A claim may be presented to the personal representative (i.e., executor or administrator) at any time before the estate is closed if suit on the claim has not been barred by the general statute of limitations or a statutory notice to creditors. Claims may generally be filed against an estate on any debt or other monetary obligation that could have been brought against the decedent during his/her life.

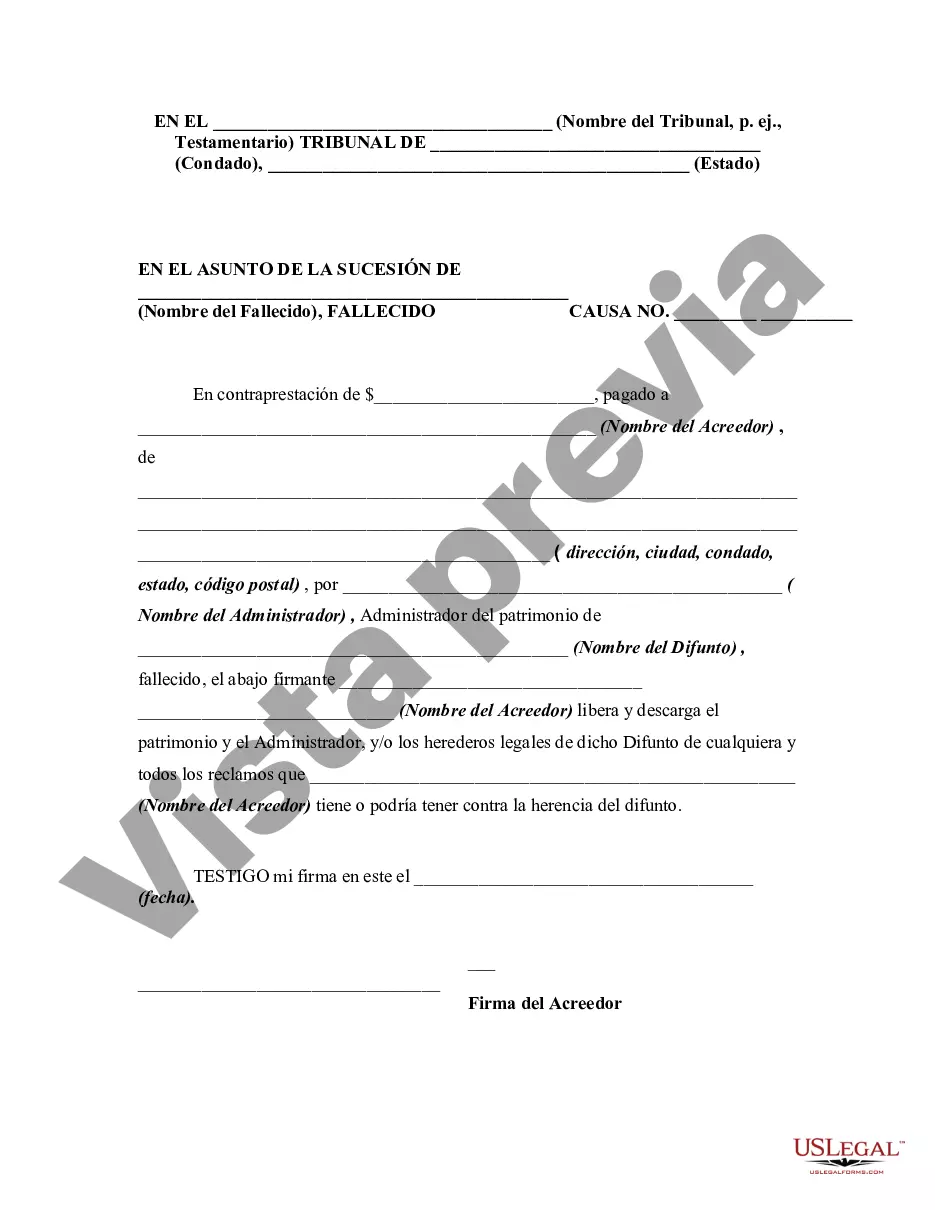

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Nevada Release of Claims Against an Estate By Creditor is a legal document that outlines the agreement between a creditor and an estate, releasing the creditor's claims against the estate. This form is crucial in the probate process to ensure all debts and claims are properly resolved. When a person passes away, their estate goes through a legal process called probate, during which any outstanding debts or claims against the deceased's estate are addressed. Creditors, who are owed money by the deceased, may file claims in order to recover the amount owed to them. However, in some cases, creditors may choose to release their claims against the estate voluntarily, which is where the Nevada Release of Claims Against an Estate By Creditor comes into play. This release form serves as a legal contract that relieves the estate from any outstanding debts owed to the creditor. It is important to note that the release of claims against the estate is a voluntary act on the part of the creditor and requires their explicit agreement. By signing this document, the creditor acknowledges that they have received full satisfaction of their claim or have decided to waive their right to pursue any further action against the estate. Different types of Nevada Release of Claims Against an Estate By Creditor may include: 1. Conditional Release: This type of release occurs when the creditor agrees to release their claims against the estate once certain conditions are met. For example, the release may be dependent on the estate's payment of a specific amount by a specific date. 2. Unconditional Release: In this case, the creditor willingly and permanently relinquishes all claims against the estate, with no conditions attached. The creditor acknowledges that they have received full settlement or satisfaction of their debt and will not pursue any further action. 3. Partial Release: Sometimes, a creditor may choose to release only a portion of their claim against the estate. This partial release could be due to negotiations or compromises reached between the creditor, the estate, and any other interested parties. 4. Limited Release: This type of release is usually specific to certain claims or debts within the estate. The creditor may release claims related to a particular asset or property, preserving their right to pursue other outstanding claims against the estate. Drafting and executing a Nevada Release of Claims Against an Estate By Creditor requires attention to detail and can often involve complex legal considerations. It is recommended to seek the guidance of a qualified attorney or legal professional to ensure the document is properly prepared, meets all legal requirements, and accurately represents the intentions of the creditor and estate.

Para su conveniencia, debajo del texto en español le brindamos la versión completa de este formulario en inglés. For your convenience, the complete English version of this form is attached below the Spanish version.