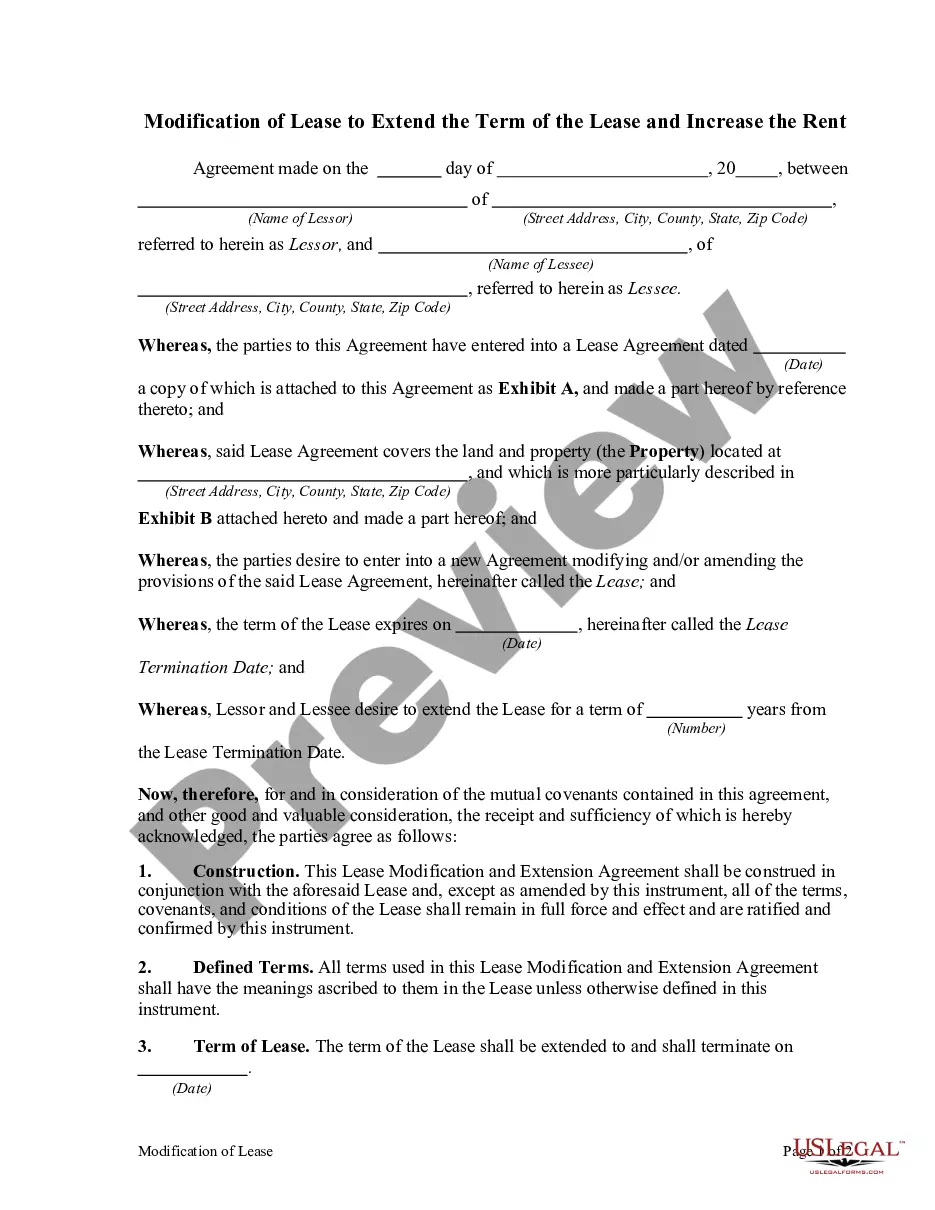

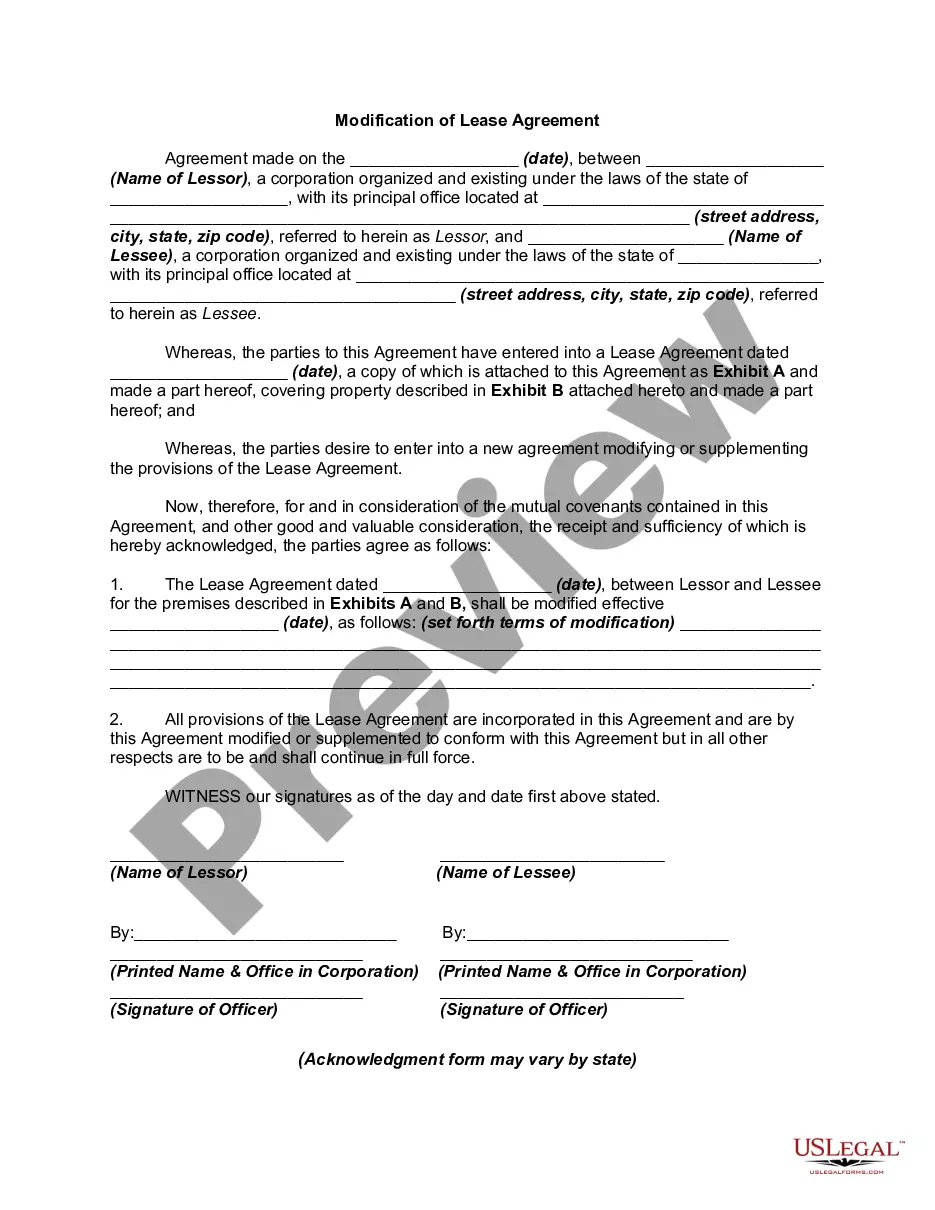

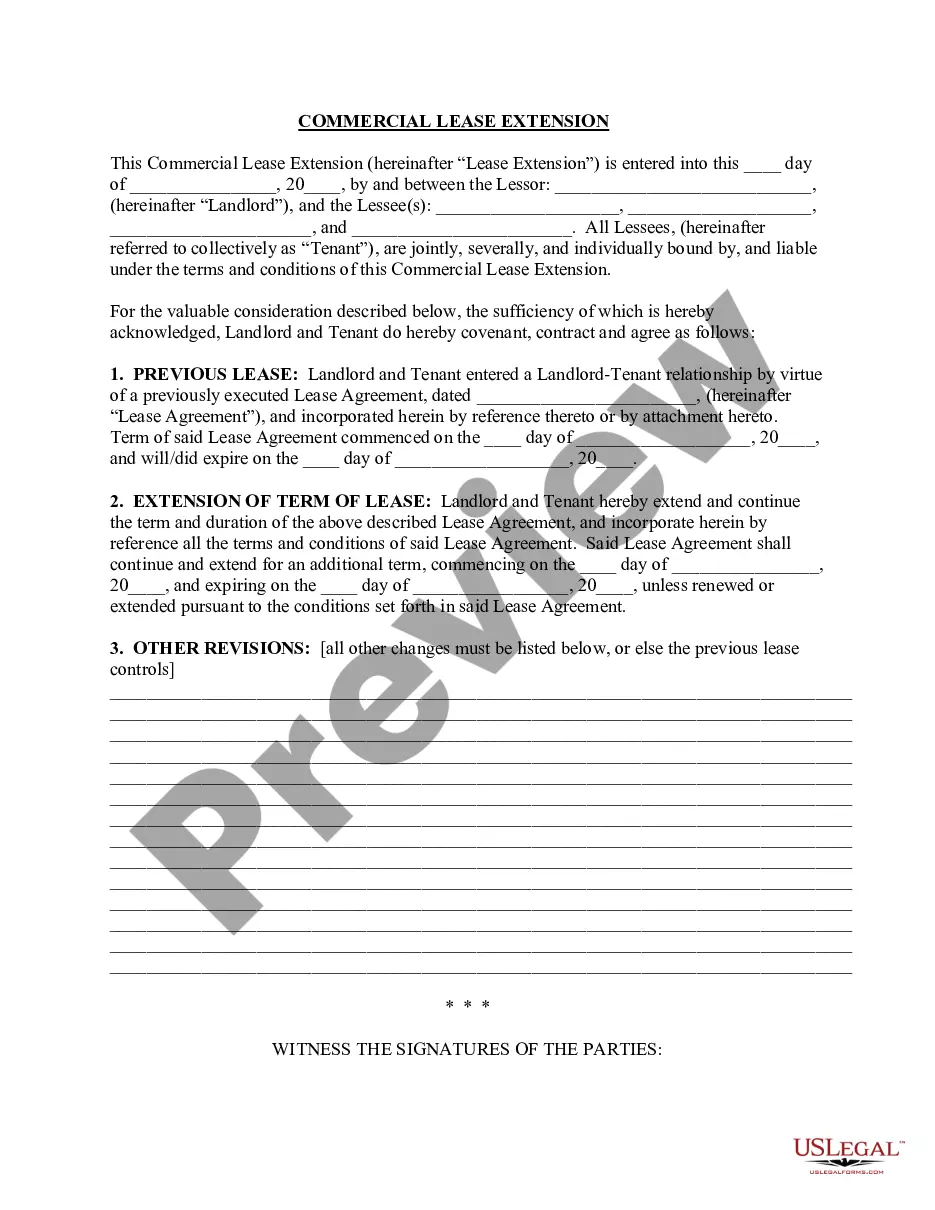

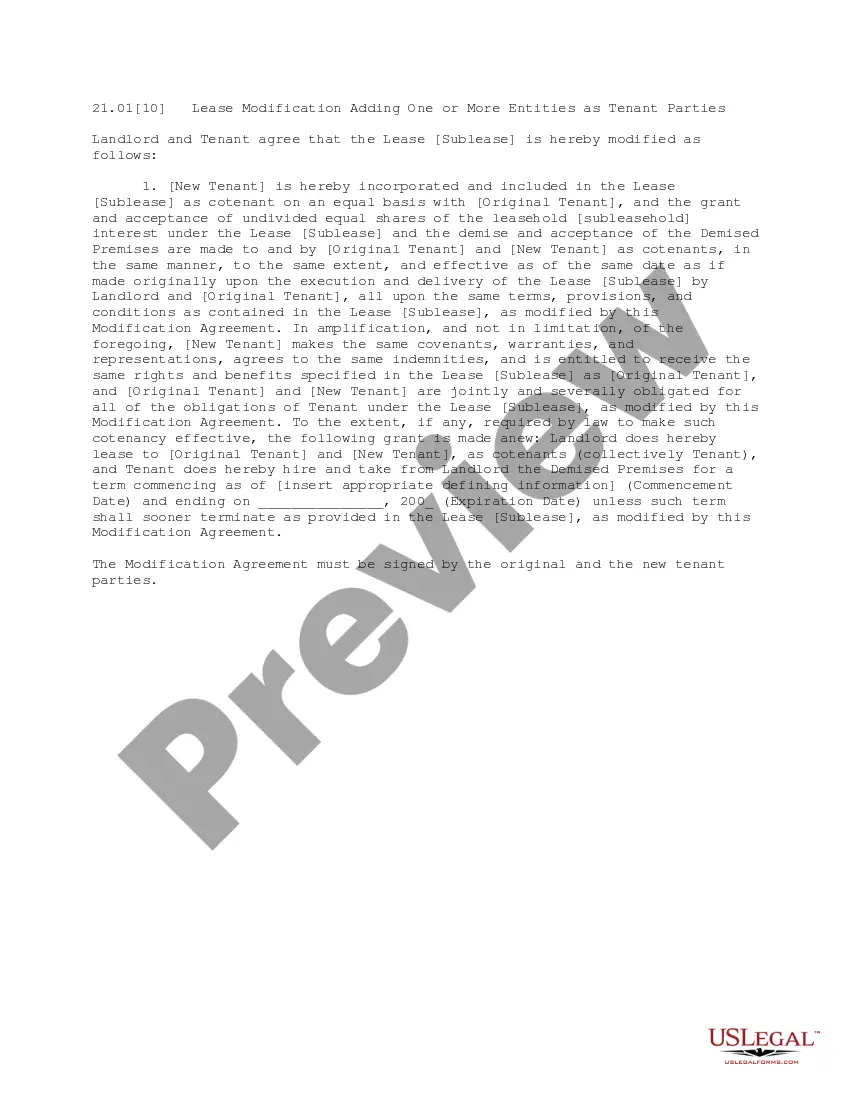

This lease clause states that the landlord and the tenant agree that the lease [sublease] is modified, and illustrates the terms and conditions of the modifications of the lease.

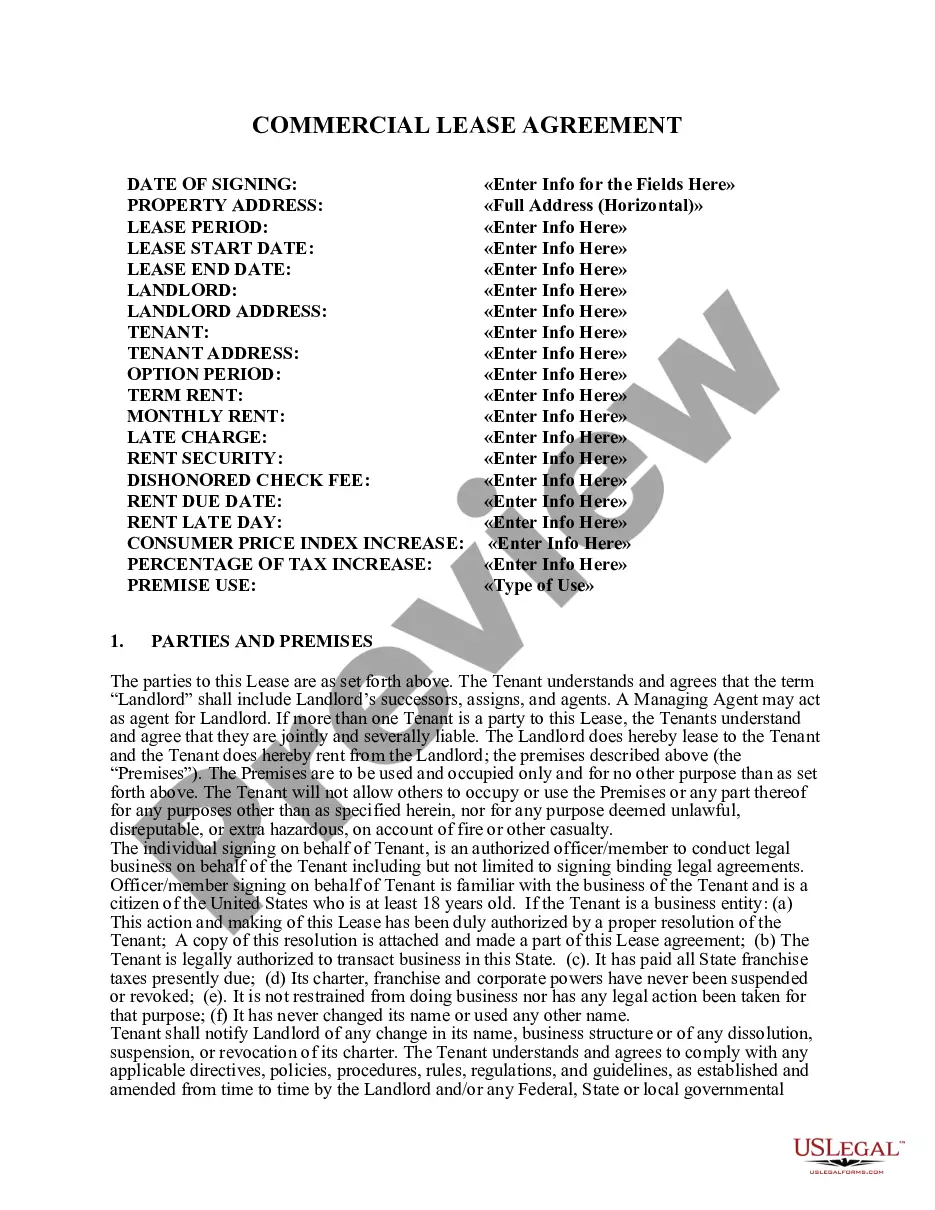

New Mexico Lease Modification Adding One or More Entities as Tenant Parties

Description

How to fill out Lease Modification Adding One Or More Entities As Tenant Parties?

Discovering the right legitimate document format can be a battle. Of course, there are a variety of templates available online, but how will you get the legitimate develop you need? Take advantage of the US Legal Forms site. The support offers thousands of templates, including the New Mexico Lease Modification Adding One or More Entities as Tenant Parties, which you can use for company and personal requires. Every one of the types are examined by experts and meet federal and state demands.

In case you are presently authorized, log in in your profile and then click the Obtain switch to find the New Mexico Lease Modification Adding One or More Entities as Tenant Parties. Make use of your profile to check from the legitimate types you might have purchased earlier. Proceed to the My Forms tab of your own profile and get an additional version of the document you need.

In case you are a fresh end user of US Legal Forms, here are basic guidelines so that you can follow:

- Initial, make certain you have selected the proper develop for the area/area. It is possible to check out the shape making use of the Review switch and browse the shape explanation to ensure this is basically the best for you.

- If the develop fails to meet your expectations, use the Seach industry to find the correct develop.

- When you are sure that the shape would work, go through the Acquire now switch to find the develop.

- Pick the prices program you desire and type in the required information and facts. Create your profile and pay money for the transaction using your PayPal profile or credit card.

- Choose the file file format and acquire the legitimate document format in your product.

- Total, modify and print and sign the attained New Mexico Lease Modification Adding One or More Entities as Tenant Parties.

US Legal Forms will be the greatest catalogue of legitimate types in which you can see different document templates. Take advantage of the service to acquire professionally-made paperwork that follow express demands.

Form popularity

FAQ

The lessee shall remeasure the lease liability to reflect those revised lease payments only when there is a change in the cash flows (ie when the adjustment to the lease payments takes effect).

Ing to the IFRS 16, A re-assessment of the lease liability takes place if the cash flows change based on the original terms and conditions of the lease. Changes that were not part of the original terms and conditions of the lease would be considered as lease modifications.

Lease Modifications under ASC 842 A lease modification occurs when there is a change in the scope or consideration of a lease that was not part of the original terms and conditions. Examples of lease modifications include changes to the lease term, adjustments to the leased space, or modifications to the lease payment.

Operating lease modifications If the original lease is an operating lease, the lessor accounts for the modification as a new lease from the effective date of the modification, including any prepaid or accrued lease payments relating to the original lease in the lease payments for the new lease.

As can be seen from the diagram, a modification will only be treated as a separate lease if it involves the addition of one or more underlying assets at a price that is commensurate with the standalone price of the increase in scope. 1 All other modifications are not treated as a separate lease.

In order to calculate the selling profit or loss on the lease, the fair value of the underlying asset is its fair value at the effective date of the modification and its carrying amount is the carrying amount of the net investment in the original lease immediately before the effective date of the modification.

Account for the lease modification as a termination of the original lease and creation of a new lease from the effective date of the modification. Measure the carrying amount of the underlying asset as the net investment in the original lease immediately before the effective date of the modification.

Ing to the IFRS 16, A re-assessment of the lease liability takes place if the cash flows change based on the original terms and conditions of the lease. Changes that were not part of the original terms and conditions of the lease would be considered as lease modifications.