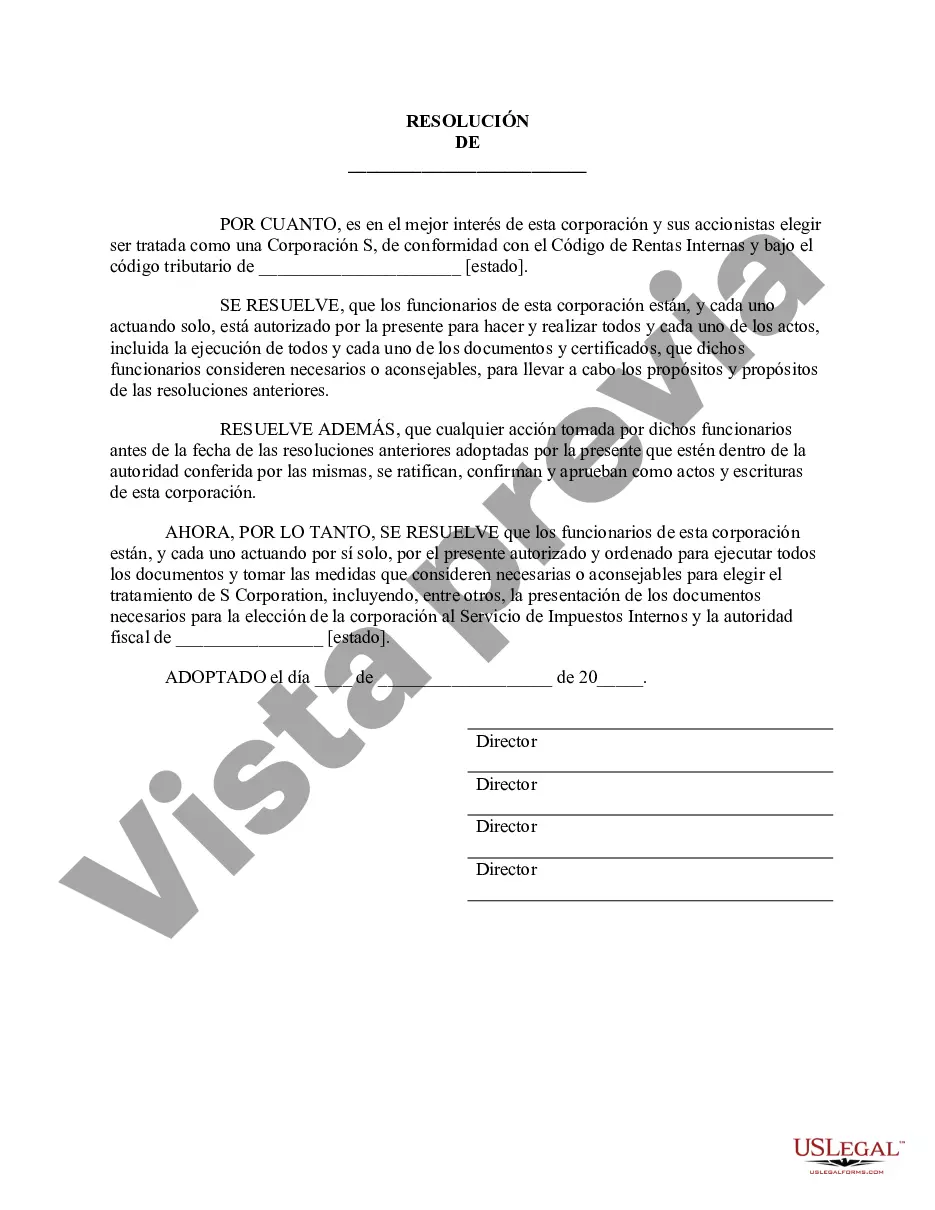

In Nevada, a corporation can obtain S Corporation status in order to avail certain tax benefits offered by the Internal Revenue Service (IRS). To achieve this, certain formalities need to be fulfilled, and one of them is the submission of Corporate Resolutions Forms. The Corporate Resolutions Form plays a crucial role in documenting the decisions made by the corporation's board of directors or shareholders regarding the S Corporation status. These forms outline the actions taken to elect S Corporation status and are usually prepared and signed during a formal meeting of the board or by written consent. There are various types of Corporate Resolutions Forms that can be used to obtain S Corporation status in Nevada, depending on the particular situation and the decisions made by the corporation. Some commonly used forms include: 1. Election of S Corporation Status Resolution: This form is prepared to officially elect S Corporation status for the corporation. It outlines the decision made by the board of directors or shareholders to elect S Corporation status and includes details such as the effective date of the election. 2. Shareholder Agreement to Elect S Corporation Status: In instances where the decision to obtain S Corporation status is dependent on the consent of the shareholders, this form is used. It captures the agreement of each shareholder to elect S Corporation status and may include their respective ownership percentages. 3. Board Resolution to Adopt S Corporation Status: This form is prepared when the decision to obtain S Corporation status is made by the board of directors. It documents the board's resolution to adopt S Corporation status and may include additional details such as the authorized officers to sign any necessary documents on behalf of the corporation. 4. Shareholder Consent to Elect S Corporation Status: In cases where the decision to obtain S Corporation status is made by written consent of the shareholders, this form is used. It captures the consent of each shareholder to elect S Corporation status and may include any necessary majority or unanimous consent requirements. These forms, when properly completed and signed, provide the necessary documentation to support the corporation's decision to obtain S Corporation status. It is important to consult with an attorney or a certified public accountant (CPA) familiar with Nevada corporate law to ensure the correct forms are used and all legal requirements are met. Additionally, keeping copies of these forms in the corporation's records is vital for compliance and potential audits by the IRS.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Obtener el estado de S Corporation - Formularios de resoluciones corporativas - Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Nevada Obtener El Estado De S Corporation - Formularios De Resoluciones Corporativas?

Are you presently within a placement where you need to have files for both business or person uses just about every working day? There are a variety of legitimate file themes available on the net, but finding ones you can rely on is not simple. US Legal Forms delivers a huge number of form themes, much like the Nevada Obtain S Corporation Status - Corporate Resolutions Forms, which are composed to meet state and federal requirements.

In case you are previously acquainted with US Legal Forms web site and also have a merchant account, just log in. After that, it is possible to down load the Nevada Obtain S Corporation Status - Corporate Resolutions Forms format.

If you do not offer an account and need to begin to use US Legal Forms, abide by these steps:

- Obtain the form you need and make sure it is for your proper metropolis/region.

- Use the Preview key to check the form.

- See the information to actually have selected the proper form.

- In the event the form is not what you are looking for, use the Look for industry to obtain the form that fits your needs and requirements.

- If you find the proper form, click Get now.

- Pick the prices plan you need, fill in the necessary information and facts to produce your money, and buy your order utilizing your PayPal or credit card.

- Choose a practical document file format and down load your version.

Find all the file themes you might have purchased in the My Forms food selection. You can aquire a further version of Nevada Obtain S Corporation Status - Corporate Resolutions Forms whenever, if required. Just click the needed form to down load or print out the file format.

Use US Legal Forms, one of the most comprehensive assortment of legitimate varieties, to save some time and steer clear of mistakes. The services delivers appropriately produced legitimate file themes that can be used for an array of uses. Generate a merchant account on US Legal Forms and begin creating your life easier.