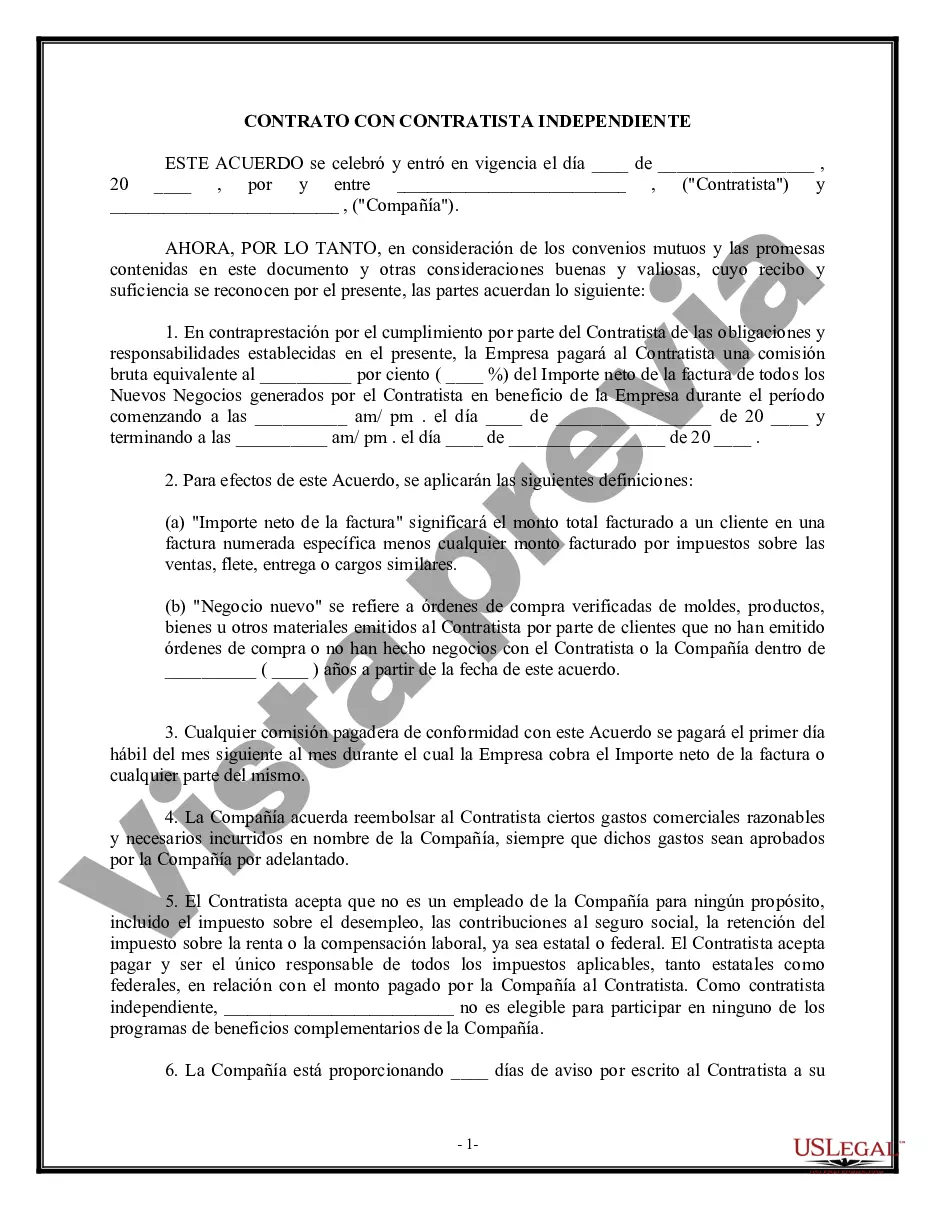

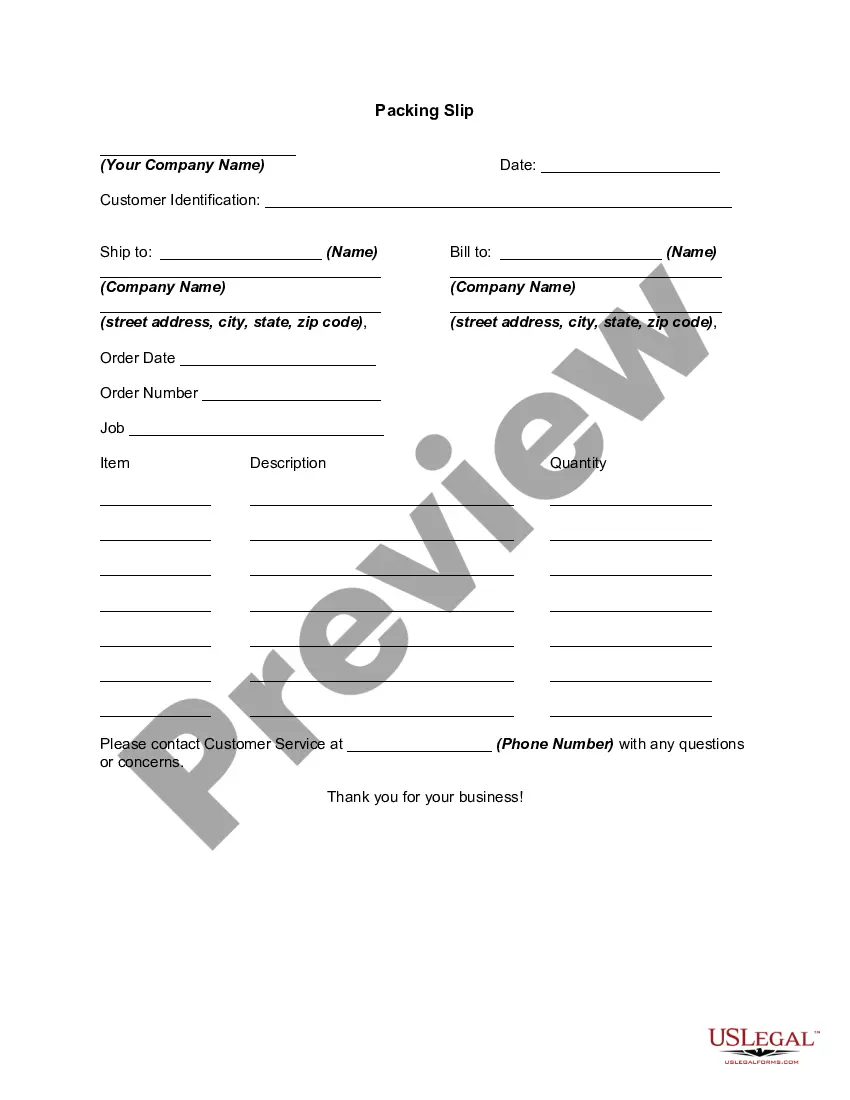

A Nevada Employment Agreement — Percentage of Sale— - Self-Employed Independent Contractor is a legally binding document that outlines the terms and conditions between an employer or business and a self-employed individual operating in Nevada. This agreement specifies the compensation structure based on a percentage of sales made by the contractor. Here are some relevant keywords and types of Nevada Employment Agreements pertaining to the percentage of sales compensation model for self-employed independent contractors: 1. Nevada Sales Commission Agreement: This agreement establishes the terms and conditions for compensating a self-employed independent contractor based on a percentage of sales generated. It outlines the commission rate, payment terms, and any additional provisions related to sales targets or performance metrics. 2. Nevada Independent Contractor Agreement: This agreement defines the relationship between a business or employer and a self-employed individual operating as an independent contractor in Nevada. It covers various aspects such as scope of work, payment terms, confidentiality, intellectual property rights, and termination clauses. The percentage of sales compensation model can be specified within this agreement. 3. Nevada Sales Representative Agreement: This agreement is specifically designed for sales representatives who work on a commission-based structure. It includes the details of the sales representative's responsibilities, territories, commission rates, and other terms relevant to the compensation structure based on sales generated. 4. Nevada Freelance Agreement: This agreement is suitable for self-employed professionals, such as freelancers or consultants, who provide services and are compensated based on a percentage of sales. It covers the nature of the services, deliverables, payment terms, and any intellectual property rights or confidentiality clauses. 5. Nevada Affiliate Agreement: This agreement pertains to individuals or companies that promote products or services on behalf of a business in exchange for a commission on sales made. It outlines the responsibilities of the affiliate, commission rates, payment terms, and any specific marketing or promotional guidelines to be followed. In conclusion, a Nevada Employment Agreement — Percentage of Sales — Self-Employed Independent Contractor is a contract that governs the relationship and compensation structure between a business and a self-employed individual operating as an independent contractor. The agreement can vary based on the specific area of work, such as sales representatives, freelancers, or affiliates.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.Nevada Contrato de Trabajo - Porcentaje de Ventas - Contratista Independiente Trabajador por Cuenta Propia - Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor

Description

How to fill out Nevada Contrato De Trabajo - Porcentaje De Ventas - Contratista Independiente Trabajador Por Cuenta Propia?

US Legal Forms - one of several largest libraries of legitimate varieties in the USA - delivers a wide array of legitimate file themes it is possible to acquire or produce. Utilizing the internet site, you will get thousands of varieties for enterprise and person purposes, sorted by types, says, or keywords.You will discover the newest models of varieties much like the Nevada Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor in seconds.

If you already possess a membership, log in and acquire Nevada Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor in the US Legal Forms catalogue. The Down load key can look on every develop you look at. You have access to all in the past saved varieties from the My Forms tab of the accounts.

If you wish to use US Legal Forms the very first time, listed here are easy guidelines to help you get started out:

- Ensure you have selected the correct develop for your personal city/state. Select the Review key to examine the form`s articles. Read the develop information to actually have chosen the proper develop.

- In the event the develop doesn`t satisfy your requirements, use the Lookup industry on top of the screen to get the the one that does.

- When you are satisfied with the shape, verify your option by visiting the Purchase now key. Then, choose the costs plan you favor and offer your accreditations to register for the accounts.

- Method the transaction. Make use of your credit card or PayPal accounts to complete the transaction.

- Select the formatting and acquire the shape on your system.

- Make alterations. Load, revise and produce and indicator the saved Nevada Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor.

Every format you put into your bank account does not have an expiration particular date and is also yours for a long time. So, if you would like acquire or produce yet another copy, just visit the My Forms portion and then click on the develop you require.

Obtain access to the Nevada Employment Agreement - Percentage of Sales - Self-Employed Independent Contractor with US Legal Forms, probably the most substantial catalogue of legitimate file themes. Use thousands of expert and status-particular themes that satisfy your organization or person requirements and requirements.