

New Mexico Agreement for Sale of Assets of Corporation

Description

How to fill out Agreement For Sale Of Assets Of Corporation?

If you desire to compile, obtain, or reproduce legal document templates, utilize US Legal Forms, the premier repository of legal documents available online.

Take advantage of the site’s straightforward and user-friendly search functionality to locate the documents you require.

Various templates for business and personal purposes are categorized by groups and jurisdictions, or keywords.

Step 4. Once you have found the form you require, click the Buy now button. Choose your preferred payment plan and provide your information to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the New Mexico Agreement for Sale of Assets of Corporation in just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click on the Download button to obtain the New Mexico Agreement for Sale of Assets of Corporation.

- You can also access documents you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview feature to review the form’s content. Do not forget to check the summary.

- Step 3. If you are not satisfied with the template, use the Search field at the top of the screen to find different versions of the legal form template.

Form popularity

FAQ

In New Mexico, an LLC is typically taxed as a pass-through entity, meaning profits and losses are reported on the personal tax returns of the members. If you’re considering a New Mexico Agreement for Sale of Assets of Corporation, understanding your LLC’s tax obligations is essential for compliance and minimizing liabilities. This structure allows for flexibility in income reporting, making it a popular choice among entrepreneurs.

Filing a New Mexico tax return depends on your residency status, income, and specific transactions, such as those related to the New Mexico Agreement for Sale of Assets of Corporation. If you earn income from New Mexico sources or engage in asset sales, you may need to file even if you are a non-resident. It's best to consult a tax professional to navigate your filing requirements accurately.

Yes, New Mexico does impose a pass-through entity tax which affects partnerships, S corporations, and LLCs. If you’re involved in the sale or transfer of assets through these entities, the New Mexico Agreement for Sale of Assets of Corporation may necessitate understanding this tax structure. This mechanism allows the pass-through income to be taxed at the owner level, making it crucial for strategic tax planning.

New Mexico offers tax exemptions for low and middle-income earners, which can significantly impact financial decisions, including those related to the New Mexico Agreement for Sale of Assets of Corporation. These exemptions help ease the tax burden on qualifying residents, allowing for better financial planning and asset management. If you meet the criteria, you may benefit from reduced tax liabilities.

The New Mexico non-resident withholding tax applies to specific transactions involving non-residents, including the New Mexico Agreement for Sale of Assets of Corporation. This tax requires withholding a portion of payments to ensure that non-residents meet their tax obligations. If you are engaged in a sale or asset transfer, understanding this tax is crucial to avoid unexpected liabilities.

The RPD 41359 form, also known as the Non-Resident Withholding Tax Form, is essential for transacting in New Mexico. When individuals or companies engage in the New Mexico Agreement for Sale of Assets of Corporation, this form helps ensure proper withholding of taxes for non-residents. By filing this form, you can avoid potential tax penalties and ensure compliance with New Mexico's tax regulations.

Shareholder approval is typically required in New Mexico to sell significant corporate assets, depending on the size of the assets being sold. This requirement safeguards shareholders’ rights and ensures transparency in corporate dealings. When crafting a New Mexico Agreement for Sale of Assets of Corporation, ensuring proper approvals is essential for validity and compliance.

In New Mexico, you generally have three days to cancel a contract if it falls under certain consumer protection laws, such as home solicitation sales. This 'right of rescission' applies to specific types of agreements, so it's important to review the terms of your New Mexico Agreement for Sale of Assets of Corporation carefully. If you're uncertain, consider utilizing uslegalforms for guidelines on contract cancellations.

Statute 56 8 3 in New Mexico addresses terms related to the sale of corporate assets and the rights of creditors involved in such transactions. It provides a legal framework that protects stakeholders when corporations engage in asset sales. Understanding this statute is important when drafting a New Mexico Agreement for Sale of Assets of Corporation.

Yes, under New Mexico law, you often need shareholder approval to sell a company, particularly if the sale involves substantial assets or changes the nature of the business. This requirement is essential when drafting a New Mexico Agreement for Sale of Assets of Corporation, as it protects shareholders' interests. Always consult with legal professionals to navigate these requirements effectively.

Interesting Questions

More info

Justin Lawyer Directory Platinum Member Justin Elevate Websites Blogs Justin Amplify Management Google Business Profile Social Media Justin Onward Blog Justin Connect Membership Basic Membership Justin Lawyer Directory Platinum Member Justin Elevate Websites Blogs Justin Amplify Management Google Business Profile Social Media Justin Onward Blog There younger version this Article View the newest version here.