New Mexico Agreement to Form Limited Partnership

Description

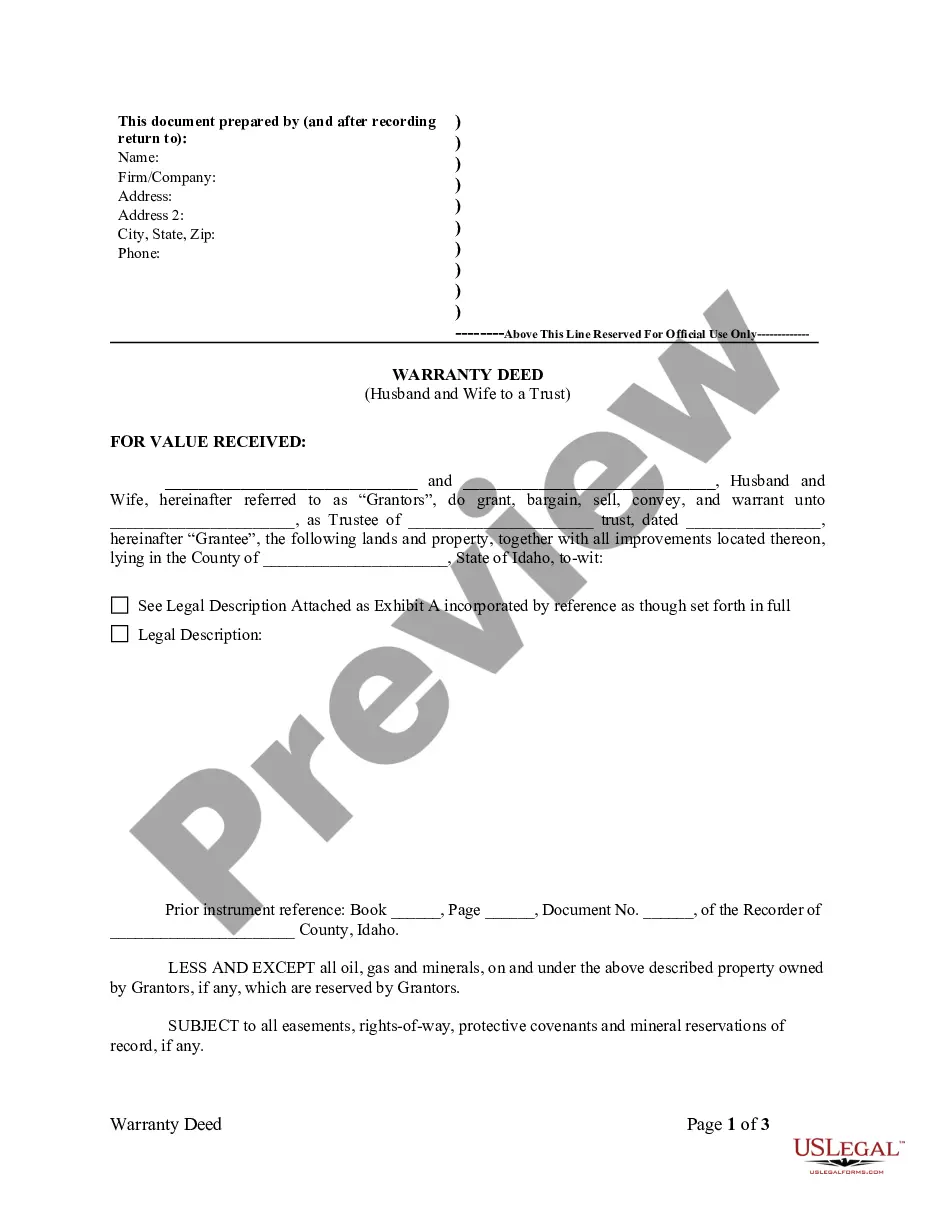

How to fill out Agreement To Form Limited Partnership?

Locating the appropriate legal document template can be a challenge.

Of course, there are numerous templates available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. This service offers thousands of templates, including the New Mexico Agreement to Form Limited Partnership, which can be used for both business and personal purposes.

You can preview the document using the Review button and read the document description to ensure it is the right one for you.

- All of the documents are verified by professionals and comply with federal and state guidelines.

- If you are already registered, Log In to your account and click the Download button to acquire the New Mexico Agreement to Form Limited Partnership.

- Utilize your account to search through the legal documents you have obtained previously.

- Proceed to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, confirm you have selected the correct document for your locality.

Form popularity

FAQ

To set up a partnership agreement in New Mexico, start by clearly outlining the roles and responsibilities of each partner. Next, define how profits and losses will be shared, along with processes for dispute resolution and changes in partnership. Using a New Mexico Agreement to Form Limited Partnership can simplify this process, ensuring all legal requirements are met. Lastly, consider using platforms like uslegalforms, which provide tailored templates for your partnership needs.

A partnership agreement becomes legally binding when it meets specific criteria such as mutual consent of all parties, clear terms, and lawful objectives. Each partner must sign the agreement, indicating their acceptance of the terms. If you use a proper format, like the New Mexico Agreement to Form Limited Partnership, it further solidifies the agreement's validity.

Creating a partnership agreement involves several steps: discuss the terms with all partners, draft the agreement, and outline critical elements such as management, contributions, and profit distribution. Utilizing a New Mexico Agreement to Form Limited Partnership template can facilitate clarity and effectiveness. Don't forget to keep a copy for each partner once signed.

To register a partnership in New Mexico, you need to file a Statement of Partnership Authority with the Secretary of State. Additionally, it’s wise to check local requirements for business licenses, zoning, and permits. You might find that using platforms like uslegalforms simplifies the registration process by providing necessary forms and instructions.

In New Mexico, a partnership agreement, including a New Mexico Agreement to Form Limited Partnership, does not legally require notarization to be effective. However, having the document notarized can provide an additional layer of authenticity and may help in disputes. Consider consulting with an attorney for guidance tailored to your situation.

To fill out a partnership agreement in New Mexico, start by gathering personal and business information for each partner. Detail the partnership’s objectives, specify the duration, and include terms for withdrawal and dissolution. It’s crucial to ensure that all partners review and agree to the terms before signing, which helps prevent conflicts later.

Writing a New Mexico Agreement to Form Limited Partnership involves outlining essential details such as the partnership name, purpose, and contributions from each partner. You should clearly define roles and responsibilities, as well as how profits and losses will be distributed. Using a template can streamline this process, ensuring you cover all critical aspects.

The requirements for a limited partnership include filing a certificate of limited partnership with the state, designating a registered agent, and specifying the roles of general and limited partners. Additionally, it's crucial to maintain proper records and adhere to tax regulations. By following these steps, you can create a robust New Mexico Agreement to Form Limited Partnership that meets legal standards and supports your business objectives.

While a verbal agreement can establish a partnership, having a written agreement is strongly recommended to clarify terms and conditions. A written document, like a New Mexico Agreement to Form Limited Partnership, reduces the risks of misunderstandings and protects all parties involved. It ensures that everyone is on the same page regarding expectations and responsibilities.

The three essential elements of a partnership are shared profit and loss, mutual agency, and the intention to form a partnership. Partners work together to manage the business and share its profits according to the established agreement. Recognizing these elements is vital when drafting your New Mexico Agreement to Form Limited Partnership.