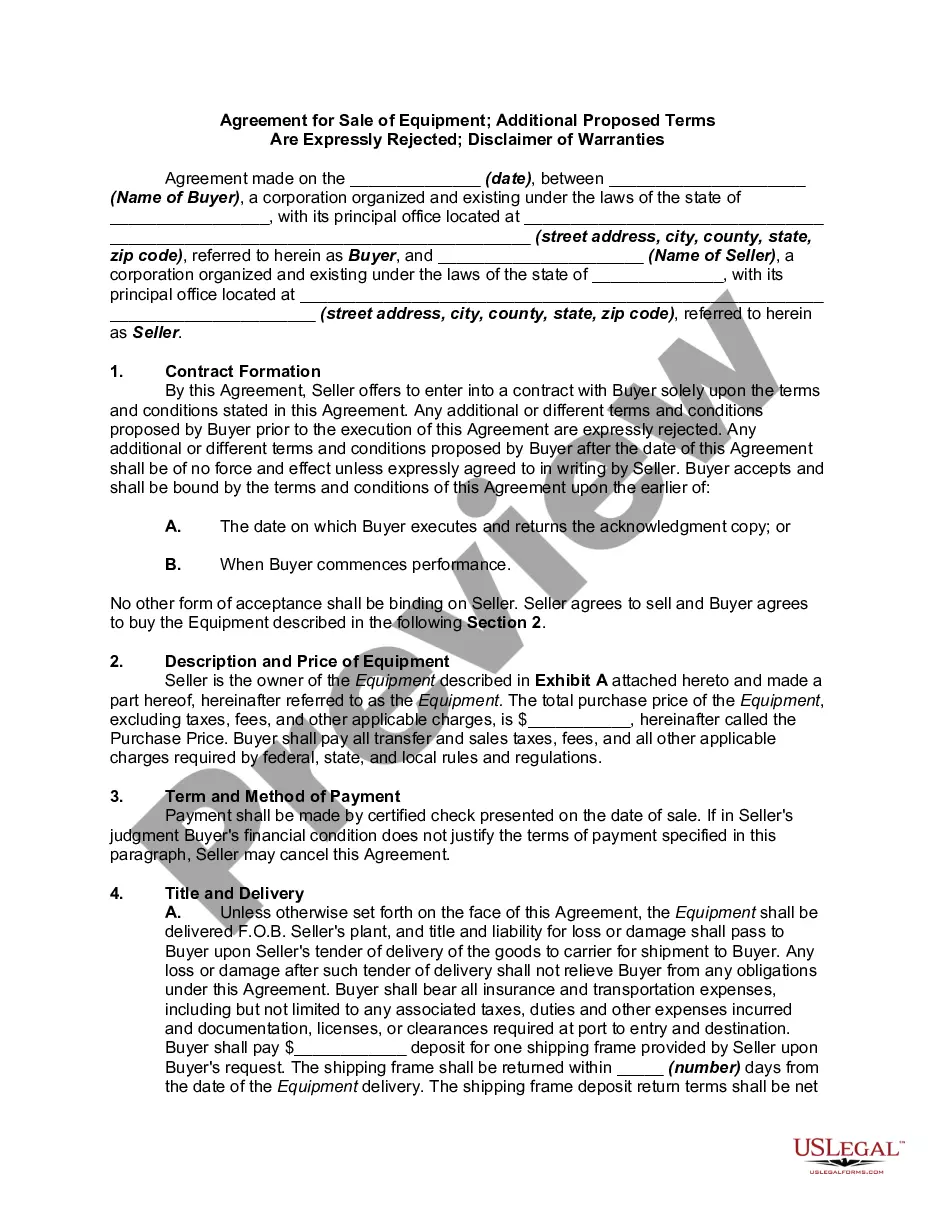

This is a Prior instruments and Obligations form, in addition to being made subject to all conveyances, reservations, and exceptions or other instruments of record, this assignment is made and assignee accepts this assignment subject to all terms, provisions, covenants, conditions, obligations, and agreements, including but not limited to the plugging responsibility for any well, surface restoration, or preferential purchase rights, contained in any contracts existing as of the effective date of this assignment and affecting the assigned property, whether or not recorded.

New Mexico Prior instruments and Obligations

Description

How to fill out Prior Instruments And Obligations?

US Legal Forms - one of several largest libraries of legal varieties in the States - delivers a wide array of legal papers templates you can down load or printing. Using the site, you can find a huge number of varieties for organization and individual functions, categorized by groups, states, or keywords and phrases.You can find the latest versions of varieties much like the New Mexico Prior instruments and Obligations in seconds.

If you already have a monthly subscription, log in and down load New Mexico Prior instruments and Obligations through the US Legal Forms local library. The Down load switch will show up on each type you look at. You have accessibility to all earlier acquired varieties within the My Forms tab of your profile.

In order to use US Legal Forms initially, allow me to share simple instructions to help you began:

- Ensure you have picked out the proper type for the metropolis/area. Click the Review switch to examine the form`s content. Read the type description to ensure that you have chosen the proper type.

- In the event the type does not suit your requirements, take advantage of the Look for discipline at the top of the display screen to discover the the one that does.

- In case you are satisfied with the form, affirm your decision by clicking on the Purchase now switch. Then, select the rates plan you prefer and supply your accreditations to register to have an profile.

- Procedure the financial transaction. Use your credit card or PayPal profile to accomplish the financial transaction.

- Find the formatting and down load the form on your system.

- Make changes. Load, change and printing and indication the acquired New Mexico Prior instruments and Obligations.

Every single template you included in your bank account lacks an expiration particular date which is the one you have for a long time. So, if you would like down load or printing yet another duplicate, just visit the My Forms portion and click on the type you need.

Get access to the New Mexico Prior instruments and Obligations with US Legal Forms, the most considerable local library of legal papers templates. Use a huge number of skilled and condition-particular templates that meet up with your organization or individual requires and requirements.

Form popularity

FAQ

Section 30-12-1 - Interference with communications; exception. E. using any apparatus to do or cause to be done any of the acts hereinbefore mentioned or to aid, agree with, comply or conspire with any person to do or permit or cause to be done any of the acts hereinbefore mentioned. New Mexico Statutes Section 30-12-1 (2021) - Interference ... - Justia Law justia.com ? codes ? chapter-30 ? article-12 justia.com ? codes ? chapter-30 ? article-12

Each person shall have exempt a homestead in a dwelling house and land occupied by the person or in a dwelling house occupied by the person although the dwelling is on land owned by another, provided that the dwelling is owned, leased or being purchased by the person claiming the exemption. New Mexico Statutes Section 42-10-9 (2021) - Homestead exemption. justia.com ? codes ? chapter-42 ? article-10 justia.com ? codes ? chapter-42 ? article-10

As used in the Criminal Code: A. "great bodily harm" means an injury to the person which creates a high probability of death; or which causes serious disfigurement; or which results in permanent or protracted loss or impairment of the function of any member or organ of the body; B.

A person may be charged with and convicted of the crime as an accessory if he procures, counsels, aids or abets in its commission and although he did not directly commit the crime and although the principal who directly committed such crime has not been prosecuted or convicted, or has been convicted of a different ...

Does New Mexico Law Allow for a Redemption Period After a Foreclosure? Yes, New Mexico law allows a borrower to redeem a property within nine months of the foreclosure sale date. The borrower must pay the foreclosure sale price, costs, fees and interest in order to redeem the property. Foreclosure Resources: Does New Mexico Law Allow for a Redemption ... lawinfo.com ? resources ? does-new-mexico... lawinfo.com ? resources ? does-new-mexico...

Criminal Trespass 30-14-1 NMSA 1978 Criminal trespass consists of knowingly entering or remaining upon posted private property without possessing written permission from the owner or person in control of the land. The provisions of this subsection do not apply if: 1).

Section 30-7-2.2. Unlawful possession of a handgun by a person; exceptions; penalty. (7) on real property under the control of the person's parent, grandparent or legal guardian and the person is being supervised by his parent, grandparent or legal guardian.

Section 56-8-4: Judgments and decrees; basis of computing interest. 56-8-4. Judgments and decrees; basis of computing interest. (2) the judgment is based on tortious conduct, bad faith or intentional or willful acts, in which case interest shall be computed at the rate of fifteen percent. NM Stat § 56-8-4 :: Section 56-8-4: Judgments and decrees; basis of ... justia.com ? new-mexico ? chapter56 ? article8 justia.com ? new-mexico ? chapter56 ? article8