Nevada Corporate Right of First Refusal (ROAR) is a legal provision that grants a corporation the priority to purchase a certain asset or participate in a specific transaction before the opportunity is offered to others. This right is established through corporate resolutions, which are formal decisions made by the board of directors or shareholders to authorize specific actions. The Corporate Right of First Refusal in Nevada is aimed at protecting the interests of corporations by ensuring they have the option to acquire assets, such as real estate, securities, or intellectual property, or to engage in crucial corporate transactions, such as mergers, acquisitions, or financings, before these opportunities are presented to external parties. By having the right to refuse or match the terms of an offer made to a seller, corporations can retain control over their operations, resources, and strategic direction. There are different types of Nevada Corporate Right of First Refusal that can apply to various situations: 1. Asset-specific ROAR: This type of ROAR grants the corporation the right to purchase a specific asset, such as a piece of property, shares of stock in another company, or a patent, before the owner sells it to a third party. If the ROAR is triggered, the corporation must exercise its option to purchase within a specified timeframe. 2. Transaction-specific ROAR: This type of ROAR provides the corporation with the right to participate in a specific transaction, such as a merger or acquisition, before it is offered to other potential buyers. The corporation must evaluate the terms of the transaction and decide whether to exercise its ROAR. 3. Shareholder ROAR: This type of ROAR ensures that existing shareholders have the right to purchase newly issued shares before they are offered to external investors. This allows shareholders to maintain their ownership percentage and control within the corporation. 4. Partnership ROAR: In some cases, partnerships may also include a ROAR provision. This grants the partnership the right to purchase a partner's interest before it is sold to an external party, ensuring that the ownership structure and dynamics within the partnership remain under its control. It is crucial for corporations in Nevada to include the specific provisions of ROAR in their corporate resolutions and legal agreements, clearly outlining the scope, conditions, and limitations of the right. ROAR provisions are subject to statutory requirements and must be carefully drafted to ensure their validity and enforceability. Seeking legal advice from an attorney specializing in corporate law is advisable to ensure compliance with Nevada state laws and to protect the corporation's interests when utilizing the Corporate Right of First Refusal.

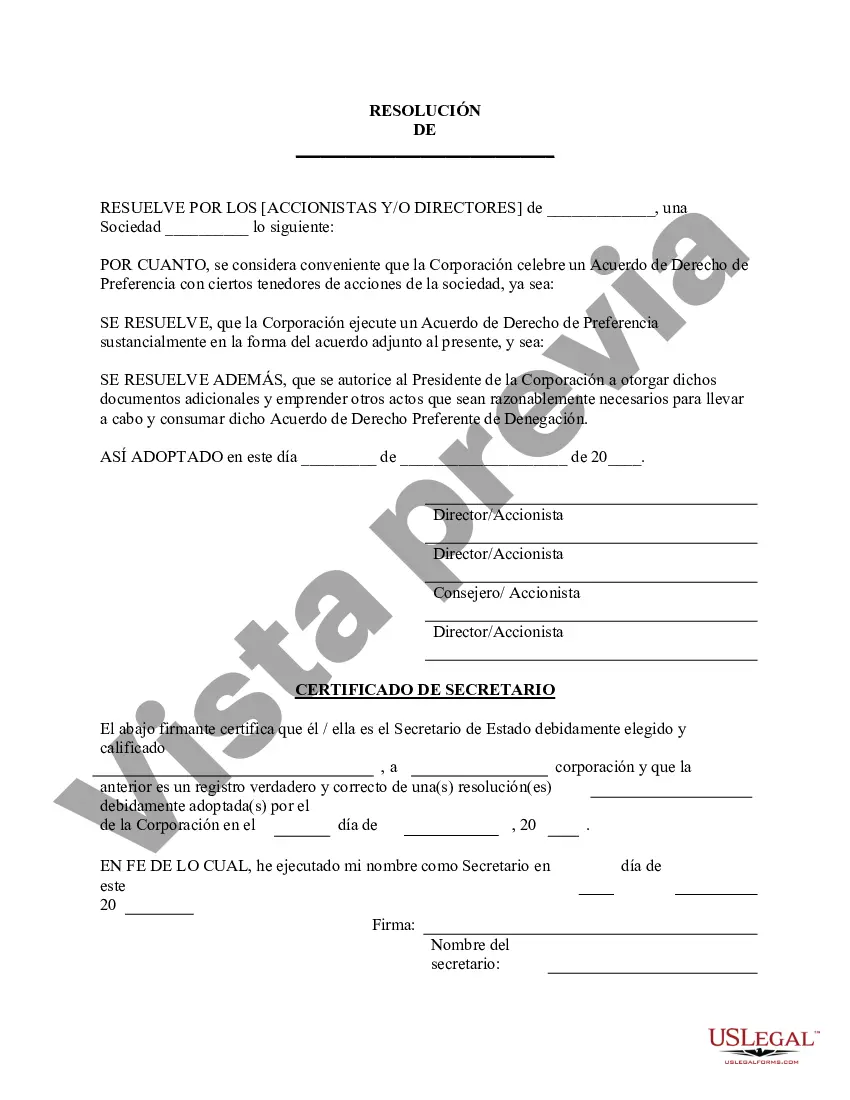

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Derecho Corporativo de Preferencia - Resoluciones Corporativas - Corporate Right of First Refusal - Corporate Resolutions

Description

How to fill out Nevada Derecho Corporativo De Preferencia - Resoluciones Corporativas?

If you wish to full, obtain, or produce authorized record layouts, use US Legal Forms, the most important collection of authorized types, which can be found on the Internet. Use the site`s easy and convenient lookup to get the documents you want. A variety of layouts for organization and individual reasons are categorized by categories and states, or keywords and phrases. Use US Legal Forms to get the Nevada Corporate Right of First Refusal - Corporate Resolutions with a handful of click throughs.

In case you are previously a US Legal Forms consumer, log in for your account and then click the Acquire switch to find the Nevada Corporate Right of First Refusal - Corporate Resolutions. You may also entry types you formerly acquired in the My Forms tab of your account.

Should you use US Legal Forms initially, follow the instructions under:

- Step 1. Ensure you have chosen the shape for the right metropolis/nation.

- Step 2. Take advantage of the Review solution to look through the form`s content. Never overlook to read through the description.

- Step 3. In case you are not satisfied with all the type, use the Search area on top of the display to find other versions from the authorized type web template.

- Step 4. When you have found the shape you want, select the Acquire now switch. Opt for the prices plan you choose and put your accreditations to sign up for the account.

- Step 5. Method the transaction. You can utilize your credit card or PayPal account to finish the transaction.

- Step 6. Select the formatting from the authorized type and obtain it in your system.

- Step 7. Total, revise and produce or signal the Nevada Corporate Right of First Refusal - Corporate Resolutions.

Every single authorized record web template you get is yours forever. You may have acces to each type you acquired within your acccount. Click the My Forms portion and decide on a type to produce or obtain once again.

Be competitive and obtain, and produce the Nevada Corporate Right of First Refusal - Corporate Resolutions with US Legal Forms. There are millions of professional and status-certain types you can utilize for your personal organization or individual requirements.